Wrong again, dimwits

This was the most important turning point in recent financial history. Forty years of falling interest rates...and the biggest boom in stock market history...were over.

Monday, January 12th, 2026

Bill Bonner, from Baltimore, Maryland

Here we go again!

Business Insider:

Trump says he is instructing ‘representatives’ to buy $200 billion in mortgage bond purchases in an effort to push down rates

Trump has stuck to the script. He’s playing his part masterfully...helping to bring the empire down with the classic mix — an excess of spending and reckless military adventurism.

In the latest caper, POTUS proposes to offer the housing market more of what it needs least — more credit.

Excess credit already caused two bubbles in this century...and the worst affordability crisis in history. Credit drives demand for housing. But it drives up house prices too. And then people end up with way too much mortgage debt. Come the next correction, they find they have more mortgage than house.

Already, in last week’s news, the housing market is getting ready for another bubble. Barron’s:

Real estate stocks jump on Trump’s mortgage bond plan. Rates hit 5.99%.

The first bubble in housing blew up in 2008...it was such a serious explosion that the Fed jefe at the time, Ben Bernanke, warned Congress that we might not have an economy at all unless it stumped up $700 billion in subsidies and bailouts.

Yes, it was idiotic...but that is the sort of thing that dimwits do. The bubble was caused by the Fed itself, which lowered its key lending rate by 500 basis points in the early 2000s. Mortgage rates went down with the Fed rate. People borrowed to buy houses. Housing prices went up — to the point where they became unaffordable.

Then, as the Fed normalized interest rates, house prices fell. Homeowners realized that they owed more on their houses than they were worth. And mortgage lenders realized that they had made some bad business decisions, lending too much money based on overpriced collateral.

This led naturally to the biggest bankruptcy filing in US history — Lehman Bros. It probably would have brought down some of the biggest names on Wall Street too, including Goldman Sachs, but the feds, having caused the crisis, intervened again to save the big banks… and caused another bubble.

Once again, beginning in 2008, the Fed cut its key lending rate by 500 basis points to make housing more ‘affordable’...and what ho... housing prices soared!

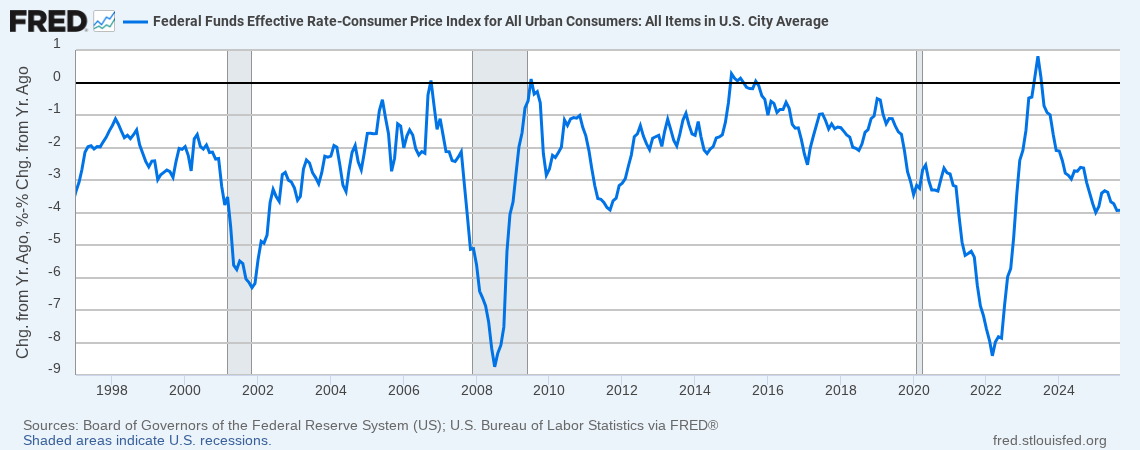

The Fed had learned a lesson — the wrong one — from the first blowup. It saw that returning mortgage rates to a ‘normal’ level triggered a sell-off in housing. So, it decided not to return rates to normal.

Instead, it pushed them down...and left them below zero — after inflation — for much of the next 13 years, 2008–2021.

Finally, , in the summer of ’21, interest rates could go no lower. After four decades, the downswing of the credit cycle finally reversed. Inflation — caused by bailouts, stimmie checks, and overspending — forced the Fed to raise interest rates.

In our view, this was the most important turning point in recent financial history. Forty years of falling interest rates...and the biggest boom in stock market history...were over.

But in the housing market, it left a huge affordability problem. Normal mortgage rates made sellers reluctant to give up their abnormal, ultra-low-rate mortgages. Tight supplies kept prices high.

High prices combined with high mortgage rates meant that few ordinary people could afford to buy the ordinary house. Between 2008 and 2025, the Social Security Administration’s Average Wage Index rose from $41,000 to $70,000 — a 70% increase. During that same time the average selling price for a house rose from around $200,000 to around $430,000 — up 115%.

The Housing Affordability Index hit record lows last year in nearly every major housing market in the US.

In 1971, the average person paid a 7.5% interest rate on an average house price of $28,000...leaving him with a monthly interest cost of $175. Now, thanks to all the efforts over the last 54 years to make housing more affordable, the average house buyer faces an interest payment of 6% on $420,000 — or $2,100 per month.

Thanks a lot.

Regards,

Bill Bonner

Research Note, by Dan Denning

Breaking news this morning that the Department of Justice issued two subpoenas to the Federal Reserve late Friday. The Department is looking into testimony by Federal Reserve Chairman Jerome Powell in front of the Senate Banking Committee last summer (and whether Powell misrepresented the cost of a renovation project at the Fed). Powell made the potential grand jury probe public last night and in a video said:

‘The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president.’

For markets, the issue is the Fed’s independence from political pressure. Gold is up over $120/oz in early trading and silver is up over 7% to more than $85/oz. Lower interest rates likely mean a weaker US dollar, hence the big moves this morning. Stay tuned for more!

The cure for a hangover is…. drink more beer. The cure for a credit hangover is… more credit. The Administration is fixing a grease fire with bacon. Rates too high? Buy two hundred billion in mortgage bonds!

That’s exactly what a degenerate gambler does, “double or nothing” the housing market. America already did this dance.

Cheap money makes houses unaffordable, then people act surprised when they owe more house than they own. Congratulations, the President invented affordability by making everything cost more and calling it help.

Two bubbles already blew up, and the plan is to blow a third one with a leaf blower. The first time wrecked Wall Street, the second time wrecked Main Street, and now he’s aiming straight for the renters too. Rates drop, stocks pop, real estate bros high-five, and normal people just get a new monthly payment that eats their soul. This is Financial gaslighting, but they’ll say “See, we helped, now why can’t you afford it?”

When your last two experiments exploded and your answer is still “let’s do it bigger,” that sounds less like economics and more like a guy who keeps microwaving forks to see if this time it won’t spark. Anyway, thanks for making houses so affordable that only a family of 10 can move in!

How's any of this Trump's fault? And the military adventurism is anything but reckless. It's precise and well-contained, and over quickly. Best always. PM