Trade Under the Big Top

Saying is one thing. Doing is another. A trade deal, procured under duress, is not likely to be more valuable than intel gotten by torture.

BPR is offering free subscribers a chance to access all our paid research—including Investment Director Tom Dyson’s Wednesday Market Notes with updates on all the positions on our Official List—at a special rate until August 31st. You can join today here.

Thursday, August 21st, 2025

Bill Bonner, writing to you from Poitou, France

We struggle to understand how the ‘Great Reset’...or ‘Mar-a-Lago Accord’...is not essentially a scam:

We want a toaster oven. We go to Walmart and buy one, Made in China. We pay with dollars — which are IOUs from the US government. The Chinese central bank ends up with the money.

Relatively few Chinese people buy toaster ovens that were Made in America, however. So, the Chinese central bank ends up with a lot more IOUs from the US than the US central bank, the Fed, has in Chinese yuan.

And since the US can print as many IOUs as it wants...and since the foreigners use them as a financial reserve — almost ‘as good as gold’ — the imbalances get larger and larger, growing recently by $1 trillion per year.

In this manner, foreigners ‘rip us off’ by producing better, cheaper goods...and they ‘take our jobs’ by working for lower wages than we do.

This results in big piles of IOUs (from trade surpluses) overseas...and big empty, rusting factories in the US. Mothers want their sons to grow up to work in finance, not manufacturing. Because, that’s where the money is!

Fund managers and speculators become the richest people in the US...financing universities and politicians...and owning the fine homes that used to be a source of pride for America’s industrialists.

It was a mutually satisfying relationship for many years. Americans got something-for-nothing...paying with paper IOUs — which cost almost nothing to produce — for real goods and services. And then, what could the foreigners do with the dollars? They bought what they wanted from the US. The rest, recycled into US Treasury bonds, financed the US government.

The Germans sold their autos. The French sold their perfumes. And the Chinese were able to sell so much stuff they made the fastest economic progress of any country in history. In a single generation they went from one of the poorest countries on earth to one of its richest...with nearly a billion people lifted from mud-smeared poverty and put onto the comfortable seats of a BYD electric car. They made progress politically too — going from an oppressed people who were allowed only one child...to a free people who wanted only one child.

But the IOUs were not only ubiquitous, they were unreliable. The US government’s official policy was to depreciate its IOUs at the rate of 2% per year. Inflation now is running closer to 3%. Which leaves the real return on a 10-year T-bond at barely more than 1%. Since the turn of the century, officially, US dollars have lost nearly half their value.

Foreign dollar holders are getting edgy...and less eager to buy US Treasury debt. And while the amount of debt can go up without limit, the cost of debt service must come out of the real economy. The interest on the US national debt, for example, went over $1 trillion per year — more than the ‘defense’ budget. US deficits reached Argentine levels...equal to 7% of GDP.

This could not go on for much longer. The cost of debt service was quickly becoming more than the nation could stand. And any attempt to lower interest rates — to make the debt payments lighter — risked setting off inflation.

What could be done?

Enter Stephen Miran and Scott Bessent.

The honest way to deal with the problem is also the obvious way — cut back on spending, buckle down...pay down debts that can be paid, default on others. Most important, renounce the ‘paper’ dollar that distorted the whole world economy. Turn back to gold...or something that would anchor the currency to real world output.

But Miran and Bessent have a trick up their sleeves: Make the foreigners pay.

They realized that foreign countries have become so used to taking America’s IOUs in payment for goods and services, they would suffer a large shock if the dollars stopped coming. So, they go to the foreigners and say:

“Look, if you want to keep doing business with us you need to take those IOUs and re-invest them back in our economy. Oh...and we’ll take 90% of the profits”.

That is, we believe, the state of play. Negotiations are underway...to create a US Sovereign Wealth Fund using the foreigners’ money as the initial capital.

And now we will take some guesses about the future.

China will say ‘no’...or whatever it is that the Chinese say when they mean F-off. “If you want our strategic metals, you’ll stop trying to boss us around,” they’ll add.

The US will back down.

Other nations, however, do not produce strategic metals. They will have little to bargain with. Most will say ‘yes,’ or whatever they say when they mean ‘we have no choice; we’ll go along.’

Team Trump will declare a big win.

But saying is one thing. Doing is another. And a trade deal, procured under duress, is not likely to be more valuable than intel gotten by torture. How much, what, when...how — the details will be subject to endless negotiation and almost infinite corruption. In the end, very little additional money will be invested.

Guided politically, rather than commercially, almost none of it will be profitable.

And the foreigners will look for other trading partners.

Regards,

Bill Bonner

Research Note, by Dan Denning

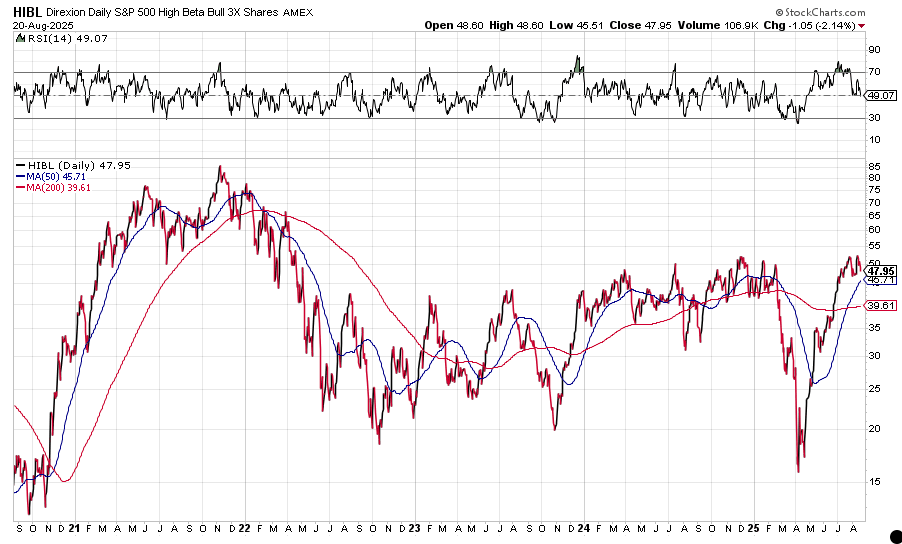

The Nasdaq 100 [NDX] is up 36% from the lows this April. But a leveraged (three times) exchange traded funds based on ‘high beta’ stocks in the S&P 500 is up over 200% in the same time (see above). That’s not as big as the move from late 2020 to late 2021. But the important question is, what’s next?

A report from the MIT Media Lab says 95% of AI investment is unprofitable. Only 5%, at the ‘enterprise’ level, generates any ‘significant’ financial return. For large businesses—where perhaps middle managers and back-office workers have a vested interest in not training AI to replace them—AI has been a nothing burger. So far. Which brings me back to HIBL.

Its full name is The Direxion Daily S&P 500 High Beta Bull 3X Shares ETF. It uses derivatives (swaps and futures) to try and 3x the return of the 100 highest beta stocks on the S&P 500 over the last twelve months (high beta stocks are more volatile, and often more lucrative) than the average stock on the market). Current examples include Super Micro Computer [SMCI], Advanced Micro Devices [AMD], Nvidia Corporation [NVDA], Vistra Corp [VST], and Palantir Technologies Inc. [PLTR].

If there’s a canary in the bull coal mine, it’s HIBL. If the MIT report is right, and AI investment shows no big impact on corporate bottom lines (so far), how different is the AI bubble from the 1999 dot.com bubble? And how big (and fast) will the fall be for HIBL and the ‘high beta’ stocks it seeks to leverage?