Sunday, August 31st, 2025

Laramie, Wyoming

By Dan Denning

Greetings and good morning. Below you’ll find the transcript of my interview with Rick Rule on ‘critical minerals,’ uranium, and the gold price. You can watch the video as well, if you prefer. Feel free to comment below or ask questions.

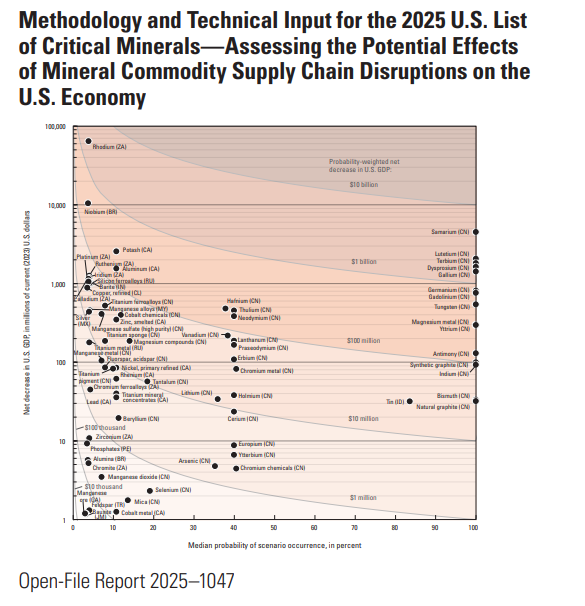

By the way, the chart above is from the USGS report I asked Rick about. It’s information dense but helpful. Why?

It’s what the USGS calls ‘a data-driven risk assessment of mineral commodity supply chain disruptions.’ The graph plots various mineral commodities based on two factors: the probability of a supply chain disruption and the potential economic impact of such a disruption. The minerals are represented as dots on the graph, and their location indicates their overall risk.

The x-axis shows the median probability of a scenario occurrence, in percent. This represents the likelihood of a supply disruption occurring. The y-axis shows the net decrease in U.S. GDP, in millions of current 2025 U.S. dollars. This represents the potential economic damage to the U.S. economy if a disruption were to happen.

I’m not sure you can accurately forecast potential disruptions to critical minerals, or that you can assess their likely economic impact on GDP down the penny. But that’s not really the point of the exercise. The point of the exercise is to identify which minerals/metals/elements are likely to be fast-tracked because of the risk of a supply shut off.

The minerals in the upper-right quadrant of the graph—samarium, lutetium, rhodium— represent the highest risk. That means they have both a high probability of disruption and a high potential economic impact. Those three happen to be essential in the production of American weapons.

It was an ambitious project to reduce 1,200 potential ‘disruption scenarios’ for 84 different critical minerals. For our purposes, it will help determine which deposits and projects are worth investing and speculating on going forward. That’s the important point Rick covers in detail below, including how to go about investing in this theme.

Enjoy!

Dan

P.S. A few readers wrote in about the International Living conference in Dublin in October, having trouble with the link. Try this one. I’ll check with my friends at IL on their end. But everything seems to be working now (for me).

P.P.S. If someone forwarded you this email and you’re not a paying subscriber to Bonner Private Research, you can become one today. Here’s how.

TRANSCRIPT BEGINS NOW, LIGHTLY EDITED FOR CLARITY

Dan Denning: Hello everybody. This is Dan Denning from Bonner Private Research. Welcome to our latest Private Briefing with one of our favorite guests. In fact, he was the first guest on our Private Briefings, and he's on today because I reached out to him earlier in the week and he made himself available to talk about a subject that I think is important to investors, and very interesting, right up his alley. Rick Rule, welcome back to Bonner Private Research.

Rick Rule: Pleasure. Thank you for having me back, and congratulations on the great services that Bonner Private Research is offering to the individual investor community. I'm a huge fan.

Dan Denning: Oh, thank you. I'll pass that on to Bill and Tom. I know they keep up with your very busy schedule and your very high public profile. If you're a new reader or a listener and for some reason you're not already aware of Rick, let me introduce you to him quickly.

He's a longtime friend and collaborator with Bill Bonner. They met back either in the late seventies or early eighties at the New Orleans Investment Show. Bill tells that story fondly. Rick has been a very busy man in the last 30 years. He is currently the founder and president of Rule Investment Media. Some of you may know him as the president and CEO of Sprott US Holdings. He no longer holds that position, but if I'm not mistaken, he's still the largest shareholder in Sprott, and over the years.

Rick is the organizer of what many longtime readers will remember as the Vancouver Conference, which more lately is the Rule Symposium on Natural Resource Investing, which has relocated to the warmer climes of Boca Raton, Florida, where I was able to join him a few years ago.

We have a lot to talk about. If you like what you hear from Rick, there's two places you can hear more from him. Follow him on Twitter at @RealRickRule. He's so famous and popular that he has many impersonators, so make sure you get it. It's then if you want to search for the Rule Symposium on Natural Resource Investing or Rule Investment Media, you'll get more information on some of the things we're going to talk about today. Rick, let me take a breath and ask you, why were you eager or did you agree to come on with such short notice to talk about critical minerals?

Rick Rule: Well, it's a fascinating topic, first of all, politically. It's also a fascinating topic geopolitically, and really it's the second topic that interests me. As an example, the attempt by China to muscle its way into the global supply chain, much the way, by the way, the United States did in the 1950s and '60s, and the way Europe did in the 1970s and the way Japan did in the 1980s, is an important story in natural resources, and there is a lot of impact from that that needs to be discussed among investors and speculators. Understanding the geopolitical interplay and understanding the impact on finance and supply is important.

The second is a sea change, perhaps temporary, in US public opinion around extractive industries. One of the actually critical, as opposed to politically critical, commodities on the planet is the uranium business. I bring it up because it illustrates my second point. Five or six years ago, as a uranium investor and speculator, I was in effect vilified. Public opinion would suggest that I was profiting off Hiroshima, Nagasaki, and Fukushima. Fast-forward six years, and the same political forces that would've vilified me now want to subsidize me. Now, Dan, I need to say, I felt cleaner when I was vilified than I do now that I'm subsidized. But the old man in me, the cost of capital part, says that I would prefer to be subsidized than either persecuted or prosecuted. Your question brought up that feeling.

To emphasize in a non-personal way the importance of this, there is a deposit in Idaho in a company called Perpetua. Idaho for twent years, as a permitting jurisdiction, has been challenging. It's gone from being part of the Old West to being a place where shop is spelled S-H-O-P-P-E, with the change in public opinion around extractive industries, but particularly around critical minerals.

This deposit has as a by-product something called antimony, which most of the political players couldn't have spelled ten years ago. After a 12-year permitting hiatus, when the permitting regulations were rejiggered as a consequence of critical minerals, that permit was forthcoming in eight months, and this is an important political consideration. There was a brownfield uranium project in Utah that in the former permitting regime probably would've taken 12 to 15 years to permit, that got preliminary approval in three weeks, and I think that this is something that resource investors and speculators need to consider.

I need to say one more thing, Dan, before we drill deeper down into this, and that is that the Trump administration, while being partly ideological, is much more transactional. I think that this list will be very fluid. The list of critical minerals that enjoys either subsidy or regulatory relief, and I'm not sure that additions or deletions of the list will have an awful lot to do with the reality of the American economy or global geopolitics, and much more to do with the political process of rewarding one's friends and punishing one's enemies. Don't look at this list and don't look at the regulations around the list or the potential subsidies around the list as being geared primarily economically. My suspicion is that they'll be geared primarily politically.

One more comment. Understand that US participation in critical minerals won't be limited to US soil. There are not sufficient reserves and resources of the materials that are currently politically considered to be germane to the US economy on US soil. So a correct viewing of the topic from the point of view of investors and speculators has to do also with the impact of US actions and the impact of the competition between US and China on reserves and resources and processing capacity in other countries. Sorry for that long-winded introduction, but I read your first question and there were three things that jumped immediately to mind as challenges to answering it.