How $50 Trillion Could Vanish

The following was prepared for new readers of Bonner Private Research and is intended for investors, savers, and retirees in the United States.

Monday, April 21st, 2025

By Bill Bonner

Dear Reader,

You may find this alarming. Or aggravating. Or irritating. Or all of the above. Why?

In our experience, people don't like being told that what they thought was true is wrong. They especially don't like being told they might not make as much money as they thought. Or, that they are not really as rich as they thought they were.

We’ve learned this the hard way over many years.

In the 1970s we attempted to convince the states to call a Constitutional Convention to add a balanced budget requirement. US debt level then: $700 billion

In 1986, we sued the Federal government, arguing that saddling the next generation with debt was ‘taxation without representation.’ Debt level: $2.1 trillion

In 1993 we published a small but influential book called The Plague of the Black Debt. It warned, in precise detail, of the dangers a country faced from becoming addicted to debt. The mainstream media–in the tank for Bill Clinton–hated it. Our warning was ignored and America went down a disastrous debt path (more on that later). Debt level: $4.4 trillion

In 2003, we published Financial Reckoning Day. It was a warning that the hangover from the dot.com bust would be a soft depression, with lower stock prices and higher inflation. It took the Nasdaq 15 years to make a new high after the crash. Debt level: $6.7 trillion

In 2006, our book, Empire of Debt, warned about the recklessness of more and more federal borrowing. Debt level: $8.5 trillion

In 2007, we warned that real estate had become dangerously inflated – thanks to the Fed’s too-low, too-long interest rate policies which encouraged debt in the housing sector. In 2008, Ben Bernanke warned Congress that ‘we may not even have an economy,’ unless it took immediate action to save Wall Street. Debt level: $10 trillion

About six years later, we made what we think was our most important observation ever–that too much of a good thing (credit!) leads to catastrophe. It was more philosophical than our previous books. But more relevant today than ever. Debt level: $17 trillion

Debt level today: $37 trillion.

Today, there's no time to write a book. All we can do is raise the alarm...and introduce you to a way of seeing financial markets that can save you from bigger losses...or even result in unexpected gains.

The idea we’d like to show you could be the single most important investment idea of the next ten years. And because so many Americans are at or near a critical time of their financial lives–the timing couldn't be more urgent.

US stocks began 2025 at all-time high valuations. A big correction has begun. But it has much further to go. We can prove it to you below. The risk is so high – in real estate and bonds as well as stocks – that without exaggerating, this may be the most important warning we’ve published to savers, retirees, and investors in forty years.

Reversion to the Mean

Price movements in the stock market are episodic and cyclical. They are never completely independent from the real economy. And here is the most important part: they are always subject to mean reversion. That is, they always go back to where they ought to be.

Stock market prices are about the future. And maybe the future will be far better than we expect. But prices cannot be independent of the real world. And right now, there is a huge gap between the reality of the American economy…and the market value of American stocks.

The only way that gap closes is the subject of the rest of this short report. It's what we call The Big Loss. We don't have time to write a whole book on how to avoid it. But we don't have to. We’ll show you instead.

Pattern Recognition

Most of what you think about investing and the stock market is wrong. Did you know that 58% of stocks made no money for investors over the last 100 years? Studies show that the average investor does much worse than the market averages. And even if you were to keep your stocks for 100 years, they’d be unlikely to gain a penny of real value.

Markets follow cyclical patterns. Some of those patterns can last up to 73 years, top to top. You can’t afford to be on the wrong side of them. Nor can you afford to take the Big Loss, especially not late in your investment career.

While anything can happen in the short run, over a longer period market events follow patterns. A man, at 90, can occasionally father children; he can appear youthful… and win tennis matches. Still, in a few years, he’ll be dead. That’s a pattern that would be unwise to bet against.

The Pattern of Bear Markets: Structural and Cyclical

In markets and economies…as well as politics…there are patterns too. The table above, provided by our Research Director Dan Denning in Wyoming, shows that there have been over 25 bear markets in US stock market history. The cyclical ones happen more often and are shorter. The ‘structural ones’--like the one we’re in now—last longer and hit harder.

The most important pattern in markets is what we call the Primary Trend — the deep current that moves events, regardless of what people know, want, or think.

Unfortunately, amid all the noise of constant market movements… and a hurricane-force wind of news and opinion…it can be difficult to make out the Primary Trend. You have to put your ear to the ground…tune out the background commotion as much as possible…and listen hard.

There are predictable patterns — a tree grows to a great height…then it rots. An Empire — even the most powerful one of all time — expands…and then shrinks. Up, down, up, down…round and round — cyclical patterns in the natural world, say, the cycles of the sun or of a four-cycle engine, are regular, and to a certain extent...foreseeable.

But market patterns are different. They are subject to ‘reflexivity.’ It’s a feedback loop where prices affect perceptions...which affect prices...which affect perception. Markets aren’t always efficient or rational. Sometimes they go a little mad.

That is, they react to what is happening…what has happened before…and to what people think is happening. It makes for a lot of uncertainty. And volatility. But that makes sense...

If market tops were as predictable as solar eclipses, for example, they would never happen at all. Investors would anticipate the climax and rush to sell…each afraid that prices would go down before he got out.

Instead, investors are always guessing…always wondering…and always subject to influence. Stocks go from very cheap to very expensive in long-term trends. During the entire 20th century, there were only three of these long-term cycles, as I’ll show you in a moment. But first, a quick word about money.

When the Money Goes, Everything Goes

Today’s money—the paper kind—loses value fast. We look at it in terms of gold. At the start of 1915, the 30 Dow Jones Industrials stocks (a good stand-in for quality stocks) were worth 2.65 ounces of gold. That ratio rose to over 18 as the first peak of the century was reached in August 1929. Then began the downdraft, ending in early 1933 with the Dow worth just 1.92 ounces. That was the first bottom-to-top-to-bottom cycle.

The next began in 1933. It continued to another top in the Dow stocks during the first week of 1966. The Dow crested at 28 ounces of gold. Thereafter, prices fell again and came to rest 14 years later (in January 1980) at 1.29 ounces of gold to the Dow. That was the second cycle.

The third began in 1982 with the Dow rising to a remarkable 42 ounces by the end of the century. And today, a quarter century on, the relationship between real prices (in gold) and real value (Dow companies producing useful products and services) is as strong as ever. Please look at the long-term Dow/Gold chart below.

In 1915, you could have bought 2.65 ounces of gold for the price of the 30 Dow stocks. That ratio followed the up-and-down pattern we previously discussed… from a low under 2 to a high over 40. But when stocks were very cheap in terms of gold, they tended to become less cheap going forward. If they were expensive, the opposite happened.

Today, after more than a century of up-and-down movement, the ratio is at 11.1. Just a few months ago it was around 15, about the same as September of 1929. From then to today, investors in the Dow made only dividends and not a penny of capital gain. The value of America’s finest industries — compared to the value of real money — went nowhere.

In GDP terms, the gravity of the economy keeps stock prices in its orbit. In the boom of the 1960s, the Dow was worth about 1.2 times GDP, or 120%. To put that in perspective, the ‘mean’ (the long-term average) for the stocks-to-GDP ratio is about 82%. Anything higher, stocks are overvalued. Much higher, a bubble.

If you knew that the stock market went up and down…in long cycles lasting a decade or more …and you knew that over time you couldn’t expect to make any capital gains from your stocks…and that the only way to make progress was to trade in and out, buying when they were cheap and selling when they became expensive…wouldn’t you try to put this insight to work?

Market statistics show us that being in the right place at the right time is the key to big gains. To put it another way, ‘allocation’ is much more important than stock selection — or in Wall Street speak, beta is more important than alpha. The real question is how much of your wealth to have allocated to stocks at any given time.

We’ve developed a Dow/Gold trading system to help our readers. If you’d invested $100 in the Dow stocks starting on January 1, 1913, today you’d have $51,338 or $4,897,400 with dividends reinvested. But if you’d followed our Dow/Gold trade — with only five trades in the last century not including the initial investment — you’d have an account worth $56 million today.

Details of the performance of this trade are updated in Investment Director Tom Dyson's Gold Report, which is available (with other Research Reports and Private Briefings) to paying subscribers. Which brings me back to the market doay.

The Big Loss

The surprising goal of the Dow/Gold trading system is not to make money. It’s to avoid the Big Loss. Right now, the risk of the Big Loss in US stocks, the US dollar, and US bonds, has never been greater. We show this each day in our regular letters to readers.

If you get hit by a car…or hit by the market…the result is the same – you're out of the game. Taking the Big Loss is the worst thing that can happen to you, because you can no longer hope for any gains.

It’s important to realize that just as it is hard to identify the Primary Trend, it is even harder to identify the investments that will be the big winners. Even if you are one of the best investors in the country, you win some, you lose some.

Overall, if you’re in tune with the Primary Trend, you can hope for growth. But only if you are still in the game…only if you have avoided the Big Loss. That’s why we make avoiding the Big Loss our number one concern. Our whole strategy is built around staying in Maximum Safety Mode to avoid this loss. Why?

It is okay to lose money when you are young. It is part of the learning process. But if you work all your life to accumulate a nest egg you can't afford a wipeout. By then you will be in your 50s or 60s. You won't have time to recover.

You avoid the Big Loss by respecting the discipline of the Dow/Gold trade. Investments go up and down. When they are up, we don't necessarily have any idea where they will go next, but we know that they now carry the risk of a big loss. The more expensive they are…the more they can lose.

In short, we don't try to predict the stock market's next move. We simply pull out of investments when the risk of loss is elevated. Then, after stocks sell-off, the risk is reduced and we buy back in. The current state of our asset allocation strategy--between cash, stocks, precious metals, and cryptos--is published once a month in our Monthly Strategy Report (the May report, prepared by our Investment Director Tom Dyson, is due out in 10 days).

The Golden Rule

When we say things are “worth” more…it means that you can exchange them for more of other things. Money is merely a way to keep track and make transactions easier.

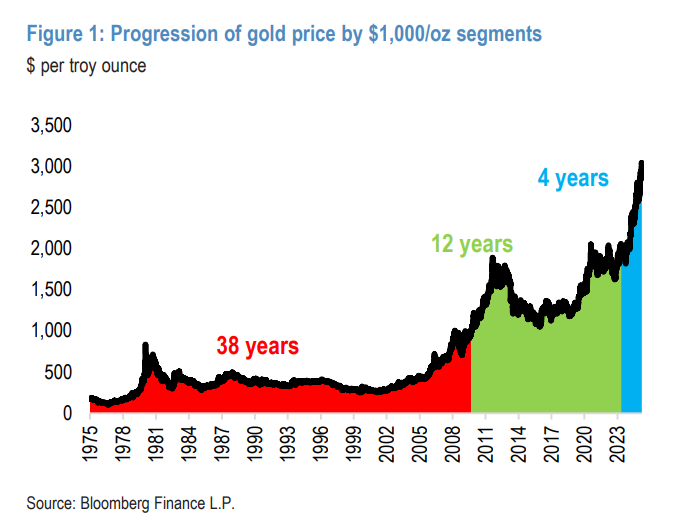

Gold arose as money because it worked, both as a store of value and a means of exchange. It doesn’t have any other significant purpose (other than ornamentation). And over time, gold doesn’t change much, relative to other things. As an economy grows there are more things available for money to buy. If the supply of money were fixed, prices would fall. There would be the same quantity of money but a larger volume of ‘stuff’ that it could buy.

But the quantity of gold tends to grow at the same speed as the economy itself. Mining is part of the economy, made easier by technology…but made harder as easy deposits are played out…and newer discoveries tend to be further afield and more costly to exploit. So, the balance between money and the things it buys doesn’t change very quickly. That is why a cache of gold, from hundreds of years ago still has about the same purchasing power today as it had when it was buried.

The value of a nation’s productive companies (stocks) doesn't change much either – not compared to the goods and services available…or the money used to measure them. That's because their value comes from the real economy too. Companies are only worth what they can deliver to shareholders in profit. But taken together, they cannot produce more sales and profits than the economy permits.

The economy might grow at a three per cent rate. Consumers’ purchasing power should grow with the economy, not more nor less…meaning that the sales and profits available to the nation’s businesses grow at that rate too, along with the quantity of gold (the nation’s money supply).

We use gold to keep score. It is real money. As JP Morgan put it, ‘Gold is money. Everything else is credit.' The total amount of credit can be expanded easily. Gold cannot. 'Printed' money can make it appear that things are 'going up.' It can juice up sales, GDP, and earnings. It can distort the whole picture.

Profits are especially susceptible. Typically, businesses pay their workers. Then, the workers buy products and services from the corporations they work for. So, profits are usually restrained by labor expenses.

But credit expansion gives businesses sales with no labor costs to offset them. It is as if the money came as if by magic, rather than from the real economy. And with no wages to pay, sales revenues fall disproportionately to the bottom line.

Stocks can appear to go ‘to the moon.’ But only in ‘funny money’ terms. In real money, they only go above 15 ounces of gold/Dow periodically, and temporarily. And as gold is always connected to the real economy and real output, the links between gold, GDP, and the companies that produce it can be stretched but never broken.

Often, we are told that these limits no longer apply. New technology…or new government… promises to make them obsolete. But since WWII – despite many technological breakthroughs -- no real, sustained increase in GDP growth has been observed. Instead, generally, GDP growth rates have fallen…and continue to fall.

Investors are lured to buy into new fads – dot.coms, cryptos, NFTs, AI. Some of them pan out. Mostly they do not. And since they are new and unknown, they all carry the risk of failure…and the Big Loss.

We stay away. When values are low, we favor the stocks. When they are expensive (over 15 ounces of gold/Dow) we favor real money, gold. And always, we look for where the Big Loss may come from…and try to avoid it. Now is one of those times.

What to Do Now

If our research is correct, then Americans are set to see at least $50 trillion in wealth disappear. That’s what the chart at the top of this letter shows. It was provided by our Research Director Dan Denning. American households added roughly $50 trillion in ‘net worth’ since the Covid lockdowns. Most of that was in stocks and real estate. We believe ALL that is now at risk.

Keep in mind it was never 'real’ wealth in the first place. It was the result of the Greatest Financial Experiment in History, as Tom called it. Reckless government spending and even more reckless Federal Reserve money printing have blown the biggest bubble ever – in stocks, corporate sales and earnings, GDP, bonds, real estate…almost everything.

Like my other warnings every ten years or so, we expect this one to be ignored. Or by some, ridiculed. And if it makes you angry, we understand. As we said before, no one likes being told that they stand to lose everything they have.

But here's the important point….you don't HAVE to lose everything. If you play your cards right you can turn this into a once-in-a-lifetime opportunity to buy great stocks again...but only when they are cheap. Then, sit back, collect dividends, and watch them compound.

Could we be wrong? Of course. There were things we missed in the past that postponed the day of reckoning in previous cycles. China entered the world economy and poured trillions of dollars into American bonds (allowing us to run up greater deficits than I could ever imagined).

There were also our reckless central bankers like Alan Greenspan, Ben Bernanke, Janet Yellen, and now Jerome Powell. They didn't stick to their job of providing liquidity in a crisis. Instead, they slashed interest rates, bailed out Wall Street banks, and poured gasoline on a fire that was already raging out of control (we believe the Fed itself may cease to exist once this next great crisis comes).

And our politicians played a part, too. Both parties in Washington have run up a debt tab our nation can never repay. For years we’ve warned that the size of the debt would trigger a crisis. That crisis would lead to much higher inflation–or worse, the destruction of the US dollar (and your savings) as we know it. And now the stock market, too.

Maybe President Donald Trump save us. Among some Americans, there is a great deal of enthusiasm that Donald Trump and his team are our last best chance to shrink the size of government, roll back the tide of insane ‘woke’ ideology in our schools and towns, and restore the economic prospects of the American Middle Class through ‘fair’ trade and tariffs.

It would be great if all that happens. But history–and our own experience in Washington–tells me it's unlikely. Price action in the market this spring suggests something deeper and more permanent is happening, to the detriment of US stocks and the dollar.

More importantly, your investment plan CANNOT depend on political forces beyond your control. If you read history, you'll know there are eerie similarities between Donald Trump and Herbert Hoover. Both rode into office on a wave of enthusiasm. Both embraced the use of tariffs to restore American competitiveness and waged. But how did it work out?

A year after Hoover signed into law the Smoot-Hawley tariffs, the stock market collapsed. The Great Depression followed. The Dow Jones Industrials did not make a new high for 25 years.

We believe the same thing could happen today. And yes, in the past, our warnings have been early. But in this case, it is better to be early than late. We began writing this invitation earlier this year. Now, it’s clear we’re no longer early. What next?

We've taken the time to write to you today with a broad overview of the key forces moving markets right now. If you do nothing else but include these in your thinking, that’s fine with us. Job done.

We thought it was a good idea to introduce new readers to our ‘big picture’ thinking at such a critical time. Our records show that you may not receive all the research we provide. If you’re a serious investor or at all concerned about your financial future, we’d like to make it easier for you to decide if our work can help.

For the next five days, we’re trying something new. You can take out a seven-day trial of our work and review all of it. That includes the upcoming Monthly Strategy Report for May. It includes Tom’s weekly Market Note and Dan’s weekly Research Note. It also includes all our Research Reports and Private Briefings (recorded and transcribed in-depth interviews with other analysts and experts).

We’ve never offered a free trial before. And we’re not prepared to lower our price (which would be unfair to existing and loyal subscribers). We also hate trying to sell our services and we don’t accept any paid advertising.

We’d prefer to spend all our time and brain power trying to figure out what’s going on and making our research better, more useful, and more profitable for you. If that’s not for you, that’s fine. We won’t make the offer again. It’s back to business as usual tomorrow.

But we started getting many new readers to our work earlier this year. We realized that you may be one of those readers who felt like you were joining a conversation that had been going on for a long time. We wanted to take a few moments of your time to explain the main ideas—the Primary Trend, the Big Loss, Maximum Safety Mode, and of course the Dow/Gold ratio and how to use it.

Click here to start your free seven-day trial to Bonner Private Research.

Regards,

Bill Bonner

Founder, Bonner Private Research

P.S. To activate your seven-day free trial to Bonner Private Research, you’ll need to provide us with your credit card number. You will not be charged. After the seven-day trial is over, your card will automatically be charged for an annual subscription at $395/year. You can cancel your free trial at any time during the trial.

P.P.S. If you’re already a subscriber to our research, you’re receiving this letter because you have two email address with us, one of which is ‘free’ and one of which is ‘paid.’ You can disregard this letter for your own purposes. Feel free to pass it on to anyone you think could benefit from it.