Pilbara Killer

Precious metals are soaring…rising relentlessly, day after day. Gold rose 11% in September. It’s up 47% in 2025. Silver rose 17% in September. It’s up 63% in 2025. Platinum rose 14% in September. It’s

Chiswick, West London

Wednesday, October 1st, 2025

By Tom Dyson, Investment Director

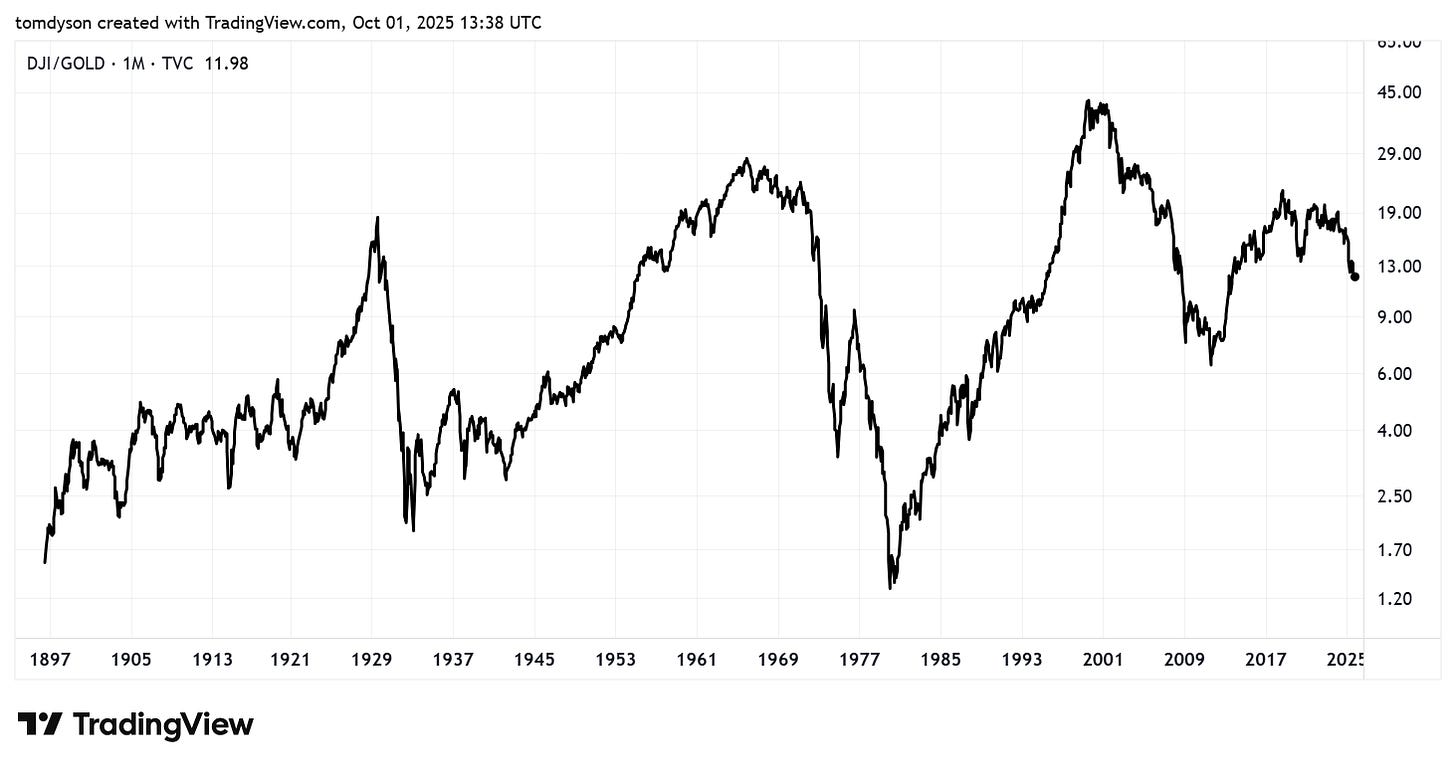

When gold goes up, investments go down.

Not every day. Or every month. Or every year. But over the last century, it’s been the rule. Why? Because gold is the anti-investment. When some large section of the market dumps the US dollar and chooses to store an inert, unproductive yellow lump instead, that’s never an environment that’s conducive to the growth of real investment returns.

Right now, precious metals are soaring…rising relentlessly, day after day. Gold rose 11% in September. It’s up 47% in 2025. Silver rose 17% in September. It’s up 63% in 2025. Platinum rose 14% in September. It’s up 70% in 2025.

This relentless rise in the metals is a terrible omen for the stock market.

But stocks haven’t fallen yet, even as young people can’t find jobs, house prices have started falling, the oil and construction sectors are laying off workers, and the giant tech companies are in a race to throw away hundreds of billions building infrastructure on an unproven business model.

As the S&P 500 makes new all-time highs, it’s not obvious yet, but it will be soon.

I’m keeping the dial set to Maximum Safety.