Revolutionary Devices

Maybe that’s the biggest evil of the inflationary fiscal and monetary policies of the last fifty years. There’s no reward for delaying consumption and planning for the future.

Friday, May 30th, 2025

Laramie, Wyoming,

By Dan Denning

Greetings from the High Plains of Laramie. One important programming note before I get into this week’s letter: If anyone contacts you on Substack–or any other platform–purporting to be or someone from Bonner Private Research, and is asking for money for a private deal or any personal information…IT IS NOT US. You should block or report that person (or bot, or malicious AI agent) immediately.

Unfortunately it’s the sort of thing that happens when you start to get bigger (more subscribers and social media attention). It’s the first I’ve ever heard of it happening on Substack. But it probably won’t be the last time. We’ll never contact you directly–via private message or email–with any request that you transfer funds or participate in some deal.

If you DO receive anything like that, please contact us via email and we’ll report it to the proper authorities on Substack. I know most BPR readers are pretty internet savvy and could sniff out this kind of activity a mile away. But since I was notified that it happened, I wanted to let everyone know to watch out for it. With that out of the way, let me start the research part of this week’s letter with an image.

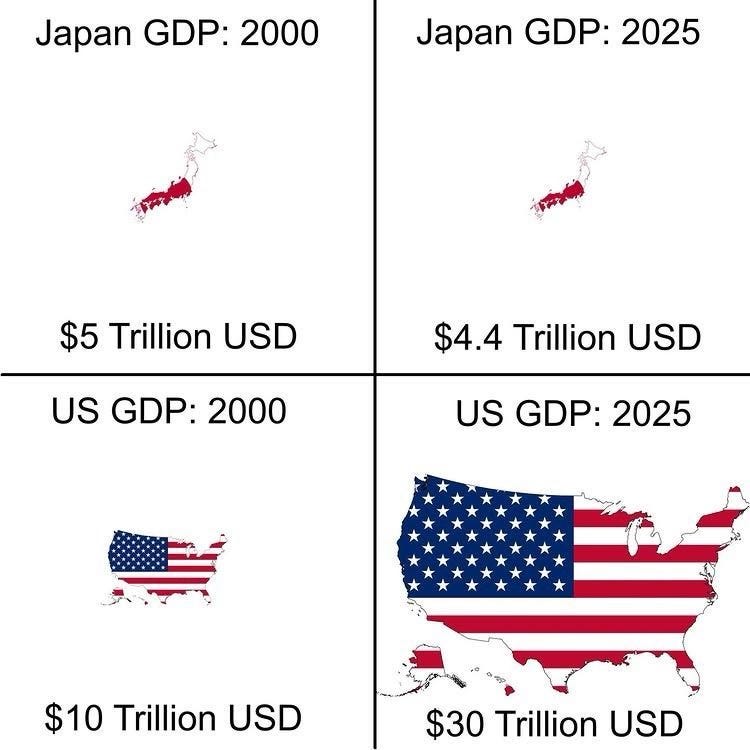

The chart above, which I saw on X this week, is a bit of a Rorschach test for your understanding of money. If you’re an American exceptionalist, you’ll see 200% growth in US GDP this century. Bigger, better, richer. Japan, in the same century, has shrunk, with GDP falling 12% in twenty five years.

Not many people would argue that Japanese standards of living or quality of life have declined by 12% this century. Public debt has soared, it’s true. But until recently, deflation was the great threat, according to expert economists. Other than a very serious demographic decline (a lot of centenarians plus low marriage and birth rates) there’s no evidence Japanese civil society is in rapid decay, increasingly violent, or under attack from mass influx of illegal migration (I can’t speak to people’s internal emotional or spiritual states or whether they are happier, fulfilled, and living meaningful lives, doing meaningful work, and living with people they love…much of which has absolutely nothing to do with asset values or material prosperity).

Is the US better off than Japan in all the ways that really matter? Probably not. In material terms, or in nominal GDP terms, the US is richer than ever. But the gains in financial assets and house prices are confined to the top 10% of the population. Instead of being evidence of healthy growth in productivity driven by new investments (from accumulated savings), the US map looks like an inflationary boom driven by debt.

And if we’re talking numbers instead of feelings or hunches, the numbers back it up.

Total M2 money supply in he US has grown 158% this century.

Total federal government debt has grown by 560% since the start of the new millennium, from $5.6 trillion to $37 trillion.

Total debt–public, private, and corporate–has grown 281%, from $26.8 trillion to $102.2 trillion.

Household net worth data from the Fed says US households are 290% richer this century, from $41 trillion to $160 trillion.

If we’re right, this isn’t a history-making boom. It’s an inflationary asset bubble pumped up by record debt accumulated at historically low interest rates (which are now moving up). This is why we’ve gone on record saying a $50 trillion wipeout is a conservative estimate of what a ‘big loss’ looks like.

You can have deflation AND high standards of living. But you need sound money and sane politics. In fact, stable or falling prices (what is often referred to as deflation) is one of the dividends of a sound money system. It incentives the accumulation of savings, investment, and thinking about the future. Your purchasing power (and the value of your labor) go UP over time, not down.

Maybe that’s the biggest evil of the inflationary fiscal and monetary policies of the last fifty years. There’s no reward for delaying consumption and planning for the future. All the incentives are for instant gratification. The fact that fiat money loses real value (purchasing power) by design leads to so much psychological and spiritual unhappiness, despite the rise in the headline figure (GDP). Which brings me to the following chart.