Are we there yet?

We are all part of these patterns, not the architects or controllers of them. When a child is born, you might as well alert the funeral parlor. There is no doubt where this will lead.

Tuesday, October 7th, 2025

Bill Bonner, from Youghal, Ireland

The Financial Times reports:

UK start-up seeks to reverse ageing with drug aimed at blocking cell death

LinkGevity plans global trial targeting kidney damage in first step to reversing necrosis.

Now, there’s a cause we can get behind! Not since Jesus Christ has there been the promise of everlasting life. And LinkGevity is promising not just to slowthe ageing process...but to reverse it. Where do we sign up?

And please stop the reversal when we get back to age 18 or so...no need to go through pimples and puberty once again.

But what would it mean? If we could stop death...what couldn’t we stop?

The geniuses who run public policies have been trying to stop bear markets, crashes, unemployment and recessions for many years. Not much success so far. Like Smokey the Bear, who snuffs out forest fires, they can delay corrections by easing credit. But people use the low rates to go deeper into debt...the dry tinder piles up on the forest floor and makes the inevitable conflagrations even worse.

And today, the things the feds are trying to stop grow closer. Fortune:

America saw ‘essentially no job growth’ last month, warns Moody’s, and any roles added were in three wealthy states

And if you live in Wyoming, Montana, Minnesota, Mississippi, Kansas, Massachusetts, Washington, Georgia, New Hampshire, Maryland, Rhode Island, Illinois, Delaware, Virginia, Oregon, Connecticut, South Dakota, New Jersey, Maine, lowa, West Virginia, District of Columbia...you’re probably already in a recession.

Here’s Newsweek:

According to (Mark) Zandi’s analysis, 21 states and the District of Columbia are currently either in a recession or at high risk of entering one. Zandi categorizes 13 state economies as “treading water,” and 16 as growing.

Unnatural things, such as internal combustion engines, get no benefit from setbacks. A motor is intended to function in a certain way under certain conditions. Drain away the oil...cut the ignition cables...twist the tie rods — almost anything that is out of line with the user’s manual will cause dysfunction.

But natural things – living things -- are different. They need curve balls, challenges, and corrections to grow...to learn...to triumph. Businesses learn from their Edsels and Cybertrucks. An investor who has lost money on Pets.com may be reluctant to buy Palantir. And interest rates — which the feds try to keep as low as possible — need to rise to flush out bad bets.

Even death has its purpose. How else to get rid of geezers and make room for the next generation?

Patterns. Patterns. Patterns. Patterns within patterns. Patterns coinciding with other patterns. Patterns that seem to off-set each other. Life...death. Boom...bust. Success...failure.

We are all part of these patterns, not the architects or controllers of them. When a child is born, you might as well alert the funeral parlor. There is no doubt where this will lead — to lilies and the grave. It doesn’t matter what we think or what we want. We get what the pattern gives us, not what we want.

Few investors want to see their favorite bubble stocks collapse. But that is what they do. In a well-documented pattern, bubbles always deflate.

Yes, of course there are always good ‘reasons’ why the bubble will not deflate. ‘AI will bring unparalleled progress.’ ‘Tariffs will pay off the national debt.’ ‘All that money on the sidelines will soon go into the stock market.’ Even bad news can give us reasons for believing in greater stock market glory. ‘Investors are going to buy stocks to protect themselves from inflation!’

All of these things are part of the pattern. A bubble draws in investors...hoping to get rich. More and more ‘reasons’ are found to believe in it. Prices go higher; Palantir sells, not just for one-times sales...but 110 times. And then...the bubble pops.

Where are we now? Our guess: very near the top. We’ll see.

Regards,

Bill Bonner

Research Note, by Dan Denning

Billionaire Ken Griffin sees the rise in safe haven assets like gold (and perhaps Bitcoin) as ‘concerning’ according to an interview he gave Bloomberg. Perhaps that’s because Citadel Securities, Griffin’s firm, is a market maker. If you see stocks as a dangerous place of your capital right now and prefer to sit out the peak of the bubble in gold, Citadel won’t make any money on your trades. And gold?

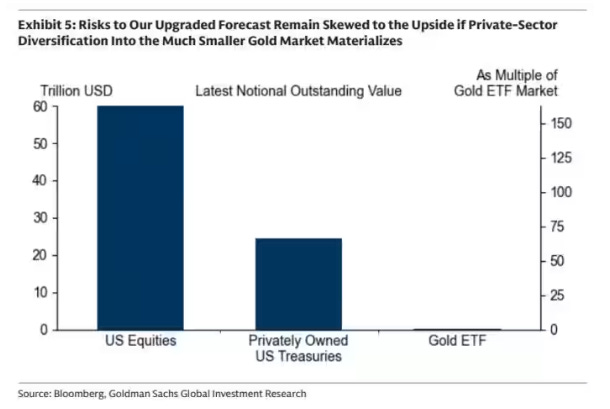

Goldman Sachs is the latest to set a new (and higher) price target for gold at around $5,000/ounce. It pointed out that even a small change in allocation strategies out of government bonds and into gold could drive the price of gold and gold mining stocks much higher. In early trading this morning, the continuous gold contract traded over $4,000/ounce. What’s next? A healthy correction (and buying opportunity) or higher highs?

Meanwhile, the US government continues to put its finger on the scales with smaller ‘critical minerals’ stocks. Trilogy Metals [TMQ] is developing a polymetallic deposit in the Ambler Mining District of Northwestern Alaska. The main targets: copper, cobalt, gallium, and germanium. Late last night, the White House released a statement saying it’s taken a 10% stake in the company worth $35.6 million. The shares opened up 260% this morning, although have traded down since.

My favorite might be Whiskey & Gunpowder, but of course Bonner has taught me well. It will be Precious Metals with a small allocation to whiskey & gunpowder to balance the portfolio.

I was interrupted before I finished. Everyone’s life from now and for all eternity depends on what you do with Jesus the Christ. The lack of understanding is shown with the statement made’’since Jesus Christ’’. There is no since, He is the great’’I am’’, He is , is,and is to come. With Christ there is no time, no before, no after, no since. I have thought and studied no time in great detail and am convinced that God created our minds with limited ability to understand and comprehend no time. Everything in our life on earth is on a timeline, the hour, day, year, your complete life on earth. People worry about where they’ll be between the time they die and judgement day. Another misunderstanding because there is no until after you die. If I were to drop dead today I’m in the same moment as when Abraham or Elijah or anyone else who ‘’fell asleep’’is. Too deep for us to understand but way to important to ignore.I’ll just trust in the Lord Jesus Christ,He has it taken care of.