Until Something Breaks

Tanking the bond market... trashing the dollar... and sinking the whole damned ship

Joel Bowman, checking in today from Buenos Aires, Argentina...

“You can’t run a country like this without ruining either the currency or the bond market. And in the end, both.”

That was Bonner Private Research’s cheery macro analyst, Dan Denning, musing from Laramie, WY., where it’s a balmy 6 below and gusty. Assuredly, Dan has the gas tanks full... a few cords piled up in the shed... maybe even a Small Modular reactor buried somewhere underground. (Is there such a thing as being too prepared?)

Market Wrap

We’ll get back to Dan’s words of wisdom in a second. First, a look at the markets...

Yesterday’s hotter than expected Personal Consumption Expenditures (PCE) data put the kibosh on investors’ hopes of an imminent Fed pivot...or even pause. At 5.4%, the much-watched figure came in well above the experts anticipated 5% rate. Core PCE (which excludes “totally unimportant” food and energy) was up 4.7% year-over-year. Experts had reckoned on a 4.3% increase. Hmm…

“So what?” dear readers may be wondering.

“So inflation is not dead,” writes Dan. “Disinflation probably is, though. And now futures markets are rating it a 50% chance that the Fed raises interest rates by 50 basis points when the Open Market Committee meets on March 21st and 22nd. Rates are headed higher.”

And, as we know, higher rates are bad for risk assets - i.e., most stocks...

The Dow Jones Industrial Average swooned like a 50s movie starlet on the news, plummeting more than 500 points in early trading, before recovering to end the session lower “just” 330 points, or 1%. The S&P 500 and the Nasdaq closed down 1% and 1.7% respectively.

The day capped the worst week for the major indices this year. The Dow alone was down 3%, its largest weekly loss since September and its fourth consecutive week in the red. The S&P 500 ended lower 2.7% while the Nasdaq fell 3.3%.

That puts the Dow officially in negative territory for 2023, down almost 1%. The S&P 500 is above water by 3.8% while the Nasdaq is still up a solid 9.7%.

Something Really Bad

Meanwhile, gold was down about 1% for the week. An ounce of the Midas Metal was last seen trading at around $1,810. Oil was off a couple of bucks, meanwhile. A (WTI) barrel of the world’s default energy supply goes for about $76 and change.

It was a rough week in Bitcoinlandia, too, with the crypto world’s lead dog down some 7% for the week. At right on $23k per coin, Bitcoin is now “only” up 38% year to date.

Higher interest rates are taking their toll on real estate markets, too. A couple of headlines from the Wall Street Journal tell a tale of two markets, commercial and retail. First, the big buildings...

Office Landlord Defaults Are Escalating as Lenders Brace for More Distress

And over on Main Street, the picture is hardly any better...

U.S. Home Sales Fall for 12th Straight Month

Sales of previously owned homes dropped 0.7% in January to slowest level since October 2010

Bill Bonner underscored our core position earlier this week: “Our view is that there will be no ‘soft landing.’ Because the Fed can’t stop raising rates ‘until something breaks.’”

Continued Bill...

“It will keep at it...until something really bad happens. Then, and only then, can it ‘come to the rescue’ by ‘pivoting’ to lower rates.”

Hold on tight, fellow passengers. Next stop: Something Really Bad.

All of which brings us full circle, back to Dan’s observations in yesterday’s research note to BPR members. Here’s a key snippet...

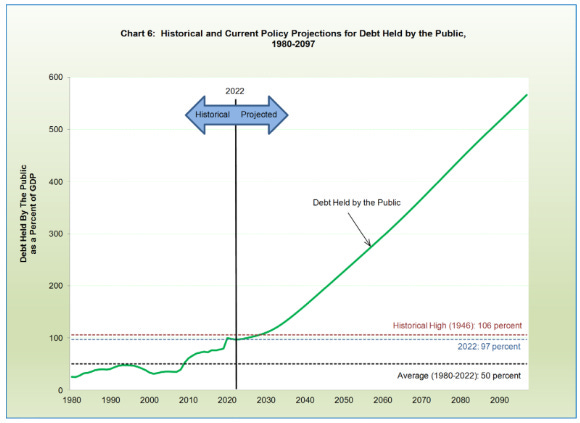

Non-financial corporate debt in the United States hit over $20 trillion last year. It was a $1.7 trillion increase from 2021, or the largest annual increase on record. All that borrowing was done to lock in lower costs while rates were low. Rates are higher now. And headed even higher if today’s PCE data is anything to go on. Paying back all that borrowed money is going to get more expensive. Take a look at the following chart...

This chart is like a landmine. It doesn’t look like much at first glance. But step on it by accident and…boom…it’ll separate your arms and legs from that part between your hears that does the thinking. Let me explain what I mean…

US government debt held by the public–you, me, pension funds, banks, insurance companies, endowments–would rise to 566% by 2097, based on ‘current policy and the report’s assumptions,’ according to the Treasury. Those assumptions include higher interest rates in the coming years and regular annual government deficits, driven by the growing cost of Social Security, Medicare, and Net Interest on the national debt.

Like me, you may be thinking that 74 years is a long time from now. Most of us reading this will be dead by then. It will be somebody else’s problem by then. And even if the present value of those future spending obligations is nearly $76 trillion (according to the report) GDP will be a lot higher too. We’ll be able to afford it, right? And we owe it to ourselves, don’t we? What do you think?

I think $32 trillion in debt is a problem now. It’s not going to take 75 years for a bond market collapse or a dollar crisis. These numbers are exactly what the report describes them as: unsustainable.

We can’t tell you when or how the next stage of this long, slow, national default takes place. But we can tell you inflation will be a key part of it. You can’t run a country like this without ruining either the currency or the bond market. And in the end, both.

Of course, as Bill has been reminding readers lately, the general is not the particular. Just because the ship goes down, in other words, doesn’t mean you need to be on it... much less tied to the mast.

For the past year, Dan Denning and Tom Dyson have been helping Bonner Private Research members navigate the tumultuous markets. By engaging “Maximum Safety Mode” (holding plenty of cash and gold... and staying well clear of bonds) members were able to side-step much of the carnage from 2022. And by taking advantage of special situations Tom identified along the way, they were even able to earn some income and capital gains in the meantime.

As of Wednesday’s research note (which Tom sends to members weekly), there were eight open positions on the Bonner Private Research Official Watchlist, with an average gain of just over 20%.

If the prudent approach seems like a reasonable strategy to you right now, and you’d like to join our private research project, simply choose a membership plan that works for you here...

And now for Bill Bonner’s missives from the past week...

And that’ll do for another Weekend Wrap, dear reader. Tomorrow, we take aim at Central Bank Digital Currencies (CBDCs)… 15-minute cities (aka holding zones)… carbon quotas… and more Orwellian nonsense from your sociopathic elitist overlords…

Join us at the virtual watering hole for all that and more in your regular Sunday Sesh, mañana.

Until then...

Cheers,

Joel Bowman

I've been in maximum safety mode for some time now, paying down debt tied to my assets, and shedding rentals in our local dictatorship aka the City of Philadelphia where it now takes 5 months minimum to evict a tenant for nonpayment. Imagine when the SHTF and folks loose financial access to real needs? My current non paying tenant is still fully employed, the house he ;resides was sold 4 months ago but was promised to the buyer to be without occupants. Yesterday we unloaded the house next-door, the buyer's out of pocket on a $177,000 purchase was $4000, with the City of Philadelphia provided a first time homebuyer grant of $3200 if she remains in the home for 15 years.

Just thinking for $800 down not much skin in the game, who knows maybe Philadelphia will outlaw evictions across the board for all reasons. That would guarantee reelection by the masses.

One of my close friends believes I've missed out on massive gains in RE and the stock market.

My retort, my wallet is full, I have some gold and silver, little debt, guns and butter.

When the time comes will you fault or envy me for. having the best seat on the lifeboat?

I LIVE for this amazing team's daily missives. So perfectly detached, yet deeply involved at the same time. They're trying their best to make sure that we "dear readers" don't drown, if and when the Phitt shits the hand. I am grateful for the Bonner gang's passion and compassion! Glenn