ChatGPT on The Dollar

Human stupidity vs artificial intelligence... Bill vs a fiery bird from hell... the US Dollar vs gold and plenty more...

Bill Bonner, reckoning today from Youghal, Ireland...

Sometimes, stupidity alone isn’t enough.

You also need to pay attention to what we call, pretentiously, the ‘Darwinism des moeurs.’ That is, we follow the evolved rules, customs and habits that have stood the test of time. It’s better not to kill or steal, for example, even if it seems like a good idea at the time. And that is true for governments as well as individuals.

But sometimes the living think they know better than the thousands of dead generations that came before them. And lately, we’ve completely despaired of today’s human intelligence. So, we’re giving the artificial kind a chance. Specifically, we wanted to know what ChatGPT, the latest thing in AI, sees coming for the dollar. Does it draw on the wisdom of the corpses? Or look to the latest claptrap and wishful thinking from Paul Krugman and Janet Yellen? Here’s the answer (admittedly, after a leading question):

"The US dollar was once the king of currencies, but [in 2023] its reign was about to come to an end.

Step 1: The monster rises: Government spending spirals out of control, creating deficits that ballooned to unsustainable levels. As debt levels reached new heights, the once-great American economy began to show cracks. Inflation took hold, wiping out the purchasing power of ordinary Americans. The cost of living skyrocketed, making it harder for people to make ends meet.

Step 2: The monster attacks: The once-strong US dollar was no match for the monster of inflation. Its value plummeted as investors around the world sought safer investments. Foreign countries, including Japan and oil-producing states, stopped buying US government bonds, reducing demand and sending the US dollar into a downward spiral.

Step 3: The aftermath: The collapse of the US dollar changed America forever. Prices rose to levels never seen before, leaving ordinary people struggling to make ends meet. The once-great American economy was in shambles, and the world would never be the same.

Hey…humans guess. AI can guess too.

Like a Crow Outta Hell

And since it’s Friday….we will spare you our own guess about the “end of the world” until Monday. For now, let us tell you about the flaming crow incident.

It began when we brought in some local lads to replace the wire on top of our chimneys. There are thousands of crows that make their home somewhere nearby. They get into chimneys and build nests, clogging them up.

One of the men who came to solve the problem was a big man, beefy, with fleshy features and a shaved head. He looked a little like “Curly” of the Three Stooges.

“Are you going up the ladder to put these new protectors on?” we asked.

The answer was obvious; of course, he was; that’s what he was here for.

The man looked at us blankly.

“He must be Polish,” we said to ourselves. “He doesn’t understand a word we’re saying.”

Then, suddenly, as if a switch had been turned on, he came to life, and in perfect local patois, he replied:

“Tat’s what um here for.”

He wasn’t Polish at all; maybe just a little slow.

Coming back down the ladder, he reported….

“Ye have some crows in dere. Better smoke dem out before ye put de wire on.”

We filled the fireplace with lightly–packed newspaper. We struck a match. In seconds, the weekend edition of the Financial Times was alight. It flared up fast, as intended.

And then came a terrible screech…and a rustling up in the flue…

...all of a sudden, a firebird appeared in the fireplace…its wings aflame…like a fowl from Hell itself. It flapped its wings amid the inferno; the flames shot higher. And still screeching it headed straight for us.

Confronted by this diabolical animal…and gripped by a cold fear, we gave out a cry of terror and fell back. The crow passed over us, still with its wings ablaze… Its feathers thus consumed by the conflagration, it couldn’t fly. So, it raced around on foot. We had seen chickens run with their heads cut off, but never a crow whose wings had been scorched. Soon, the flames were out; a trail of ash and burnt feathers circled the room.

After a few moments, the crow had only tattered, stubby feathers left….still smoking. We jumped to our feet and chased the bird around the room…moving a canapé and an electronic piano to get at it. Finally, we cornered it and managed to trap it in a wicker trash basket. We took it out the door and gave it its freedom in the nearby woods. Its prospects were poor….but not hopeless.

Later that day…

We were working outside…painting our hand-made conservatory.

Suddenly, crows appeared overhead. It was like a scene from an Alfred Hitchcock movie. They gathered in the big oak tree near where we were painting. A few dozen. Then hundreds…and finally what seemed like thousands.

Quiet…and then calmly chattering…and then, in a great rush, they took to the air…calling to each other in anger as they circled overhead.

We guessed what they were squawking about…..

“You set our cousin on fire…and you’re not going to get away with it.”

“It wasn’t intentional,” we replied meekly. “We were just trying to get him out of the chimney.”

The flock was unmoved by our excuses… Extenuating circumstances meant nothing to this jury.

“Besides, the bird is not dead. He’s in the trash heap, eating some of yesterday’s dinner.”

The birds seemed to take this in, perhaps wondering where the scrap heap was located. But inasmuch as defense yielded no progress, we went on the offense.

We clapped our hands…making a noise a little like the sound of a small caliber rifle. The birds dispersed and didn’t trouble us again.

Cluster Incoming

But let us return to Mr. Powell before signing off for the weekend. We’ve already subjected our long term dear readers – who did us no harm – to no fewer than 5,000 of these commentaries. We’re not going to stop now.

And so far, we were mostly right. At least about the big things. In 2000, the dot-coms did crash as predicted. The real estate market took a dive in 2007-2009, also as we predicted. And inflation rose up in 2021…again, following the script we had laid out years in advance.

Now, we think the whole Primary Trend has shifted…from bull market to bear market…from disinflation to inflation…and from growth and prosperity (especially in the best zip codes) to stagnation and poverty (especially in the middle zip codes.) This analysis stems not from our own native stupidity, but from the record of the past. Primary Trends reverse…white shoes aim for mud…and the best of times become the worst of times.

We also think that this major financial shift will be accompanied by a whole “cluster” of self-inflicted, cyclical, and inevitable political and social disasters.

Did you see the State of the Union, dear reader? Did you get a good look at our elected officials? Did they remind you of Franklin, Washington, Madison and the others gathered in Philadelphia in 1787 for the Constitutional Convention? We didn’t think so.

And isn’t their way of doing business – spending trillions of dollars they don’t have – bound to cause disasters?

But we remind our long-suffering readers that most analysts think we are wrong. They see moderating inflation…softening Fed policies…victories against Russia, China, germs, and carbon…and blue skies from here to eternity.

Yes, we are in a minority. Held in contempt by the Krugman school of economists…despised by the imperialist war mongers…mocked by bulls…ignored by bears…scorned by Republicans…detested by Democrats and dissed by earnest True Believers of all persuasions…

…hated by the crows…

…and wouldn’t it be nice if we were wrong?

Regards,

Bill Bonner

PS. We’re sorry we set the crow on fire.

Joel’s Note: Speaking of fiery birds from Hell, how ‘bout that flapping, floundering fiat conflagration known as the US Dollar?

Measured against real money – gold – the greenback lost 0.4% of its purchasing power in 2022… and this despite one of the most aggressive rate hike campaigns in recent history. It’s lost another 2% so far in 2023, even as Mr. Powell’s Fed remains committed to fighting the very inflation they didn’t see coming and then largely ignored when it inevitably arrived.

(As Tom Dyson pointed out in a recent note to BPR members, the dollar index (DXY) is down from its high of 114 in October last year to 103 today… a 9.6% decline.)

Of course, gold is but one tape against which to measure the dollar’s terminal atrophy. Stack your USDs up against airfares… or a dozen eggs… or school lunches… and see how far they stretch (or don’t).

The aforementioned items were up 28.5%… 59.9%… and (incredibly enough) 305% in dollar terms during 2022, a year that saw inflation rip to a four decade high.

The dollar simpered against other real world items last year, too. Flour was 23.4% more expensive in dollar terms… lettuce was up 24.9%… butter by 31.4%… and margarine by 43.8%. Overall, the cost of eating at home rose 11.8%. As for dining out, many working Americans – squeezed by rising costs on the one hand… and falling real wages on the other – simply can’t afford the luxury. (Though we doubt Mr. Powell or Ms. Yellen will be missing a lobster lunch anytime soon…)

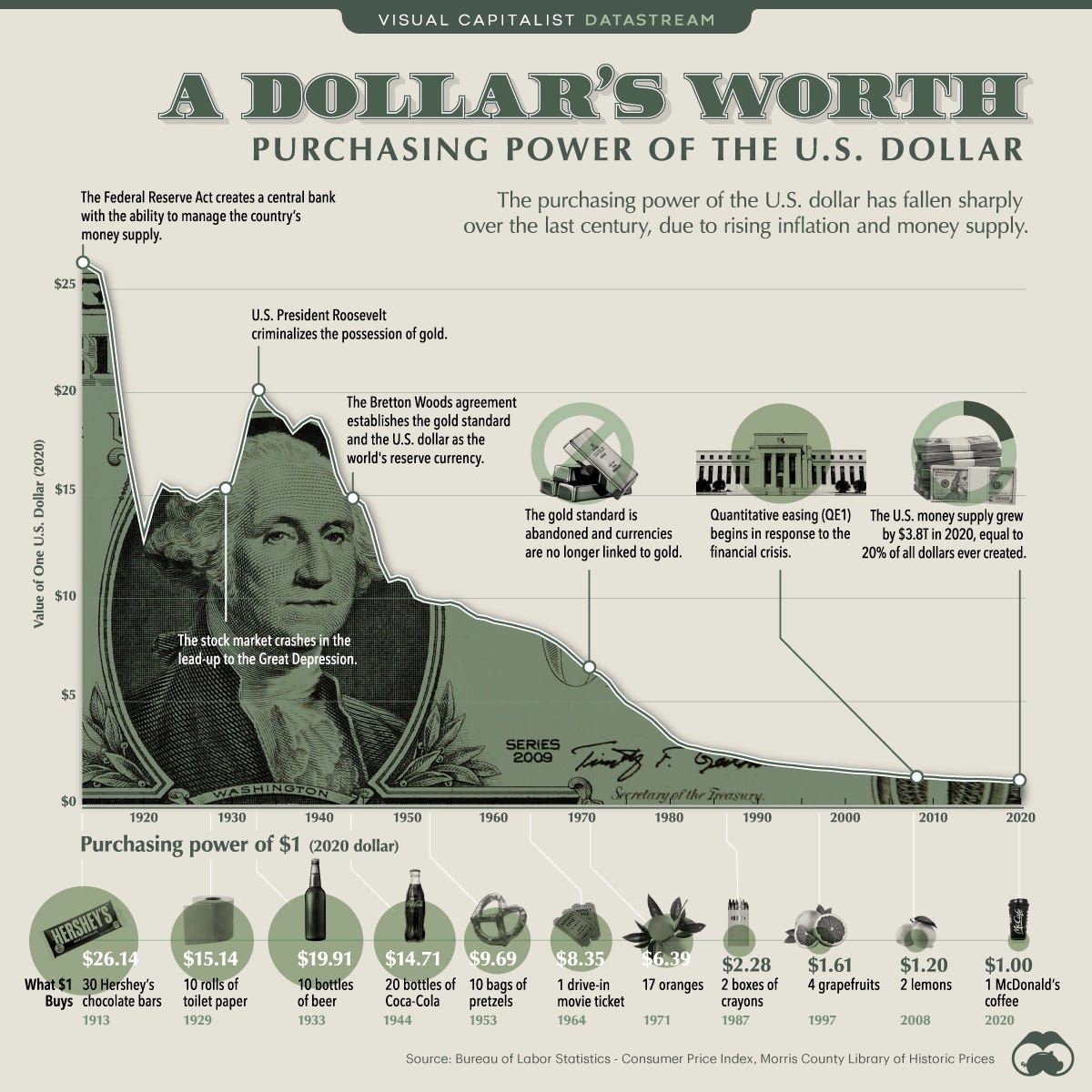

Of course, this is only a brief snapshot of a much longer, inexorable trend… that of gradual dollar debasement. No doubt you’ve seen one of a million charts on the Internet depicting just this phenomenon. Here’s one of the better ones, from the folks over at Visual Capitalist…

You can see the key dates on there… from the creation of the Federal Reserve, under President Woodrow Wilson, back in 1913… through to Roosevelt’s Great Gold confiscation, in 1933… to Nixon’s finally abandoning the gold standard altogether, in 1971… through to the massive inundation of freshly inked dollars that flooded the globe in the Great Covid Panic of 2020… (which definitely didn’t cause the subsequent inflation, or so we were told…)

As over a century of data makes clear, parking all your hard earned in one place leaves you vulnerable to the forces of the politicos, who have been cheating hard working citizens out of the value of their savings since time immemorial.

The Bonner Private Research Gold Report is a great place to start your dollar diversification strategy. Readers can access it, along with all the rest of Tom and Dan’s weekly and monthly research, by becoming BPR members, below. Find a membership plan that suits you, here…

Bill, your "Bird story" is better entertainment than Hitchcock. Thanks for keeping a smile on our face while Prof Joel gives us the bad news.

Jerry

Bill, I hope your wrong too... but I got a bad feeling...

Your list of detractors says nothing but good about Bonner the man.

Safe travels.