The Generals and a $30 trillion Retreat

More than half of the stock market wealth is unsupported by real output. The total market cap of US stocks is around $60 trillion. Look for a $30 trillion loss when the bubble finally deflates.

Thursday, August 7th, 2025

Bill Bonner, from Poitou, France

We must be getting close to the end of one thing...and the beginning of something else.

The thing whose end is nigh is the bubble on Wall Street.

As a bubble inflates, the lightest, lowest quality stocks float to the top. That is what happened in the bubble of ’99.. The serious companies in the Dow rose 25% that year. But the flakier firms in the Nasdaq went up 85%. The emptier...and goofier...they are, the pricier they become. There is probably a ‘reason’ that explains this phenomenon, but we can’t think of it right now.

In the second quarter of this year, stocks partied like it was 1999. The S&P 500 rose 27%. But it was the worst of them that did best. Many are tech companies, for example, that lose money regularly. Those companies rose 57%, twice as much as the average S&P stock.

There is a whole industry (small) of analysts who look for bad companies so they can ‘short’ their stocks. So, when you see a stock with a lot of ‘short interest’ it generally means that the company is in trouble. But in the second quarter, those stocks rose even more than the unprofitable techs — they went up 68%. And then there were the ‘meme’ stocks — which make no sense at all in traditional stock analysis — up 77%...and a group of stocks labeled ‘Bitcoin sensitive’ — up 112%.

Trying to value Bitcoin by multiplying its E by the prevailing P/E ratio is a lost cause. It has no earnings. But there they are — the ‘bitcoin sensitive’ stocks are in the lead...the fastest-moving, most admired and most purchased stocks in a bubble market.

Overall, US GDP (our national output) rose by only about 0.7% (7/10ths of one percent) in the second quarter. Stocks, however, rose 38 times as fast...far beyond the value of their additional goods and services. This is why the whole stock market is greatly over-valued...and it’s why Americans now hold trillions in ‘ghost wealth.’ Since 1971, US GDP has grown by 24 times. But the S&P has gone from under 100 to over 6,000 — a gain of more than 60 times.

In the simplest math, more than half of the stock market wealth is unsupported by real output. The total market cap of US stocks is around $60 trillion. Look for a $30 trillion loss when the bubble finally deflates.

In the meantime, Churchill, quoted above, may be right. Democracy may be the best we can do. We’ve never tried the ‘others’ so we don’t know.

But a new form of government is now taking shape in the US. Caesarist? Authoritarian? Big Man? Let’s take a look.

It exhibits itself in big ways and small ones. Mr. Trump, for example, refers to Pentagon jefes as ‘my generals.’ No US president — not even Lincoln — ever did that before. POTUS is meant to be a temporary office holder. The generals are presumed to be loyal to the US Constitution...and to the USA itself, not to its Big Man.

But this Big Man aims to make sure ‘his’ generals know whom they serve. The New York Times:

Top Generals Nominated for New Positions Must Now Meet With Trump

The move is a departure from past practice and has raised worries that it could lead to the politicization of the military’s top ranks.

POTUS also tells universities which students they should accept...what their internal policies should be...and even what they can allow their students to say. That’s new too. For example, Harvard and MIT were forced to submit to a special definition of ‘anti-semitism’ that restricts criticizing Israel. The Harvard Crimson:

A Harvard education journal’s publisher abruptly canceled a planned special issue on Palestine and education last month, sparking accusations from authors and editors that the journal’s publisher made a “Palestine exception” to academic freedom.

As for the states, they are told how they must invest their money. Responsible Statecraft:

America last: Trump demands states support Israel or risk disaster relief

FEMA money to be contingent on pledge against any boycotts or divestment of Israeli companies

What’s behind this Israel First policy? Epstein photos? We don’t know, but it is part of a wider pattern of Big Man rule.

Trump also wants to cleanse the Republican Party of anyone who thinks for himself. Thomas Massie voted against more aid to Israel. And now...Fox:

Trump blasts Massie as 'the worst Republican Congressman' and says he's seeking a challenger to support

MAGA loyalists asked ‘why does Massie vote NO to every bill we propose?’

Massie responded cheekily: “I read them.”

Regards,

Bill Bonner

Research Note, by Dan Denning

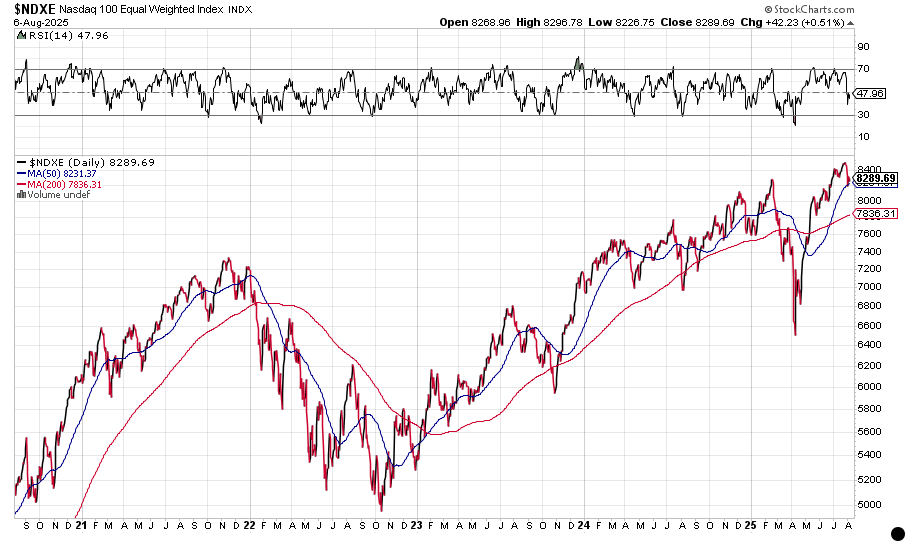

Speaking of ‘the Generals,’ Investment Director Tom Dyson published a chart in his weekly Market Note (Strong Shipping Uptrend) to paying subscribers showing that net income growth among the Mag 7 has likely peaked for this cycle. This got our research department in Laramie wondering what the equal weight Nasdaq 100 looks like at the moment. See the chart above.

The normal Nasdaq 100 is market cap weighted. The bigger the company, in terms of market capitalization, the bigger impact its price action will have on the index. The Mag 7 have a total market cap just shy of $19 trillion—about a third of the entire value of the S&P 500. This is an enormous concentration—and risk—in just a handful of stocks. But what about the rest of tech?

The equal weighted index shows that once you get past the surface seven, this latest all time high is running out of steam. In fact the equal weighted index has already started to roll over, coming off a recent RSI of 70. It’s trading just above its 50-day Moving Average, which itself is at an extreme divergence from the 200-day moving average. What do you think will happen next? Leave your comment below.

This ain’t no government anymore, this is a Maury Povich paternity test gone cosmic. The elephant rawdogged the donkey behind a Waffle House during a solar eclipse and gave birth to Trumptism, a shrieking Cheeto-dusted baby that thinks empathy’s for losers and taxes are just socialism with a neck tattoo. They used to say the GOP was about small government, now it’s just a roided-up hall monitor in a red hat telling you who to hate and what flags you can wave. Less “Founding Fathers,” more “Fast & Furious 38: Mar-a-Lago Drift.”

Meanwhile the stock market’s in full-blown crackhead mode. The Dow’s throwing gang signs, Nasdaq’s twerking on a pile of IOUs, and Bitcoin’s out assessed acting like it found Jesus and cocaine in the same NFT. The GDP grew 0.7% but stocks exploded 38 times faster!?! That ain’t growth, that’s hallucination. That’s your retirement account getting catfished by an AI startup with no office, no profits, and a CEO who vapes outta his belly button. You’re not investing anymore, you’re gambling with ghost dollars on ghost companies in a haunted casino owned by Elon’s twin who lives in the walls.

“They’re my generals”… MY generals?! The hell you talking about, bruh? You’re not Julius Caesar, you’re a human lawsuit in a suit two sizes too big. You got Harvard bending the knee, FEMA tied to foreign policy, and free speech taking more L’s than the Knicks in February. And the one guy in Congress who can read? Yeah, he’s public enemy number one. Not because he’s wrong, but because he’s literate. Welcome to the new empire, baby, where logic’s on life support, and the only truth that matters is how loud you can scream it on Truth Social.

Being the POTUS is a Big Man's game, like Massie the so called MAGA crowd can also read, let us know what you really think Big Boy Billy... cut the bullshit disguised as intellect, the same drivel needs a refresh, let us know what you really think Big Man. Take Trump out and put Harris in and tell us how the world turns for our next read, call it the Big Womans game, we need a break from TDS.