Sunday, February 15th, 2026

Laramie, Wyoming

By Dan Denning

Do you have a fever for more copper? A few years ago, sitting in the crowd at Rick Rule’s Natural Resource Investment Symposium in Boca Raton, Florida, I had to restrain myself from loading up massively on Freeport-McMoran, an obvious global copper play.

But there are less obvious plays, which several of the speakers at the show mentioned. I’m curious to hear what they’re saying this year. And I’m wondering, given the AI boom and the government pivot to ‘critical minerals,’ if copper might not be this year’s silver. If so, how do we play it?

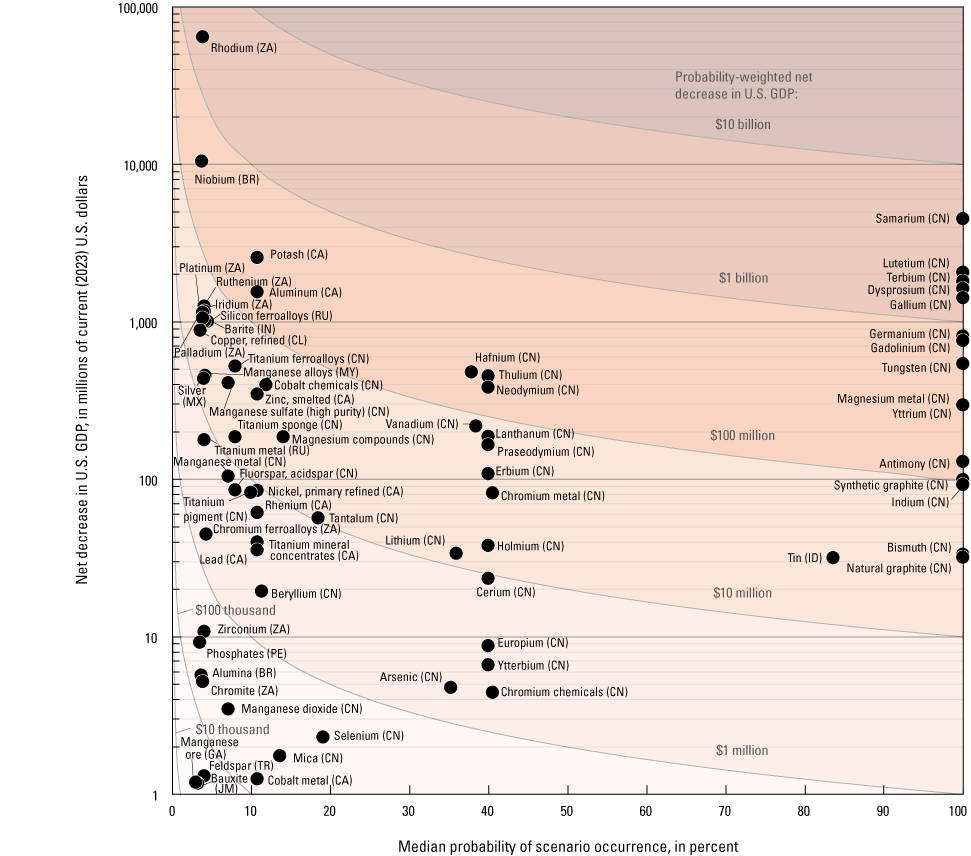

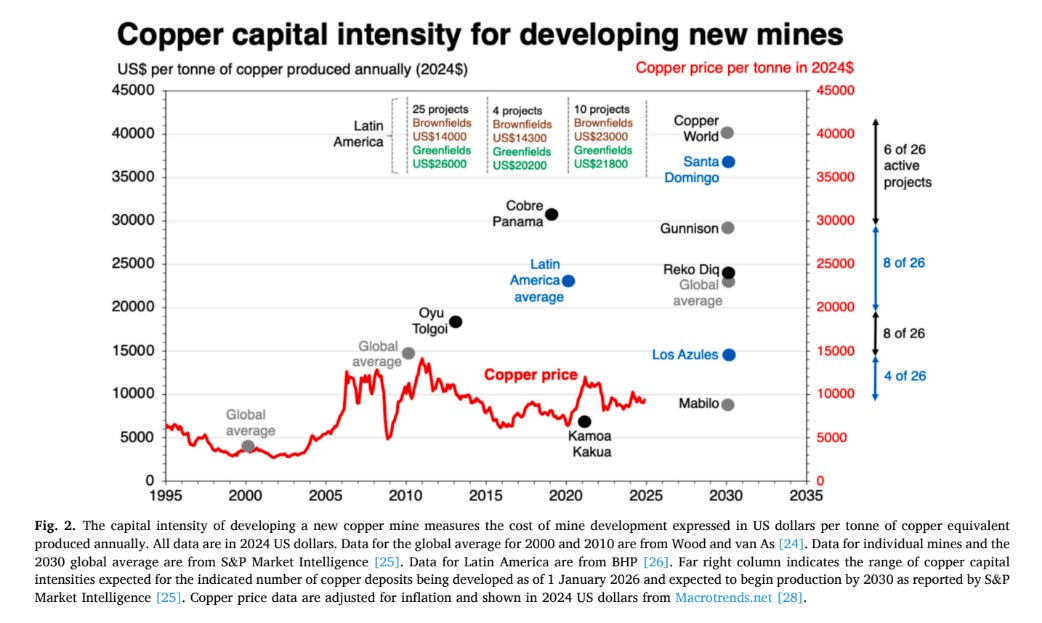

First up, S&P reckons copper demand will grow by 50% by 2040 to 42 million tonnes a year. Current global supply is around 23 million tonnes. It can take almost two decades to bring a new mine into production (regulations/permitting…and that’s IF you find a good location). And now ‘demand’ is surging with AI, EVs, and the ‘net zero’ move to electrification of everything.

For what it’s worth, I’d expect the demand side to be revised this year. EVs are too expensive in North America and Europe for the market to get much bigger than it already is (where socialist policy makers don’t want people to have cars anyway…and people who buy cars don’t seem to want EVs anymore).

And the ‘net zero’ political and social death cult is running face first into the brick wall of physical reality. Renewables can’t generate reliable base load power (in Spain, they’ve gone so far as to make their entire electric grid unreliable and prone to blackouts). And Germany’s Chancellor Friederich Merz admitted publicly that the Marxist-Green phase out of German nuclear power as ‘a serious strategic mistake.’

But there’s no doubt demand is surging and supply is not. It takes capital to make things happen. And it will take much higher prices (even if demand from EVs and ‘net zero’ is currently overstated). This academic paper suggests that copper prices will have to double from here in order to justify the capital investment needed to bring new mines into production.

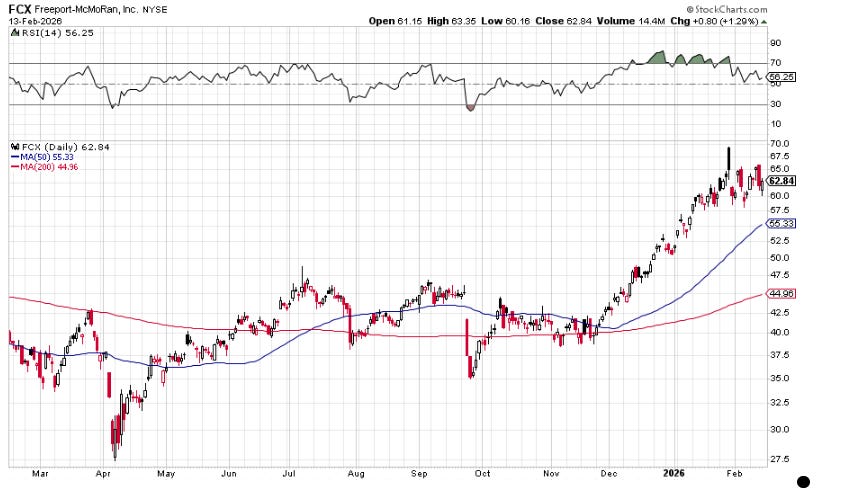

You wouldn’t guess any of that from the chart above. That’s Freeport-McMorRan [FCX]. It’s one of the names that came up at Rick’s show a few years ago. It wasn’t doing much of anything in September of last year.

And then there was a tragic accident at the Grasberg mine in Indonesia, where 800,00 tonnes of mud flooded underground operations. The accident, in which seven men lost their life, highlighted how vulnerable global copper supply is on a few big mines and countries (Grasberg accounts for 3% of global copper production each year).

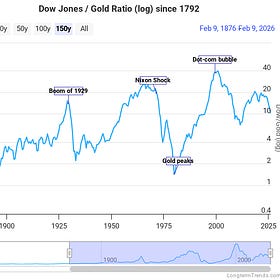

Turns out that was the dip to buy. And that has me wondering if we’ll have a similar opportunity in FCX (or copper in general) later this year. As you may know, investors reverse to copper as ‘Dr Copper’ because its a proxy for the health and strength of the global economy.

If we get a deflationary dip this spring—falling asset prices because of concern that AI is going to devastate wages…or that AI capex has been overdone—that may be our window of opportunity in copper. We’ll stay on the story. In the meantime, there’s one other, megapolitical aspect to address.

The US government doesn’t seem overly concerned about a disruption of copper supply threatening GDP growth in 2026 or any time soon. But that doesn’t mean they won’t start stockpiling it anyway. And what do you think US Secretary of State Marco Rubio meant when he said this at the Munich Security Conference this week (emphasis added is mine):

Deindustrialization was not inevitable. It was a conscious policy choice, a decades-long economic undertaking that stripped our nations of their wealth, of their productive capacity, and of their independence. And the loss of our supply chain sovereignty was not a function of a prosperous and healthy system of global trade. It was foolish. It was a foolish but voluntary transformation of our economy that left us dependent on others for our needs and dangerously vulnerable to crisis…the work of this new alliance…should be focused on…creating a Western supply chain for critical minerals not vulnerable to extortion from other powers...

This idea of ‘supply chain sovereignty’ is not new. But in the old, post World War II ‘rules based’ order there was no need for every nation to stockpile critical minerals and commodities (beyond, perhaps, oil and metals needed by the military). The world was a marketplace. And trade provided plenty for all.

That was the old world. What will this new world end up looking like? Is ‘supply chain sovereignty’ even a realistic and achievable ambition? Is it already too late?

For investors, the most important question is what should you do about it right now? More on that in the common week from BPR. In the meantime, please enjoy the brief summary below of all the research we published this week.

Until tomorrow,

Dan

P.S. There’s a megapoltical aspect to AI we’re just coming to grips with. Take this recent quotation from Palantir CEO Alex Karp: ‘There are dangers in AI. The reality is, there are only two cultures that are going to win in the next year— us, or China. If we are not the ones controlling the violence, we will not be dictating the rule of law.’

He who controls the ‘logic of violence’ controls the world, according to Jim Davidson and Lord William Rees-Mogg’s theory of megapolitics. The ‘logic of violence’ is an equation that includes the cost, returns, scale, and effectiveness of violence to amass power and control people.

In the Age of Agriculture, it meant controlling land. Then, gunpowder and the printing press decentralized both power and knowledge (lowering the cost of violence). In the Industrial era, States rolled out conscription to build massive standing armies, armored by powerful private companies. It resulted in ruinous state on state violence and the massive mis-allocation of natural and human resources for the purposes of destruction. Tens of millions people died.

JDD and LRM thought technology in the 21st century would change ‘the logic of violence’ in favor of the individual (hence the name of the book, The Sovereign Individual). They argued that the digital revolution would lead to smaller government, the collapse of the Welfare State, and a new era of empowered, encrypted sovereign individuals.

Well…the State fought back. It’s used new technological tools to reassert its control of violence. But what IS the new ‘logic of violence?’ What IS violence in the algorithm world (drone swarms, robot soldiers, predictive policing/targeting, digital censorship/de-platforming)? And who’s going to control and wield that violence?

More on this in the coming months. And more from Karp’s dangerous view. Feel free to share your thoughts below. Were JDD and LRM about technology leading to a freedom revolution? Or were they just early? And does the phrase ‘rule of law’ have any real meaning when an all-powerful State is wielding an all-knowing AI with violence?

There is the central question of whether all of this(the Great Reset) is going to work. By “working” I mean working functionally like your oven or your car or your cellphone works. We have all lived in a world where things worked, at least most of them. We may be entering a world where things no longer work, at least the ones based on technology, which is heading towards maximum prevalence and will exclude little that has been called civilization. I say this because you can’t simply make a claim that someone(say, the globalists) are going to tear everything down and replace it with something better, or rather something to their liking, and expect that it is simply going to work. We have roughly two hundred years of industrial and technological history that validate that this is so, that tell a different story. Perhaps the world was saved by the fact that during the Industrial Revolution and for all of the 20th century everything was not interconnected. It could not be. This matter of interconnection is one of the chief characteristics of the the Age of Reset that we are currently in, and is also its greatest vulnerability in my opinion. It is a vulnerability that, rather ironically, could bring the entire house down. The problem is simply massive complexity and the law of unintended(or unforeseen) consequences. It is ironic because they want to bring the entire house down, but I don’t suspect that they want to use the new house to knock the old house down, destroying both in the process. But that, I believe, is overwhelmingly the greatest risk that exists atop of what has also been called Build Back Better. The risk is that it will be Build Back Worse, for them and for us.

Thank you Dan, your knowledge and insight are greatly appreciated 🙏 Violence is just a human trait that can be magnified and manipulated together with mental illness. Good people just want to live in peace, work, love and search for peace and harmony with others who believe the same. Evil wants the opposite, and many times in history, those sociopaths and psychopaths are more driven and become more powerful due to their lack of God, empathy and morals. Unfortunately, many become leaders because of this and the results can be devastating. “One must choose between God and Man, and all ‘radicals’ and 'progressives", from the mildest liberal to the most extreme anarchist, have in effect chosen Man.”

George Orwell