Payers of Interest

Credit is not the same as real money. Owning a house is not the same as paying a mortgage on one.

Wednesday, December 3rd, 2025

Bill Bonner, from Baltimore, Maryland

If time is money, money must be time. And time is life. So, the people who control the money must also control our time.

Most people count their lives in time — in hours, weeks, months. Each one represents so many Franklins...or Jacksons...or Washingtons. From 9 to 5...or 8 to 4...their best hours are exchanged for money.

But if the money is bent...so is time...and the economy...government...society...and the lives of millions of people.

The new post-1971 money corrupted time. Instead of earning 5% or even 4% on our savings each year, the Fed cut the interest rates (to stimulate the economy!)...and suddenly, 12 months went by but yielded only half as much interest. Time stretched out...it took twice as long to yield the same return.

Real assets — the kind you had to work to earn and then save — lost value. It was now credit that you wanted. Because, as the reward for saving money was cut in half — or more — the reward for borrowing it doubled! Not only did you pay half as much interest, but you could look forward to inflation to reduce the value of the principle too.

In replacing real money with credit money, the Nixon administration rocked the ground under our feet. Gradually our eyes shifted from the plus side of our balance sheets — where we owned real things...cars...houses...bank accounts — to the minus side, where we owed money to banks, mortgage companies and credit card outfits. Gradually, too, our focus moved away from the customers, employers, neighbors and entrepreneurs with whom we exchanged goods and services to earn real money; credit money came from none of them. Instead, its source was, ultimately, the US government.

But credit is not the same as real money. Owning a house is not the same as paying a mortgage on one. Even with a 30-year mortgage a family might look forward to that joyful day when the house actually belongs to them, free and clear. But as the Fed lowered interest rates, the attraction of paying off the mortgage diminished; they could refinance...once...twice...remaining in debt forever. And with a 50-year mortgage, the battle is lost at the beginning; the family is doomed to live in a house that it will probably never own.

The switch to funny money didn’t just herald the decline of the dollar. It also bent, twisted, stunted, and warped the whole economy...and everyone in it. It turned a nation of proud, honest, independent owners...into a sad race of indentured servants.

They are indentured to politicians — nearly 100 million people rely on some form of money from the government. And they rely on the private credit industry too.

Phys.org:

New research from King’s Business School and the Federal Reserve Board reveals that most credit limit increases are not requested by consumers but are automatically applied by banks’ algorithms, often to borrowers already in debt.

The study, “Automated Credit Limit Increases and Consumer Welfare,” finds that roughly four in five credit limit increases in the United States are initiated by banks rather than consumers. These automatic increases now account for more than $40 billion in additional available credit every quarter, most of it extended to customers who already carry balances.

All eyes are on the Fed. If it lowers rates, stocks will boom and mortgages will be refinanced. If it raises them...a credit dependent nation will sigh and grumble. Almost everyone now depends on government-sourced credit just to stay afloat.

Time is a friend to the man with money to let. Every month brings him more earnings...which can then compound...eventually giving him substantial capital.

But the renter, the mortgage payer, the debtor… pays each month...for the privilege of participating in the modern economy. He cannot rest. He cannot sit back and enjoy the fruits of his labor. The fields, the plants, the harvests...they all belong to someone else. His car, his house, his cellphone and streaming service, his healthcare, his childcare — all must be paid month by month.

He cannot ‘take a sabbatical’ or repurpose himself for a career change...he can’t simply ‘take off’ and wander aimlessly on the beach, listening to the mermaids singing each to each. He has no time for serious thinking...

He has to pay the monthly fees! And if he stops paying, his whole world collapses. No house, no car, no credit cards...no internet...and probably no wife and children either.

He is a prisoner of the funny money system. He owns nothing. He has no capital. He is a worker...a prole...a payer of interest...

In debt, in hock, indentured for life...wandering dead, among the living.

Regards,

Bill Bonner

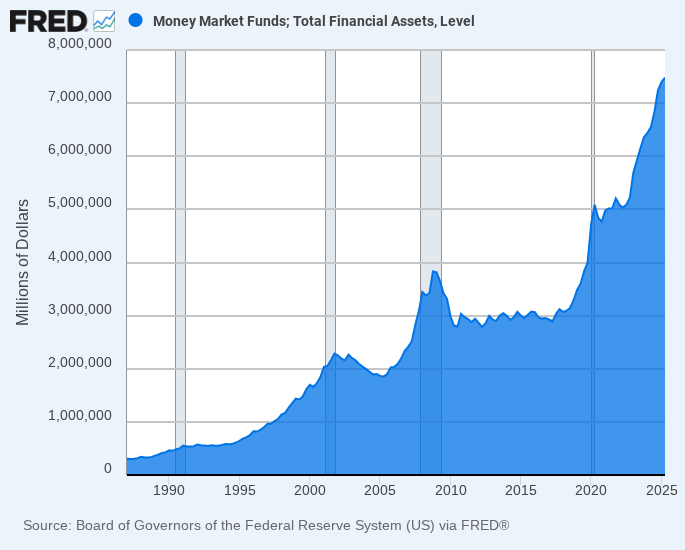

Money Market Fund assets have increased by nearly $1 trillion this year and are likely to eclipse $8 trillion when new official numbers are announced next week.

There were great things written today. Where we are is a progression of decades, not the cause of one recent man.

I find fault with the quote in the beginning.

The soul produces the man, the attitude, beliefs, the talents developed. Such a man does not need to worry about money, he seeks first The Kingdom of God and all else, no matter the circumstances, is given. Such a man is a pillar of a community worth living in.

The West is now just a ponzi scheme which will implode … it’s just a matter of when.