Cruisin' for a Bruisin'

Like a big, lazy river, deficits just keep rollin’ along, adding more and more to America’s $35 trillion delta of debt. US interest payments go up. Sooner or later, asset holders get stuck in the mud.

Tuesday, July 16, 2024

Bill Bonner, writing today from Poitou, France

—Things tend to go back to ‘normal.’ If not, there would be no ‘normal.’

Hallelujah! The economy is weakening!

In the perverse world of finance, circa 2024, bad news is good news. Up is down. And lies are as good as truth.

Investors don’t need us to connect the dots. When the economy weakens…they look for the Fed to react by lowering interest rates. A lower Fed rate means more borrowing…and more speculating…and more money for Wall Street.

Reported a week ago:

Nasdaq, S&P hit record highs…New data show labor market weakness and raise rate cut hopes.

And then, a few days later…

Dow closes above 40,000 for first time ever

The Dow Jones Industrial Average closed above the 40,000 mark Friday for the first time in its 139-year history.

Wall Street has been boosted in recent days by renewed hopes of rate cuts from the Federal Reserve that would loosen monetary conditions for consumers and businesses.

Consumers don’t consume more when the labor market weakens. Businesses don’t sell much to people without jobs. Sales go down, not up. Corporate profits go down too. Enterprises become less valuable, not more valuable.

But so what? Stock prices often have little to do with the real value of the underlying company. Over the last 10 years, for example, stock prices have gone up more than three times faster than sales. This is called ‘multiple expansion.’ It is typically a prelude to ‘multiple contraction.’

Today, the S&P 500/sales ratio is twice the normal level…and near a record high. As in March of 2000, stocks seem to be ‘cruisin’ for a bruisin’.

But investors are sure a rate cut is coming. And they know what that means – higher stock market prices.

For now, bad news is good news, since it increases the likelihood of a rate cut. So, imagine the fulsome joy of a thermo-nuclear war….or a Kamala Harris victory in November—either one might send stock prices ‘to the moon.’ Short of that, there are plenty of reasons to celebrate coming our way.

Dan mentioned in his weekend report:

Services and manufacturing–the two pillars of the economy–are in contraction. The last three times that's happened, we've been either in the middle of or at the very start of a recession. My money is that we're already in one.

Marketwatch elaborates:

Businesses show biggest contraction since pandemic, ISM finds. ISM services index sinks to 48.8% in June — the lowest reading since 2020.

David Rosenberg:

The labor market is cracking, a slowdown in services activity is dragging on real-time growth, and forward-looking financial signals still point to a coming slowdown.

Amid all this hullabaloo of ‘bad news is good news,’ almost no one mentions the bad news that stays bad: The US is going broke. Like a big, lazy river, deficits just keep rollin’ along…adding more and more to America’s $35 trillion delta of debt. US interest payments go up. And sooner or later, asset holders get stuck in the mud.

We have one core insight that informs our strategy’s construction. That is, the biggest single bubble of all time – the government bond bubble – is bursting. A government default is coming. And a run on western currencies has started.

Yeah…yeah…’the US government can never go broke because it can always print more money.’ That’s what everyone says. But it’s not true. In order to prevent an outright default…the feds choose a devious default. They ‘print’ more dollars. The US still goes broke, but in another way. Nominal prices go up, but real (after inflation) prices crash. Bloomberg, on the case:

The Bank for International Settlements cautioned that governments are vulnerable to a precipitous loss of confidence.

In S&P’s report on Thursday, it suggested the prospect that the US, Italy and France will manage to keep debt at already elevated current levels is remote.

Our guiding assumption, here at Bonner Private Research, is that water eventually finds its level, prices eventually reflect real values, and people eventually get what’s coming to them. Sooner or later, things go back to ‘normal.’

Just how and when that will happen, we don’t know any more than anyone else. But the likelihood of preventing it, as the S&P report suggests, is ‘remote.’

Regards,

Bill Bonner

Research Note, by Dan Denning

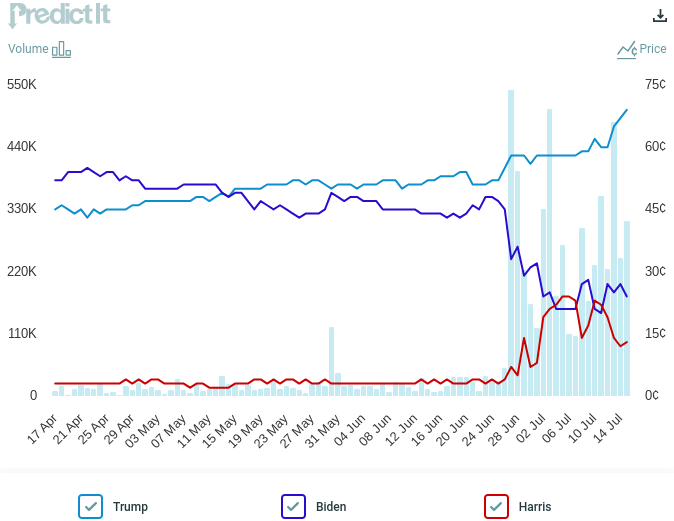

After the assassination attempt on Donald Trump Saturday, prediction markets now show the former President with a commanding lead over incumbent Joe Biden. Vice President Kamala Harris remains an outside chance, both to be the nominee of the Democratic party, and to be elected President on Tuesday, November 5th.

Later this week I’ll sit down with Bill Bonner to record our quarterly ‘State of the World’ Private Briefing. We’ll talk megapolitics, interest rates, stock prices, and gold. What else?

That’s up to you! If you have a question you’d like me to ask Bill on Thursday, leave it in the comments below or email it to bpr@bonnerprivateresearch.com. I’ll ask as many of them as I can. Please do remember we can’t give personal investment advice.

Recession is no longer a big deal. With 50% or more of the country on some form of government dole, the state of the actual economy becomes irrelevant. The government "checks", aka transfer payments, now some 30% of GDP, will always be there. People ratchet back to subsistence living, forsaking the idea of discretionary spending that nominally drives the "economy". Half the country is living in permanent recession and likes it, because there is no risk. Klaus Schwab is waiting in the wings. Best always. PM

The trouble is that that lazy river can just keep rolling on longer than we expect, or even believe possible. Thirty years ago I never thought it could get this far, yet here we are. It could collapse next week, or next year, or in several years, but until then we are better off riding the wave. At some point, confidence will collapse and it will all come apart, but I have given up trying to guess when. I stay in the stock market to ride the wave, and I have my gold and silver (not as much as I would like, but...) to help cover necessities when things change.

I think it was Lenin who said, "There are decades when nothing happens, and there are weeks when decades happen." One of those weeks is lurking out there, and possible several of them.