Too Much of a Big Nothing

So much investment has gone into AI that anything less than spectacular results will look like failure. One estimate is that the Mag 7 would have to make $600 billion in revenue to make sense.

Tuesday, August 5th, 2025

Bill Bonner, from Poitou, France

Two companies — Nvidia and Microsoft — each are worth more than $4 trillion. Together, that’s more than India’s and Japan’s combined annual output.

Price is what you pay, as Buffett puts it. Value is what you get. Our question for today: how much value will investors really get from the Magnificent 7?

Our Law of Conservation of Value tells us that prices cannot stray too far or too long from value. And value depends on output. Investors ought to be able to look to a future stream of income and from it earn their money back...and more.

Even in the dot-com bubble in 1999 the top companies were not as valuable or as concentrated as they are today. Nvidia, Microsoft, Alphabet, Apple Meta, Tesla and Amazon — together, these companies make up a third of the total US stock market value, an amount roughly equal to China’s GDP.

Part of the appeal of these Mag 7 stocks is that they are widely believed to be taking advantage of AI technology. In the case of Nvidia, of course, that is the central appeal. But the others are investing heavily in AI too.

In 2024 and 2025, Meta, Amazon, Microsoft, Google and Tesla will put more than half a trillion into AI. The revenue from these investments is expected to be around $35 billion. Amazon, for example, has invested more than $100 billion, which is thought to generate an extra $5 billion in revenue.

We don’t know how reliable or meaningful these figures are. What we do know is that they aren’t very impressive. As in the dot-com boom of the late ‘90s, AI is not paying off. This is an in-put story, with huge investments made in the hope of creating AI-based wealth. But so far, the output doesn’t measure up.

You can go to ChatGPT, for example, and pay for the service. Many people use it occasionally — including us. But few pay for it — also including us. This would be fine, except that so much investment has gone into AI development that anything less than spectacular results will look like failure. One estimate, from Goldman Sachs, for example, showed that the Mag 7 would have to produce $600 billion in extra annual revenue to make sense of their investment.

Michael Roberts:

So while the excitement of AI takes the stock market to new heights... a huge investment of money and resources, astronomical payments to AI trainers, and the construction of huge data centers [there]...so far no significant revenue has been generated and there is almost no profit. This is a steroid-friendly version of the dot-com bubble.

The appeal of the dot-com era was the idea that more information would lead to higher GDP growth rates with less need for capital investment. Costly trial-and-error expansion would be replaced by less costly, more precise, knowledge-driven growth, or so it was believed.

It didn’t work out that way. Productivity and growth rates generally softened throughout the 21st century. Capital investment went down. The Internet/Information Revolution did not compensate for the decline; it seems to have made it worse. The OECD adds detail:

In the last half century, we have filled offices and pockets with increasingly faster computers, but the increase in labor productivity in developed economies has declined from about 2% annually in the 1990s to 0.8% in the last decade. Even the production per worker of China, which once increased rapidly, has stopped. Research efficiency has decreased. Today, the average scientist produces less groundbreaking ideas per dollar than his colleagues in the 1960s. Despite the rise of intangible assets, total investment has generally been weak since the global financial crisis, which has directly worsened the slowdown in labor productivity.

Will that change with AI? Probably not. The defining curse of the Information Revolution was too much information. It piled up. It got distorted and misinterpreted. It took time and money to store and sort. And much of it was either false or useless.

Now cometh AI, adding to the too-much-info problem. Already, it generates news and reports that fill our in-boxes and waste our time. And an Israeli company just announced that it can twist and turn (distort) the news in real time.

Which leaves, at least for now, AI and the Mag 7 in an old-fashioned financial bubble. Stock prices are far higher than actual sales and profits can account for. So one way or another price and value will have to come back together. While it is not impossible that some breakthrough will lead to a big burst of productivity gains and growth, it is more likely that stock prices will fall.

Regards,

Bill Bonner

Market Note, by Tom Dyson

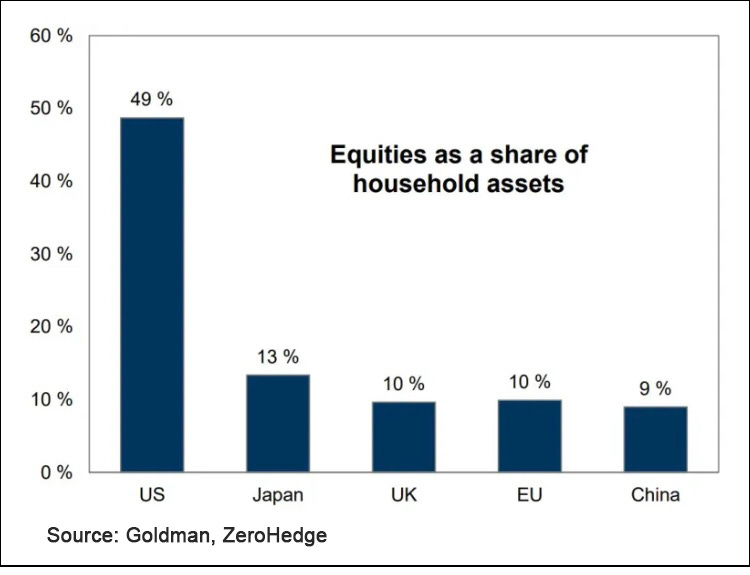

I published this chart in our recent August Monthly Strategy Report for paid subscribers. Equities as a share of American household wealth have now reached 50%, an all time high. Imagine, the average American now has more paper wealth (stock market) than all other real assets combined, including land, cash and the family home.

We’ll look back on this period in a few years as we now look back on the 1920s, the 1960s, and the 1990s. Or the 1980s in Japan. It is so obviously a bubble. All the signs are present. And one day sooner or later, it’s inevitably going to collapse. We’ll wonder what we were thinking.

“And an Israeli company just announced that it can twist and turn (distort) the news in real time.” Hasn’t our media been doing that for decades 🤔

I would add the physical construction of these mega data centers costing in upwards of $1-2 billion dollars each to build is nice fir the construction industry and suppliers of the data computers it houses. We have a $1.0 billion dollar data center under construction in my down of Fayetteville Georgia suburb of Atlanta. The investment in the data center is only part of the picture, Georgia Power Company is constructing hugh towers, substations, snd having to scramble to contruct billion dollar gas fired generation in a big hurry to supply the 100 plus megawatt power demand for this behemoth. No telling how much water is going to be consumed and infrastructure is going on to supply water to cool these computers.. I say all this because others like Georgia Power are spending billions on investment too keep up with the demand. What happens to the Non AI company investments if AI is a flop and the data centers go off line? Companies like Georgia Power will be stuck with a stranded investment. But I guess AI will be telling us all of that is not a problem not to worry.