War of Fog

What we learned in America’s great experiment with Prohibition is that you can make something illegal, but you can’t make it unattractive. Prohibition raises price margins and brings forth more supply

Friday, December 5th, 2025

Bill Bonner, from Baltimore, Maryland

‘Where were you when they were murdering those guys?’

Will our grandchildren ask? What will we say...that we voted for Kamala? That we didn’t vote at all? Or, like the billboard we saw on the Garden State Freeway, ‘We didn’t vote for this!’

As a society twists and turns...persuaded by false money...it tends to bend in a predictable, but sinister, direction. Democracy trends towards the Big Man...and the Big Man tends to go for violence.

But wait. Here’s the latest from the Washington Post:

The renamed ‘Donald J Trump Institute of Peace’ hosts first event

President Donald Trump is eager to be recognized as a peacemaker. His administration obliged Wednesday by renaming the building that houses the U.S. Institute of Peace in downtown Washington.

Is Mr. Trump an exception to the rule? Is he a peace president?

Empires are naturally inclined towards violence anyway. That’s how they become empires, by conquering other nations. And that’s why the US has been almost constantly preparing for war...tempting war...or actually in a war ever since WWII. It is the hegemon supreme...reigning over much of the world, a successor-in-interest to the British Empire.

And now, with the whole world watching, the same scoundrels who got us into Afghanistan and Iraq...are aiming for Venezuela and Iran — fogging the facts, as necessary. Elliot Abrams, for example, has his fingerprints on nearly every foreign policy disaster, unnecessary war, and gratuitous massacre of the last half-a-century. Now, he’s pushing for another one, Substack:

Former Reagan, Bush, and Trump administrations official Elliott Abrams, who has been involved in some of America’s worst crimes in South America under the Reagan administration, and regime change attempts in Venezuela under Bush and Trump, recently wrote an article for Foreign Affairs calling for a regime change war in Venezuela.

[He] wrote that Trump should, “eliminate”, “the possibility of more talks with Maduro...Iran plans to transfer missiles to Venezuela...[it] uses Venezuela as a base for Hezbollah activity”.

And here is perhaps the dumbest, and/or the most corrupt member of the senate, Lindsey Graham (who has gotten more than $1 million from the defense industry): ”I very much appreciate and respect the determination by President Trump to deal with the drug caliphate countries that inhabit our backyard - chief among them Venezuela.”

The US has at least ten times as many illegal drug users as Venezuela, per capita. But it’s always someone else’s fault.

And what we learned in America’s great experiment with Prohibition is that you can make something illegal, but you can’t make it unattractive. Prohibition raises price margins and brings forth more supply, not less. But Mr. Trump himself seems determined to get the US into another hot conflict. Associated Press:

Trump says that the US will start doing strikes on land, aimed at drug cartels, soon.

And then this from the New York Times:

Trump Declares Venezuelan Airspace Closed

President Trump said days earlier that the United States could “very soon” expand its campaign of killing people at sea suspected of drug trafficking to attacking Venezuelan territory.

And if Maduro is captured...will he then be pardoned? USA Today:

President Donald Trump pardoned a former Honduran leader sentenced to prison on cocaine distribution charges, a move the White House says doesn’t undermine Trump’s anti-drug campaign that includes military strikes on alleged drug boats near Venezuela.

Remember the Maine…Tonkin Gulf…weapons of mass destruction…Cartel de los Soles—it’s all there.

Delusions, Lies. Fog.

And another phony war paid for with phony money.

Regards,

Bill Bonner

Research Note, by Dan Denning

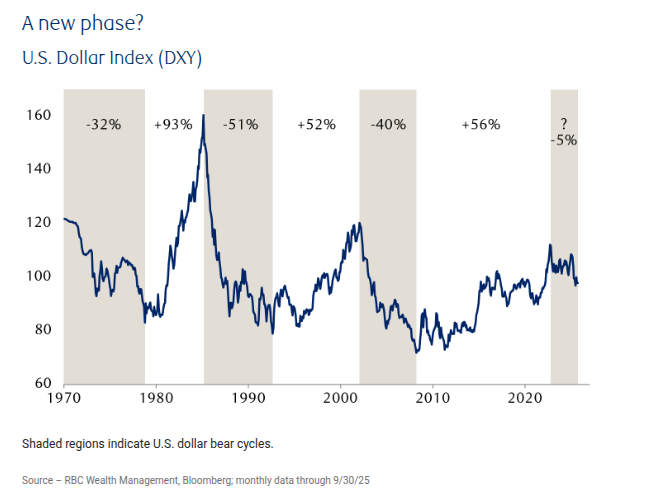

Phony money costs foreign investors in US stocks, too. The S&P 500 rose 6.5% in the first half of 2025. But the 10% fall in the US dollar index (DXY) meant foreign investors who were ‘unhedged’ had negative or flat returns once you adjusted for the falling dollar. A weaker dollar reduces foreign demand for US stocks in the long run.

The DXY moves in seven to ten year cycles, according to a research report published last month by RBC Wealth Management. Average gains are around 65% in the up cycles. Losses are around 40% in the down cycles, according to the research. A DXY down cycle looks to have begun in 2022.

US interest rates, as set by the Federal Reserve, are likely headed lower next week. Meanwhile, interest rates in Japan and Europe are on the rise. For example, the 30-year bond yield in Japan reached an all-time high of 3.44% earlier this week. Japan’s 30-year bond was first introduced in 1999.

Bond yields tend to reflect relative strengths (and weaknesses) in each region. But all things being equal, the widening divergence in interest rates sets the stage for a weaker dollar in 2026 (and higher precious metals and ‘hard asset’ prices). More on this (especially silver) in my note to subscribers later today.