Iceberg, dead ahead

The statistical principle of mean reversion is simple: extreme values return to their long-term average eventually. In stock markets, they call that a crash or a ‘draw down.’

Friday, November 8th, 2024

Laramie, Wyoming

By Dan Denning

Before you do anything else this Friday, take a moment and listen to the bells of Notre Dame ringing again. The medieval cathedral will open to the public again in early December more than five years after its roof and spire were destroyed in a fire in April of 2019.

The French spent over a billion dollars and used over 1,000 workers (and 2,000 oak trees)—sometimes using tools and techniques designed in the 13th century–to rebuild what was destroyed. There is still some work to do (the apse, the sacristy, new stained glass windows). And some final work around the grounds won’t be finished until 2027.

We can still build beautiful buildings, buildings that inspire. It’s just a choice. First, the resources. Second–and this is harder–we have to replace ugly modern architecture with styles that people love and admire. The Germans did this with the destroyed Old Town of Frankfurt a few years ago and people (except for the modern architects) loved it.

Now, let’s get down to business with the first of three quick modern charts…

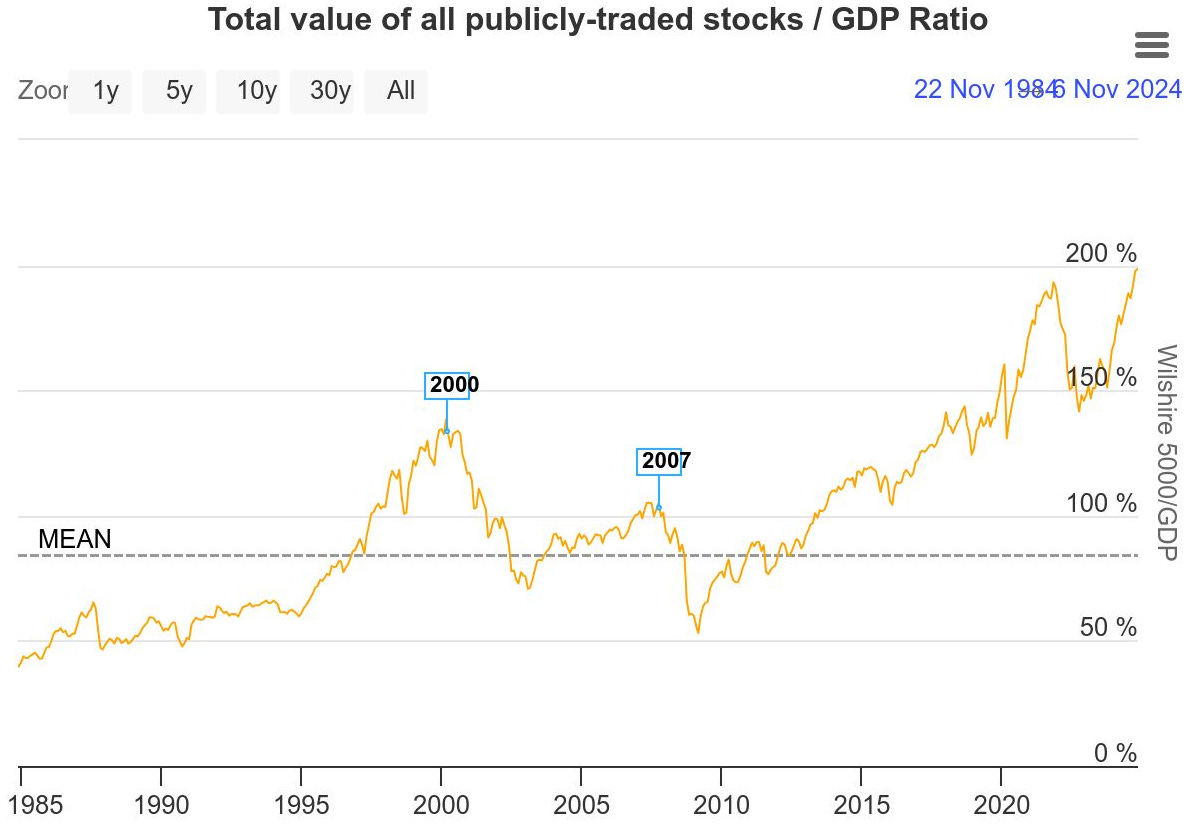

This is the price-to-sales ratio of the United States of America today. Actually, it’s from two days ago. When you include the fact that the S&P 500 has gone over 6,000 for the first time (although it couldn’t quite close above that today), this ratio–which you are more likely to recognize as The Buffett Indicator–is even higher. The highest it’s ever been, in fact.

It’s understandable if over 73.5 million Americans feel better about the future today than they did on Tuesday morning. But the mean on the mcap-to-GDP ratio is 84%. Yes, in bull markets, or during great financial experiments fuelled by excess credit, low interest rates, and psychological euphoria, the market often spends years trading well above the mean.

But the statistical principle of mean reversion is simple: Extreme values return to their long-term average eventually. In stock markets, they call that a crash or a ‘draw down.’ The more extreme the deviation from the long-term average, the bigger the crash (and the bigger the loss we want to avoid).

The initial drawdown is usually followed by a decade of below average of negative real returns. Those aren’t my rules. They’re just facts based on history. Here’s another chart putting these extreme valuations in a long-term perspective.

This the forward price-to-sales ratio on the S&P 500. It’s not quite at a record yet. But it’s close. The most recent high took out the previous high in late 2021. That was followed, as you might recall, by a crash in tech, a decline in the market, and a huge surge in energy-related stocks. And now?

The last time Wall Street analysts were this optimistic about the future of sales was at the peak of the dot.com era. Cisco was briefly king of the world (in market capitalization terms). And analysts and newsletter editors were outdoing themselves talking about how much better and brighter the future would be for technology, media, and telecom stocks (TMT).

The technologies and the stories are different today. We have AI data centers, powered by chips made by a few monster companies. The concentration (lack of breadth) at the top is even more pronounced. The top ten largest stocks in the S&P 500 account for 37% of its total market cap. And US stocks now make up more than 60% of the total market cap of ALL publicly traded stocks on the planet (see my PS below). One more valuation chart…

Sales are one thing. Earnings are quite another. The last in this trifecta of valuation charts is Robert Shiller’s Cyclically Adjusted Price Earnings ratio (CAPE). Earnings are, of course, subject to all sorts of accounting shenanigans. But let’s take Shiller’s metric at face value. It peaked at 44 in 2000. It’s at 38.08 now, and almost exactly where it fell apart in 2021.

You can say it’s a new era. You can say valuations don’t matter. You can even say there are things about to happen in Washington DC that will usher in the greatest era of American prosperity ever (I’ve gone into that case below). But you can’t say stocks are cheap.

As long as liquidity is abundant and there’s not a major financial crisis, we can make higher highs from here. But keep an eye on the most important price in the world, the yield on the US 10-year Treasury. It was 4.42% on Tuesday. It’s 4.31% now.

At 5%, alarm bells start ringing all over the financial world. Yields rise and the market value of bonds falls. Which brings me to the innocuous looking chart below, one I’ve called the most important chart in the world before. Or today, the Blue Iceberg.

Every year, like a giant nerd, I wait for the Bureau of the Fiscal Service to publish its Financial Audit of the US Government. It’s not a long report. But what it lacks in length it makes up for in tedium. Except for the chart above. It shows, in shades of blue and black, the debt iceberg that threatens to rip a hole in the hull of Donald Trump’s second term as President.

First up, the chart shows that there is $27.7 trillion of US government debt held by the public. This is less than the $35.9 trillion total Federal debt you are familiar with, because some of that debt (around $8.2 trillion worth) is owned by or owed to various Federal agencies (debt ‘we owe ourselves,’ allegedly). That non-marketable portion of the debt will likely be held to maturity and is excluded from the debt held by the public figure.

Second, the debt is a mix of Treasury bills, notes, bonds, Treasury Inflation Protected Securities (TIPS), and Floating Rate Notes (FRNs). All of those increased in the last year (bills the most, by $745 billion). And that’s where the chart gets scary.

As of the end of September of this year, $16.8 trillion of that debt will mature within the next four years. That’s 61% of the total of ALL marketable debt held by the public (debt that trades). As my friend Porter Stansberry pointed out on X, that’s more than 50% of US GDP.

Even worse, 82% of that $27.7 trillion matures in the next 10 years. And none of this includes new debt that must be sold to cover new annual deficits. Some important points to keep in mind:

Too many Bills to pay. The upside of a 4.53% yield on 90-day T-bills is that it’s like cash AND has a yield. The downside, for the US government, is that shifting more of its borrowing to Bills and Notes instead of long-term bonds makes all new debt more interest rate sensitive. You have to pay people more interest to lend you money, especially when they don’t want to own or hold long-term bonds because of inflation (which itself is virtually guaranteed, given the debt levels racked up by the government, creating the debt doom loop).

You’re the bag holder now. Marketable publicly held debt is owned by everyone: the Fed, foreign central banks, hedge funds, drug lords, terrorists, criminals, state governments, pension funds, retirement funds, insurance companies, banks, and individuals. If you own it, or you have your money with an institution that owns it, you have risk. For years we’ve been told this debt is ‘risk free’ (the US government will never default). It is NOT risk free (inflation is a stealth default).

Let’s borrow more for longer. Can’t we replace the long-term debt with 50-year bonds? The San Francisco Fed studied this issue in a report published in November of 2021. It pointed out that Austria, France, Switzerland, and the United Kingdom have all sold 50-year bonds and that these bonds ‘could open a new sustainable option to fund the national debt.’ This conclusion is both pithy and naive, given the growth in US debt since then and the higher interest rates required for a theoretical 50-year bond (unless you forced institutions to buy them through financial regulation/repression).

What if we back the 50-year bond with gold? I was asked this question recently, or if I knew of any plans to issue gold backed US government bonds. I don’t know of any serious ones. What’s more, in order to shift more of that blue iceberg to the right into longer-term bonds, we’d need more gold than the Treasury claims to have. Or, we’d have to revalue the gold we do have at a much higher statutory price.

Is there a trade in 2025 into relatively scarce 30-year bonds? Maybe. There might be some investors who want to lock in the yield on marketable 30-year bonds, for a couple of reasons. First only 18% of the debt outstanding matures between 20-30 years (a lot of this, I believe, is held by China and Japan). The relative scarcity of the longer maturity debt might generate some demand, although if there really IS demand, the government would just issue more debt with longer maturities. Second, if you believe in a stagflationary scenario of low growth, low inflation, and outright deflation in financial asset markets (and a depression), then maybe there’s a case for bonds. Maybe. Stay tuned.

The House of Representatives passed the Smoot-Hawley Tariff Act in late May of 1929. The Senate didn’t pass it until June of 1930, at which point the Dow Jones Industrials had already crashed and the country was in full financial panic. President Hoover signed the bill shortly after the Senate passed it. But he ended up getting the worst of the blame for a stupid policy (fairly) and a failed economy (unfairly).

Tariffs may not be inflationary in the strict monetary sense, in that they don’t increase the money supply. But they do increase prices. Producers always pass price increases on to consumers. It will be no different this time around.

In the long-run, as Trump and JD Vance hope, tariffs on China might lead to the re-shoring of US manufacturing from both Mexico and China, along with higher wages for US workers. But in the short run higher prices will reduce consumption, GDP growth and government tax revenues (increasing the size of the deficit, unless spending is reduced even faster).

Mind you, this might be EXACTLY the medicine the American economy and the US middle class need. Consumption financed on high-interest credit cards not only makes (or keeps) people poor, it’s demoralizing and leads to higher ‘deaths of despair’ among people who can no longer get ahead by playing by the rules (this is one reason Trump did so well with his traditional constituency of white, non-college educated men, but also Latino men, black men, and younger men–groups who’ve found it impossible to get ahead with higher inflation and lower real wages, which themselves may be a result of illegal immigration, automation, and globalization).

The last issue is the biggest issue, at least in macroeconomic terms. As my old mentor Dr. Kurt Richebacher used to point out in Paris, when he’d come to visit Bill and I from his home in Cannes, when a nation favors consumption over production, it has to favor the capital account (finance) over the current account (trade). The results are inevitable.

Under Bill Clinton, with the help of Republicans in Congress, the US passed NAFTA in 1995. Ex-Goldman man Robert Rubin, as Treasury Secretary, favored a monetary and trade policy that would funnel money into Wall Street and US government bonds, even while factories were shuttered in the heartland (great for corporate insiders and shareholders, bad for wage earners and workers).

This great hollowing out of the American Middle Class–or what I’ve called the controlled demolition of the American dream–has been underway since the mid 1990s. Every Fed chairman along the way has sped up the process with a ‘put option’ to bail out investors on the stock market and leveraged banks. And until Trump (and Vance, who has articulated this analysis well), no one has thought to fight it. Can they win?

Here are ten hings I’d love to see Trump do:

Slash the Federal workforce by 30% and trim $2 trillion spending. Start with Jerome Powell and the IRS.

End the ‘timed entry’ reservation system in our National Parks (public lands belong to the people).

Release the CIA’s JFK assassination files

Replace the income tax with a flat tax, but exempting individuals with a gross income under $30k so as not to be ‘regressive’ and punish those who spend a larger percentage of their discretionary income on food and fuel.

End the Forever Wars and trim the defense budget by half (down to $350 billion)

Magically increase productivity so GDP can grow between 4-6% without $2 trillion annual government deficit spending

Deport anyone in the country illegally who has a criminal record, either in their country of origin or in the US

Balance the budget

Find out how much money Tony Fauci and Big Pharma made off Covid

Secure the integrity of future elections by ending mail in ballots and voting without an ID, get dead people of the voter rolls, and figure out how, in 2020, 15 million more people voted for Joe Biden than had voted for any previous Democratic candidate for President.

That would be a good start. But he faces an entrenched Administrative State who will fight him every step of the way. He faces corporations–from Boeing and Raytheon to drug companies and the banks who finance our wars–who don’t want any change in the status quo (and certainly not the loss of cheap illegal labor). And half of Congress will do everything they can to fight him (although his proposal today for a constitutional amendment on term limits might help).

My point? If you’re against the collusion between Big Government and Big Tech, there’s a lot to be happy about this week. If you’re tired of being bashed over the head about being racist, sexist, elitist, and generally being a ‘colonizing oppressor’ unaware of your own privilege, it was also a good week. And if you’re opposed to endless immoral wars funded by American tax dollars in places where we have no real national interest, let’s hope it was also a good week.

But look at that blue iceberg on the chart above. Captain Trump is on the deck of a ship whose direction is almost impossible to change. And there’s an iceberg dead ahead.

There are a lot of people in Foggy Bottom, Capitol Hill, and on Wall Street who want a crash and a disaster they can blame it on him, on capitalism, on too much freedom and liberty and not enough socialism and government.

We’ll see what’s stronger…the Red Wave….or the Blue Iceberg. Whatever happens, don’t forget your golden life preserver.

Until next week,

Dan

PS There are two great sources to get a sense of how and why US stock markets have dominated the globe since the beginning of the 20th century. First, this animation from Visual Capitalist shows the growth of both stock markets and national GDPs over time. You’ll get a sense of the ebbs and flows associated with historical events, technological innovation, geography, demography, and what we call ‘Megapolitics.’

But in general, being born in America–with low taxes, the rule of law, sound money, limited government, and relatively limited regulation–was a good choice to make since 1900. More public companies are formed and successful in the US than anywhere else in the world. They are also subject to more extreme valuations–the ups AND the downs.

Second, UBS puts out an annual outlook of global investment returns each year. Like we do here at BPR, it takes a ‘big picture view’ of financial markets. Other than a brief period at the start of 1989, where Japan was 40% of the world markets and the US just 29%, US stocks have been the best game in town for 100 years. Japan’s dual bubbles in real estate and stocks crashed so hard that they still haven’t recovered (and may never do so, given Japan’s steep demographic decline).

You can see that at over 60% of total world market cap, the US is just above where it was in 1929. But it’s still below where it was in the late 1960s. Back then, the stress of paying for ‘guns and butter’--the Vietnam War, the Cold War, and LBJ’s Great Society–became too much.

The stock market crashed. The gold dollar broke. Inflation dominated the decade. Interest rates soared.

And now? Well that’s the question, isn't it? Leave your thoughts and comments below.

PPS This is what’s on the reading list of the weekend: The Finances of the Confederate States. Before 1868, 90% of direct revenue raised by the US government (in Washington) was through taxes on beer, wine, whiskey, and tobacco.

There was no income tax, which made it terribly hard to fight and fund a Civil War. The result was paper money, money printing, and massive borrowing.

Getting rid of the income tax is tantamount to getting rid of the Warfare State AND the Welfare State. It would truly make America great again. But look what they did to Kennedy for wanting to smash the CIA into a thousand pieces.

Best research BPR has ever published. Make sure it gets onto Trump's and Vance's desks!

Great article Dan, I take it you and Bill don't discuss politics much.