Sunday, October 12th, 2025

Laramie, Wyoming

By Dan Denning

It turns out that in a trade war, your biggest immediate risk is getting caught in the cross-fire between superpowers. Stocks lost $2 trillion in market value in late Friday trading when US President Donald Trump announced a 100% increase in tariff on Chinese goods. That’s over and above what the Chinese are already paying.

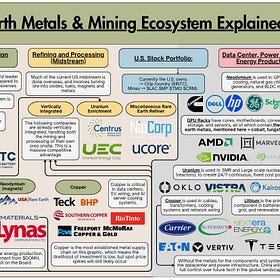

Trump’s move was in response to China slapping export restrictions on refined rare earth elements and critical minerals. China went one step further and announced export controls on any products or technologies that contain rare earths processed in China. Trump followed up with export restrictions on US software (it’s not clear yet what this means or who it affects the most).

The futures markets will open later today, likely deep in the red (unless there is a social media post softening the positions and announcing a meeting between Trump and Chinese leader Xi Jinping). But all of this raises an interesting issue…

Who controls pricing power? Is it the buyer or the seller? In a perfectly free market, there would be no monopoly on any one good or service. The government tends to ruin free markets by giving one or two key players monopoly-like leverage. In this case, there is one big difference…

China leads the world in exports of refined and processed rare earth elements. Many of these elements, as we’ve shown to paying BPR subscribers, are indispensable to the US fire-power industry. Thus, in the 21st century conflict with its main strategic rival, the US finds that its supply chains for elements critical to the firepower industry are dangerously dependent on the Chinese Communist Party.

Not a great position to be in, is it?

It reminds me of something that happened in 2010 when I was in Australia covering the commodity boom and mining companies. The iron ore price exploded on the back of a huge boom in fixed asset investment in China (directed by the State). Australian iron ore from the Pilbara region in the West used to go to Chinese, Japanese, and Korean steel makers under an annual contract price. That price was negotiated between the two main producers, BHP Billiton and Rio Tinto, and the steel mills in Asia.

When China’s fixed asset boom triggered a huge surge in iron ore exports, a few things happened. First, the annual price became a quarterly price, to reflect a larger, more liquid, and more important market. Price discovery became the object of more frequent negotiation. Second–and this is the important part for investors now–the price boom triggered an investment boom in future iron ore projects, which would later lead to a boom in annual iron ore production.

China’s massive advantage in refining rare earths would seem to give them a big upper hand in negotiations with the US. As far as I know, there is no such thing as ‘just in time’ rare earth refining. China has called Trump’s bluff.

Even if the US government ran a crash program in ramping up production of rare earth ores from US, Canadian, and Australian projects, they’d still have to refine the ores for use down the line in critical technologies. This takes years. Thus, this appears to be a very large strategic supply chain vulnerability to which there is no quick and easy answer.

So we wait to see what the futures markets do when they open later today. And in the meantime, we continue to look for those rare earth and critical minerals projects that can most quickly be brought to market with an injection of capital (perhaps, again, from the US government). And of course, we keep our heads down in Maximum Safety Mode, hoping not to get caught in the crossfire between Trump and Xi and their escalating war of words and tariffs.

Good luck out there this week!

Dan

P.S. China appears to have massive leverage over the rare earth supply chain. Some publicly listed rare earth producers may benefit in the US and Australia as a result. We’ll continue to follow and develop this speculative opportunity in BPR for paying subscribers.

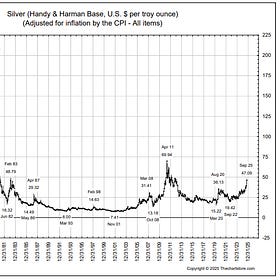

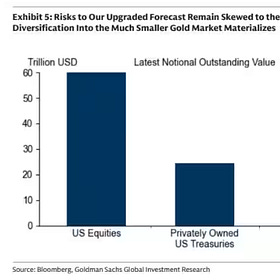

But gold and silver are getting a bid from everyone and everywhere based on these rising trade tensions. As always, investors should be aware that gold and silver (and mining stocks) can and do sell off when they’re correlated with stocks as an asset class. Be aware.

There could be good news, too, though. This MAY be a dip we can buy in the precious metals in the next two weeks. We’ll have more on that this week in BPR. Meanwhile, here’s what you missed this week.

It is not a free market or "free trade" when a communist dictatorship is a vital trading partner who is building up its military. It just shows the string of morons we've had running this country to get us into this position. Trump is trying to get us out. We need a long-term strategy to extricate us from ANY dependence on Communist China.

Been meaning to ask: if one buys stocks with a stop or especially a trailing stop, does it negate the need to be in maximum safety mode? The answer is no if one buys at $X and the stock then descends to the stop. But in the melt-up we’re living through, why not put some chips on the table with said protection?