Joel’s Note: A quick heads up before we dive into today’s regular missive…

We’re happy to announce that Bill’s energy, resources and mining expert, Byron King, has kindly offered his time today to answer your questions regarding how the evolving situation in Russia-Ukaraine will likely impact oil, the dollar, inflation, etc. … plus everything else, from the Biden Administration’s decision to tap the Strategic Petroleum Reserve to skyrocketing fertilizer prices and how this will likely impact consumers (and investors) this coming summer.

As you might imagine, with the state of the world as it is, there’s lots to cover…

Byron will be online from 1pm EST today (Thursday, April 14th) to field your questions and lend his insights. We’ve done a few of these events in the past and they’re always interesting and informative. And fun, too!

If you’d like to join the discussion thread, simply follow this link and head on down to the comments section at or around 1pm EST. We hope to see you there…

Also, as this is an open public event, please feel free to invite friends, foes, investor pros and amateur pundits alike. We’d love to hear from them, too.

And now, it’s back to your regular, scheduled programming...

(Source: Getty Images)

Bill Bonner, reckoning today from San Martin, Argentina...

March numbers show producer prices rising at an 11.2% rate. It was the biggest jump in prices since the data series began in November 2010. At that pace, (to give you a hint about where this is headed) the real value of the government’s $30 trillion trash pile of debt will be reduced by $3 trillion this year. And the money shufflers in Washington get to keep on shuffling the cash to their friends, clients... and most important… to themselves.

It’s an ill wind that blows no one good. And as we will see, maybe not everyone wants to ‘whip inflation now.’

But wait… maybe the fight is already over. Is this the ‘peak’ for this round of inflation? MarketWatch is on the story:

Inflation may have peaked in March and there could be some relief on the way, but the U.S. central bank must press ahead with a series of hikes of its benchmark interest rate, said Fed Gov. Christopher Waller on Wednesday.

“I’m forecasting that this is pretty much the peak, it is going to start to come back down,” Waller said, in an interview on CNBC.

Higher market interest rates should start to take a bite out of demand, and oil prices have already retreated after spiking when Russia invaded Ukraine, he noted.

Inflation hit an 8.5% annual rate in March, the fastest pace since 1981. At the same time, core inflation — excluding food and energy — came in softer than expected in March. Because the core rate is seen as a good predictor of future inflation, some economists have started to talk about a peak of inflation.

A Faux Retreat

Like everything in the world of finance, inflation can be a trickster. In the early ‘70s, the ‘core’ reading for inflation rose over 10%. Then, it retreated… back to 6%. ‘Inflation is beaten,’ said the experts.

But inflation wasn’t beaten in 1975. It was just a tactical retreat, not a rout. It backed off, shilly shallied for three years… and then attacked again, this time going up to 13% in 1979.

Responding to the assault, in 1980, Paul Volcker not only took away the punchbowl; he replaced it with the strongest coffee Americans had ever had – a Fed Funds rate that bumped up to 20% and tasted like Draino. Stocks gagged. Unemployment rose. Politicians howled. And the inflation rate went down.

But Jerome Powell is no Volcker. 2022 is not 1979. The Fed’s current one-half of one percent lending rate is a long way from 20%. And 1979’s federal debt – $827 billion – was peanuts compared to today’s $30 trillion. So we wouldn’t buy any long term bonds just yet. As always, there’s more to the story – the important part. Back then, Paul Volcker meant business. He actually wanted to bring inflation under control. Today, Jerome Powell? Maybe not.

The feds appear to be hopelessly dim. Dysfunctional. Incompetent. But could they really be as dumb as they seem? After all, they are still able to front-run the stock market.

We’ve been predicting a rise in consumer prices for years. It is an obvious consequence of money printing. But the Fed governors act like Beavis and Butt-Head with a bad case of cooties. They can’t imagine how they got it.

And yet, they ‘printed’ up $8 trillion in extra cash since 1999. The biggest spurt – $4 trillion worth – came in a single 18-month period after March 2020. To this tsunami of ‘demand,’ the feds also weighed in on the ‘supply’ side – shutting down large portions of the economy, thinking it would make the Covid go away. And now they are squeezing the supply side with sanctions on one of the largest oil exporters in the world. Consumer prices had little choice; they had to go up.

Overshooting the Mark

A year ago, the decline of the dollar was about the safest bet on Wall Street. The Fed can push up the price of stocks. It can push down the price of credit. And it can finance whatever loopy wars and domestic boondoggles the feds come up with next. But only by printing more dollars. And as the quantity goes up, the quality (the value) necessarily suffers. That’s why selling the dollar is on the short side of our Trade of the Decade. Whatever else may happen, the decline of the greenback is likely to continue.

All of this was so obvious, you had to be paid not to see it coming, which those Ph.Ds who work at the Federal Reserve apparently were.

As recently as 2 years ago, they were still saying that inflation was too low. How they knew precisely how much prices should rise or fall has never been satisfactorily explained; but that’s the way it was.

Then, they said inflation might show up eventually… and it would be a good thing. The Fed would allow it to ‘overshoot’ its 2% target, helping to make up for years of “lowflation.”

But the inflation readings soon did ‘overshoot’… like a pilot who aims for LAX and mistakenly lands on the moon. The Fed heads said not to worry; the surprisingly big inflation numbers were just ‘transitory.’

Finally, only about two months ago, Jerome Powell hemmed and hawed, saying that maybe ‘transitory’ meant different things to different people; he then explained that the Fed was indeed reacting to the threat with a 0.25% rate increase.

About two weeks later, the Fed chief must have realized that people were laughing at him. His new policy left the Fed Funds rate far below inflation – at MINUS 7.5%, inflation adjusted. It made him look like the Neville Chamberlain of inflation fighters.

It was then that he put a cigar between his teeth and vowed to fight inflation ‘on the beaches... in the streets…’ etc… with a 0.50% hike next month. Based on this week’s figures, that will leave the key rate at MINUS 7.7%.

You can think what you want, dear reader. As for us, this still looks a lot more like appeasement than confrontation. And we suspect that there’s a reason for it that goes far beyond incompetence. Nobody can be that incompetent.

Stay tuned...

Bill Bonner

And now a note from BPR Investment Director, Tom Dyson…

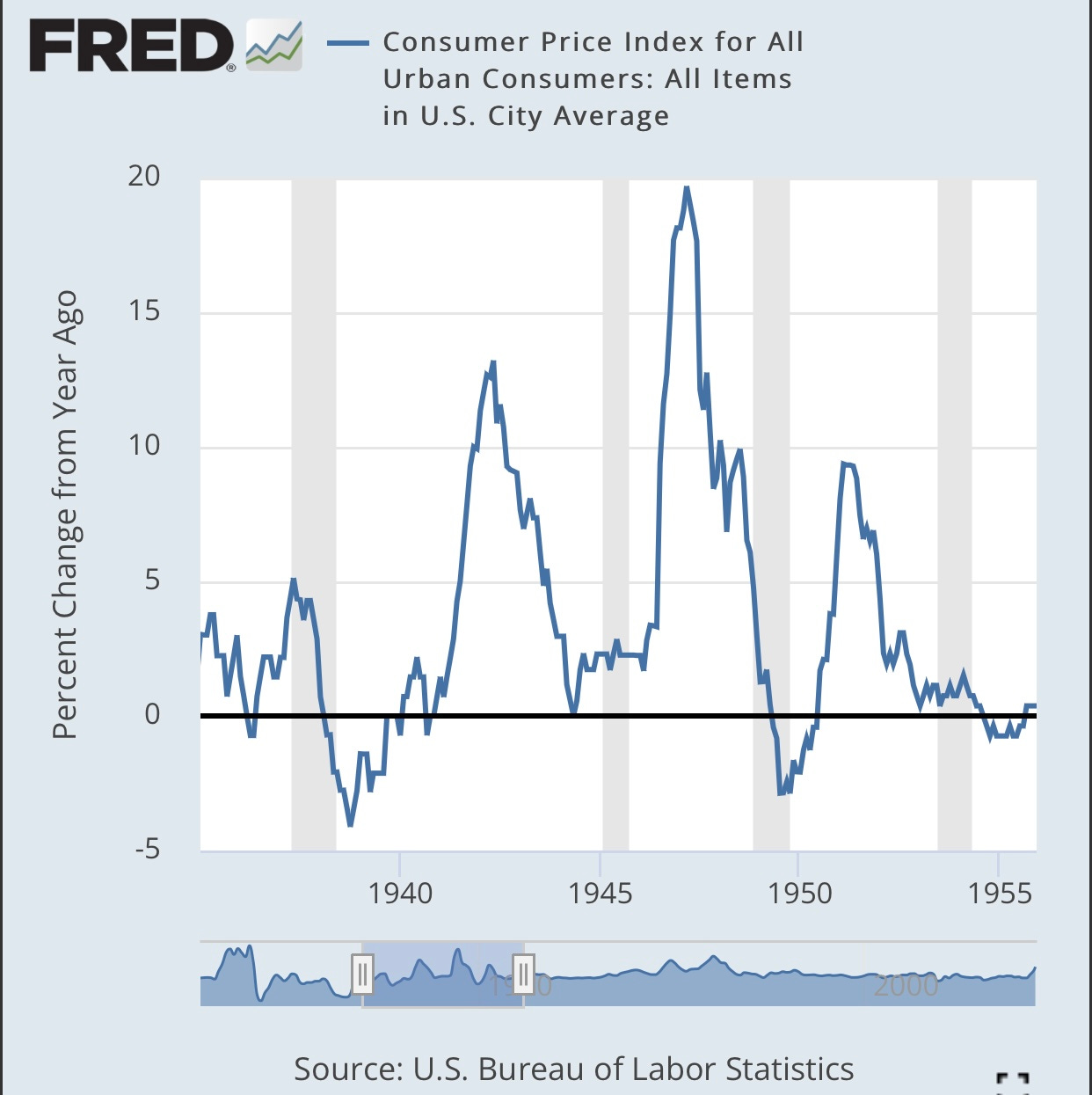

This chart shows CPI between 1935 and 1955…

(Source: US Bureau of Labor Statistics)

I think this is a useful idea of what to expect over the next twenty years and why we’ve been emphasizing to our paid readers the concept of inflation volatility and the need for investors to stay flexible and open minded about inflation. There were three inflation spikes and three bouts of deflation…

At Bonner Private Research, we’re preparing our portfolios to weather the coming storm. If you’d like to join us and begin receiving our paid research today, you can do so right here…

© 2022 Bonner Private Research, Carrick Road, Portlaw, County Waterford, Ireland.

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here. Neither Bonner Private Research nor its employees and writers receive any compensation for securities or investments covered herein.

Bill, I absolutely love your writing. Its not just the years its the accumulated wisdom. One can learn a lot spending their lifetime attempting to connect the dots. Your writing bears the fruit of this journey. Another of my favorite authors, Richard Maybury, uses his accumulated wisdom to build and continually refine his model for how he sees the world. I'm very thankful to have access to the writings of giants like you and Richard.

You'll get no argument from me that the apparatchiks at the Fed will continue to be wrong. Central Planning has never worked for the commoner, but its a great tool for the elite to enrich themselves. We'll most likely get a temporary reprieve from this current bout of inflation with a nasty recession. Then the apparatchiks will crank up the printing press again and we'll get more of their sacred elixir, inflation. Yeah, its inflate or die rather we like it or not.

"But the inflation readings soon did ‘overshoot’… like a pilot who aims for LAX and mistakenly lands on the moon."

My hope is that Bill outlives us all. I want to be able to shuffle off this mortal coil, laughing to his missives until my last days.

Yeah, I'm selfish in that regard. Almost as bad as federal policy makers?

Yeah, no.