Stocks on the Gold Standard

Societies evolve. Things change. Elites compete for power... and use it to move wealth in their direction.

Gold is money. Everything else is credit.

J. P. Morgan

Wednesday, August 21st, 2024

Bill Bonner, writing today from Poitou, France

Here’s good news for dear, long-suffering readers. We didn’t ‘miss out’ on anything.

The Wall Street Journal has the story:

Gold Ascends to New Record High

Front-month Comex gold futures rise 0.4% to a new record of $2,511.30 an ounce — while the most-active contract gains 0.3% to $2,548.90 an ounce, also a new record. Meanwhile, SPDR Gold shares are up 0.3%. The drop in the U.S. dollar to a 7-month low helps spur flows to gold, as well as speculation over a coming cut in interest rates by the Federal Reserve.

The precious metal’s gains come as the markets await Fed Chair Jerome Powell’s speech in Jackson Hole on Friday, with investors looking for more hints on a potential cut to U.S. interest rates, says Samer Hasn, senior market analyst at XS.com. Markets are currently pricing in cuts of up to a full percentage point over the remainder of the year...

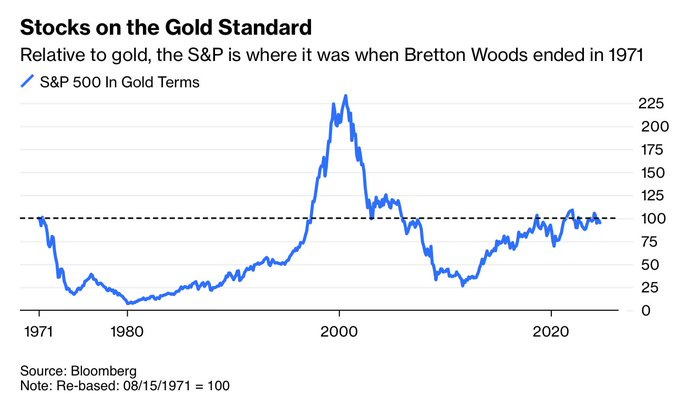

We direct your attention to the Dow/Gold ratio. In round numbers, the ratio was around eighteen in January... meaning, it took eighteen ounces of gold to buy the thirty Dow stocks. Now, it only takes sixteen.

For all the cheers, back slapping and celebration on Wall Street... over the Dow’s 3,000 point gain this year... stocks have actually gone down. In terms of real money — gold — they’ve lost about 10% of their value. Another way to look at it: the dollar lost value faster than stocks rose.

FOMO NO MO! (Fear of missing out, no more)

Our Maximum Safety Mode has actually outperformed the stock market. And here’s a guess: This trend will probably run for the next five-ten years, maybe longer.

Why?

The USA is the oldest major government on the planet. For more than two centuries, it has met every challenge (and opportunity) with regulations and spending... now congealed in $35 trillion of debt.

The first, most obvious, and current measure of the ‘cost’ of all this problem solving and world improving is the percentage of GDP spent by the feds. US federal spending was 17% of GDP — roughly in line with receipts — in the 1950s. Now, it is 24% of GDP, with a ‘structural’ deficit equal to 7% of GDP... or three times as much as the average deficit in Argentina over the last twenty-five years.

Of course, there are other costs — the hidden costs of rules, regulations and red tape... and of forcing people to do what they don’t want to do.

We put the total cost — arbitrarily, but plausibly — at around 50% of GDP. But we are a rich society. We can afford to squander half our energy and resources on what are essentially boondoggles... and wealth transfers. And if the tax rate were a flat 50%... we could presumably go on like this — enjoying only half of what we should produce — more or less forever.

But it doesn’t work that way. Societies evolve. Things change. Elites compete for power... and use it to move wealth in their direction.

The credit money system, in America, allowed the elites to take not only a big part of current output…but a large portion of future output too. No politician will propose a flat 50% tax. He is more likely to propose a tax cut. And so... the real costs are rolled forward until they become unmanageable. The debt is then a measure of ‘accumulated costs’ that Tainter says destroy a civilization.

Research shows that when debt reaches 130% of GDP, you arrive at the real point of no return... when the system falls apart. Already, deficits are expected to hit $2.8 trillion by 2034. Sometime before then, the doomsday debt device will be triggered (if it hasn’t been already.)

What that means exactly, nobody knows. And nobody wants to find out. But the price of gold — the only ‘investment’ that is relatively impervious to lies — is rising. As we saw above, gold is now trading over $2,500 per ounce... up more than 50% from two years ago.

Stock prices rose too — but only by about half as much.

At normal interest rates, there is no way the feds can service $35 trillion in debt — not in today’s money. And there is no way they are going to allow the bubble economy to collapse completely.

But politicians don’t get power by paying their bills or telling the truth. This week, the lies come fast and fulsome from the Democrats’ fraudfest in Chicago. Last month, they came from Milwaukee, out of the mouths of Republicans.

And the most convenient and attractive lie for both parties is that somehow, sometime, someone will pay our debts for us. Harris claims the rich and corporations will pick up the tab. Trump tells audiences that tariffs on foreign imports and an economic boom caused by more fracking will do the trick.

Not going to happen. Instead, US debt will be liquidated by reducing the value of the dollar.

More to come...

Regards,

Bill Bonner

Research Note, by Dan Denning

In gold terms, the S&P 500 is exactly where it was in August of 1971, when President Richard Nixon ended the gold dollar. Does this mean stocks are under-priced, in gold terms? Not according to the Dow/Gold ratio (currently just over 16). Interest rate cuts by the Federal Reserve later this year could send the US dollar lower in gold terms. Stocks? Stay tuned for more on that in Live Chat with Investment Director Tom Dyson this weekend (paid subscribers only, look for details on how to participate tomorrow).

The Wall Street Journal puts out a podcast twice a day. When gold hit a new high v the USD they mentioned it. This was the first time I can remember this podcast even acknowledging the fact that gold exists...

Great column, Bill. Wish you would write more of these based on economic facts and insights rather than on your warped political fantasies. LOL!