Roll Out the Barrel

The real promise of gold is not just a rate cut or two...and not really ‘easier borrowing costs.’ Gold may be a good gamble now...but in the long run it is just a way not to lose money.

Monday, September 29th, 2025

Bill Bonner, from Normandy, France

‘We are barreling toward double digit inflation.’

--Former Kansas City Fed chief, Tom Hoenig

We have a friend in France who smoked heavily for nearly 70 years.

“I gave it up,” he reported when we saw him last week.

“How did you do that?” we asked.

“I just decided to quit...and I quit.”

Earlier in the week, we reduced the problem of western democracies to: They spend too much.

In theory the problem of ‘too much spending’ could be solved just as easily as giving up smoking. But in a complex, democratic political system it’s hard to say ‘no.’

It is as though all Americans shared the same credit card. One might very well decide to forego spending in order to reduce debt. But that just leaves the others with more to spend. Everyone collectively benefits from a stable currency and a healthy economy. But every one, individually, benefits even more from free stuff.

It is a ‘paradox of the commons’ situation. Spending desperately needs to be cut...but for any individual voter, it is better to keep the grease coming his way. Especially for the elite who control where the grease goes.

And there are plenty of ‘free lunch’ economists ready to tell POTUS what he wants to hear — that he can spend without worry.

Airplanes need wings. Money systems need guardrails. As we saw last week, without the ‘golden guardrail’ the financial system ends up in the ditch. And here’s the latest. Reuters:

Gold vaults past $3,800/oz to record high as rate-cut hopes add luster

Speculators are gambling on rate cuts. But the gold trade is not necessarily an overnight win. Money Talks News:

Federal Reserve Slashes Rates to 4.25%, Signaling New Era of Easier Borrowing Costs

The real promise of gold is not just a rate cut or two...and not really ‘easier borrowing costs.’ Gold may be a good gamble now...but in the long run it is just a way not to lose money.

We get the inside story from former president of the Kansas City Fed, Tom Hoenig. In a speech to the Committee for the Republic, which we attended via video link, the economist explained how the Fed’s independence has already been severely compromised...and how it finds itself today in position to do little more than help finance Washington’s excess spending.

It’s called “fiscal dominance,” he explained. The Fed is in charge of monetary policy. But it’s the politicians in Congress and the White House who control how much the government spends.

And if spending is not brought under control, Fed governors — with the exception of those brave enough to say ‘no,’ such as Paul Volcker, backed by Ronald Reagan in the 1980s...and Hoenig himself, backed by nobody, in the 2000s — have little choice but to go along.

The Fed has, after all, a ‘dual mandate.’ It must protect the banking system and the dollar...but it must also ensure full employment. And since the governors are appointed by politicians, they tend to favor the politicians’ view. No one illustrates that better than the recently appointed heir apparent to Jerome Powell, Stephen Miran.

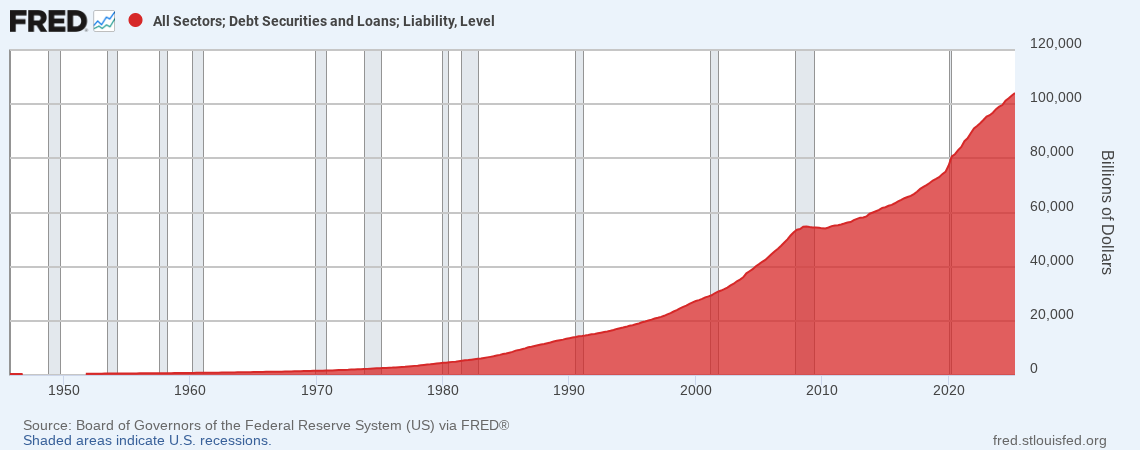

Hoenig shared some familiar charts. One showed deficits since WWII. What we see is that they were few and feeble before 1971 and many and fulsome after. After 1971, instead of paying down one year’s deficit with a surplus the following year, they just ran another deficit...year after year, until we arrive at our $37 trillion debt today.

When the golden guardrail was in place, money supply growth was restrained. The feds couldn’t ‘print’ gold. But when the guardrail was taken away...it was ‘drive it like you stole it’ at the Eccles Building.

In 1971, federal debt was 30% of GDP. Now it’s 120%. Total debt today is about $103 trillion...of which about a third is federal. We can guess that about half to three-quarters of today’s debt is phantom debt with no real output that supports it. And as we know from double-entry bookkeeping, for every debt there is an asset. (Every debtor owes money to someone.) In other words, in the US, there is around $60 trillion of fake assets now outstanding.

In global terms, the IMF figures that total world debt was about 100% of GDP...before 1971. Today, it is 235% of GDP. This suggests that about half of all assets (the other side of the debt ledger) — over $100 trillion — cannot be justified by actual output.

Tom described the financial situation in his October Monthly Strategy Report, from last Wednesday:

The greatest imbalance is that there are too many paper claims (dollar credits) on the world’s real wealth...so either the nominal value of the wealth must increase or credit must decrease. This is why the gold price is rising. It’s the great equalizer. Anyone who understands the imbalance will immediately look to trade paper claims (dollars) for gold (real wealth.)

Trading paper claims (stocks and bonds) for real wealth (gold) has been extremely rewarding so far this century. Gold rose from $260 to $3,600 — up 13 times. The Dow has risen less than five times.

This big picture trend is likely to continue. But probably with some scary counter-trends to keep us on our toes.

Regards,

Bill Bonner

Starting in 1987, just before Black Monday, I have seen many cycles of the Boom and Bust( not completely).. in Gold; This cycle is Different in that Gold has another contender: Bitcoin. There are many who chose to own Bitcoin, drank the Kool-Aid and follow the Gospel of Michael Saylor; They even piggyback on the Luster of GOLD.. calling it .. Digital Gold!..; Inspite of all the Political backing Bitcoin has .. it is still Lagging the Performance of Gold… Which is a better investment? Or, should I say… Store of .. Value? Gold has a 5,000 Year Track Record and Bitcoin?.. 20 years? Time will Tell 🙏🎉🍁.. Confession,, I am a Believer in .. Gold✅

For most Americans, during the past 70 years, the government was not a sugar daddy but a thief.

Before Bobby Kennedy Appalachian pity party and the civil rights marches, culminating in the Johnson Great Society: welfare, Medicare, and Medicaid, myriad programs, and excesses, you worked or starved and mostly people worked their way out of poverty. The middle class grew. Americans were upwardly mobile.

Socialism was an elite ploy to create an enduring growing underclass, a way to control votes. Now, they do it with immigrants.

They created an underclass and government redress to steal all the money. The fruit 10% own 80%.

You keep blaming the wrong people.

The whole government is corrupt. It is not a democracy. The people don’t rule.

It is a kleptocracy.