Up in Smoke

Capital goes to the side of the fence where the grass is greener. And if good Chinese companies are forced out of the US, suddenly the clover in Europe and Japan will be six feet high.

Thursday, April 17th, 2025

Bill Bonner, writing from Youghal, Ireland

Someone should have been more careful. Did he flick a cigarette butt into a trash can? Did he leave a candle too close to a curtain? Nobody knew. But the Great Baltimore Fire of 1904 was soon out of control.

Baltimore’s own fire, police, and national guard brigades fought to stop it. Whole city blocks were demolished to create a ‘fire break’. Postal workers braved the flames to move the mail out of the area, while fire crews rushed from Washington and Philadelphia to help.

But each city had its own fire hose connections. Those of Washington and Philadelphia didn’t fit Baltimore’s hydrants. A machine shop in Locust Point worked through the night to make adapters. But the fire crackled and popped , block after block. And when it was over it had reduced most of the downtown area to cinders… from the Hurst Building in the West to out beyond ‘Little Italy’ in the East…

1,500 buildings were destroyed and $150 million (1904 dollars!) of property value had been incinerated.

And wait…is that Donald Trump with a can of gasoline and a pack of matches?

Could his ‘trade war’ spark a larger conflagration…as politicians fan the flames with incendiary comments? Could the whole town burn down? Let’s take a look at this burg before it goes up in smoke.

The rules-based financial order was designed by the US itself. It had three important pillars — free movement of goods, free movement of capital, and free movement of people.

The free movement of people was the hardest to implement. Peoples always moved about. But mass migrations were often accompanied by conquests, famines, rape, pillage, and mass murder. After WWII, enlightened democracies tried to sanitize them. Article 13 of the Universal Declaration of Human Rights asserts that:

"Everyone has the right to freedom of movement and residence within the borders of each state."

"Everyone has the right to leave any country, including his own, and to return to his country."

In the 1930s, Californians tried to block immigrants from Oklahoma. The ‘Okies’ were taking their jobs! At the national level, governments still restrict immigration, each according to its own goals and prejudices.

But today, almost everyone would agree that people should be free to move wherever they want, within the US. No one objects when retirees from Michigan increase house prices in Miami…or out-of-work factory hands from Gary, Indiana serve pina coladas at Houston’s chic bars.

Donald Trump suggests, however, that the feds should decide where at least some people go. He wants to rehearse the glory days when the Tsar exiled opponents to Siberia…France sent criminals to Devil’s Island…and England shipped thousands of unwanted citizens to Australia.

Where he will deport Americans, we don’t know…but we don’t think we’d want to go there.

Meanwhile, the post-WWII effort to reduce trade and financial barriers was largely successful. Today, most trade crosses borders at less than a 2% tariff rate. Money goes pretty much where it wants.

Trump has already made known his plans to curtail immigration (a move that enjoyed wide support). His trade war aims to replace free trade with trade managed by central planners and bureaucrats. And the movement of capital, already restricted by sanctions and various reporting requirements, now faces a new challenge. Here’s the latest; Politico:

New trade war front: Washington weighs kicking Chinese companies off Wall Street

Washington is exploring… a new weapon… the prospect of delisting the nearly 300 Chinese companies that trade on U.S. exchanges.

Sen. Rick Scott (R-Fla.)…

“The U.S. capital markets are the envy of the world, providing unparalleled access to funding for companies worldwide. However, this privilege comes with responsibilities…Chinese companies continue to enjoy access to American capital while refusing to play by our rules.”

Of course, all the companies listed in the US are subject to the SEC…and all their operations in the US are subject to a plethora of local, state and federal rules. Even if they use slave labor in their home countries, they still have to pay wage-slave rates in the US…with overtime!

No one expects a Chinese company to apply Chinese labor law in the US… but somehow poor Rick Scott thinks that it should still be held to US labor standards, even in Shanghai.

And while it is hard enough to control the movement of people and products, it is even harder to control money. Capital goes to the side of the fence where the grass is greener. And if good Chinese companies are forced out of the US, suddenly the clover in Europe and Japan will be six feet high.

Stay tuned.

Regards,

Bill Bonner

P.S. Baltimore was a dynamic, growing city in the early 1900s. Within months the entire downtown area had been almost completely rebuilt…better than before.

Market Note, by Dan Denning

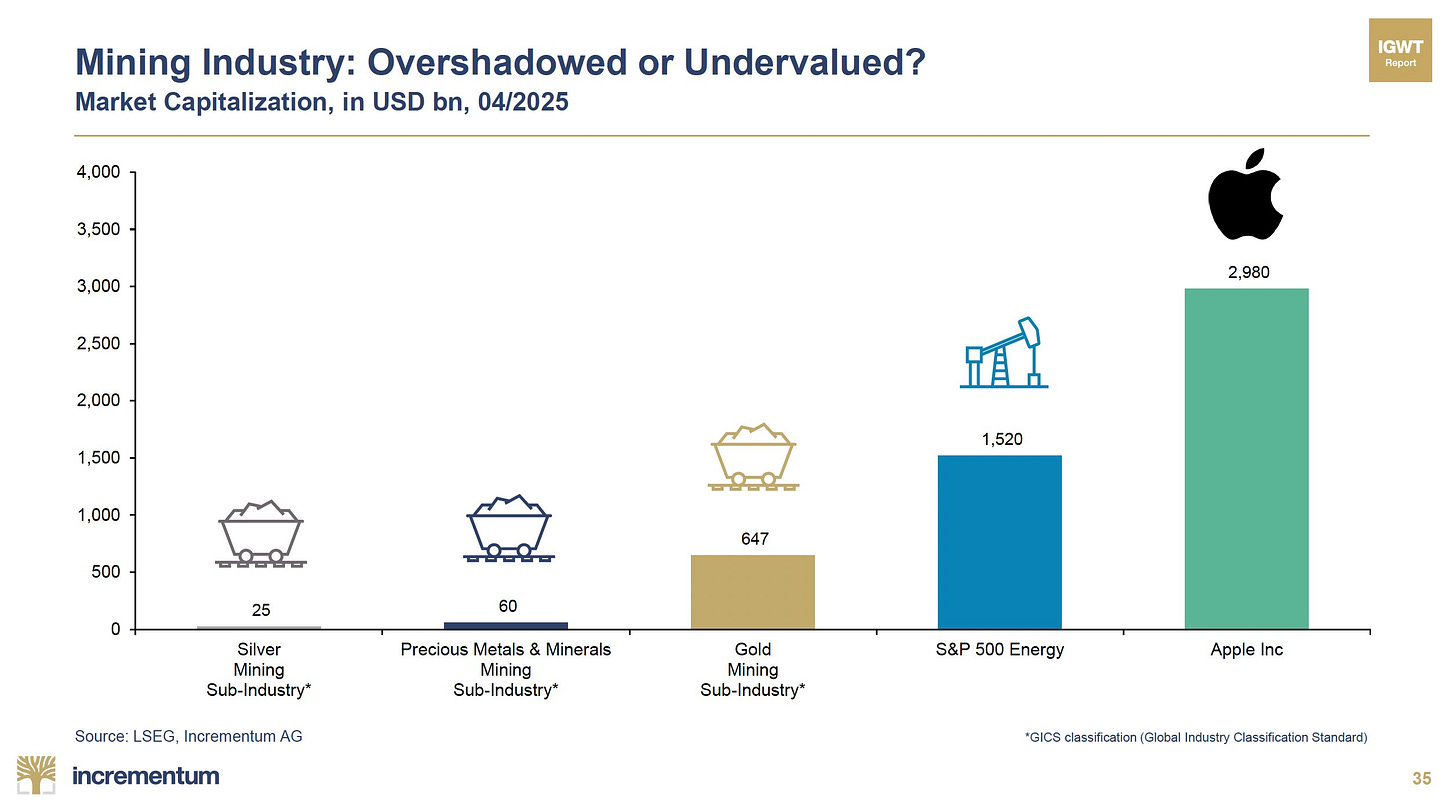

One theory of President Trump’s actions is that he’s trying to de-couple world trade from China, thus choking off (and ending?) the control of the communist party (while Making America Great Aagain, of course). But one unintended consequence is the emergency of the ‘Sell America’ trade, where money flees US stocks and bonds for safer havens and bigger returns. One place to look? Mining and energy stocks. They are still under-invested in, at least relative to tech and finance. And in the scramble to find secure supplies, scarcity has a quality all its own.

"𝘕𝘰 𝘰𝘯𝘦 𝘦𝘹𝘱𝘦𝘤𝘵𝘴 𝘢 𝘊𝘩𝘪𝘯𝘦𝘴𝘦 𝘤𝘰𝘮𝘱𝘢𝘯𝘺 𝘵𝘰 𝘢𝘱𝘱𝘭𝘺 𝘊𝘩𝘪𝘯𝘦𝘴𝘦 𝘭𝘢𝘣𝘰𝘳 𝘭𝘢𝘸 𝘪𝘯 𝘵𝘩𝘦 𝘜𝘚… 𝘣𝘶𝘵 𝘴𝘰𝘮𝘦𝘩𝘰𝘸 𝘱𝘰𝘰𝘳 𝘙𝘪𝘤𝘬 𝘚𝘤𝘰𝘵𝘵 𝘵𝘩𝘪𝘯𝘬𝘴 𝘵𝘩𝘢𝘵 𝘪𝘵 𝘴𝘩𝘰𝘶𝘭𝘥 𝘴𝘵𝘪𝘭𝘭 𝘣𝘦 𝘩𝘦𝘭𝘥 𝘵𝘰 𝘜𝘚 𝘭𝘢𝘣𝘰𝘳 𝘴𝘵𝘢𝘯𝘥𝘢𝘳𝘥𝘴, 𝘦𝘷𝘦𝘯 𝘪𝘯 𝘚𝘩𝘢𝘯𝘨𝘩𝘢𝘪."

This is extraordinarily disingenuous, Bill. The heart of the delisting issue (as you well know) is the fact that the Law and the SEC require 𝘼𝙪𝙙𝙞𝙩𝙤𝙧𝙨 of listed companies to open their books to the Regulators. Ignoring this requirement 3 years in a row 𝘪𝘴 𝘴𝘶𝘱𝘱𝘰𝘴𝘦𝘥 𝘵𝘰 𝘳𝘦𝘴𝘶𝘭𝘵 𝘪𝘯 𝘢𝘶𝘵𝘰𝘮𝘢𝘵𝘪𝘤 𝘥𝘦𝘭𝘪𝘴𝘵𝘪𝘯𝘨, yet somehow many of the Chinese companies on US markets have ignored the requirement for nigh on 7 years with ZERO consequence. Seven years - odd that. Hmmm, let's see: ignore the law for the last 3 years of Trump's first term, then skate for the next 4 because you purchased the new "president" long ago and there is no way his SEC will enforce 𝘢𝘯𝘺𝘵𝘩𝘪𝘯𝘨 against you. Sounds like a plan if books are getting barbequed - which they likely have been and are still. Criminality like this is Gospel for communists and we are rapidly discovering that it is also the standard playbook of the dimocrat party in this Country (recent examples with more on the way include USAID Theft, NGOs skirting Laws without prosecution, Tishy James' magnificent mortgage fandango, and on and on and on.)

This law is in place for a reason - 𝗶𝘁 𝗽𝗿𝗼𝘁𝗲𝗰𝘁𝘀 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗼𝗳 𝗮𝗻𝘆 𝗻𝗮𝘁𝗶𝗼𝗻𝗮𝗹𝗶𝘁𝘆 𝘄𝗵𝗲𝗻 𝘁𝗵𝗲𝘆 𝗽𝘂𝘁 𝘁𝗵𝗲𝗶𝗿 𝗺𝗼𝗻𝗲𝘆 𝗶𝗻 𝗨𝗦 𝗠𝗮𝗿𝗸𝗲𝘁𝘀. This is just one of the many regulations that make our markets the safest, most genuine and most transparent in the world - a large driver of our Success as a Nation. How very devious and dishonest of you to not mention any of this in your crocodile-tear, deflective diatribe while you try to pawn everything off on the 𝗮𝗹𝘀𝗼 𝘃𝗮𝗹𝗶𝗱 Labor concerns outlined by Rick Scott. The lack of Inspection Access issues are what is driving the threat of delisting and you damn-well know it, yet you ignore that fact and prattle off a distraction that you think will make the Repugnicant's and Trump look ridiculous and out-of-touch.

Shame on you, Bill...

PS - The volume of the Chinese company stocks traded on US markets is minuscule in the big picture and if investors have such a hard on to put their money behind communists, they can always fund these same companies through the Hong Kong markets...

Something I find almost comical is Bill's (and many other reader's) warnings about how Trump and his tariffs are going to crash the US and (possibly) the world economy.

For years now Bill has been warning, (and most of us agree), that because of stupid and short-sighted political decisions, there is an economic crash in our future that's just waiting for a trigger. And worse, there is no viable way to avoid it. When something can't continue on--it won't.

We here at Bonner Private Research are in maximum safety mode because bad times are coming--a debt crisis, a stock market crash of epic proportions, hyperinflation, deflation, depression--one or the other, or a combination of several, but it's going to happen and all we can do is prepare for it.

So my question for Bill and others is this--if it was drop dead certain anyway, why is NOW so terrible? If the system was so completely screwed up and unredeemable as we all claimed, then why the long faces? Let's just pass out the "I-Told-You-Sos" congratulate ourselves for being in maximum safety mode, and get ready for whatever emerges from the ashes.

I have no idea how all this tariff stuff will play out, and neither does anyone else here. But it just seems silly to me to bitch about an impending economic crisis that we all agreed was inevitable anyway.