The Bad Seed

Consumer prices may also go up at 10% per year. Or more. And given the trends now in motion, the dollar may not exist at all, in its present form, when today’s newborns reach 65.

Monday, December 22nd, 2025

Bill Bonner, from Baltimore, Maryland

The new ‘toys for tots’ program announced by Donald Trump set our mind to spinning. Newsweek:

Once the program goes live, a financial institution will receive the funds for a given child’s account and activate it. From then on, up to $5,000 can be contributed to the account per year, though no additional deposits are necessary.

“The compound growth from Treasury’s initial seed funding alone stands to make young Americans wealthy. The S&P has grown at a rate of 10.5% each year, on average, since the 1950s. Assuming that growth rate continues, a single $1,000 deposit into a Trump account at birth will grow to over $600,000 by the age of retirement,” [Scott] Bessent said.

Hold on...Fox reports:

A fully funded account could reach as much as $1.9 million by age 28, according to the Treasury’s Office of Tax Analysis.

Whoa...where does this money come from?

In order to give $1,000 to a youngster, the feds need to take $1,000 from someone else — oldsters...and middle-agedsters...and all the sters in between. A simple question: How will this money do more good for the recipients than for the people it was taken from?

Some of the people from whom the money is taken worked hard for it. Others got it by investing. Some would otherwise invest it in enterprises that would grow and hire more people. And some would just p*** it away. What sense does it make to take it from them and give it to someone else to p*** away?

But neither the press nor the public nor Congress itself took much notice of this latest larceny.

Probably the most entertaining part of the story is the way rich guys are getting on board. Especially those in the industry most likely to benefit from it. They make it sound like a public service. Bloomberg:

Dalio, BlackRock join donor list for ‘Trump Account’ program

Bridgewater Associates founder Ray Dalio...said Wednesday his foundation will donate $250 each to roughly 300,000 “Trump Accounts” for children in Connecticut. BlackRock Inc. also announced it would match the federal government’s contributions to the accounts for employees’ children, seeding them with $1,000 each.

Bessent...“An entire generation of Americans is about to learn in the most life-changing way possible how even small contributions can become generational wealth, and it’s all thanks to President Trump.

For half a century, Wall Street has brought in the sheep. It colluded with Washington to boost up nominal stock prices...while suppressing real interest rates...practically forcing savers into the stock market. The wool grows while you sleep, it tells clients; ‘all you have to do is buy our retail investment products.’

At first glance, it looks like they were right. The Dow rose from 880 in 1971 to over 48,000 today — a leap of 54 times.

But here’s Stephane Renevier, CFA:

A surprising reality: the majority of individual stocks actually lose money. And Treasury bills have delivered better returns than nearly 60% of stocks ever listed on Wall Street.

And during that same period, keeping your money out of the stock market, and in gold, did much better than Wall Street...as gold rose from $40 to $4,387 — 109x, twice as much as the Dow.

What about dividends? We haven’t done the calculation, but our guess is that after-tax dividends gave the investor less than he lost to inflation.

And now...all thanks to President Trump… Wall Street is sharpening its clippers. Management fees, commissions, performance bonuses — the poor little innocents...they’ll have their funds in the hands of a federal agent(!)....and then move to accounts with...well, Ray Dalio and BlackRock.

They’ll all get rich. Or, maybe not...but at least the kids will get an education. Warren Buffett says he was lucky to be born when he was...and to spend his whole life in the greatest bull market run in history. As we’ve seen, it wasn’t all that great. And it was goosed with ‘printing press money...which came with complications...

...such as the biggest debt pile in world history...

...almost guaranteeing high levels of inflation for many years and paltry, if not negative, returns for years to come.

Consumer prices are already rising at about 3% per year — according to official tallies. Unofficially, the real inflation rate is probably over 5%. But since the economy only increases the output of real goods and services at maybe 2% per year it is unlikely (impossible?) that stock prices will do much better.

More likely the stock market will struggle just to keep up with inflation. It may grow at 10% per year, as Scott Bessent suggests. Consumer prices may also go up at 10% per year. Or more. And given the trends now in motion, the dollar may not exist at all, in its present form, when today’s newborns reach 65.

What $600,000 dollars will buy you then, we don’t know. Probably not even a pot to p*** in.

Regards,

Bill Bonner

Research Note, by Dan Denning

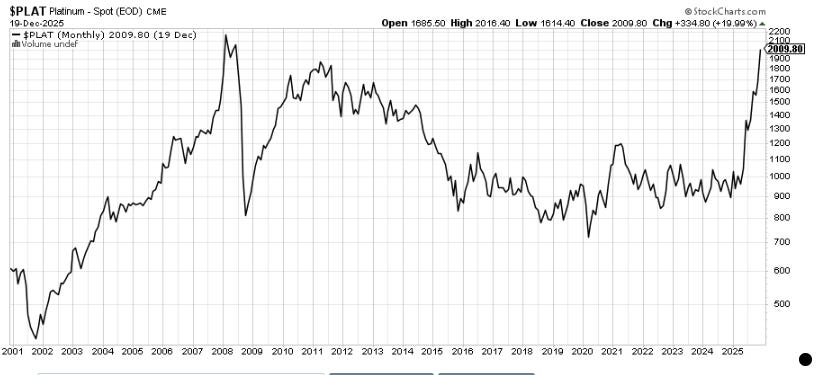

Platinum has traded over $2,000/ounce overnight. That’s a 17-year high. What’s next in 2026? Investment Director Tom Dyson calls it ‘the gold catch up trade.’ That’s where other metals (precious and base) and other real assets (especially energy) imitate gold’s performance.

I asked a few AIs about the value of the dollar before the Federal Reserve was established.They agreed on this: "The value of a dollar in 1900 was roughly equivalent to what it was in 1800; in fact, the dollar's purchasing power increased by approximately 33% over the course of the century due to general deflationary trends in the latter half".

Maybe the crooks and spectators in DC should work on ending the Fed instead of printing more money to buy votes.

Bill misses an important aspect of the "Stock Market". It is NOT a monolithic single entity, even if you buy an S&P500 index fund. The stock market is more like a forest, with young saplings competing for sunlight among mature trees and large old ones that are beginning to rot at the core. If you buy a "sapling" and hold until it is rotten and falls over, you'll have nothing. But if you, at least annually, review your holdings and ask "do I still want to own this tree (company)?" and prune the mature investments and look for younger, more vigorous ones (or speculate on the promising sapling), you will make satisfactory returns. I used to own GE and Boeing (decades ago). They had good runs, but lost their way. I rolled that into Microsoft and Apple after the 2008 crisis, and rode them up. Now I am taking some of that and putting it into energy as it seems historically cheap now. Sometimes I think Bill does not understand wealth creation, although he talks about it all the time.