Prepare for Rip-Off

People generally are probably no more corrupt than they always were. They are neither always good, nor always bad...but always subject to influence.

Tuesday, November 4th, 2025

Bill Bonner, from Baltimore, Maryland

We are entering a new world — the post-hypocrisy, post-shame planet. Forget the pretenses. Now bribery, influence peddling, murder, larceny, vulgarity — it’s all right out in the open.

Tom Nichols:

The White House press secretary answers a question from a member of the free press—a serious question about who planned a meeting between the American and Russian presidents—by saying, “Your mom did.” The secretary of defense cancels DEI and other policies by saying, “We are done with that shit.” The vice president calls an interlocutor on social media a “dipshit.” The president of the United States, during mass protests against his policies, responds by posting an AI-generated video of himself flying a jet fighter over his fellow citizens and dumping feces on their heads.

What kind of country is this, Nichols wonders?

We don’t know...but our beat is money, so let’s stick to the coin. And the way to make money now is to invest in the Trump family and its pet projects. Here’s the latest from the Washington Post:

More than half of the companies that donated are facing or have recently faced federal enforcement actions tied to alleged wrongdoing, ranging from engaging in unfair labor practices to deceiving consumers and harming the environment, according to the report from Public Citizen, a consumer advocacy organization.

A conflict of interest? You bet. But that’s the post-hypocrisy world...where we ‘let it all hang out.’ The business of government, after all, is to redistribute wealth and power, from ‘The People’ to the rich and powerful. Canny investors want to be on the right side of that trade.

Yesterday, we explored the way public standards slip. Richard Nixon went on national TV to overcome the appearance of wrongdoing. Today, there’s so much wrong being done, it’s hard to keep up with it.

And it’s not just a few billion dollars and the reputation of the first family that are at stake. It’s the future for all of us.

Note that the Fed lowered interest rates last week. Adjusted for inflation, member banks now borrow for less than 1%. This is supposed to stimulate the economy by making credit more readily available. As we have seen, lower rates do not actually help the Main Street economy where most people live, work and shop. This century has seen more ‘stimulus’ than ever before...with Fed rates actually below zero, in real terms, for nearly ten years. And yet, GDP growth rates have gone down, not up.

What has gone up are asset prices. The big banks borrow from the Fed at super-low rates and feed the money into the Wall Street economy, not the Main Street economy. They use it to wheel and deal...to speculate...and to pay themselves huge fees.

Forty percent of the public may rely on SNAP or food banks, but the rich get richer than ever. NewsBytes:

Top 10 US billionaires gain $700B as wealth gap widens

The top 10 billionaires in the United States have seen their collective wealth increase by a staggering $698 billion over the past year, according to a report by Oxfam America. The study highlights how policies from both Republican and Democratic administrations have contributed to widening the wealth gap in the country. It also shows that between 1989 and 2022, the richest 1% of American households gained 101 times more wealth than median households.

Did these people suddenly become smarter or more productive? Nope. They were just on the right side of the trade. People generally are probably no more corrupt than they always were. They are neither always good, nor always bad...but always subject to influence. And what has influenced us all is a money system that is easily exploited by those who control it.

If the Trump boys take out a billion here...a billion there...who cares? But as the Fed reduces rates, it leaves the rip-off rate (inflation) at 3% officially...and nearer to 10% by our reckoning. Consumers pay higher prices. And savers lose money.

On outstanding US treasury debt alone, that means somewhere between $1 and $4 trillion will be scammed away.

And the tariffs!

The ground shifts daily...but it is fundamentally another transfer of wealth, from the middle classes to the ruling classes. Consumers pay the toll when they shop. It’s a trivial amount to the rich, but a major cost to those who live paycheck to paycheck. The overall rate is said to be around 17%. With total imports around $3.5 trillion, that’s another half a trillion-dollar transfer. The money goes from the public to the feds, their donors, and their favorite causes.

Where this leads, we don’t know...but we buckle our seat belts, close our laptops, and prepare for rip-off.

Regards,

Bill Bonner

Research Note, by Dan Denning

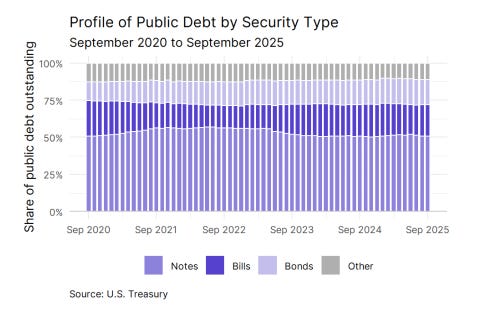

The national debt of the United States increases by almost $69,000 per second. That’s according a report which produced the chart above, showing the composition of publicly traded US debt by maturity. Basically, of the debt not held by federal agencies (money ‘we owe to ourselves’) this chart tells us when America must pay the piper for her world-class spending spree.

The Bureau of the Fiscal Service publishes an annual version of this chart next week. I’ve been following it for years and will have an update for paying subscribers when it comes out. It’s an early warning sign for when the government (and the bond market) might run into more trouble. The general trend in this century is that various administrations have borrowed more money at shorter terms because the interest rates are lower (and the Federal Reserve has ‘pushed down’ the short end of the interest rate curve by keeping interest rates artificially low for excessively long).

There’s around $30 trillion in ‘marketable’ US government debt. Half of that, or $15.4 trillion, is held in the form of Treasury Notes. Of that amount, 31.4% (or just under $5 trillion) matures in less than twelve months. The debt is paid off or refinanced by issuing new debt (at whatever the current interest rate is). The average maturity on all outstanding publicly marketable debt is 72 months. Six years.

Dan

P.S. While checking for the 2025 Annual Report from the Bureau of the Fiscal Service, I learned the US Treasury began phasing out paper checks at the end of September. Did you know this? If you still receive Social Security, Veterans, or any other form of federal benefit by check, you’ll have to switch to an electronic direct debit of your bank account. And if you don’t have a bank account?

Here’s where it gets interesting. Treasury can help you ‘get banked’ by enrolling with an FDIC sponsored private bank. If you don’t have sufficient ID/residence documentation to meet the requirements for a private bank account, you can sign up for a Direct Express Debit MasterCard directly with the US Treasury. Your federal benefits will be automatically debited to your card, which works just like a normal debit card, eliminates the need for cash, and has 24/7 customer service!

Almost 2000 years ago, something very similar happened in Rome. As the empire weakened, the elite saw the end coming. They began openly “extracting” wealth from the system. They avoided taxes, sold influence, took bribes, and debased the currency until silver coins were basically copper with a silver wash — from 98% silver to around 5% near the end.

Inflation exploded. Ordinary Romans were paid in money that was worth less every month. The rich insulated themselves by buying hard assets: land, slaves, private armies, and fortified estates. They weren’t trying to save Rome. They were preparing for what came after.

When the empire finally collapsed, those elites simply became feudal lords. The state died. Their wealth didn’t.

Sound familiar?

Well, Bill, I have been reading you for several year now. And like so many others, I grow weary of the doom-saying. By now those of us who can learn (or be convinced) either agree with you or stop reading after the first sentence or two. Far be it from me to tell you how to run your newsletter, but perhaps it's time to try a new tack: don't tell us what's wrong -- tell us how to make it right. Then when we go to the polls we can vote for the person who promises to do what you think should be done.