The Generals Surrender

As the Big Tech stocks take casualties with lower earnings, the rank and file in the stock market advance into fourth quarter uncertainty. Recession or melt up?

Source: Getty Images

Friday, October 28th, 2022

Laramie, Wyoming

By Dan Denning

This is a day that our founder Bill Bonner would have been sorry to miss. His bitter long-term rival, Amazon—whom he’s been writing about for over 20 years—joined the ranks of the Tech Generals who surrendered to earnings reality yesterday. But as we told you earlier in the week, Bill is away for another ten days working on a new project. He’ll be back to tell you all about it soon.

But what’s this? After less than stellar third quarter earnings results at Facebook, Amazon, Google, and Apple (which reported lower than expected iPhone sales and declined to give any financial forecasts), the markets have ripped to the upside this morning. The Generals are in retreat. But the rank and file in the indexes are advancing!

It’s a mutiny! A real insurrection! A retail rebellion!

Tom and Bill and I discussed this privately over e-mail earlier this morning. Do lower rates and a stronger dollar—plus ‘The Generals’ making new lows—mean we rally from here? How can stocks (that are still overpriced) rally ahead of recession and stagflation? Will the ‘buy-the-dip’ crowd finally meet its maker this time? What do YOU think? We’ve included a poll today so you can weigh in/vote.

As we’ve written before, bear market rallies can be tempting. But if this one’s based on the belief that the Fed will be finished raising interest rates at a ‘terminal’ rate of 4.5%, we’d encourage investors to look at what happened in the 1970s when the Fed ‘pivoted’ too soon. Inflation came roaring back and rates went much higher.

Bonds are so far down this year, historically speaking, that a rally from here (lower rates and higher prices) is consistent with a stock market rally too. But it’s not like inflation has suddenly been extinguished. Core personal consumption expenditures (PCE)—the Fed’s preferred measure of inflation—were up 6.2% in September year-over-year. Remember, the Fed’s target is 2%. Excluding food and energy—and who needs those?—the core inflation rate was still up 5.1% year-over-year.

Vapid market pundits were encouraged by the 1.2% rise in the employment cost index in the third quarter. That’s an index of wages that includes benefits and is supposedly watched closely by the Fed. It’s supposed to indicate consumers are resilient and in robust health. But riddle me this: if total wages are rising less fast than actual inflation, how do consumers make up the difference? Now look at the chart below.

Source: US Federal Reserve

The personal savings rate fell to 3.1% in the third quarter, according to Fed data released this morning. That’s the lowest it’s been since 2005. Not coincidentally, credit card balances hit $916 billion in September, according to data released by Equifax today. That’s back to a pre-pandemic high.

Savings down. Credit card balances up. Earnings down. And the recession hasn’t even begun yet!

We’re not buying the dip. For more on why, please enjoy another research note we published late last month. For non-subscribers, this gives you an idea of what’s behind the ‘pay wall.’ It’s not everyone’s cup of tea. But while Bill’s away, we wanted to give you a peek behind the curtain to see what our long-term strategy is and how we form our short-term analysis.

We hope you’ve enjoyed the change of pace. Send your questions for Tom or myself to research@bonnerprivateresearch.com. We’ll try to answer as many of them as we can next week (of course we can’t give any personal investment advice). We’ve also lined up some guest essays from some of Bill’s most trusted insiders. Stay tuned for that.

Until next week!

Dan

[The following is an excerpt from a research note published to paid subscribers on Friday, September 30th. The prices and the charts have not been updated. Excepts from this research note are included in the Monthly Report that Bonner Private Research provides through our joint venture to our friends at True Wealth.]

$15 trillion to go

Since 1929, the average bear market lasts fourteen months and has a peak-to-trough drawdown of 36%. If there’s no recession, the average bear market lasts twelve months and the average drawdown is 29%.

If you take your bear markets with a side of recession, then the bear market lasts sixteen months and with a 42% drawdown. All these statistics are courtesy of Charlie Bilello, the CEO of Compound Capital Advisors (a must follow on Twitter).

Since we’re in a recession (or since we had one in the first eight months of this year with two consecutive quarters of declining GDP), that means we could be looking at a sixteen month bear market with a fall to around 2,782 on the S&P 500 (a 42% decline from the January closing high at 4,796). That’s another 22% below today’s close at 3,585, which by the way breaks the support at 3,600.

Today we’re going to conduct a short exercise in ‘what if we’re wrong?’ As you know, we’ve been in Maximum Safety Mode all year. And for good reason. Valuations were sky-high in January. Stocks were not priced for higher interest rates. And they were not priced for lower earnings that would result from a recession.

About the best thing you can say about September, from a stock market perspective, is that it’s over. Having a large allocation to cash and ZERO allocation to bonds has been spot on all year long. But you should never break your arm patting yourself on the back in markets.

Besides, it’s not the past we’re concerned with here. It’s the future. Is it possible that after dumping stocks in the third quarter, investors will have a change of heart come Monday?

Earlier on Friday, the Atlanta Federal Reserve revised its ‘GDPNow’ estimate for the third quarter from 0.3% to 2.4%. That’s a huge revision in a matter of days. If it can be trusted, it might mean the economy is already stronger than expected. But if so, it might also mean the case for the Federal Reserve hiking interest to around 5% is still strong, with labor markets and inflation powering higher.

To try and untangle the mess, let’s look at some charts. The price action should tell you something. Specifically, it should tell you if you can expect another big bear market rally this year, beginning next week. Or, whether there's more pain ahead. Let’s begin with the Russell 2000 Vanguard Growth ETF (VTWG) vs. the S&P 500 going back three years.

Source: www.stockcharts.com

Growth outperforms value and blue chips (quality) in a bull market. Vanguard’s growth ETF tracks the Russell 2000 growth index. You can see that it tracked the S&P 500 (the blue line) all the way up until November of 2020. And then it took off and outperformed. Growth beat value and tech melted up.

You can also see that the growth ETF peaked before the S&P 500 in late October 2021. The S&P eventually turned down too. But growth underperformed all the way down right up until this week.

And that’s exactly what you’d expect with higher interest rates and a recession. As Investment Director Tom Dyson wrote at the beginning of the year, you saw a rotation out of growth and into value. And now?

The growth ETF didn’t take out its June low. And the Relative Strength Index (RSI) has moved above oversold conditions at 30. It’s still down almost 30% year-to-date.

Nearly 80% of the holdings in the ETF are concentrated in five sectors: Healthcare (23.2%), Industrials (19.2%), Technology (16.3%), Consumer Discretionary (12%), and Energy (8.3%). If there were a rally, it would have to be pretty broad based and not just confined to one or two sectors.

Two quick notes on ETFs that track indices. First, you have to make sure they actually DO track the underlying index. Not all of them do. Second, how do you define a small cap growth stock in a small cap growth ETF? You have to read the prospectus (which you should always do anyway). In this case, the average market capitalization of the companies held by the ETF is $2.9 billion.

That doesn’t tell you anything about the company, what it does, how expensive it is, and how much cash flow it might generate in the next year. For that, you’ve got to do bottom-up analysis, the kind Tom does when looking at individual companies.

But for my purposes today. I’d watch this ETF to see if there’s a turnaround in investor sentiment in the fourth quarter where growth starts outperforming value. Next chart!

Source: www.stockcharts.com

The QQQ ETF tracks the Nasdaq 100. It’s another ‘growth’ proxy. Same story as the growth ETF but shorter. The ETF (and the underlying index) peaked late last year. In April, the 100-day moving average (the blue line) crossed under the 200-day moving average (the red line). And now?

Today’s close at $267 took out the June low of $271. It’s not that much further down to the pre-pandemic high at $234. On the plus side, if you’re bullish, the RSI is under 30. That’s no guarantee of a rally. But it’s something.

QQQ is full of mega-cap tech stocks. Apple (AAPL) closed down 3% on the day and 7% on the week. It hasn’t taken out its June low of $129 yet. But it is down 22% year-to-date.

It also cut production levels for the new iPhone 14 on lower than expected demand. But that news came out on the same day as the Bank of England intervened in the bond market and sent stocks higher–a timely reprieve for tech. For how long? One last price action chart.

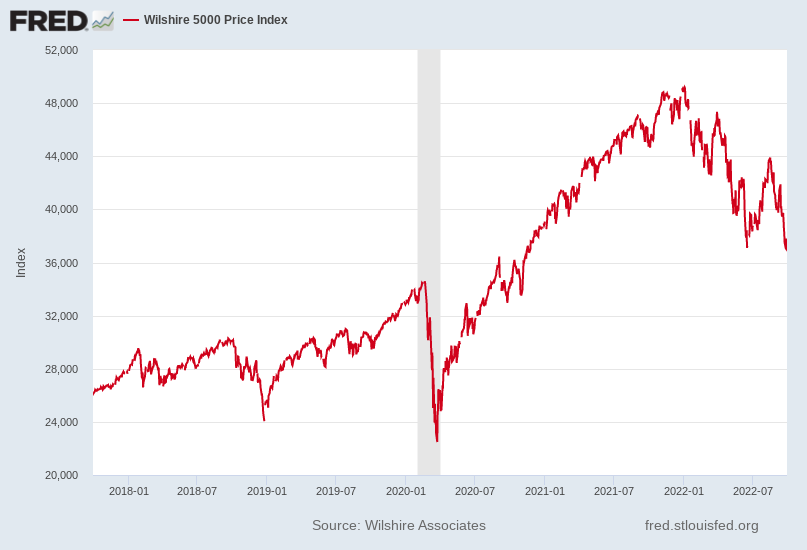

Source: US Federal Reserve

Twelve and half trillion dollars. That’s what’s been wiped out of the market value of publicly traded US stocks since the market peak in January. The chart above is the Wilshire 5,000 Index, the broadest measure of the market value of US stocks.

The current decline exceeds the $12 trillion wipe-out due to the pandemic lockdowns. That decline was much faster–from late February of 2020 to mid-March of 2020. And coming from a lower base, the pandemic wipe-out was bigger in percentage terms. Want to know the scary thing?

The historic median value for Warren Buffett’s market-cap-to-GDP indicators is 86%. Take GDP Of $25.2 trillion and if stock market values were to revert back to the historic mean versus GDP, you’re looking at another $15 trillion in losses from here. That would be a peak-to-trough drawdown of 56% from the highs and would erase around $30 trillion in stock market wealth.

Inflation and Rates

Markets tend to over-correct. A 56% peak-to-trough decline isn’t the worst case scenario for stocks. But it’s bad enough–and entirely possible.

The key question will be inflation and interest rates. The Fed is hiking rates into a recession. Mainstream media pundits have already said the Fed’s gone too far and that inflation has peaked. Thus it can, and should, pivot to a more neutral stance. And soon!

The data don’t support that conclusion. The Fed’s preferred measure of inflation is not the Consumer Price Index (CPI), which was up 8.3% year-over-year in August. It’s the Personal Consumption Expenditures (PCE) index. That index was up 6.2% year-over-year in August–better than July’s rise of 6.4%. But wait! Check out the chart below.

Source: US Federal Reserve

‘Core’ PCE excludes ‘volatile’ food and energy prices. That’s the number the Fed pays the most attention to. And in August, core PCE was up 4.9% year-over-year. The July figure was 4.7%.

Imagine how much higher the figure would be if you included food and energy AND if the Biden Administration hadn’t been emptying the Strategic Petroleum Reserve to its lowest level in 40 years!

On the chart above, core PCE is the blue line. I’ve added the Effective Fed Funds Rate in blue. This is the ‘target’ rate the Fed sets. And remember, the Fed is aiming for 2% inflation, and missing badly. But what does the chart show you?

The Fed briefly raised interest rates above 10% in August of 1969. This was to combat the inflation that resulted from LBJ’s ‘guns-and-butter’ fiscal policy. By 1972, the Fed’s target rate was below PCE. Inflation took off again. In response, the Fed hiked its target rate to 12% in 1974.

That worked. But then the Fed cut rates again. In April of 1977, the target rate was 4.7% and PCE was 6.4%. Not surprisingly, inflation spiked again and forced Fed Chair Paul Volcker to raise the target rate to 18.9% in 1980–almost twice PCE of 9.64%.

The moral of the story is that every time the Fed thought it had a handle on inflation in the 1970s, it cut rates too soon and inflation came roaring back. It took a target rate nearly twice core PCE to finally slay the inflation dragon. Today, that would imply a nominal target rate of 9.8%.

That’s never going to happen. Why? Because what we learned this week is that the financial world can’t survive higher interest rates. The UK nearly had a pension/sovereign bond crisis because the Fed has already pushed rates above what the financial economy can stand.

The trouble is, the real economy can’t survive higher inflation. Energy prices are up. Food prices are up. And see the chart below. Adjusted for inflation, real disposable wages are in a massive slump.

In previous recessions, real disposable wages didn’t decline because interest rates were higher and inflation was lower. All of the huge year-over-year gains to real disposable income that came from pandemic handouts and stimmies are gone. Inflation eating away at wages is what’s left.

Source: US Federal Reserve

So yes. It’s possible we see a fourth quarter bear market rally. But if so, we’re staying firmly on the sidelines. The Fed conducted a giant financial experiment by lowering interest rates and keeping them there. An asset price boom ensued. Now comes the bust.

I wish it were better news. But it isn’t. And our job isn’t to make you feel good about what’s happening. It’s to connect the dots and show you what really is happening. A massive asset price bubble is deflating. It will take months before it's done. And it may take years before the stock market recovers.

In the meantime, it isn’t ALL bad news. Facebook’s market cap ($366 billion) finally fell below ExxonMobil’s ($369 billion) with Friday’s price action. Amazingly, Facebook’s market cap is only $10 billion above where it was in 2018 at $356 billion. It’s lost $712 billion in market value since peaking above $1 trillion in early September of 2021.

Why is that good news? Because the leadership change in the stock market is still underway, from tech stocks to energy stocks. The first aspect of it is destroying value for companies that relied on the liquidity provided by low interest rates and the premium investors attached to growth and tech stocks. Who’s next? Try Apple, or Tesla.

The tech sector still has a total market capitalization over $10.5 trillion. Financials are next at over $8 trillion. The Energy sector, by contrast, is just the 8th largest at $3.4 trillion. That’s up from last at 11th when we first recommended energy as our Trade of the Decade.

But the entire sector trades at a forward price-to-earnings ratio of 6.32, compared to 17.44 for tech and 19.66 for Consumer Defensives. Utilities are the only other sector with a lower forward P/E at 2.66. Utilities are usually valued for their income-generating qualities, not earnings growth. Of the eleven S&P sectors, only two trade at price-to-sales ratios below 1%--Consumer Cyclicals at 0.86 and Energy at 0.82.

Russia, the Pound, and the Euthanasia of the Rentier

This is already a long update. But it was an extraordinary week. And the mail bag was full of concerns and questions. Tom will reply, as usual, on Wednesday. But I wanted to answer some of the most common ones that have come in over the last few unusual days.

Question: Would Russia use nuclear weapons to defend the new territory it has annexed in Ukraine? Should I buy defense stocks or an ETF with defense companies?

My answer: If we’ve ever been closer to nuclear war in my lifetime, it’s news to me. Russia officially annexed the territory it conquered in its war in Ukraine. Ukraine formally applied for admission to NATO. Someone–we don’t know who–blew up two Russian pipelines carrying gas to Germany.

In a speech on Friday, Russian President Vladimir Putin said, ‘The United States is the only country in the world that has twice used nuclear weapons, destroying the Japanese cities of Hiroshima and Nagasaki, and setting a precedent.’

He’s not wrong. But a precedent for what? For Russia to use tactical nuclear weapons to prevent a long war of attrition in Ukraine? God help us if that’s what he means.

Putin also added that ‘Even today, they [the US military] actually occupy Germany, Japan, the Republic of Korea, and other countries, and at the same time cynically call them allies of equal standing.’ Keep in mind that the large US military presence in all those countries means both ends of the ‘The World Island’ Halford Mackinder wrote about are contained by force of arms.

A fuller analysis of what’s going on is beyond the scope of today’s update. It’s more than just an investment story. We did, however, have a private discussion last week about whether defense stocks and ETFs containing them were worth a look. The answer?

No.

If things continue to get kinetic in Europe, you’ll have a lot more serious things to worry about than picking the right defense stock ETF.

Question: Why did the falling pound nearly cause a financial crisis in the UK? What is a balance of payments crisis?

My answer: Like the US government, the British government has been deficit spending for years. The UK, also like the US, runs a trade deficit in the broader economy. A balance of payments crisis happens when a country is no longer attracting sufficient foreign capital to offset its expenditures/consumption.

One of my mentors back in the early 2000s was Dr. Kurt Richebacher. When I worked with Bill in Paris in 2002-2004, Dr. Richebacher had my direct line in Paris and would often call from Cannes to bitterly complain about the mess America and its policy makers were making of the economy.

He could have written a book about a balance of payments crisis. But the short version is that a trade deficit is measured in the current account. The capital account measures financial flows–money into stocks and bonds. You can afford to run a deficit in the current account if you run a surplus in the capital account. This has been the deliberate policy of the United States ever since Robert Rubin was Bill Clinton’s Treasury Secretary.

Rubin worked for Goldman Sachs in the private sector prior to working for them as US Treasury Secretary. Once Bill Clinton signed the North American Free Trade Agreement (NAFTA), the writing was on the wall for manufacturing and the Middle Class in America. Washington decided that as long as exporters in Asia (China and Japan) recycled their trade surplus dollars (our deficits) into US stocks and bonds, everything was fine. The Capital Account (new highs on Wall Street) was more important than the Current Account (ever larger trade deficits).

Spending more on imports than you earn on exports is sustainable as long as the money comes back to you in some form. A Balance of Payments crisis happens when the money no longer comes back into your capital markets. That’s what happened in the UK after the new government under Prime Minister Lizz Truss announced tax cuts and energy subsidies.

Foreign investors took one look at more deficit spending with double digit inflation and decided they no longer wanted to buy British bonds. The pound fell and the Bank of England had to step in. But a printing press can’t repair confidence when it’s damaged by fundamentally unsustainable fiscal habits.

The US, by the way, isn’t in a much better position than the UK. The big difference is that the US dollar is the world’s reserve currency and US Treasury bonds and notes are, for the time being, the most liquid ‘safe haven’ asset for most global investors. If the Fed keeps hiking, expect more problems for other countries and currencies.

The chickens will come home to roost in the US too, one day. You don’t run a trade deficit with a $30 trillion government debt and get away with it forever. But that is a story for another day.

Question: Do you think wealth taxes are coming to America? What about a central bank digital currency?

My answer: Yes. Spain announced a ‘temporary’ wealth tax earlier this week on individuals or households worth more than $3 million. Between $3m and $5m, the tax is 1.7% of the value of assets. Between $5m and $10m, it’s 2.1%. And over $10m, it’s 3.5%.

It’s not clear that wealth taxes are legal under US law. Wealth is not income. And if it’s not a capital gain–an actual taxable event–then it becomes even harder to assess a tax on the value of assets that rise and decline in value with markets. People who don’t understand markets will try anyway (we’re looking at you Senators Warren and Sanders).

More likely in the US are measures which make it harder to move your money while also punishing money in certain types of investments. This is classic Financial Repression and has a long history in the US, going back to Regulation Q in the Great Depression, which prevented banks from paying interest on demand deposits (checking accounts).

A Central Bank Digital Currency could be used to impose negative interest rates on bank balances above, say, $1 million. When money is all digital and all public–accounts with the central bank instead of private banks–it is fully captive, fully transparent, and fully taxable for every transaction.

In Chapter 26 of his General Theory, economist John Maynard Keynes writes about the ‘euthanasia of the rentier.’ He means ‘the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity-value of capital.’ What does he mean?

He means savers and investors–capitalists–are extinguished from the economy by redefining money and capital itself. Savers will no longer ‘exploit the scarcity-value of capital’ by demanding interest on their savings or a return on their investment.

Communal capital will be made abundant through the agency of the State–via deficit spending and/or the printing press, or even by spending into existence a la Modern Monetary Theory (MMT). The ‘functionless investor’ who earns interest income on savings will be put to a financial death.

That’s always been the plan for the enlightened despots who want to command the economy. In order to do that, they need to redefine money. And they need the technological tools to prevent you from moving your money into assets or other forms beyond the reach of the State.

They’re coming for you. Make no mistake about it. That’s the real war the media isn’t covering.

Until next week,

Dan

PS Our whole mission here, since we started almost a year ago, is to find solutions to these problems (not just to explain them in painstaking detail.) But you have to understand what you’re up against before you can figure out how to survive and prosper.

Job number one is to not take the ‘big loss’ in the bear market. So far, so good. The bear market isn’t over. But we’re getting there. In the meantime, please enjoy a picture I took last week on a mountain bike ride into Medicine Bow National Forest, just east of Laramie.

Most of what happens in the world is beyond your control. But your reactions to it aren’t. And what you do with your time is also in your control. Use it wisely.

The road keeps going, around the corner and out of sight. Put one foot after the other. It’s all you can do. And you never know what’ll happen next

!

"many systems have survived through periods of deflation and that includes the U.S. But no system

has ever survived unabated inflation."

Richard Russell's Dow theory letter #751 Feb. 28, 1979

January 2022 will be remembered as the start of the Depression….. we got a LONG way to go till the bottom… sometime in the two years?

Caveat Emptor