Greatest Economy Ever

How so much debt is eventually written off is the most important financial story of our era. It is a story in which gold is likely to play a leading role. But not many people want to think about it.

Thursday, August 29th, 2024

Bill Bonner, writing today from Poitou, France

A really efficient totalitarian state would be one in which the all-powerful executive of political bosses and their army of managers control a population of slaves who do not have to be coerced, because they love their servitude

—Aldous Huxley

Gold will tell the tale. Not just about the economy and the stock market... but about the world we live in, too.

The Feds can manipulate the stock market... and the bond market. They can ‘print’ as much money as they want. They can lend it to themselves at whatever rate they want. They can tell all the lies they want too... and pass out their dollars all over town.

But they can’t control how much each dollar is worth. Which is where gold comes in. Gold now trades at five times more than it did twenty years ago... and nearly ten times what it cost in 1999. And the Dow? Less than four times what it was in 1999.

We’ve been mostly out of stocks the whole time. Arguably, we’ve failed to profit from the ‘greatest economy ever,’ under Donald Trump, and the ‘best economy in the world,’ of Joe Biden. And we’ve missed the ‘most powerful bull market in Wall Street history.’

But we’ve still come out ahead.

How could that be possible? There’s more to the story, isn’t there... something is going on that is deeper than the stock market and more important than Wall Street.

At a superficial level... stocks are up because investors expect a big boost from the Fed. If the past two decades are anything to go by, however, stock market gains will be overshadowed by the gold market. Stocks will go up in response to easier credit conditions. That will be enough for most people; they won’t look deeper.

We keep score in gold. It is ancient. And universal. It tells us what is really going on. Yes, it is subject to panic attacks and mood swings too. But it can’t be readily fiddled by the feds.

Now over 41,000, the Dow is at an all-time high. But so is gold. At $2,500 it takes 16 ounces of gold to buy the Dow. Six years ago, it took 21 ounces... 24 years ago you would have needed more than 40 ounces to buy the Dow. In other words, investors think stocks are going up... but they’ve actually been going down for the last quarter of a century.

While the plus side of America’s ledger shows its publicly-traded corporations worth four times what they were in 1999... the minus side shows the public debt (national debt) has exploded to seven times what it was back then... and total debt, including household and business debt, approaches $100 trillion. How so much debt is eventually written off is the most important financial story of our era. It is a story in which gold is likely to play a leading role. But not many people want to think about it.

Few people want to look too deeply into politics either. Like looking into an open sewer, you’re likely to see some disgusting things. But it’s not a bad idea to understand where the drains lead.

At a superficial level, the old bull, Trump is facing off against the mysterious Ms. Harris.

The nice thing about Mr. Trump is that we already know what a big dope he is.

Ms. Harris’s dopiness, on the other hand, has yet to be weighed. Thanks to the anti-democratic Democrats, she rose to the top of the heap without the usual debates, interviews or other opportunities to reveal herself. Presumably, her managers intend to keep her carefully wrapped up... and ‘on message’ as the ‘joyful’ candidate... until after the votes are counted. Then, we’ll find out what’s really in that pantsuit... if anything.

The deeper story is that it probably doesn’t matter. The insiders made her. They can break her too... just as they did with Joe... Joe... Joe who?... The US president, jolly Joe Biden, has already disappeared from the headlines; he outlived his usefulness.

It’s the handlers... the managers — the know-it-all global elites — who really run things. It’s people such as Mark Rowley, chief of police in London (Commissioner of the Police of the Metropolis, officially). According to the New York Post, he’s warned Americans that if they have a contrary opinion about the recent riots in the England, they should keep it to themselves:

"We will throw the full force of the law at people. And whether you’re in this country committing crimes on the streets or committing crimes from further afield online, we will come after you."

You are in Nebraska... you post an opinion on the UK riots. Maybe you think there are too many immigrants in England. Is it a ‘hate crime’ in the UK to say so? Will the bobbies come after you?

What kind of brave new world is this? And what tale will gold tell?

Tune in tomorrow.

Regards,

Bill Bonner

Research Note, by Dan Denning

Numbers, numbers everywhere! On the macro front, the number of Americans applying for unemployment insurance benefits (initial jobless claims) was ‘just’ 231,000 at the end of the last week. The Bureau of Labor Statistics (the same bureau that revised new jobs lower by 818,000 last week) said the latest unemployment claims figure was lower than the previous week and lower than expected.

Meanwhile the Commerce Department reported that second quarter GDP growth was 3% in the second quarter, better than the expected rate of 2.8%. And personal consumption is rising at an annualized rate of 2.9%, according to more data released this morning. If it can be believed, this macro data clouds the probability of a Federal Reserve rate cut later next month (the Federal Open Market Committee meets on September 17th and 18th).

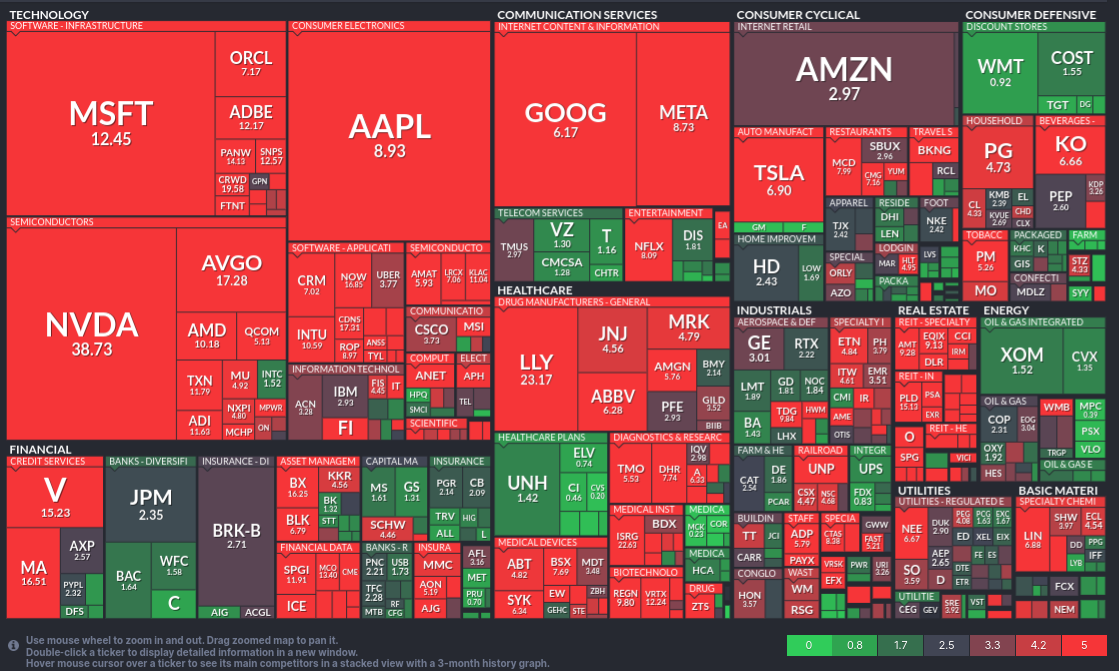

In the stock market, Nvidia (which the heat map above shows trading at nearly 40x sales) reported the fourth straight quarter of triple digit revenue growth. But it was not enough to please investors who are expecting more! The stock fell aftermarket.

More on that in my Friday research update. And what do you make of this? The Financial Times says that central banks bought 483 tonnes of gold in the first half of the year and that ‘this gold rush has staying power.’ Barron’s says ‘Don’t miss out on the rally in gold mining stocks. Here’s what to buy now’. Is gold about to correct?

Also of note, Berkshire Hathaway has crossed the $1 trillion market capitalization level (there are now seven US-listed stocks with that distinction, with a combined market cap of $15.5 trillion). Meanwhile, Warren Buffett continues to unload hundreds of millions of dollars in shares of Bank of America and has built a cash war chest of $278 billion at Berkshire. The ‘Buffett Indicator’ of total stock market capitalization-to-GDP is back over 200%—a massive overvaluation in stocks.

Yes Mark Rowley is a piece of work, that's for sure. Chairman Starmer is also a vile tyrant who repeatedly does toxic, divisive speeches riddled with lies. They rule by deception in a fake world perpetuated by the media. The outlook is bleak in the UK.

Economics is about how goods and services are produced. Politics is about how goods and services are distributed. The rules for distribution heavily impact the quantity and quality of goods and services produced, so Political Economy is the subject matter needing the closest attention. But anthropology is the foundation for all of these, and the toughest subject of all, because it involves a level of introspection that is very difficult to achieve for easily self-deceived creatures like humans. It's fun to try, though, and Bill Bonner et al are stimulating influences for making the attempt and keeping the household economy solvent for the journey. Ever since encountering "Family Fortunes" I've found BB's story telling helpful in rethinking my filters on reality.