All Aboard

Tariffs are essentially a sales tax. And a sales tax — averaging maybe 15% — is going to reduce consumer purchasing power…and cut into sales and profits. That is, it will be downer.

Friday, September 5th, 2025

Bill Bonner, from Paris, France

The train keeps rumbling and trundling down the tracks.

Out the window, the most exciting financial trend we’ve seen so far this year? Al Jazeera:

The gold market is booming as investors seek a safe haven for their investments amid global economic uncertainty. The price of gold has risen by nearly a third over the past year, surpassing $3,550 per ounce on Wednesday to hit an all-time high.

And the biggest worry? Bloomberg:

Global Bond Selloff Deepens with Longer Debt Leading Losses

What are these news stories telling us? We don’t know for sure, but we think this train is headed for a place that begins with an ‘s.’

“The real problem is the money…the dollar,” we explained to French friends last night.

“When the Nixon administration switched to a pure-paper currency, it falsified our money and skewed everything. Foreigners were able to make things cheaper…partly because they are just lower-cost competitors…but also because the US was pumping up labor rates, along with everything else.”

Today, the ‘labor cost’ part of making a product in China, for example, is only about 1/5th of what it is in the US. In Vietnam, it’s only 1/16th as much as the US.

This labor cost gap widened after the phony dollar was put into service. As the fountainhead of worldwide money-printing, US manufacturing costs increased faster than those of other countries — making the US less and less attractive as a place to make things. That’s why so many things are no longer ‘Made in America.’

“It had nothing to do with the lack of tariffs…or with foreigners taking advantage of us,” we continued. “Last year, trillions in trade changed hands, at low tariff taxes…with less than 1% average difference between what we had to pay in tariffs and what others paid us.

“Tariffs were never the problem. And raising them now won’t solve anything. It will just raise costs by creating new barriers to trade.”

That little discourse seemed to do the trick. Our friends changed the subject.

We’d like to change the subject too. But our subject is money. And the new tariff regime is going to ‘play Hell’ with it.

Tariffs are essentially a sales tax. And a sales tax — averaging maybe 15% — is going to reduce consumer purchasing power…and cut into sales and profits. That is, it will be downer.

Fewer goods and services will trade hands. GDP growth will slow. Sales and profits will fall. A real slowdown, in other words.

And look, we strain our eyes…we can now make out the first four letters of the sign ahead — s, t, a, and g….

The tariffs may be struck down next month, along with many other features of the Big Man’s rule. Not knowing what comes next also contributes to a slowdown. No one wants to make a major financial decision while so many balls are up in the air. They might come down on our heads.

Rising bond yields (falling prices for bonds) tell much the same story. It will be more expensive to borrow money tomorrow than it was yesterday. Projects that might have made sense in May or June are looking less attractive in September. Because the cost of finance has gone up.

But of course…there’s always more to the story, isn’t there? And the more to this story is on the signpost ahead -- f, l, a, t, i, o, n. That’s the part the gold market is probably talking about.

Tariffs will drive up prices. So will uncertainty itself. Producers will be reluctant to ramp up output. They will want to see sustained price increases before they make further investments. Supplies will go down; prices will go up. And the job market will soften.

A report out yesterday told us that the feds are about to announce a big revision in the unemployment numbers – in which almost a million jobs will disappear.

And then, the Fed, whose job is to make sure we have full employment, will have to lower interest rates…and ‘print’ more money.

Next stop. Stagflation.

Regards,

Bill Bonner

Research Note, by Dan Denning

With official unemployment at 4.3% and just 22,000 new jobs in August (where 75,000 were expected), the weak labor market now sets the stage for a Fed rate cut later this month. Stock futures reversed their decline on the weak jobs data. But so did gold and silver. Why?

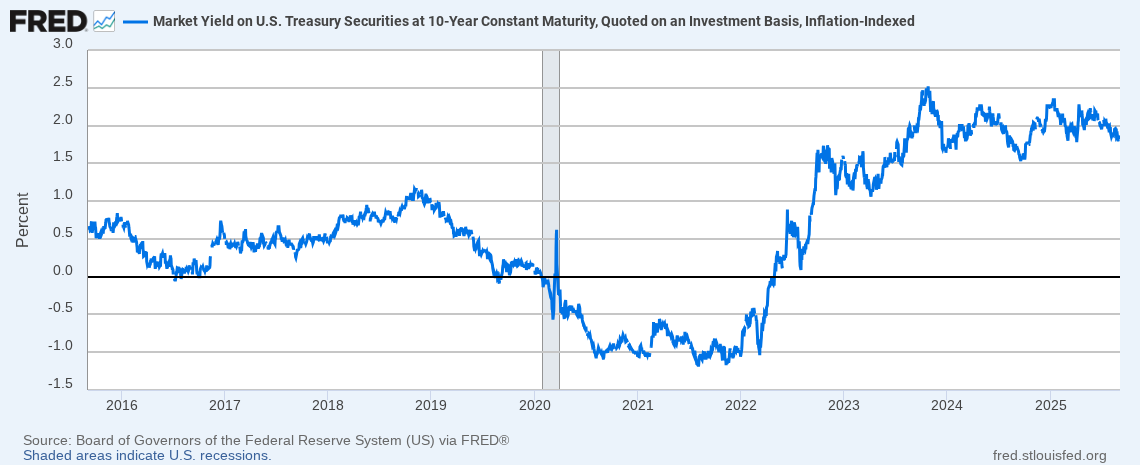

Real yields will decline in a stagflationary economy. The ‘real yield’ on a government bond is the nominal yield minus the ‘breakeven’ inflation rate (the market’s expectation for inflation over the next ten years). The Fed calls this the ‘Fisher equation.’ And right now it means real yields are falling while growth and employment are weak.

Declining real yields are historically bullish for gold (although gold also showed strength the last time real yields rose, as well). As a safe haven asset, the cost of owning gold (storage) is lower on a relative basis when real yields fall. And beyond cost, more and more investors see gold as a better store of value during stagflation than government bonds OR stocks. Buckle up.

Should tariffs drive up prices, and in the long term such is likely unavoidable, although not in a consistent, across-the-board way, then, in response to tariffs (tax), prices may go up, but rising prices by themselves are not inflation. We have become accustomed to the idea that increasing prices are, in and of themselves, inflation, because price increases so often accompany money creation, the cause of inflation. Inflation is an increase in the money supply larger than the value of the production value in the economy. Therefore, it is, as Milton Friedman said, always and everywhere a monetary phenomenon. Prices may increase, and no one likes to see it. Taxes are never a positive for anyone but government, but taxes are not inflationary. Money printing is inflationary, and over the last 50+ years, we've printed $37 trillion dollars more than we have produced. Are you surprised prices have risen? As my high school math teacher said, "Gentlemen, your equations must balance." Best always. PM

I think Bill needs to widen his gaze a bit and not blind himself by staring at Trump so much. Yes, tariffs are a sales tax. But guess what? Most European countries have a VAT (sales) tax of about that same amount. What if (taking the opposite view from Bill, the most charitable to Trump), Trump is trying to compensate for a horribly irresponsible Congress that refuses to balance the budget? The president cannot unilaterally raise taxes to raise revenue to try to fill the deficit gap, *except* when you do some mental and legal gymnastics and utilize some arcane old laws, and then you can affect tariff rates. I am sympathetic to Bessents' claim that the reserve currency status of the dollar is both a privelege *and* a problem, in that it gradually exports America's wealth overseas. I am also sympathetic to Trumps argument that every time something goes wrong in the world, the world expects the US to "do something", whether it's wars or disasters, and maybe they should pay something for that aid or protection.

I find "Big Man Bad" to be just as tedious as "Orange Man Bad".