Parable of Plenty

The rich get richer, the poor get sanctioned and The Covid gets lost in the news cycle...

(Getty Images)

Bill Bonner, reckoning today from San Martin, Argentina...

“Them that has, gits.”

And so it came to pass in the Year of Our Lord, 2008, the Fed panicked. In its hysteria, it bestowed on the rich such gifts as the world had never seen. The US stock market rose 5 times higher. Or, as Tom shows below, people with capital assets added about $84 trillion to their wealth since 2007.

Many times over the past 14 years have we bemoaned the unfairness of it. The Fed had no wealth to give. Its generosity towards those in the wealthiest zip codes had to be exercised at the expense of others – namely, those in the others.

This was accomplished via what is known as the “inflation tax.” The Fed and other central banks ‘printed’ some $25 trillion in new money, which was funneled into the financial markets by buying bonds (owned mostly by the rich)… and then used to buy stocks and other financial assets (also owned mostly by the rich).

The rich got richer as their assets increased in value.

Money-printing and bond-buying had other effects too. They queered the financial system, added $50 trillion to America’s trash pile of debt, accustomed the economy to below-zero (adjusted for inflation) interest rates, and caused consumer prices to rise at the fastest rate in 40 years.

But our theme today is only this: there’s always more to the story. And it’s usually the part that few want to hear. For whatever virtuous, practical and high-minded thing the Fed thought it was doing, it was actually shifting wealth from those who earned it to those with brokerage accounts.

Unintended consequences? Perhaps.

More Gittin’

Meanwhile, the Covid story has disappeared from the headlines. Thank God… we were getting tired of it. Now we have a new crisis… a new bete noire – Russia. This time, ‘them that has’ – the influencers… the deciders – have put us on the side of the angels… to do battle against the devilish Russkies.

But there’s more to that story too… and more gittin’ to be gotten by those who already have.

Two full years have passed since the Covid-19 first made landfall in the US. As more of the story comes out, we see that it too was largely a transfer from the poor to the rich.

For instance, wasn’t it strange that some countries – even those with very low standards of public health… in Asia and Africa, for example… had very low rates of Covid? Why? About a year ago came this report from CNN:

The risk of death from Covid-19 is about 10 times higher in countries where most of the population is overweight, according to a report released Wednesday by the World Obesity Federation.

Researchers found that by the end of 2020, global Covid-19 death rates were more than 10 times higher in countries where more than half the adults are overweight, compared to countries where fewer than half are overweight.

The team examined mortality data from Johns Hopkins University (JHU) and the World Health Organization (WHO) and found that of 2.5 million Covid-19 deaths reported by the end of February, 2.2 million were in countries where more than half the population is overweight.

In an analysis of data and studies from more than 160 countries, the researchers found that Covid-19 mortality rates increased along with countries' prevalence of obesity. They note that the link persisted even after adjusting for age and national wealth.

In the US, the average person consumes 3,800 calories per day. And the US suffered one of the highest death tolls from Covid in the world – nearly 3,000/million. In Bangladesh, where ‘plus-size’ clothes are missing from the fashion racks, the disease was barely noticed, with only 175/million.

But while shutting down the world economy in 2020 may or may not have reduced the death toll for well-fed people, it almost certainly increased the number of poor people who died of starvation.

We have no figures and no proof. But 9 million people are said to die from malnutrition and hunger-related diseases each year. All it would take would be an 11% increase… and a million more people would die.

And now, here’s more bad news for hungry people. Fox News:

Goya Foods CEO Bob Unanue warned on "Fox & Friends Weekend" Sunday that the war between Russia and Ukraine is having a "devastating effect" on food supply as shortages are expected to contribute to higher inflation.

President Biden said last month that a food shortage is "gonna be real" following the sanctions that were placed on Russia by the U.S. government as a result of Russian President Vladimir Putin's invasion into Ukraine.

"With regard to food shortage, yes we did talk about food shortages, and it's gonna be real," Biden said during a press conference at a NATO summit in Brussels, Belgium, following a meeting with other world leaders.

"The price of the sanctions is not just imposed upon Russia," he added. "It’s imposed upon an awful lot of countries as well, including European countries and our country as well."

Unintended Consequences

The price of wheat has shot up from $7.50 a bushel in January to over $10 today. A poor person in Bangladesh may have been able to afford 1,500 calories per day last year… and stayed alive, barely. With the cost/calorie up by a third… his daily allotment may now fall to only 1,000 calories per day – not enough to survive.

In Iraq, before the US invasion, an estimated 500,000 children were said to have died because of US sanctions. Then-Secretary of State, Madeleine Albright, thought that was a fair price to pay for the benefits of the sanctions, whatever they were. A half a million deaths were “worth it,” she told “60 Minutes” in 1996.

And now, the fat countries congratulate themselves on their tough sanctions against Russia. Foreign policy ‘experts’ explain what a great and glorious war it is. America’s defense industry jefes look for lavish vacation homes in Aspen or North Carolina’s Outer Banks. Politicians look forward to more campaign contributions.

And skinny people tighten their belts.

Regards,

Bill Bonner

A Note from Investment Director, Tom Dyson…

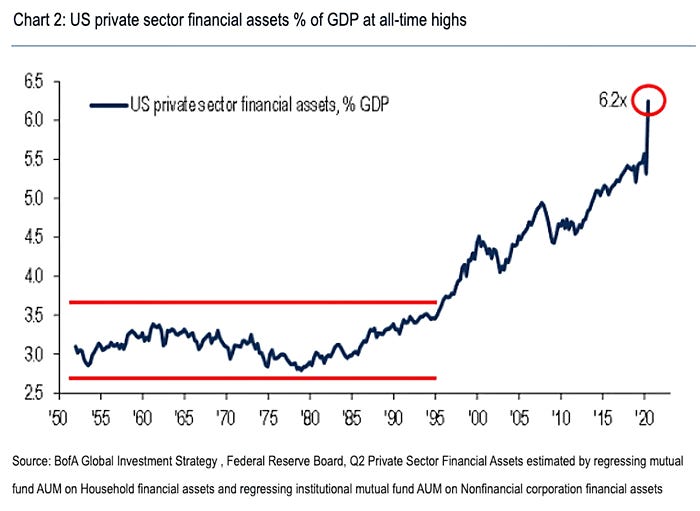

The following chart shows Americans' private holdings of financial assets (stocks and bonds) as a percentage of GDP going back 70 years. As you can see, it just hit 6.2x... or about $143 trillion.

Consider the effect QE has had on this chart. They started QE in 2008... and continued it on and off for the last 14 years. QE created a lot of wealth on paper. But I find this chart pretty concerning... especially when we consider they're about to start unwinding QE. That's a lot of wealth that might disappear.

The time to begin preparing for this fallout was yesterday. Failing that, today works, too. Learn how, here...

© 2022 Bonner Private Research, Carrick Road, Portlaw, County Waterford, Ireland.

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here. Neither Bonner Private Research nor its employees and writers receive any compensation for securities or investments covered herein.

Regarding the covid story getting lost: I guess you have probably heard that Vladimir Putin has been nominated for the Nobel Prize in medicine for singlehandedly removing the concern for covid as the most dangerous threat to world health

Russia invaded Ukraine so we sanction them causing millions to starve in Africa. That’ll teach them Russians!