Friday, October 10th, 2025

Laramie, Wyoming

By Dan Denning

Dear Reader,

Greetings from the High Plains of Laramie. I’ve just arrived back in town after making a quick run to the mountains of Colorado to move some final items storage to my new Wyoming bolt hole. You can imagine my surprise when I pulled back into town and saw the price action in stocks…and the war of words between China and the US about rare earth elements.

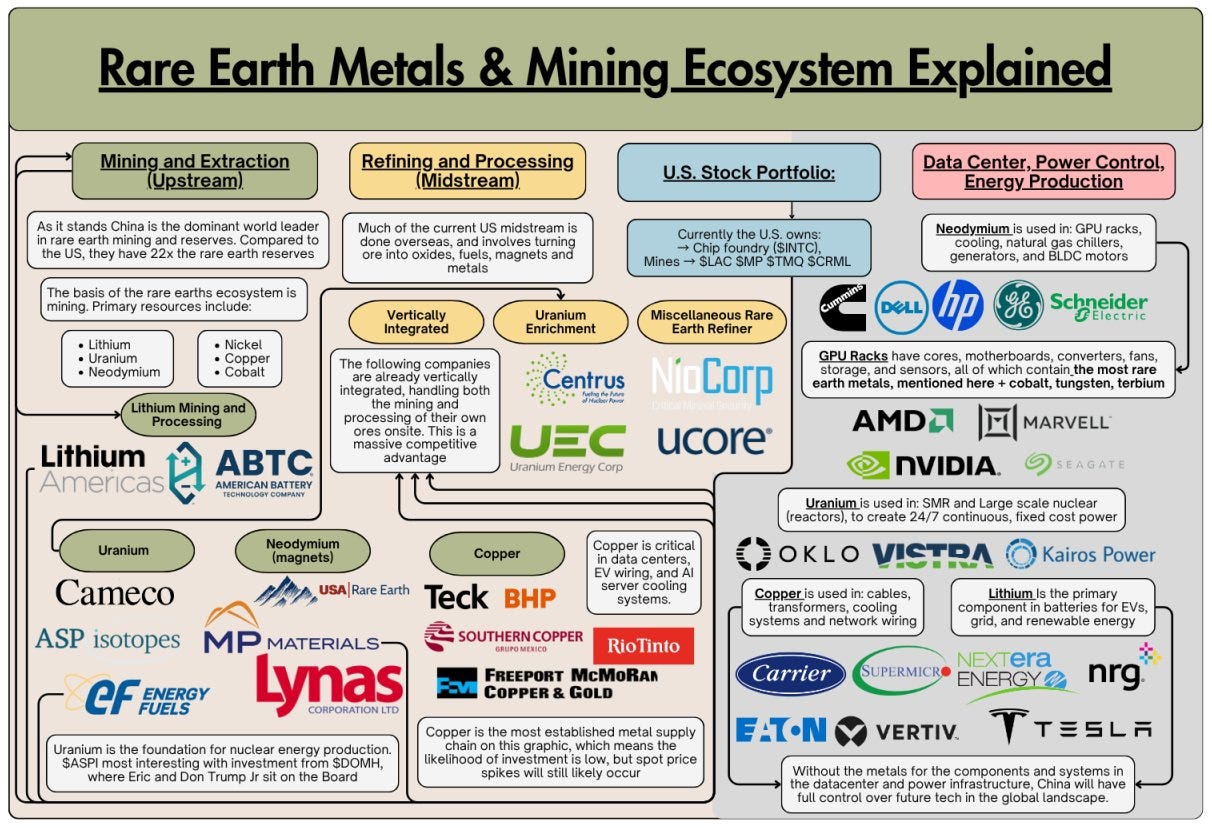

Long story short…China expanded export controls on certain rare earth elements AND technologies used to mine, refine, smelt, and recycle rare earths. It also introduced measures requiring foreign companies to get export licenses for exporting products that contain even a fraction of Chinese-sourced rare earths. It’s a power move designed to show China holds all the cards in rare earths supply…for now.

China’s Ministry of Transportation then announced it’s slapping ‘special port fees’ on US vessels birthing in Chinese ports. This fee applies to cargo ships, tankers, and any commercial vessels docking in Chinese ports. We’re looking into this further over the weekend.

In the meantime, I received an essay from Bill’s son Edward on the state of the precious metals and commodity markets. I’ve republished that essay in full below. After reading it, and after the price action in gold and silver this week, I asked Edward three questions via e-mail:

Gold has a four handle on it now since you first published this piece to clients. For investors who don’t yet own gold or gold mining stocks, should they wait for a healthy correction and a three handle? Or do you see five coming up this year?

Silver is near all-time nominal highs around $50/ounce. But its inflation-adjusted high is closer to $200/ounce. What’s the play?

The US government made an investment this week in an Alaskan-based poly-metallic miner named Trilogy Metals. Are ‘criticical minerals’ a place for investors to make double and triple digit gains right now? Can the next US government investment in rare earths or critical Minerals be predicted and acted on ahead of time?

Edward replied:

1. “If you don’t own gold you should get long and stay long. Keeping in mind market volatility, I almost always suggest averaging in if building a significant position, especially given current overbought conditions (high RSI). But you don’t break through all time highs without significant momentum. I won’t speculate on price targets but needless to say we think it’s going much higher. If you’re long the physical, the miners give you leverage at double digit FCF yields”

2. “Likewise for silver. Industrial utility/demand notwithstanding, it’s essentially leverage on gold. Silver miners take it up a notch and they too are printing cash. However, there are fewer to pick from and quality is a bit harder to come by. You need to be selective.”

3. “Geopolitical fragmentation has been driving the need to secure supply of critical materials essential for technological development and weapons manufacturing. Export controls and competition for these raw materials is testing an already fragile supply chain, which has been under-invested for years. And finding/mining these commodities (e.g. copper) has gotten harder and harder overtime. It’s been very topical and we’ve seen a few companies benefit from this trend and we think it’s likely to continue. You can make educated guesses as to who might be on the government’s short list.”

I’ll be working on educating some of my guesses over the weekend and will have more for you tomorrow in the BPR Week in Review. Following China’s measures, President Trump announced a potential ‘massive increase’ on US tariffs imposed on China. The stock market didn’t like that one bit.

The tech-heavy Nasdaq fell over 3.5%, the S&P 500 2.7%, and the Dow by 1.9%. Gold closed up 1.6% and is up almost 53% year-to-date. It held $4,000/ounce.

More to come this weekend. Until then, please enjoy Edward’s essay below and feel free to contact him directly with the link attached to his name.

Until next week,

Dan