Tariff Deal Mania

Centralized trade policies are a scam. There is no evidence that bureaucrats in Washington can do a better job of making trade deals than independent buyers and sellers with skin in the game.

Tuesday, May 13th, 2025

Bill Bonner, from the ranch at Gualfin, Salta Province

‘I think they can have three dolls or four dolls because what we were doing with China was just unbelievable.’

Donald J. Trump

What fun!

Declare a National Emergency. Start a trade war. Then, put on tariffs at impossibly high levels.

Stocks naturally sell off... along with bitcoin and oil.

Then, let people know that you didn’t really mean it. A ‘pause!’

If it were true that the foreigners had been ripping us off...

Why let them continue to rip us off for another three months?

It’s a spectacle on the level of Wrestle Mania, emotionally, though lacking its intellectual depth. Sub farce. No subtlety. No ambiguity. No plot development. There are good guys — USA...USA...USA — and there are bad guys (everybody else) who have been taking advantage of us for decades.

And then, when it becomes obvious that carpet bombing our trading partners and allies is less than optimum policy...the ‘war’ is called off...the outrageous tariffs are lifted...and guess what?

Stocks, oil, and bitcoin bounce on cue.

A Big Win!

Reuters:

S&P 500 jumps to over two-month high after US-China tariff truce

The S&P 500 hit its highest since early March on Monday as a crucial U.S.-China agreement to slash tariffs put investors worldwide at ease after weeks of uncertainty around the future of global trade.

The Dow Jones Industrial Average rose 2.51% to an over one-month peak, while the Nasdaq Composite gained 3.34% to its highest in more than two months. The S&P 500 advanced 2.53%, surpassing its 200-day moving average for the first time since late March.

Alan Beattie at Trade Secrets summarizes the state of play so far:

Trump’s deals with China and the UK have one thing in common, which is — and please sit down if you’re prone to fainting — they’re not binding and they leave a huge amount of negotiation down the line. I know, right? In fact, it’s not 100 percent clear what they mean now, especially the China deal.

But the Straits Times thinks it knows:

Mr Xi Jinping’s decision to stand his ground against US President Donald Trump could hardly have gone any better for the Chinese leader.

After two days of high-stakes talks in Switzerland, trade negotiators from the world’s biggest economies announced on May 12 a massive de-escalation in tariffs. In a carefully coordinated joint statement, the US slashed duties on Chinese products to 30 per cent from 145 per cent for a 90-day period, while Beijing dropped its levy on most goods to 10 per cent.

The dramatic reduction exceeded expectations in China, and sent the dollar and stocks soaring – providing some much-needed market relief for Mr Trump, who is facing pressure as inflation looks set to speed up at home. Chinese equities also surged.

In other words, according to the Art-of-the-Deal guy’s deal, the average American will pay three times as much in tariff taxes as the average Chinese.

Big win? Reciprocal?

Just as with other forms of central planning, centralized trade policies are a scam. There is no evidence (NONE!) that bureaucrats in Washington can do a better job of making trade deals than independent buyers and sellers with skin in the game.

But who cares? We’re into politics now, not economics. And while the price of stocks rose yesterday, the real value of America's capital continues to decline. In 2018, it took 22 ounces of gold to buy the 30 Dow stocks...now you only need 13.

Thus, it all hangs together — at least in our philosophy. Politics is win-lose. Economics is win-win. The greater the payoff from politics – that is, from lobbying, bribing, and brown-nosing politicians – the lower the payoff (and stock market values) of output-producing enterprises.

Or, to put it another way…when the Primary Political Trend is up --- towards more policies, legislation, and brute force – the Primary Trend in markets is down.

And maybe Mr. Trump is right; our children don’t need any more dolls. Prosperity isn’t everything. And maybe poverty and absurdity won’t be so bad. So, buckle up! And take this opportunity to sell the S&P.

Stay tuned.

Regards,

Bill Bonner

Market Note, by Tom Dyson

As I explained to readers in my recent update (The Best Shipping Portfolio Money Can Buy), for any new money that I would have invested in gold, I’d rather buy platinum, silver, uranium, oil or oil stocks now. These all offer debasement protection and in terms of gold, they’ve all become extremely cheap.

Crude oil is about as cheap as it’s ever been in terms of gold. So is platinum, which used to command a price three times that of gold. Now gold commands a price three times that of platinum.

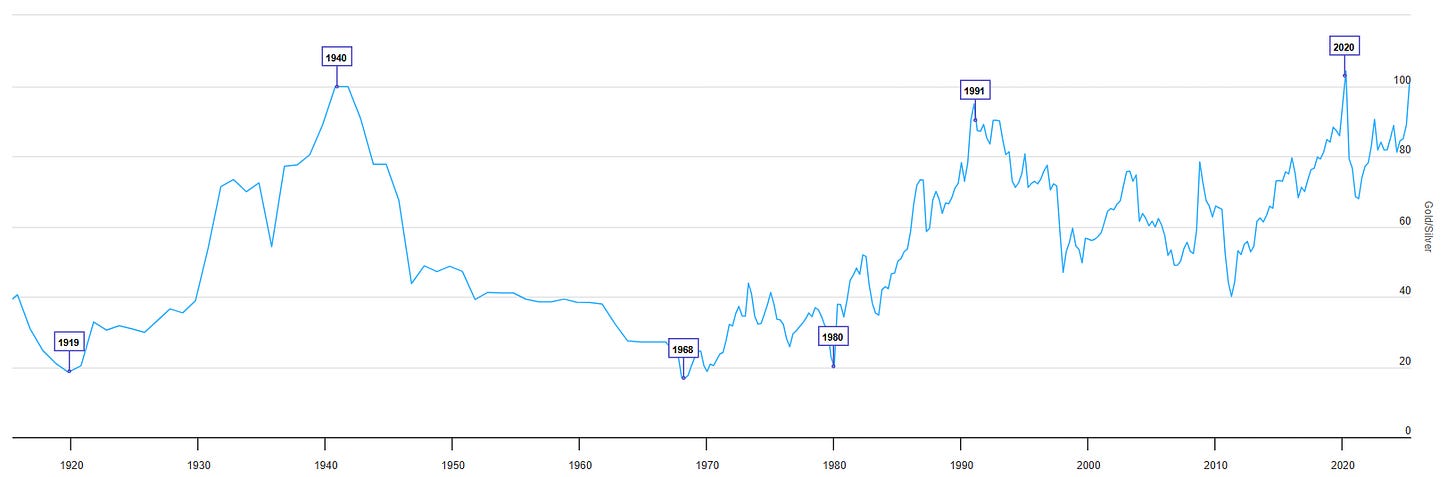

Here’s a long term chart of the Gold/Silver ratio. The Gold/Silver ratio has hit 100:1 on three prior occasions over the last century...and it was never sustained.

"It’s a spectacle on the level of Wrestle Mania, emotionally, though lacking its intellectual depth."

Worth tuning in today for this alone!

The biggest illusion being promoted here, is the idea that there’s ever really been “free trade” to begin with. It’s not beneficial to live in a country of “free trade” when your trading partners are not doing the same.