Smooth Sailing

We see what is, not what could be, or ought to be, or will be. A man takes a vacation to Milan, and misses the sights in Paris.

Thursday, August 14th, 2025

Bill Bonner, from Poitou, France

Uh oh. In the fight between virtue and vice, it looks like our fav congressman is going down. The Washington Examiner:

Pro-Israel billionaires spent over $1.5 million in 38 days to oust Thomas Massie

Polling shows him running way behind the candidate Trump/AIPAC paid for.

Massie made a good point in a recent interview. It’s not just Trump and the Israel lobby he’s up against...it’s America’s firepower industry too. They all want more of the public’s money. But it’s worse. Massie is up against the whole system of fake money and inflated prices. Anyone who stands in the way is marked for elimination. .

Massie: “The Pentagon provides Congress with a handy map showing all the districts where defense industries are located and all the jobs they create.”

That is what we see. What we don’t see is all the jobs, incomes, sales and earnings taken from elsewhere. Every pound of steel used to make a tank is not used to build an HVAC system. And even if the money is fake — ‘printed’ and borrowed — it still is used to buy real resources that must come out of the real economy.

Which brings us to our question for today. What is it we’re not seeing? What’s the rest of the story?

We see what is, not what could be...or ought to be…or will be. A man takes a vacation to Milan, and misses the sights in Paris. Napoleon takes his soldiers to Moscow; they might have enjoyed the Cote d’Azur instead. A bomb goes off...and kills a man who might have found a cure for cancer.

We only know a small part of the story. And the part we think we know we see only through a glass darkly.

We are told, for example, that the tariffs are a big success because the revenue to the Treasury will reduce deficits and debt. In this case, the ‘more to the story’ didn’t take long in coming. CNBC:

US deficit grows to $291 billion in July despite surge in tariff revenue

The deficit for July was up 19%, or $47 billion, from July 2024. Receipts for the month grew 2%, or $8 billion, to $338 billion, while outlays jumped 10%, or $56 billion, to $630 billion, a record high for the month.

At this rate, expected revenues from tariffs, while substantial, will still be negligible from a debt reduction standpoint.

Until last week, Mr. Trump looked upon the job numbers as proof of a healthy economy. Then, when the numbers were revised downward, he claimed they were ‘rigged.’ But either way, the numbers prove nothing.

Some of the disappeared jobs might have vanished because industries feared the uncertainty of Trump’s unpredictable Big Man management. Others might have gone away because women are leaving the workforce. Newsweek:

Hundreds of Thousands of Women Are Leaving the Labor Force

Or because the immigrants are packing up. USA Today:

The country's immigrant population may have dropped by roughly two million people in the first six months of the year, according to new government data.

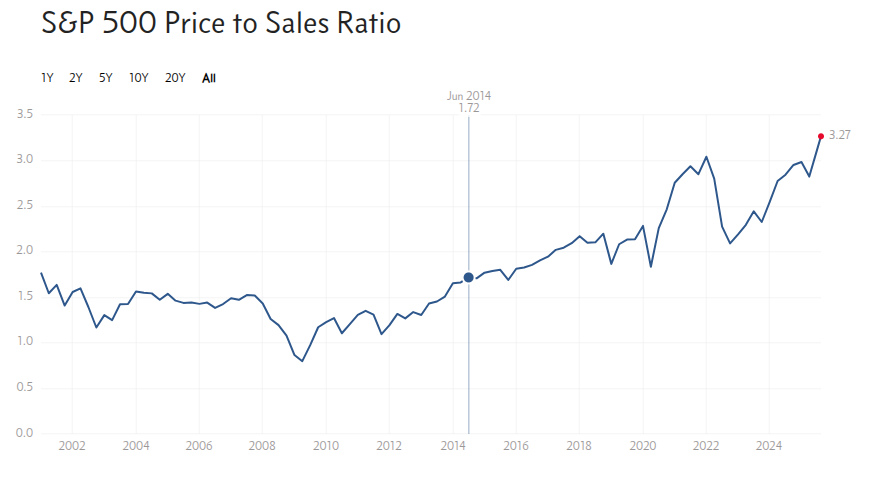

And in the stock market, record prices prove that the Trump Team must be doing something right...right? Stock prices are data. Facts. They don’t lie. Reuters:

S&P 500, Nasdaq hit record highs at open...

But wait. What stories are stock prices not telling us?

Stocks in the US are up almost 10% this year. But in Germany they’re up 35%. Has the Trump Team cost investors a 25% gain?

We don’t know. But congratulations may be premature. Like praising the captain of the Titanic for four days of smooth sailing…or Herbert Hoover for the remarkable stock market of the summer of 1929…

It might be wise to wait for the rest of the story.

Bill Bonner

The loss of Massie would be a shame... but then, what can one man do against a pack of fools...

it does seem that catastrophe stalks us... the government has grown so large that it acts like a black hole sucking everything in within its grasp... and the private economy becomes weaker and weaker.

The quote at the top says it all. The ultimate conclusion is…we will pay a price.

After reading “The Lords of Easy Money” it is not hard to understand that the series of financial distress and the monetary policies that pushed the problem down the road will lead to one last gigantic financial crash.

I can understand why Bonner says, “hold cash;” all assets will crash, there will, for a period, be no buyers and sellers will accept anything.

In the addendum to “Screwtape Letters” Lewis says that the modern soul will be so insipid and stupid that it will be unable to be good or evil, just sheep led to the slaughter.