Memorial Day special to Veterans and Seniors

Save 25% off your subscription

Offer good until Monday, May 26th, 2025

Sunday, May 18th, 2025

Laramie, Wyoming

By Dan Denning

Greetings from sunny Laramie this Sunday. After I published my research note on Friday afternoon, Moody’s became the third and final ratings agency to downgrade US government debt (from AAA to Aa1). Fitch downgraded the US in August of 2023. Standard & Poor’s was way ahead of the game, having downgraded US debt in August of 2011. Why now?

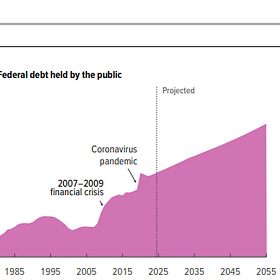

The agency said that, ‘We do not believe that material multi-year reductions in deficits will result from current fiscal proposals under consideration.’ Those proposals include a Republican bill in the US House of Representatives that would add between $4 trillion and $6 trillion to the national debt over the next ten years (and once again raise the debt ceiling, with any spending cuts taking place…in the future).

Gold prices and interest rates on US government bonds rose after the close on Friday. We’ll be keeping an eye on that over the coming week. One interesting fact: Microsoft [MSFT] and Johnson & Johnson [JNJ] are the only companies in the S&P 500 to enjoy an AAA credit rating. To show you how perceptions of credit risk have changed, a Microsoft bond maturing in 2037 currently yields 4.10%, while a 30-year US government bond maturing in 2035 yields 4.25%. Advantage, Microsoft.

Other interesting facts:

China’s holdings of US Treasury bonds dropped almost $20 billion between February and March. That’s a drop in the bucket. But as the chart at the top of today’s letter shows, China has dropped below the UK and is now the third-largest holder of US debt.

Selling some of its $1 trillion worth of bonds is a ‘card on the table’ in trade talks with the United States, said Japanese Finance Minister Katsunobo Kato two weeks. He has since walked back the comments. But the comment raised concerns about US dependence on foreign lenders to finance $1 trillion annual budget deficits.

Interest payments on the current national debt of $36 trillion are 18% of total Federal revenues, according to the latest Monthly Statement of the US Treasury. Were it not for a record monthly take in personal income taxes, the year-to-date deficit of $1 trillion would be even larger (and is on the way to $2 trillion).

Worries about a US fiscal ‘doom loop’ reduce demand for the US dollar. That reduces demand for US stocks AND pushes interest rates up. Not a good scenario.

We’ll see what happens this week in Congress to change the budget math. Probably not much. It should also be said that Moody’s is traditionally late to the party in warning of impending credit risks. The gold price has been warning of US default risk for all of 2025.

It finally feels like summer. But the fiscal winter isn’t coming. It’s here. More on all this in the coming week.

Until then,

Dan

P.S. New paying subscribers should be sure to check out Investment Director Tom Dyson’s weekly market note from Wednesday. Tom published a list of all the closed recommendations and trades since 2022. You can find it here.

Fiscal winter is here. Fiscal summer, fall and spring are on the way.

Why are governments always fiscally under-water?

Maybe the government should just stop fiscal policies altogether. They are clearly incapable of planning, controlling and organizing anything. Are there any governments that control money successfully?

If the claim in the graph is correct the strong downward trend in chinese TB holdings could well be offset largely by moving them to strawmen-accounts in LUX and Belgium.

Interesting that Crypto majors have a good run right now. Just on the Moody News it appears.