Your loyalty and your submission

We interrupt our romp through the funny money world...exploring the link between crooked money and crooked behavior...to give thanks for the whole funny money system.

Wednesday, November 26th, 2025

Bill Bonner, from Baltimore, Maryland

It’s Thanksgiving week. And in the spirit of our fake money era, we give fake gratitude. Comes this gem from USA Today:

Trump proposes 50-year mortgage.

Bless his heart. POTUS is trying to be helpful. He’s trying to solve the problem caused by too much credit...with more credit!

Housing has never been so un-affordable. The average family income is around $80,000. But the income needed to buy an average house is around $120,000.

What are America’s families to do? Drink muddy water and sleep in hollow logs?

The cause of this problem is not hard to find. The Fed caused the first mortgage finance crisis by dropping its key rate from 6% in 2001 to only 1% in 2003. This set the housing market a-tingling. Remember the ‘lo-doc’ mortgage loans? All it took to get a mortgage — guaranteed by the feds — was an application. Then, when the Fed tried to bring rates back into a normal zone, it triggered widespread bankruptcies, defaults and foreclosures.

So, the Fed cut rates again...from over 5% in 2007 to under 1% in 2009. Adjusted for inflation, rates remained under zero for most of the next fifteen years. This led to a huge new bid for housing...much of it coming from institutional buyers able to tap into the Fed’s low rates. The new demand led to the highest prices ever — now averaging about $100,000 more than the typical family can afford.

As to Trump’s solution, Charlie Bilello comments:

So the very cause of the problem is being proposed as the solution?

Correct. And on top of that, a 50-year mortgage would more than double the amount of interest paid compared to a 30-year. And only 5% of payments in the first 10 years would go towards principal with 95% going towards interest. Doesn’t sound like a panacea to me.

You can check the math easily. Just go to one of the many ‘mortgage calculators’ on the internet. They’ll show you that an average house today costs $420,000...and an average 30-year mortgage rate is 6.24%. You would have to make total interest payments of $407,000 before you were mortgage-free. Raise the term to 50 years and the interest rate goes to 6.72%, with total interest payments of $837,000...and you never own the house.

Thank you, Mr. President?

Today, we’ve interrupted our romp through the funny money world...exploring the link between crooked money and crooked behavior...to give thanks for the whole funny money system.

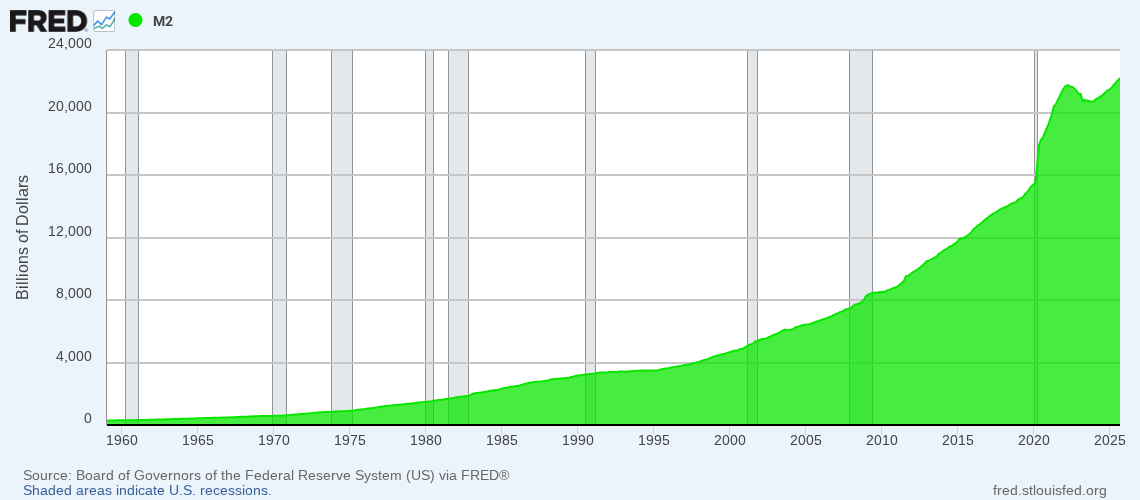

Also in the news, the money supply (M2) in the US just hit a new record high, at $22 trillion. That’s up from just $650 billion in 1971, when the Funny Money Era began. In that year, GDP was around $1.2 trillion; it’s now $28 trillion. In other words, the money supply has grown about half-again-as-much as the supply of goods and services.

And public and private debt — the dark side of credit — has gone up even more...from 125% of GDP in 1971, it is now around 260% of GDP. In other words, for every dollar’s worth of GDP in 1971 (before the Funny Money Era began) there was $1.25 of debt. Today, there is $2.60. That’s an additional 135% of GDP — or $38 trillion worth of spending that is untraceable to any increase in output. Naturally prices have gone up to absorb the additional liquidity.

But we’re not here to kvetch. Not today. We’re here to give thanks. And our gratitude overfloweth. Fortune:

Trump promises to send $2,000 tariff dividend checks ‘probably the middle of next year...

In ancient Rome the ‘annona’ was a system of giving out free grain to buy the loyalty — or least the submission — of the urban proletariat. In Argentina, Eva Peron handed out Christmas presents to poor children. And now in 21st century America, there’s a turkey on every table and a $2,000 ‘dividend’ check in the mail.

Calling it a dividend is in keeping with the whole fraudulent project. ‘Dividends’ come from earnings. But there are no earnings involved. Just the tariff revenue...which is more like a sales tax on Americans than a levy on foreign producers. At best, you might call it a tax rebate. But the tariff tax is only expected to bring in about half the cost of the ‘dividend’ checks...which means, the bulk of the expense will be borrowed...added to the national debt...and will ultimately show up in more inflation.

This is the same policy followed by Mr. Trump in his first time at bat. And what a success that was! A home run.

His Covid-era stimmies added as much as $3 trillion to US debt...and drove up the inflation rate to 9% — the highest in forty years. Then, of course, prices never went back down and now are about 25% higher than they were in 2020.

Muchas gracias. Merci beaucoup.

Thanks a lot.

Regards,

Bill Bonner

My advice to readers is to read the book "The Housing Boom and Bust" by Dr. Thomas Sowell. There you will see a full explanation for the housing crisis that preceded the 2008 mortgage crisis. Full disclosure - the interest rate was somewhat peripheral, and a reaction - rightly or wrongly - to the actual problem. You'll also be able to more easily see the relationship between the Swamp and Wall Street banks which continues, virtually unabated.

Note especially the fact that whether contemplating "50 year mortgages" (which Bill and I would both agree as wholly inappropriate), we continue to hear crickets when inquiring whether WS Banks should be constrained to reasonable limits on owning (monopolizing?) housing stock.

Surely, the road to a feudal perdition lies in allowing a "landed gentry" of banks to emerge and strengthen even as we create a permanent class of renters as modern day Serfs. As those of us who still have an appreciation of history would observe - that won't end well.

An addenda post: I used to own a residential and commercial construction company when I was younger. I also have a background as a Process Plant design engineer as well as an industrial Project Controls, capital budget estimator. I spent the bulk of my career either designing, building or estimating capital budgets for Oil & Gas, Chemical, Power and/or Biopharmaceutical plants.

My observation from my earlier home construction days was of a typical capitalist driven (read messy but self-correcting) system which saw many bankruptcies of builders as housing prices collapsed when housing stock became too expensive for the market to support. Interestingly, some of the most skilled and insightful builders were veterans of multiple bankruptcies. You would lose your current investment, but no one could eradicate your technical skills. One could simply reincorporate - often under the guise of other family members. As I said, it was messy.

Additionally, there were housing cycles to contend with, and few builders would anticipate the timing of these cycles in a manner that avoided the collapse while retaining past profits. I exited this business once I fully realized that low interest rates-built homes while the inevitable, reciprocal high interest rates, built industrial facilities with corporate Bond sales. A Kiplinger Letter of the late 1980's had exposed me to a study that had established that "when fewer than 5% of those making an average income could afford to buy an average priced home, the housing market would go into recession". A key insight.

Makes me now wonder what sort of corrective action could occur when banks own and control the housing stock and the lending mechanism that drives both housing stock growth and affordability - all while also issuing credit cards to their Serfs... err... I mean renters.

The ways of capitalism aren't as easy and appealing as the superficial sirens song of statism but, unlike the dead and manipulative yet constantly erring hand of statism as corporatism (see China's own housing mess today) - honest money capitalism is, at least, self-renewing.