Sunday, October 6th, 2025

Laramie, Wyoming

By Dan Denning

Scammers continue to impersonate Tom Dyson and myself on social media. They will contact you via direct message (with an account using a picture of Tom or myself) and then urge you to communicate with them on another messaging platforms like Telegram. They will ask you to open a trading account or send them money.

These people are scumbags. We’ll initiate legal proceedings against them if and when we track down the company or persons behind it. Please keep reporting them to us via our email at bpr@bonnerprivateresearch.com

Neither Tom nor myself will ever directly contact or message you privately on a social media platform for any purpose, especially not to open up a speculative trading account. Block and report anyone perpetrating this scam.

Scams are common at the top. And it’s a lot easier to target and deceive innocent investors these days. Keep your guard up. And watch for the other signs, too, like the one above.

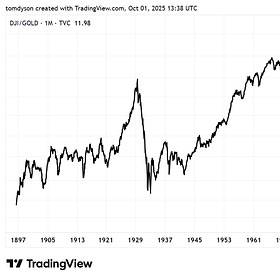

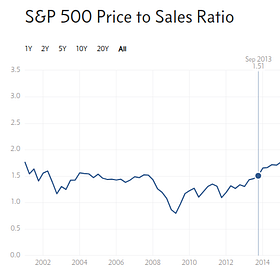

US stocks are now worth more than double the US economy, as measured by GDP. I’m referring to indicator Warren Buffet uses to see whether stocks as an asset class are over- or under-valued. At 220%, US stocks have never been more over-valued relative to the real economy.

This is why we’re in Maximum Safety Mode. It’s also why we have a large allocation precious metals, cash, AND some small companies whose performance is not correlated to stocks in general. One such category is ‘critical minerals’. It was a busy week in that space last week.

The US government has made inquiries and offers to buy equity stakes in Australian critical minerals companies, according to Reuters. This was a point Rick Rule made in the Private Briefing he gave BPR readers in late August. Look for the projects where they are…but especially in countries allied with the US politically, where investment would be welcome and could happen quickly.

The Department of Energy announced it has restructured a deal to take a 5% equity stake in Nevada-based Lithium America’s corporation. Under President Trump and Energy Secretary Chris Wright, the government appears to be determined to build-out US-based supply chains for lithium batteries.

The US Nuclear Regulatory Commission gave permission to New Mexico-based Urenco to begin producing what the company calls low-enriched uranium ‘plus’ fuel for conventional nuclear reactors. Russia is currently the top supplier of nuclear fuel, but imports were banned in 2024 by President Biden.

I’m generally not a big fan of government investments in private companies, much less government-led efforts to expedite the development of industries that are deemed essential for national security reasons. The government’s priorities usually end up building weapons of war and leading to further conflict, funded by more borrowing. Perpetual debt and perpetual war.

But we can’t ignore what’s happening either. Earlier this year, in response to an Executive Order, the Department of Energy launched a pilot project designed to fast-track the development of next generation US nuclear reactors. The US government has decided only nuclear energy can provide the power required for both AI data centers…and the AI war it believes it’s in with China.

Maybe it will work. Probably it won’t. And if the AI capex bubble bursts, the demand for these new reactors might dry up too.

Yet speculators have already made money in stocks like Oklo Inc [OKLO]. Oklo, which is tied to Open AI’s Sam Altman and is building a new reactor based on ‘experimental breeder’ technology is one of the eleven companies partnering with the DOE in the pilot program. You can read about the technology here.

It’s amazing the permitting and fast-tracking have led to ground-breaking so quickly. That’s also a risk of investing in the technology side of the nuclear supply chain—regulations can change and permits can be revoked. Equity stakes can be sold.

Our preferred method of investing in the nuclear story is simple: uranium. It’s the second-oldest position on the Official List. And we’ll keep looking for opportunities in other industries/commodities to enter into good long-term positions. Stay tuned.

In the meantime…have a great Sunday. Enjoy your BPR Week in Review below . And look out for the full moon tomorrow night (the Harvest Moon). Send pictures if you like. I’ll post them next week.

Until then,

Dan

Yep When government is involved, You know that the unlimited budgets will get a boost. Matters not which Country's in the world. All are the same . Leave government out of the economy. Please!

Today I communicated through text on Substack and asked “are you Tom Dyson or a scammer”?

“TD” replied “why would you ask me that”?

My reply “Tom said he had would never text or attempt to communicate with subscribers online, so by default you are a scammer”. Conversation ended.

Handsome Dan has been reaching out as well.