Rivers of Money

The S&P and the Dow are hitting new highs...with the S&P recording 32 new highs so far in 2025. The S&P has seen earnings grow 156% over the last decade. But stock prices have gone up 248%.

Thursday, October 9th, 2025

Bill Bonner, from Youghal, Ireland

Cycles...cycles...cycles. Cycles of debt. Cycles of inflation. Cycles of power. And cycles of corruption.

Sleep cycles. Wash cycles. Motorcycles.

The US is now in the middle of a very familiar ‘shut down cycle.’ Airport traffic has slowed. And the IRS had laid off nearly half its employees.

Democrats and Republicans never bothered to pass a budget. So, they rely on continuing ‘resolutions’ to keep money flowing. According to news reports, Republicans are at least slightly embarrassed by their Big, Beautiful Budget Abomination. They want to keep the tax cuts in place but are hoping to get a little street cred with conservatives by chiseling away at Obamacare provisions.

We wish them luck. But if the past 21 shut down cycles are any guide, they will soon give up...and irresponsible spending — both on domestic programs and firepower — will resume.

Ray Dalio sees think this presages a repeat of the cycle of the ‘70s. Fortune:

Bridgewater Associates founder Ray Dalio said investors should allocate as much as 15% of their portfolios to gold even as the precious metal surged to an all-time high above $4,000 an ounce.

“Gold is a very excellent diversifier in the portfolio,” Dalio said Tuesday at the Greenwich Economic Forum in Greenwich, Connecticut. “If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold...because it is one asset that does very well when the typical parts of the portfolio go down.”

Of course, we’ve been saying that for 26 years. Butin many respects, the early ‘70s were very different from today. Gold was cheap at t he beginning of the ‘70s. It’s not so cheap now.

Yes, some of the ‘70s cycle -- over spending...borrowing... printing money...and inflation -- may be repeating themselves. And we hope gold will prove to be a good antidote to the feds’ poison.

But while gold goes up — much like it did in the ‘70s — stocks are going up too, unlike the ‘70s. Says Charlie Bilello:

Markets Are Partying Like It’s 1999...

The Nasdaq crossed above 23,000 today for the first time, hitting another record high. It took just 27 days for the index to go from 22,000 to 23,000, the shortest amount of time between 1,000-point milestones on record.

The S&P and the Dow are hitting new highs...with the S&P recording 32 new highs so far in 2025. The S&P has seen earnings grow 156% over the last decade. But stock prices have gone up 248% — far outstripping the real gain in output.

Much of the excitement in the ‘70s was in the ‘Nifty Fifty’ blue chips. In the ‘90s, it was dot-coms in the Nasdaq. This time around it is in the AI world.

Open AI is a private company. But based on its funding, it has gone from a value of $28 billion to a value of half a trillion dollars today. This is despite a loss of nearly $8 billion in the first half of this year...and expected losses of $110 billion through 2029.

Here’s a company that will decrease the world’s wealth by more than $100 billion over the next four years (beyond that, who knows?)...and Wall Street says it is worth $500 billion.

It doesn’t make any sense to us either. And we suspect that the value will come down — sharply, and suddenly. That’s the way the boom-bubble-bust cycle works. That’s the way the tech cycle works too. No matter how cool the new tech is, there is always newer, cooler tech coming down the pike.

There are other, deeper, more pernicious cycles grinding away too. Yesterday, for example, we talked about the ‘corruption cycle.’

Here’s the latest on Scott Bessent’s pledge to rig the Argentine peso/US dollar trade for the benefit of his speculator friends:

New US ambassador: Firms on brink of ‘unprecedented’ investment in Argentina

Peter Lamelas, incoming US ambassador to Argentina, claims US companies and “Western world” are on the verge of investing an unprecedented amount of capital.

Get it? Rather than encourage companies to invest in the US, we green light investment at the foot of South America. America suffers from a lack of real investment and Americans, in general, get poorer. But a few Americans — Bessent, Citrone, and other insiders — get richer than ever.

In Argentina, this sort of hanky panky runs as wide and as deep as the Rio de la Plata (the silver...or ‘money’...river separating Argentina from Uruguay.) And now, the scum on the Potomac is getting thicker too.

More, tomorrow.

Regards,

Bill Bonner

Research Note, by Dan Denning

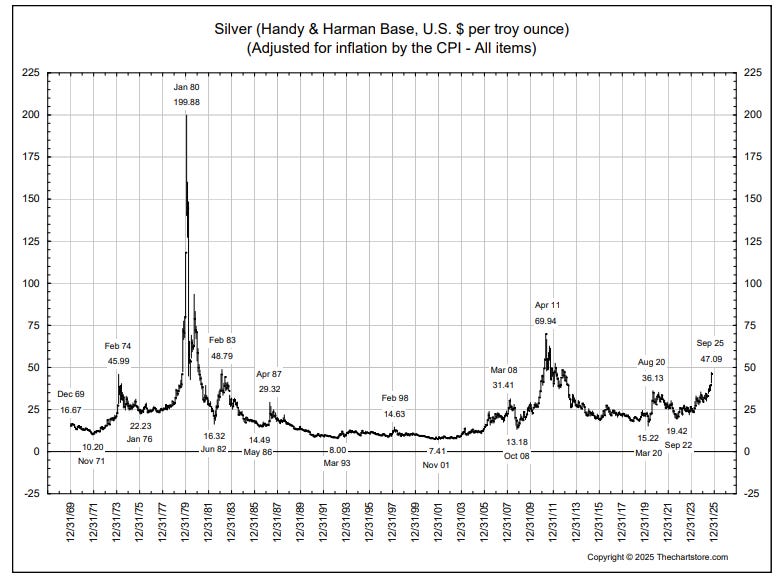

Where were you on January 18th 1980 when the Hunt brothers tried to corner the silver market? Spot silver made an all-time high of $49.95/ounce on that day. Today, when trading opened in New York, spot silver went over $50/ounce for the first time ever.

Where will it go from here?

The chart above shows the silver price adjusted for inflation (using CPI as the deflator). By that methodology, the 1980 inflation adjusted silver price is just shy of $200, or 300% higher from here. Silver futures are up 69% year-to-date.

I’ll have more on this price action tomorrow in my weekly research note to paid subscribers. including an update on the silver recommendation in our Official List. And if you’re just getting to your in-box this morning, please review Investment Director Tom Dyson’s note from yesterday on the Dow/Gold ratio (Cement Hands). It’s a must read for anyone who’s been following our Dow/Gold trading strategy.

We’ve been on this hamster cycle wheel since Moses forgot to bring a calculator to Mount Sinai! You think the government shutdown is new? It’s not new, they do this every few years to make you think they’re fighting for you. They’re not, it’s the same darn circus. You’re broke, you’re tired, and your tax refund is stuck in limbo while Congress argues about who gets the bigger elephant chair!

The debt cycles, the shutdown cycles, the corruption cycles, it’s like America is in an AA meeting but keeps blacking out and waking up in Tijuana. The Republicans and Democrats are like divorced parents fighting over custody, but instead of kids, it’s just a sack of taxpayer cash they both want to blow on hookers and jet fuel. And Ray Dalio says put 15% in gold? Great, that’s helpful advice if you’re already a billionaire hedge fund vampire. The rest of us are lucky if we can afford a Goldschläger shot.

What cycles really mean is, we screwed you yesterday, we’re screwing you today, and guess what? Tomorrow, bend over again Sunshine. They don’t solve anything. They continue it. “Continuing resolutions” which is government doublespeak for: “We resolve to continue screwing you indefinitely.” And gold? They tell you it’s a hedge against inflation. Sure. But it’s also a shiny rock you can’t eat. Try paying your electric bill in gold coins. They’ll laugh in your face while shutting off your lights.

It’s funny because they say the markets are partying like it’s 1999. I was partying in 1999. Didn’t end well. Woke up in 2000 with no pants, a pet iguana, and somehow, two mortgages. But hey, OpenAI’s worth half a trillion, right? Losing $100 billion while being worth $500 billion. That’s a helluva trick. If I ran my career like that, I’d be a billionaire too. Just walk into the bank and say, “Hey, I lost all my money… but doesn’t that make me more valuable?” And the banker says, “Yeah dude, here’s a half a trillion dollars.” Then I say, “Thanks, I’ll buy some gold.”

A nation can't survive when its finances are controlled by cosmopolitan humus eaters.