Sunday, January 18th, 2026

Laramie, Wyoming

Markets are closed for a public holiday on Monday (Martin Luther King Jr. day). But it’s a big week for earnings on Wall Street. JP Morgan reports on Tuesday. And the government will release the Fed’s ‘preferred’ inflation measure too. But let’s talk ‘junk silver’ first…

A pre-1965 quarter was 90% silver, or about 0.18 of a troy ounce. In today’s term the ‘melt’ value of four quarters is about $65 (using the current spot price of around $90/ounce). Keep in mind that the 1965 Coinage Act signed by President Lyndon Johnson removed silver altogether from dimes and quarters (and reduced the silver content of the half dollar to 40%…and thanks to legislation passed in late 1970…silver was completely removed from the half dollar).

All these pre-1965 silver coins are now called ‘junk silver.’ You used to be able to easily buy them from banks of dealers. Not so easy now, or cheap. A bag of pre-1965 coins with a total face value of $100 will cost you over $6,700 today (be prepared to wait as orders are delayed due to soaring demand and high prices).

Here’s a fact: You couldn’t actually buy a Big Mac in 1965. It didn’t come out until 1967, when a franchise in Uniontown, Pennsylvania (southeast of Pittsburgh) introduced it as a ‘premium’ burger on the McDonald’s menu. Nonetheless, the thought occurred to me earlier today of constructing a silver-to-Big Mac ratio just for fun.

It’s Sunday, however. So I didn’t do that. But I didn’t have to. The point is pretty simple to understand: Silver was demonetized because the government started debasing the currency in earnest when the cost of the Vietnam War and the Great Society skyrocketed.

Over time, a silver-to-Big Mac ratio would show you getting dozens of Big Macs per ounce when silver peaked in 1980…and only about 1.5 Big Macs in the fall of 2001, when silver was $4.03/oz and a Big Mac was around $2.50. Today, if you could pay with an ounce of silver, you could buy about 15 Big Macs with one ounce.

Will that be true next month? Next year? We’ll see.

Last month, rumors abounded on the Internet of a major Wall Street bank getting a back-door bailout from the Fed due to its massive short position in silver. Has that short position been closed? What’s next for silver? Does anybody still eat Big Macs?

Stay tuned for more this week.

Until then,

Dan

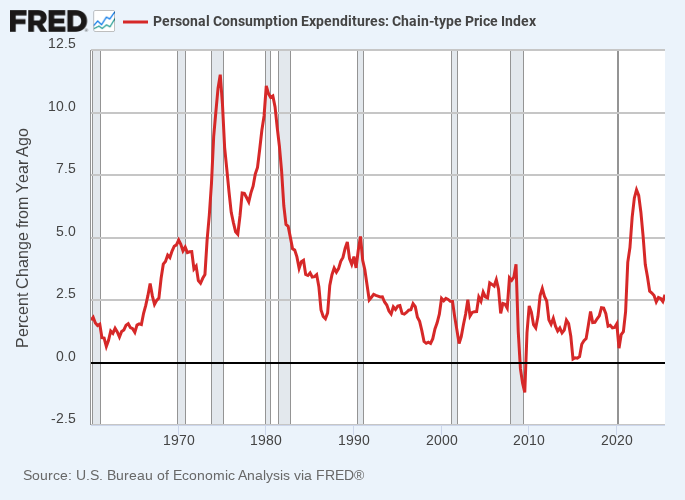

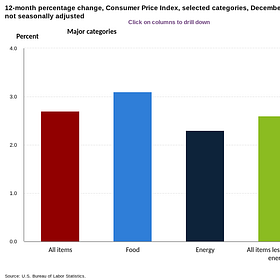

P.S. The Personal Consumption Expenditures index (PCE) will be released by the government this week. In a normal world, it’s not the the sort of data point a normal person has to pay attention to. But our world is not normal. Prices are distorted and the money is unsound. So pay attention we must.

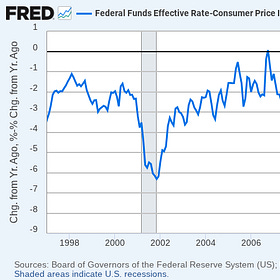

You may have heard that the Federal Reserve ‘prefers’ this inflation calculation over the Consumer Price Index (CPI). But I never understood why until doing a bit more research this weekend. The answer was simple: PCE is constructed in such a way to report a lower inflation rate than CPI.

Of course the Fed wouldn’t come right out and say it prefers an inflation metric that under-reports inflation. This would remind people that the counterfeiters in charge of the value of our money are the most responsible for the decline in our quality of life (and the rise in our cost of living). Tar. Feathers. Rails.

Technically, PCE relies on a lot more ‘substitution’ that CPI. CPI measures the price of a fixed basket of goods. PCE assumes that if beef gets more expensive, shoppers buy spam instead. While strictly rational in a theoretical way, people do not always behave rationally (or even often). This makes PCE theoretically flawed.

The far bigger problem with PCE is that about 25% of the inputs into the calculation come from a ‘black box.’ The data is not derived from any actual market prices or transactions. It is not based on real prices and the choices actual people are making with their actual money in voluntary exchanges.

Instead, 25% of the PCE data is based on models, trends, and something called ‘imputed’ prices. The net result is a metric that, by design, consistently understates the real rate of inflation people face everyday in the real economy.

Is the government deliberately lying to you about inflation? Or is it just a bad model? We’ll let you decide. Or comment below! And enjoy the week in review.

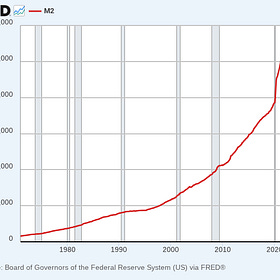

Reagan and Volcker conspired to alter the way CPI was calculated. SS had seen double digit increases in COLA, and govt and private pension tied to CPI data had seen the same. CEOs of major corporations were screaming and SS Administration told Reagan the continued double digit increases were unsustainable. So they totally revamped the basket, weighting, came up with hedonic adjustments, all designed to understate actual inflation.

But that wasn’t good enough. PCE became the preferred tool in 2000 under Greenspan. No surprise there. As you point out, PCE understates actual inflation more than CPI.

The reality is that since 1984, trillions have been stolen from retirees, pension holders, money that would have flowed into the economy organically. Instead, the govt used those funds to wage war and pay Somalis to open daycares in MN.

You cannot hate these people enough. You just can’t.

I don’t trust any stat coming out of the DC swamp anymore. And that’s a sad statement about my government, I admit. Enabling it all is our blatantly biased media. Pravda was more objective.

R, D, UniParty…all will ‘spin’ it to show things are just peachy.