Policy Creeps

Trump will appoint his political yes monkeys and make sure the Fed does what it is told to do. That will make America’s central bank more like those of Zimbabwe, Venezuela or Argentina.

Thursday, October 16th, 2025

Bill Bonner from Baltimore, Maryland

In our never-ending quest for reductio ad simplicitas...that is, making things as simple as possible so we can understand them...and keep track of them...we come to this: The more policies you have, the poorer you will be.

Corollary: Changeable, discretionary policies are worse than those fixed by law.

You may have wondered.

How is it possible that US GDP growth has actually gone down since WWII? The country has been flooded with immigrants. Each one adds to sales, output and GDP. The economy has also absorbed countless new innovations and discoveries. The internet has vastly increased the availability of information. And more or less free trade policies (until recently) gave the US a huge market to which it could sell its products and services, and from which it could buy the things that others produced more efficiently.

More patents. More Ph.Ds. More people. All the things that should lead to economic progress. And think of all we’ve learned about how to manage a business...or a country? How is it then — with so many advantages — that economic growth slowed down?

In the 50s, 60s, 70s, 80s, and 90s, US GDP growth averaged around 4% per year. Now it’s around 2%. Cut in half.

Trying to understand why, here at BPR we have focused on the money. Today, we introduce another obvious reason.

Since 1971, America has had an artificial currency that can be readily manipulated for political purposes. The politicians prefer low interest rates to higher ones. The low rates give the appearance of prosperity and thus help their re-election prospects.

The lower rates, however, stimulate borrowing...which essentially shifts future GDP growth (from tomorrow’s sales and investment) to the present. That is, we borrow money, intending to pay it back from future earnings.

And now, after more than 50 years, we are in the future from which GDP growth was taken. Now, we have the debt from sales made long ago...but not the sales themselves. Though we are not paying off the debt directly, we are nevertheless paying the interest on all our past borrowing, thus devoting current GDP to spending that has already happened.

Note that this situation is about to get a lot worse. The Fed is not supposed to pay too much attention to the election cycle. But Donald Trump has put his ‘low interest rate man,’ Stephen Miran, on the Fed payroll. And Miran is expected to replace Jerome Powell when his term expires next year. Trump now openly discusses how he will appoint more of his political yes monkeys and make sure the Fed does what it is told to do. That will make America’s central bank more like those of countries such as Zimbabwe, Venezuela or Argentina...ready to ‘print’ as much money as the politicians require.

But money isn’t everything. There is also ‘policy creep.’ As we saw yesterday, the more government ‘policies’ you have...the less free you are to pursue your own policies.

As governments become bigger, older, and more controlled by elites, they add even more ‘policies.’ At the end, for example, the Austro-Hungarian empire employed a third of the population. And they published a tax code in three huge tomes, with two columns per page, printed on thin paper in small type. There were 15 official languages in Austro-Hungary, including Yiddish and Ruthenian. Often, parliamentary policies allowed debates in languages most of the delegates didn’t speak.

US federal policies are less baroque but no less stifling. They often prevent action...or simply make it more difficult and expensive. Typically, economic progress slows.

Federal policies, implemented by the vast army of public servants, are recorded for us in the Federal Register. In 1980, it had 70,000 pages. Last year, the count was up to 107,000 pages. And each page has a rule, a regulation, a no-no that a business must pay attention to. They tell farmers how high to pile their manure...or how high off the floor a toilet seat must be...or what kind of procedure a bank must follow when it suspects a customer of laundering money. The list of dos and don’ts is almost endless. For a large business, the cost of administration and compliance mounts up. For small businesses, without crackerjack legal help, it can be almost impossible to keep up.

And like a golf course with 87 different traps, it creates an economy full of missed fairways.

Regards,

Bill Bonner

Research Note, by Dan Denning

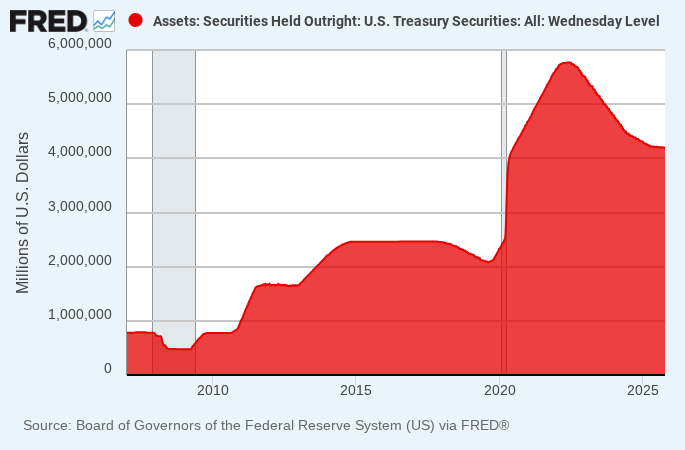

Has the Federal Reserve already caved to pressure from President Trump and begun inflating asset values in the economy again? Earlier this week, Fed Chair Jerome Powell said the US central bank may be approaching the point ‘in the coming months’ where it will cease the balance sheet run off. More importantly for investors, Powell said the Fed has no plans to return the balance sheet to its pre-Covid size of around $4 trillion.

The use of the balance sheet to create bank reserves out of thin air is otherwise known as ‘Quantitative Easing.’ The run-off of the balance sheet—letting purchased securities mature without replacing them—is known as ‘Quantitative Tightening.’ In practice, the Fed purchases either US Treasury bonds/bills/notes from banks (or mortgage backed securities) by crediting the sellers account with newly created bank reserves.

The Fed becomes the proud owner of these assets. As you can see from the chart above, the Fed increased the size of its balance sheet by $5.2 trillion between September 2019 and May of 2022 to nearly $9 trillion. It do so by purchasing roughly $1.5 trillion in MBS (leading to a 40% rise nationwide in average house prices) and $3.7 trillion in US government debt.

What does all this mean now?

Former Fed Chair Ben Bernanke—the god father of QE—once told then-Congressman Ron Paul that the Fed needed about $1 trillion in reserves on its balance sheet to guarantee enough cash in the economy and liquidity for the banking system in the event of a financial crisis. Now we learn from Powell that the Fed balance sheet will likely never be lower than $5 trillion again (it’s currently $6.5 trillion).

It my research note to paying subscribers tomorrow, I’ll look at whether Fed balance sheet expansion is inflationary…and if so…for what assets. That’s the problem with expanding credit in the banking system. You can create more bank reserves out of thin air. But you can’t control where they go or how fast they get there (the velocity of money). The relentless rise in gold and silver suggests at least some of this money is finding its way into precious metals…which cannot be created with a few keystrokes on a computer.

Well then, if the country’s been growing at 2% instead of 4% and everyone’s real upset about it. I don’t know, two percent sounds pretty good to me. You know, if a doctor says, “your cancer is only growing at two percent” I’d probably say, “Well, that’s a relief.” And they say it’s all because of low interest rates. Yeah, yeah, they borrowed too much from the future. Which is funny because the future never asked for it. The future’s just sitting there like, “Hey, I didn’t order 30 trillion dollars of crap. I just wanted a hoverboard.”

The system is BUILT to slow down! You think the elites want you growing at 4%? Forget it! They want you fat, dumb, and filling out Federal Register Form #32-A about the “proper stacking height of cow shit.” So if you’ve got 107,000 pages of federal rules, that’s not governance, that’s a bad marriage, you know you’re screwed, you just don’t know what it’ll cost yet!

And let’s not talk about innovation.

We have the internet! We have AI! We had free trade! And what’d we do? We made Facebook so you can argue with your aunt about vaccines, (X) so the president can scream at 3 a.m., and Wall Street algorithms that can steal a trillion dollars while you’re still tryin’ to reset your Wi-Fi! So they’re not slowing GDP folks, they’re slowing us. We’re the product. We’re the cattle. And the elites? They own the slaughterhouse!

The whole economy’s just a Ponzi scheme run by old guys in suits who think lowering interest rates is an innovation. Like, “Hey, let’s borrow from the future so our grandkids can have the privilege of eating cat food in space!” And policies? Geez, we don’t need more policies, we need a policy torch. Every time a new one gets added, some poor bastard in Ohio has to hire a lawyer just to mow his lawn. And then we’re shocked! Shocked that GDP slowed down? It’s not a mystery, it’s math: debt plus bullshit equals America’s growth strategy. 🤩

Ho boy, where to begin. Ok - just spit-balling here:

"𝘛𝘩𝘦 𝘤𝘰𝘶𝘯𝘵𝘳𝘺 𝘩𝘢𝘴 𝘣𝘦𝘦𝘯 𝘧𝘭𝘰𝘰𝘥𝘦𝘥 𝘸𝘪𝘵𝘩 𝘪𝘮𝘮𝘪𝘨𝘳𝘢𝘯𝘵𝘴. 𝘌𝘢𝘤𝘩 𝘰𝘯𝘦 𝘢𝘥𝘥𝘴 𝘵𝘰 𝘴𝘢𝘭𝘦𝘴, 𝘰𝘶𝘵𝘱𝘶𝘵 𝘢𝘯𝘥 𝘎𝘋𝘗."

Sputter, cough, gag - Wut? DEMONSTRABLY FALSE STATEMENT - just scratch a TINY bit below the Lie. Maybe search "Are immigrants legal and/or illegal a net plus or minus to our Economy?" The answer is stunning, but not surprising if your not trying to plug The Narrative constantly (looking at you, Little Bill.) Alright, I guess since government "spending" is now counted as part of GDP, and welfare/free healthcare/free education/free food stamps/free rental assistance/free daycare/free re-fillable CASH CARDS/free O'hammed phones ARE part of government "spending", you might be able to only tell HALF A LIE and say that "immigrants" are a net plus to GDP. But you'd still be a disingenuous liar to do so.

"𝘛𝘳𝘶𝘮𝘱 𝘯𝘰𝘸 𝘰𝘱𝘦𝘯𝘭𝘺 𝘥𝘪𝘴𝘤𝘶𝘴𝘴𝘦𝘴 𝘩𝘰𝘸 𝘩𝘦 𝘸𝘪𝘭𝘭 𝘢𝘱𝘱𝘰𝘪𝘯𝘵 𝘮𝘰𝘳𝘦 𝘰𝘧 𝘩𝘪𝘴 𝘱𝘰𝘭𝘪𝘵𝘪𝘤𝘢𝘭 𝘺𝘦𝘴 𝘮𝘰𝘯𝘬𝘦𝘺𝘴..."

Hmmmm. I can only call 'em like I see 'em, and based off of 5 years of Economic History with our ship being Captained by President Donald J. Trump, I say open the cage doors and let those monkeys get to work. The result will be free bananas all around, with a side of Freedom. Also note - thank GOD the Hyenas and Jackasses are being corralled and are no longer calling the shots. Based on 𝙩𝙝𝙚𝙞𝙧 past performance they should probably be shipped to the Glue Factory. Surely we can all agree on that, eh libtardes?

"𝘜𝘚 𝘧𝘦𝘥𝘦𝘳𝘢𝘭 𝘱𝘰𝘭𝘪𝘤𝘪𝘦𝘴 𝘢𝘳𝘦 𝘭𝘦𝘴𝘴 𝘣𝘢𝘳𝘰𝘲𝘶𝘦 𝘣𝘶𝘵 𝘯𝘰 𝘭𝘦𝘴𝘴 𝘴𝘵𝘪𝘧𝘭𝘪𝘯𝘨. 𝘛𝘩𝘦𝘺 𝘰𝘧𝘵𝘦𝘯 𝘱𝘳𝘦𝘷𝘦𝘯𝘵 𝘢𝘤𝘵𝘪𝘰𝘯...𝘰𝘳 𝘴𝘪𝘮𝘱𝘭𝘺 𝘮𝘢𝘬𝘦 𝘪𝘵 𝘮𝘰𝘳𝘦 𝘥𝘪𝘧𝘧𝘪𝘤𝘶𝘭𝘵 𝘢𝘯𝘥 𝘦𝘹𝘱𝘦𝘯𝘴𝘪𝘷𝘦. 𝘛𝘺𝘱𝘪𝘤𝘢𝘭𝘭𝘺, 𝘦𝘤𝘰𝘯𝘰𝘮𝘪𝘤 𝘱𝘳𝘰𝘨𝘳𝘦𝘴𝘴 𝘴𝘭𝘰𝘸𝘴."

Ya don't say. How interesting and duh. Tell me again WHICH PRESIDENT has enacted REGULATION-CUTTING Executive Orders in BOTH HIS TERMS (2-for-1 in first term, 𝟭𝟬-𝗳𝗼𝗿-𝟭 in second term)? 𝗛𝗼𝘄 𝗱𝗼𝗲𝘀 𝘁𝗵𝗲 "𝗶𝗻𝘀𝗮𝗻𝗲" 𝗿𝘂𝗹𝗲 𝘁𝗵𝗮𝘁 𝟭𝟬 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗼𝗻𝘀 𝗺𝘂𝘀𝘁 𝗴𝗲𝘁 𝗖𝗨𝗧 𝘁𝗼 𝗲𝗻𝗮𝗰𝘁 𝗢𝗡𝗘 𝗻𝗲𝘄 𝗼𝗻𝗲 𝘀𝗼𝘂𝗻𝗱 𝘁𝗼 𝘆𝗼𝘂, 𝗟𝗶𝘁𝘁𝗹𝗲 𝗕𝗶𝗹𝗹? Wait, it's Trump that has done this to great success - so no surprise you ignore him completely while you bitch about the Burden of Government Regulation. Your severe TDS is laughably obvious to anyone with a brain.

For the slower readers out there (Hi, Ed and Pat!)

This term:

https://www.whitehouse.gov/fact-sheets/2025/01/fact-sheet-president-donald-j-trump-launches-massive-10-to-1-deregulation-initiative/

First term:

https://www.agencyiq.com/blog/trump-reintroduces-revamped-deregulatory-executive-order-one-in-10-out-and-a-bigger-role-for-the-unified-agenda/

Try to be a little more transparent tomorrow. It is entertaining to see how many morons gleefully support the most atrocious of the BS you put on your stack....

PS - On the "Honey" side - other than the above, great article. Right on target, um, except for the stuff I pointed out in this post....