Gouge of the Century

Tuesday, August 27th, 2024

Bill Bonner, writing today from Poitou, France

‘How dumb does she think we are?’ was the question we left you with yesterday.

Ms. Harris says it’s time for a change. Which is a funny thing to say when you’ve been the Vice President for the last three and a half years... and your boss was MIA during much of that time. Weren’t you, effectively, in charge? If not, who was? And how will leaving you in charge change anything?

But wait... the Democrats’ candidate promises something new – price controls. She’ll make it a crime for grocers to ‘gouge’ consumers with higher prices. Good news for the swamp critters! Lawyers, administrators, lobbyists — they’ll put their children through elite colleges... and build beach houses in Florida... on the money they earn arguing about what ‘price gouging’ means.

Food retailing is a notoriously ‘low gouge’ industry... the big grocers move millions of tons of food — much of it perishable — and earn net margins below 2%. If greedy corporations were gouging so lustily, you’d think they’d be able to get a rate of return at least higher than a 2-year T-bill.

Greed is one of the ‘seven deadly sins’ made famous by Tertullian in the 3rd century, AD. It is considered ‘deadly’; you go to Hell, with a one-way ticket. Why would corporate managers risk the fiery furnace to squeeze out such a pathetically small net margin from selling cucumbers and ground beef?

Or is it more likely that greed had nothing to do with it? Prices had been rising at around 2% per year for decades. Then, in the spending debauch of the Trump-Biden era — in which $15 trillion was added to the national debt... prices shot up. A coincidence? Or were the feds themselves guilty of another ancient sin — debauching the currency?

And wasn’t Ms. Harris ‘in the room’ the whole time — from 2021-2024 — as the price of food rose more than 20%? It was she who was sleeping with the Vice President’s husband... and sitting in the chair reserved for the Vice President himself. And she, who in the absence of a real president, should have assumed the adult-in-the-room responsibility.

Prices were rising at the fastest rate in almost fifty years; why didn’t she stop the gouging when the gougers were really going at it? Why wait ‘til the problem had largely solved itself before swinging into action?

But if Ms. Harris really wanted to stop big corporations from ripping off the public, we have a suggestion...

We’re talking about the biggest gouge in history... and right under Ms. Harris’s nose.

Yes, she was in the control room when a $200 billion bill... became, not a $250 billion bill... not even a $500 billion bill... nor even a $1 trillion bill. It soared to $2 trillion as the feds allowed the firepower industry to pull off the ‘Gouge of the Century.’ Responsible Statecraft:

F-35: $2T in 'generational wealth' the military had no right to spend

The Joint Strike Fighter had a $200B price tag in 2001, now babies born that year are out of college and the plane is still not ready for prime time

The plane is the F-35. Federal legislation limits the allowable price margins that defense suppliers can enjoy. So, instead of making 10% on a $200 billion F-35 program, they’ll make 10% on $2 trillion worth of costs.

Are the tomato sellers greedier than the sellers of fighter planes? Why is a 20% increase in food costs more egregious than a 1,000% increase in ‘defense’ costs? And why should Ms. Harris poke her nose into something that is none of her business (the price of bananas)... while ignoring something that is very much her responsibility (containing military spending... and getting a fair deal from military contractors)?

But wait... this is politics. It is not meant to be taken seriously. Like professional wraslin’, it depends on a willing suspension of disbelief... or just stupidity... on the part of the voters. Either way, Ms. Harris can count on their cooperation.

Regards,

Bill Bonner

Market Note, by Tom Dyson

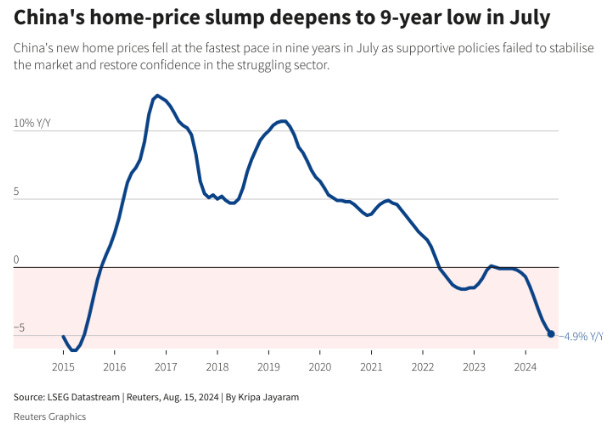

Two charts from China today. Chinese real estate – once known as the ‘Iron Bubble’ because prices never fell – continues to deflate. The deflation is now entering its third year. At its peak, China’s real estate assets were worth $60tn or about 29% of GDP, making it the most valuable single asset class in the world. What knock-on effects will these gigantic losses have on other markets? Big ones, I suspect...

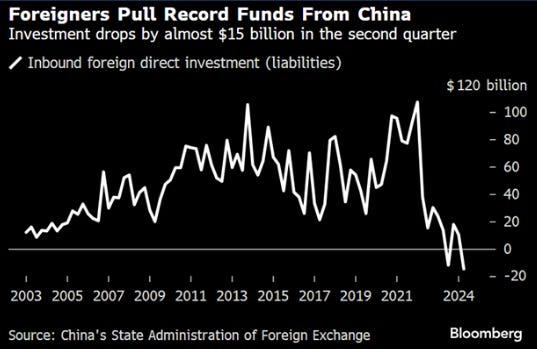

Meanwhile, foreigners are pulling their capital from China, after two decades of investing heavily there. Yesterday, IBM announced it was closing down its research and development efforts in China and firing a thousand employees. I’ll have more thoughts on China and our investment strategy in tomorrow’s Monthly Strategy Report...

"Are the tomato sellers greedier than the sellers of fighter planes? Why is a 20% increase in food costs more egregious than a 1,000% increase in ‘defense’ costs?"

Easy answer. Because the voters are very aware of the food costs and utterly unaware of the defense costs (because they don't think they pay the defense costs.)

Give Harris a break - she was busy tending to the border, you see.