Sunday, October 19th, 2025

Laramie, Wyoming

By Dan Denning

The investment banks were busy bees this week. So was the mainstream press. Different investment themes—rare earths/critical minerals and gold, respectively. But all of a sudden these two ideas are wildly popular as potential sources for future investment profits. What now?

The chart at the top of today’s letter is from Morgan Stanley’s ‘National Security Index’—basically a grab bag of energy (nuclear), battery (lithium) and rare earth companies whose stock prices could go up as the US and China slug it out over chips and rare earths. Morgan upgraded MP Materials [MP]—a company that’s come up in our discussions over the last two years—and a lithium company.

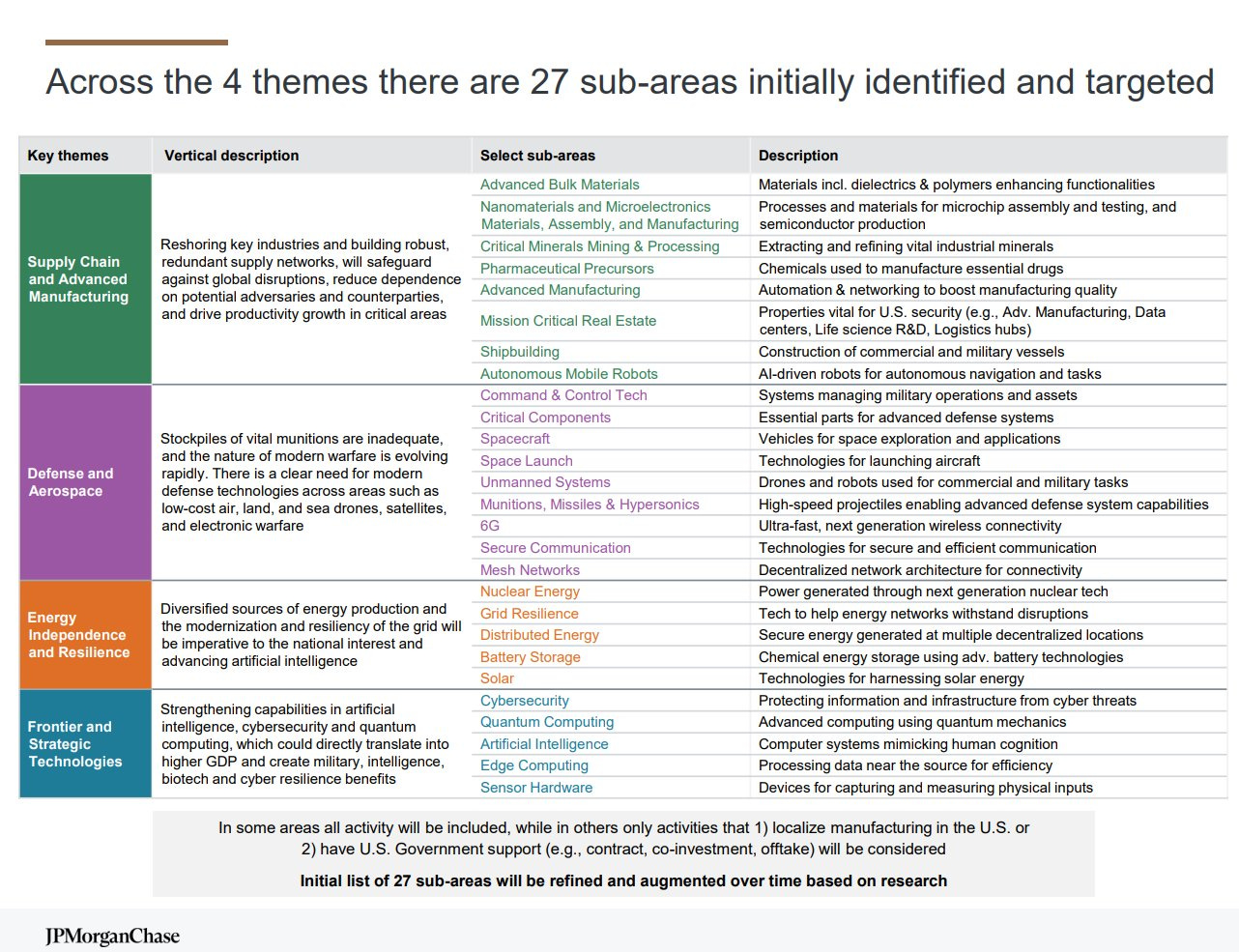

Not to be outdone was JP Morgan. The company announced a new ‘Security and Resiliency Initiative’ early last week. It’s a ten-year plan to invest $1.5 trillion in what it describes as ‘strategic industries critical to national security.’ That includes as much as $10 billion in direct equity investment in publicly listed companies with projects already in or close to production (defense, aerospace, rare earths, critical minerals).

These are good marketing ideas for the sell-side of the industry. They will pique investor interest and may even provide actual capital to companies that need it. It’s too bad this advice didn’t come two years ago. But better late than never.

Same for gold. Bloomberg wrote about long lines in Japan this week. Japanese retailers can’t keep up with demand for gold bars. Long lines formed outside bullion dealers in Vietnam and Australia. Nothing attracts new buyers like high prices. Even the New York Times got into the act, reporting on newbies and old hands flocking to New York’s diamond district to sell their gold with prices at all time highs.

All of this makes a lot more sense in the context of the waggle dance. It’s the figure-eight style dance conformist bees do when they return to the hive to communicate the location of food. The waggle dance was discovered in the 1940s by an Austrian ethologist named Karl von Frisch.

Here’s the interesting thing…

It turns out their are non-conformist bees in the hive. Rebel bees! These rebels ignore the information communicated by the conformist bees. This information is important, as it points the way to the nectar that keeps the hive alive. But is often ‘old.’ The non-conformist bees choose to go off and explore in new directions and to find undiscovered sources of food.

It turns out you need both types of bees. The non-conformists are focused on the future and discovering unknown resources. The conformists are focused on the present and maximizing known resources. In the right proportion, you need both to sustain and grow the hive. Which brings me back to investing…

We were early on gold, silver, and rare earths. That’s how you make the big money—taking the unpopular risks on the road less traveled. But you only really make that money when the traffic picks up and other people follow your trail, which is what’s happening now with precious metals, industrial stocks, and rare earths.

All of this new activity means we’re further along in the cycle. But it doesn’t mean the moves are over. For that, we continue to keep our eye on the Dow/Gold ratio. And in the meantime, we’ll keep waggling in a non-conformist way for the next new big idea.

Regards,

Dan

P.S. JP Morgan’s ‘Security and Resilience Initiative’ identified four key themes and 27 ‘sub areas’ for investors. The four themes are ‘Supply Chain and Advanced Manufacturing,’ ‘Defense and Aerospace,’ ‘Energy Independence and Resilience,’ and ‘Frontier and Strategic Technologies.’ I’ll have more on this opportunity later in the week for paying subscribers. You can read the fine print (barely) below.

An 'unbound hyperbolic trajectory' and the arrival of aliens and 'credit cockroaches'

Friday, October 17th, 2025

Dan, the BPR portfolio has been at a 40 percent allocation to gold and precious metals for several years. Since gold has appreciated more than the stock positions and far more than the cash position, gold would now be way above the 40 percent allocation in the recommended portfolio. Yet recently, you mentioned buying more gold on a pullback. Was there ever a recommendation to sell down some gold to maintain the 40 percent target? If the target is different now for long time holders could you comment on when (if ever) you’d recommend trimming back to 40 percent?

Wait… how did the portfolio make money on rare earths?