A Broken System

Sunday, August 4, 2024

Laramie, Wyoming

By Dan Denning

The stock market is catching up with economic reality. For months, our Doom Index has been telling us–based on the movement of goods, energy, and people in the real economy–that the US economy was already in moderate contraction.

A rash of economic data last week–from employment to manufacturing, confirmed that. And as Tom Dyson mentioned last November, another reliable indicator of recession (the Sahm Rule) flashed red on Friday.

What now?

As Tom mentioned in the Market Briefing we recorded on Tuesday of last week (before the sell-off began in earnest), patience is the key. Drawdowns in the market are a way of life. Our long-term goal is to avoid ‘The Big Loss’ and THEN deploy our cash into good businesses that can be had at much lower prices.

We think prices will go lower still. The Dow/Gold ratio tells us we have a long way to go before stocks, as an asset class, are a buy. But we can use that time wisely, to better understand why our financial system is broken. And more importantly, how to become financially independent no matter what happens next.

Today, to aid that process, I’m republishing, with permission, an excerpt of a chapter in a book published by BPR’s long-time friend Joe Withrow. Joe’s name will be familiar to you if you’re a former reader of The Bill Bonner Letter a few years ago. He’s been one of our go-to researchers when we’re analyzing complex macroeconomic and financial data.

Joe, in fact, was instrumental in revising and building our second Doom Index. We spoke with him at length about what we wanted–a leading indicator for the stock market based on real (not fake, or government) data from the real economy, based on actual decisions people and businesses are making with money. Joe obliged and designed Doom 2.0, which we now update in each Monthly Strategy Report.

Joe’s been on the case for years, brain deep in the data about our system and what Americans can do about it . Last August he published his conclusions in a book called Beyond the Nest Egg: How to be Financially Independent of a Broken System. Joe’s book goes beyond investing and looks at other ways and means to protect your money and grow your family wealth in the years ahead.

Please keep in mind some of the data have changed since Joe’s book was published. But we asked him to send BPR readers a chapter from his book that would be most helpful now, for understanding what he sees ahead. That’s what you’ll find below. There are other chapters in the book on real estate and taxes that are well worth a look (and beyond the normal scope of BPR).

Enjoy your Sunday and this free chapter from Joe’s book. We’ll be back tomorrow with normal service from a very abnormal world.

Until then,

Dan Denning

[The following is an excerpt from Beyond the Nest Egg: How to be Financially Independent Outside a Broken System, by Joe Withrow. It’s reproduced here for Bonner Private Research Readers with Joe’s permission.]

Chapter Seven: The Challenge We Face

People who are in or approaching retirement today face immense challenges that those who retired in the years before them did not. Why?

Simply put, we’ve been living in a bubble world since the 1980s, but the bubble popped in 2022.

I think most of us know this to be true. We can feel it. But this next chart tells the story quite well.

Here we can see the S&P 500 and the 10-year Treasury rate going back to 1980. The S&P 500 is the black line. And the 10-year Treasury rate is the blue line.

We’re using the S&P 500 as a proxy for US stock prices. And we’re using the 10-year Treasury as a proxy for interest rates. This chart makes it perfectly clear that the two are inversely correlated.

Interest rates started falling in 1982, and they fell consistently for the next 40 years. Meanwhile, US stocks consistently went up in value over that same time period.

But everything was reversed in 2022. Rates started going up, and stock prices started to fall. We can see those moves clearly marked by the red arrows on the chart above.

When we zoom out like this, it’s no surprise that stocks fell hard when rates started to rise in 2022. But it sure caught a lot of people by surprise.

In fact, many financial analysts spent over 12 months trying to convince themselves and their clients that these moves were temporary. Just wait for the Fed to pivot, they said. Then we’ll get back to normal.

But here’s the thing—what happened from 1982 to 2022 was not normal. Nor was it organic.

Instead, it was all driven by the debasement of our money. The US government and the Federal Reserve (the Fed) worked hand-in-hand to create over $8 trillion dollars from thin air during this time period.

We can see this very clearly simply by looking at what happened to the Fed’s balance sheet.

Here we can see that the Fed’s balance sheet grew by over $8 trillion from 2002 to 2022.

The key here is that when we see this line going up, that’s the Fed creating new dollars from thin air. The Fed used those new dollars to buy financial assets—US Treasury bonds and mortgage-backed securities. That’s why its balance sheet ballooned.

These new dollars are what drove interest rates down to nearly zero. They are also what bid US stock prices up tremendously. Essentially, the funny money decoupled interest rates and stock prices from the underlying economy.

In other words, these trillions of dollars created from nothing “financialized” everything. They turned the stock market into a giant casino. Except the game was rigged such that stock prices only went up over time.

Thus, this time period—1982 to 2022—will go down in history as The Age of Paper Wealth. It was a time when people truly believed that printing money could create prosperity.

Of course, it was all an illusion.

The problem is, nobody born after 1960 has known anything else in their adult life. All we’ve ever known is falling interest rates and rising stock prices. Our approach to personal finance reflects this.

Everybody has been encouraged to plan for retirement by pouring their savings into financial assets—stocks and various kinds of funds.

That approach made some sense in a world where rates only go down and stocks only go up. But if we’ve left that world—if the Age of Paper Wealth has ended—does it still make sense to manage our finances this way?

I don’t think so. It’s time to rethink personal finance 101.

And that brings us to our second major challenge…

The term “inflation” is thrown around quite a bit today. If you ask somebody what it means, they will tell you rising prices. But if you ask them what causes inflation, most people can’t give you a meaningful answer. So let’s demystify inflation for a minute.

First of all, I am sympathetic to the definition put forth by the Austrian School of Economics. Inflation is the expansion of the money supply. It is the act of creating new money and injecting it into the economy.

If we speak from a dollar-centric point of view, inflation occurs when the Fed and the US Treasury pump new dollars into the system. These dollars then have to go somewhere. Wherever they go, we are likely to see rising prices follow.

From this perspective, rising prices are the result of inflation. They are not inflation itself. And prices do not rise in a uniform manner.

Let’s zoom in on two situations to illustrate this concept.

First, we’ll look at the 2008 financial crisis. Then we’ll look at the COVID-19 event.

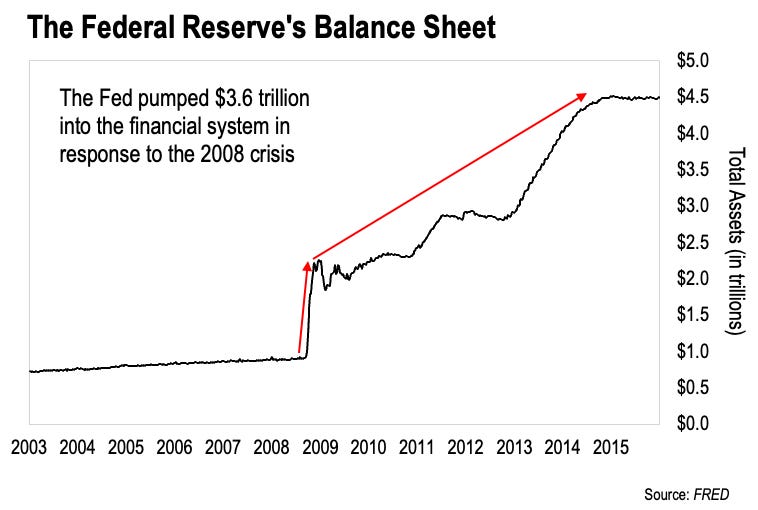

The Fed pumped over $3.6 trillion into the financial system in response to the 2008 financial crisis. Again we’re talking about new dollars created from nothing.

Here’s the chart:

This is a chart of the assets on the Fed’s balance sheet. These consist mostly of US Treasury bonds, though the Fed bought a bunch of mortgage-backed securities in the wake of the 2008 crisis as well.

Remember, when the line goes up, that’s the Fed creating new money from nothing, to buy assets.

Let’s use August 2008 as our starting point here. At that time the Fed held $898 billion in assets on its balance sheet. Fast forward to January 2015, and that number hit $4.5 trillion.

So, the Fed created roughly $3.6 trillion from thin air to buy US Treasuries and mortgage-backed securities in response to the 2008 crisis. When those transactions settled, the new money was injected into the system.

This was absolutely considered an extreme response. The Fed had never initiated such aggressive asset purchase programs before.

However, we didn’t see prices for consumer goods rise tremendously in response to the Fed’s actions. Instead, most of the inflation flowed into the stock market. This set off an epic boom that lasted over a decade.

From the Fed’s perspective, this was a fantastic result. Nobody ever complains about their stock portfolio going up.

And the Fed even made an effort to gradually taper its balance sheet after the dust settled. It gradually reduced its assets from $4.5 trillion in 2015 to $4.1 trillion by 2020.

Then came the COVID-19 event. And the Fed followed the exact same “crisis response” game plan.

Here’s the chart:

As we can see, the Fed pumped roughly $4.8 trillion into the financial system in response to COVID-19. This expanded its balance sheet from about $4.1 trillion in February 2020 to nearly $9 trillion by February 2022.

What’s more, the US Treasury directly injected more than $5 trillion into the economy via various COVID-19 “stimulus” plans as well. That’s in addition to the money that the Fed pumped into the financial system.

Perhaps it’s no surprise then that the results were dramatically different this time.

Now, the Fed’s chosen metric to measure inflation is the Consumer Price Index (CPI). And in January 2022 the CPI hit its highest level in 40 years. This seemed to shock mainstream financial pundits.

And here’s the thing—the CPI is a lowball number. It understates how fast consumer prices are rising.

That’s because the CPI employs a replacement cost model. When the price of a particular good rises too much, the model takes it out and swaps in a comparable lower-cost good. This assumes that consumers will adjust to rising prices by changing their spending habits.

For example, if the price of steak goes up too much, the CPI may swap it out for ground beef. The idea is that consumers will buy more ground beef and less steak in this scenario.

But that doesn’t change the fact that steak prices went up. The CPI ignores this by dropping it from the model. And that’s the whole point. The CPI always understates inflation.

That’s why assets with inflation protection mechanisms tied to the CPI such as Treasury Inflation-Protected Securities (TIPS) just aren’t adequate. It’s also why Social Security’s cost of living adjustment never seems to keep up with costs of living.

The key point here is that consumer price inflation is baked into the cake for as long as the Fed and the Treasury can create dollars from nothing.

This virtually guarantees that national “retirement” plans like Social Security are doomed. These plans will continue to send out checks to people for years to come, but thanks to inflation those checks just won’t buy much. Any financial strategy that doesn’t account for these challenges is also doomed.

The good news is that there’s a solution to these financial pitfalls. In fact, financial independence is more achievable today than ever before. It just requires a deeper understanding of the financial system. This is something that we won’t find in any textbook.

To me, the answer starts with asset allocation—as we have already discussed. But that’s just the starting point.

Asset allocation provides us with a fundamental “base” of operations. But to become financially independent we must use that base as a jump-off point. We must create a comprehensive wealth strategy focused on building multiple streams of income. This includes utilizing complex legal entities and arcane sections of the tax code.

What we’re talking about here is drastically different from the traditional financial plan.

Here’s a final note from Joe:

Thanks for reading. I hope you enjoyed this excerpt from my book. There is a lot more where that came from in the entire book, which you can buy on Amazon.

Also, if you’re interested in learning more about what I’m saying now. I’m hosting an event on Friday, August 9th at 3:00 pm Eastern for a small group of readers. We’re going to talk about why the conventional retirement planning model won’t work well going forward… and then we’ll discuss an alternative investment approach geared for today’s economic climate.

This may not be for you. And if so, that’s fine. I hope you found the free chapter from my book useful. But if you are interested, a few details. First, there's no cost to join the summit. And as a bonus, we'll send all attendees free guides that will help you implement the solutions we'll discuss at the event. Something you can print out and read at your leisure later.

BRILLAINT article, Dan, as usual. NOTE: The link isn't working.

I believe the Doom index has far higher integrity than any Bureau of Lying Statistics CPI numbers and job creation numbers. That is why there are so many other statistical analyses of inflation out there i.e. there are plenty of people who don't believe their numbers any more than people believe that lawfair is just or that jobs are being created in this robust economy. Or that a country and its people can grow richer by printing money that was never earned and saved.

Given that these political "leaders" spending money we haven't earned and saved to an extent never seen before with debt then at levels never seen before while the economy grows more and more slowly as the debt grows one should question their reasoning for building debt to be paid by our children. It also seems a bit ridiculous to be at war with a nation that has tremendous natural resources we could put to use, especially a losing war amongst the many losing wars. Brought to you by the same people bringing wokism, covid, calling you deplorable, cutting off young children body parts and giving your kids hormone shots that destroy their sexuality while you are kept in the dark, and now we have to watch men boxing women because the men want to call themselves women. Do these "leaders" have to show up at your house and shoot everyone in your family before one questions their motivations?

Dan—week after week I appreciate your well reasoned articles. I realized today that readers might also like to know that our system is not the only broken system. Other than mentioning Japans

plight, most Western countries and many Eastern countries are coping with system brakes that do not get covered

by the big 3 (Bill Tom Dan). My point is that this is not an American phenom. We

are not alone in the morass. Every where I look, governments are dysfunctional. JF