Heavenly Bodies

The top 10% of American companies by market cap have grown to be worth 76% of the ENTIRE value of the market. The previous high was 73% in the dot.com boom.

Friday, August 8th, 2025

Laramie, Wyoming

By Dan Denning

Do you think you’re smarter than the newest release of Chat GPT? What about Isaac Newton? He invented calculus, was the Master of the Mint for England and engineered a big money switch. But the stock market still got the best of him. More on both in a minute (including a model portfolio from Chat GPT based on a simple idea).

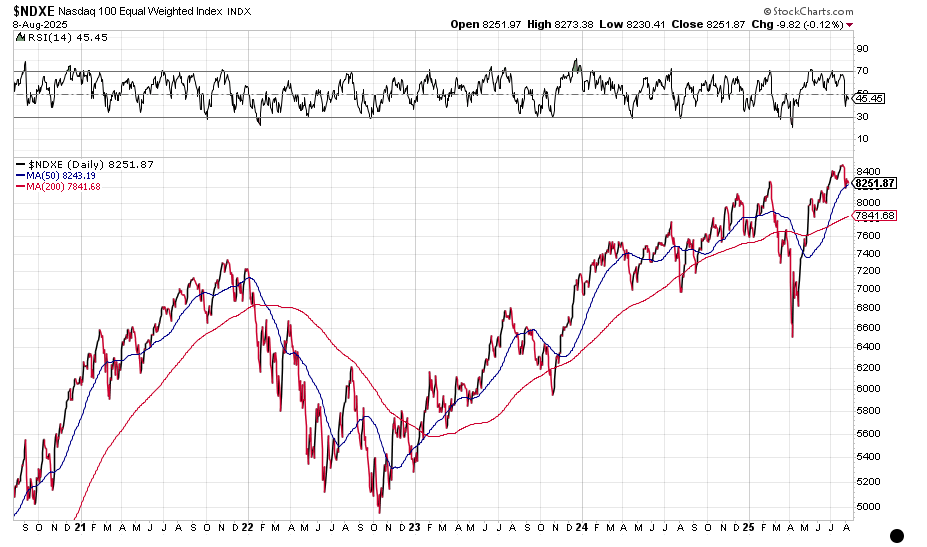

Two quick market notes. Everything–everything but volatility–was up today. For the week, the Dow Jones Industrials were up 1.4%, the S&P 500 2.4%, and the Nasdaq up 3.9%. Earlier in the week I showed you a snapshot of the equal weighted Nasdaq 100 (NDX). Here it is again today at the top. Not higher. But not massively lower. Yet.

And what in God’s creation happened to gold futures today? At one point they were trading at $3,534.20/ounce. Yesterday, the US Customs and Border patrols said that 1kg and 100oz gold bars from Switzerland would be subject to a 39% tariff (these bars play a big role in the exchange for physical market on Comex…if you want to take a deep dive in the details I recommend this post by our friend JJ at Market Vibes).

Earlier today the White House said it would clarify, via Executive Order, the ‘misinformation’ about the intention of the gold tariffs. Gold fell about $40 straight away, although it rallied to close up for the week.

There are a lot of theories about what the intention of the tariff is…controlling the price action in gold…making it harder for Russia to do business in gold…even engineering a gold ‘squeeze’ ahead of the US revaluation of its own gold reserves.

For now, it seems like more Trump Chaos. But who knows? Maybe there is a method to his madness. Which brings me to the curious case of Stephen Miran, US gold reserves, and the future of our dollar.

Remember last week when I wrote to you that Adriana Kugler had unexpectedly resigned from her role as a voting member of the Federal Open Market Committee? Well this week, President Trump nominated Harvard-trained economist Stephen Miran to fill out the rest of her time, which expires in six months. Miran is currently the head of the White House Council of Economic Advisors. His nomination requires approval by the US Senate (currently in recess).

This is a puzzler. Miran was against rate cuts last year on the grounds that they would create high inflation. He’s for them now. And that’s why Trump wants him on the FOMC …to vote for rate cuts before the end of this year (in time to ‘stimulate’ the economy ahead of next year’s midterm elections…and because Trump genuinely appears to believe that Fed Chair Jerome Powell is behind the economic curve and that US interest rates are too high).

You might remember Miran from earlier this year. He authored a long paper about restructuring the global trading system–an audacious idea that, through a few major policies (including tariffs), the US could renegotiate its current global trade arrangements. This could be done through the pain of tariffs leading to bi-lateral trade accords.

The main claim was that tariffs would not be inflationary. Other claims were that the US could bring back high-value manufacturing, restore wage growth for middle class workers and manufacturers, and improve national security through a national industrial policy used in a precise way. I wrote about it here, here, and here.