The Fed's Fallout

Plus continuing corrections, budget breakdowns and pet porcupines...

Bill Bonner, reckoning today from Baltimore, Maryland...

Yesterday, we watched the tape, wondering which way investors would take the news.

In the morning, the latest inflation numbers had investors’ attention. They showed prices coming down a little.

And in the afternoon, the Fed raised rates by 50 basis points (one half of a percentage point)…and said it would continue to raise rates until they were over 5%. CNBC:

The Federal Reserve will hike interest rates to as high as 5.1% in 2023 before the central bank ends its fight against runaway inflation, according to its median forecast released Wednesday.

The expected "terminal rate" of 5.1% is equivalent to a target range of 5%-5.25%. The forecast is higher than the 4.6% projected by the Fed in September.

What to make of it?

A New Era

At first, the inflation data looked like good news – as long as you didn’t pry into the numbers. But a 5% Fed Funds rate was not good news. No matter how you look at it, consumers, government and business are going to pay more to borrow money. And for people who owe, jointly and severally, $91 trillion, any increase in interest charges is a bummer.

Our hypothesis is that although the new era began more than two years ago – when the 10-year T-bond hit its all-time high – we are still in the ‘hinge’ period, swinging between old and new…hope and desperation…inflation and deflation. Some prices go up. Others go down. People are confused. And the financial news is mostly noise.

But one thing is sure: this new era won’t be like the old 1982-2020 era. More likely, it will be the opposite.

Already, the 10-year Treasury yield is nearly 6 times what it was back in 2020. Where it goes from here no one knows, but a lot of investors are betting that softening inflation numbers will allow the Fed to soften up too. Inflation could settle into a 4%-6% range…they believe, with a Fed Funds rate right in the middle. With no further threat of interest rate hikes, stocks could go up. They are hoping for a repeat of the last 20 years, but with the backdrop of higher inflation and interest rates.

How likely is that?

A Record Month

We don’t know, but our guess is that there are too many jagged edges sticking out; like trying to make a pet of a porcupine, it will be hard to get comfortable with it.

The federal government is the biggest debtor in the world. As rates rise, so do its costs, while its income goes down. Higher rates reduce economic activity…lowering US tax receipts. And they make it more expensive for the feds to roll over existing debt or borrow more.

Yesterday, we looked at a record monthly deficit for the US Treasury – $249 billion. That was almost half the money the feds spent. The Office of Management & Budget is still predicting a deficit of $1.3 trillion for 2023. But it will almost certainly be far worse.

The bigger the deficit, the more the feds must borrow. And the more they borrow, the more they push up interest rates for themselves and everyone else. If lenders thought inflation were anchored at around 5%, they would insist on an interest rate of around 8%, giving them a real yield of 3%. Few stocks or bonds could compete with an 8% yield on a ‘risk-free’ Treasury note. Zombie corporations, unable to rollover their debt, would go broke, and bad debt should be erased.

A Cross to Bear

In The Wall Street Journal yesterday, for example, was an update on WeWork. Two years ago, we warned that the business model of WeWork was, well, unworkable. But now we see that the financial strategy was unworkable too:

WeWork, saddled with expensive long-term leases and more than $3 billion of debt, recorded a negative cash flow of around $4.3 billion between July 2020 and September of this year.

WeWork’s stock is down more than 70% this year. Its bonds trade at about 50 cents on the dollar. And if a recession is coming, how many renters are going to want WeWork’s fancy desks?

We don’t know that either. But there are thousands of WeWorks, each with its own cross to bear. Too much debt. Too little cashflow. And no way to survive a recession.

Yes, in this hinge period, it is not inflation that investors have to fear; it is deflation. People always make mistakes. The Fed makes the mistakes worse, by dangling cheap credit in front of them…leading them to borrow too much. But markets correct mistakes by crashing prices, bankrupting over-stretched companies, and wiping out unpayable debt. That ‘correction’ is not over; it is just getting started.

Regards,

Bill Bonner

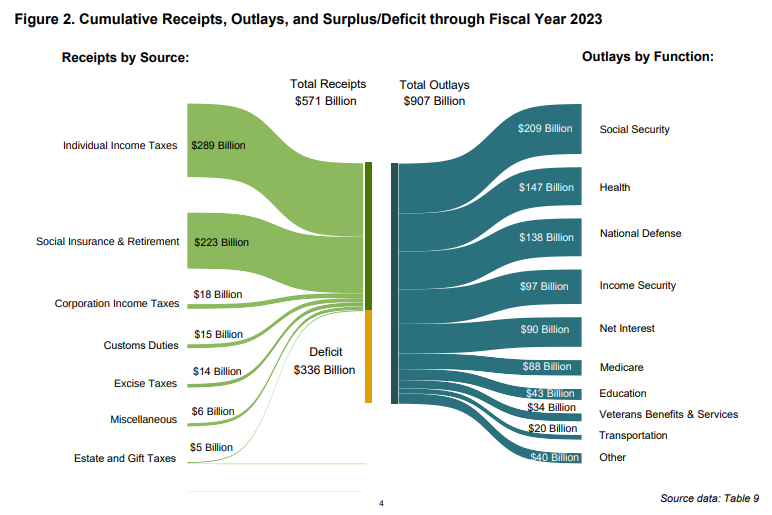

Joel’s Note: Here’s a neat little infographic for the home budgeters to help illustrate the situation the federal government is facing. And by “neat,” we mean “messy as hell.” Dan forward this one over yesterday. It comes courtesy of the folks over at the the Treasury Department.

It shows cumulative receipts vs. outlays for Fiscal Year 2023. (The government’s fiscal year begins in October, so this only represents the first two months.) Still, let’s take a look at how things are going so far, shall we?

On the left hand side (in green) you can see the various capital inflows filling the government’s coffers. Think of these as your various sources of household income. The healthier lines up top might represent you and your partner’s income, for example. Underneath that you have minor earnings… maybe you drive for Uber once a month, the wifey has a side hustle crocheting baby booties on Fiverr… you’ve got a “system” that brings in some money at Bob’s poker night every second Thursday. That kind of thing.

Then, over on the right hand side, you’ve got your outflows. The mortgage. Healthcare. Kid’s school/college fees. Gas. Food. Something nice for the missus once in a while. Maybe dinner and a movie. Oh yeah, and taxes – income, corporate, payroll, capital gains, sales, excise, property, value added, estate…

Now, subtracting the latter from the former, you get the difference – or the deficit. In the case of the federal government, you can see (on the little yellow line) this comes to $336 billion. And remember, that’s just over a couple of months.

But what does this mean in the context of day-to-day, month-to-month government spending, you ask? So glad you did…

According to the Treasury Department (and as Bill noted above), the November budget deficit jumped by $57 billion (30%) from a year earlier to $249 billion, as revenues fell and outlays rose sharply. That’s a record, by the way.

What outlays? Well there was that extra $14 billion for Medicare (+18%)… and that $11 billion (+94%) in increased education costs due largely to student loan forgiveness. Oh yes, and interest repayments. Can’t forget those!

The interest costs on U.S. public debt grew $19 billion (53%) during November. But fear not; that figure was largely offset by a $17 billion decline in tax credits for children and low-income workers. As costs to service the debt load go up, in other words, there’s less money available to do the kinds of things governments like to say they do…

Overall, receipts for November fell $29 billion (10%) from a year earlier to $252 billion, while outlays rose $28 billion (6%) to $501 billion, also a November record.

According to the Treasury Department, interest payments were up $48 billion, or 87%, for the first two months of fiscal 2023.

“We'll be watching the net interest expense closely for the rest of the fiscal year,” writes Dan. “A this rate, we’re on pace for a $2 trillion 2023 deficit.”

What does that mean for you… for your family… for your own household budget?

For one thing, it means you probably shouldn’t be relying in the government to secure your financial future. That’s something you ought to take in hand sooner, rather than later. Find out how Bonner Private Research can help you safeguard what’s yours, here…

And the "Bonner Boys" are only focusing on the government at this point. Let us not forget record corporate debt and record Consumer debt, both of which are still on the rise. Need I mention the savings rate is dropping like a rock, or is that 'salt in the wound'?

Hope everyone has started their own 'independent resilience' program...Build Back Barter, as I like to say!

Yes, Peter.

And are you gentlemen ever going to comment on what Ed Dowd has found, plus his book just this week making the scene? Surely the insurance world is going to be (or has been) mightily disrupted, and those TRUTHs will also rock the financial world.

I have read, elsewhere, that funeral home stocks are currently a good investment...