The New Fraud

Either you decide what to do with your time and money... or someone else decides for you. And when others decide, the money tends to go in their direction, not yours.

Tuesday, May 28, 2024

Bill Bonner, writing today from Dublin, Ireland

Sad to report, but a ‘new spirit of cooperation’ has descended on Washington... like a toxic smog.

Are they cooperating to lower the deficit... balance the budget, bring the troops home and bring the debt under control?

Are they coming together to cut off US support for the bloodshed in the Ukraine and Gaza... ?

Are they rallying to a common cause... of peace and prosperity?

Really, dear reader... you disappoint us. Of course, they’re not. They’ve come together, like a pair of desperadoes, making plans to rob a bank — the bank where you keep your money.

Yes, Republicans and Democrats... blue and red... are joining forces to make things worse for all of us.

David Leonhardt at The New York Times:

A New Centrism Is Rising in Washington

Call it neopopulism: a bipartisan attitude that mistrusts the free-market ethos instead of embracing it.

In a country that is supposed to have a gridlocked federal government, the past four years are hard to explain. These years have been arguably the most productive period of Washington bipartisanship in decades.

During the Covid pandemic, Democrats and Republicans in Congress came together to pass emergency responses. Under President Biden, bipartisan majorities have passed major laws on infrastructure and semiconductor chips, as well as laws on veterans’ health, gun violence, the Postal Service, the aviation system, same-sex marriage, anti-Asian hate crimes and the electoral process. On trade, the Biden administration has kept some of the Trump administration’s signature policies and even expanded them.

The trend has continued over the past month, first with the passage of a bipartisan bill to aid Ukraine and other allies and to force a sale of TikTok by its Chinese owner.

‘The new centrism’ is a fraud. Republicans and Democrats have been conspiring to rip off the public for decades. Lately, they’ve gotten bolder.

Poor Leonhardt thinks the two parties collaborate to create a better society... one in which same sex marriage is de rigueur and anti-Asian hate crimes are taboo. But these social norms have nothing to do with capitalism. You can wear your underwear on your head; capitalism doesn’t care.

‘Capitalism’ just describes the infinitely complex and always evolving ways people work together to get what they want. It’s what’s left after the feds interfere.

It doesn’t care who you marry or who you hate. Up to you.

Leonhardt rejoices that we now have a Congress that ‘gets things done.’ But the more it does, the less room is left for capitalism to do what it does — produce the goods and services that people actually want.

And there is the real problem. It is an error of commission, not omission. In 1930, the government spent only 4% of GDP. Now, the Federales take 24%. The states take another 12%. And add in the part of the GDP controlled, directed, or subverted by federal and state regulation, and the total easily tops 50%. Capitalism still does what it always does. But it has much less room to do it than it used to.

The fault lies in too much cooperation between Republicans and Democrats -- too many laws... too much spending... too much regulation, too many sanctions, too many wars and too much debt.

One of the parties should have been a stick in the mud, quietly resisting... urging caution... preaching humility... and voting ‘no.’

Instead, both vote for more power and wealth for themselves and their friends. Call it what you want, but this has nothing to do with a new, improved form of capitalism.

At the end of the day, it all comes down to a simple question: who decides? Either you decide what to do with your time and money... or someone else decides for you. And when others decide, the money tends to go in their direction, not yours.

The facts are well known. So far this year, the feds have received $3 trillion in tax revenues. Theoretically, as a voter, you have some say in it. But as a practical matter, what you want hardly matters.

But wait, it’s worse. This fiscal year the feds have already spent almost $4 trillion. And the deficit grows with every one of these vote-buying giveaways that Leonhardt regards as signifying “the most productive period... in decades.” What’s really going on? The politicians buy votes; you pay for them.

At the current rate, the nation is headed for a debt crisis, a depression and a period of sustained inflation — things you probably don’t want, but will be imposed on you by bi-partisan consensus. Dear Readers know all about it already. They are prepared — with gold buried in their backyards... and up-to-date passports in their back pockets.

No need to go on.

But the more the parties work together... the worse it gets.

Gridlock is far better.

Regards,

Bill Bonner

Research Note, by Dan Denning

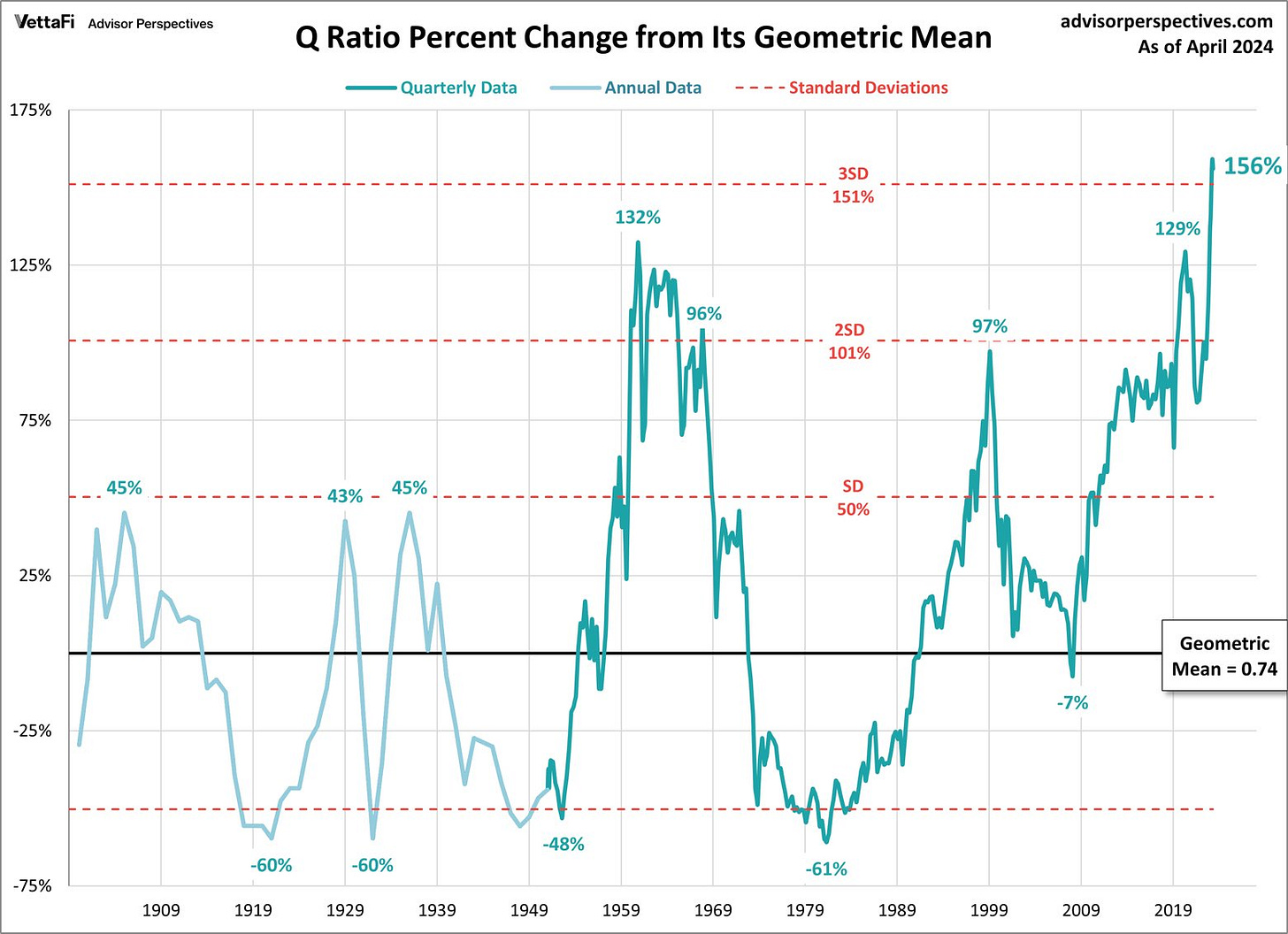

Oh look, another disused metric that shows the stock market to be historically overvalued! The chart below, from advisorperspectives.com, shows the Q ratio at its highest level in history. The ratio is more than three standard deviations above its geometric mean. What does THAT mean?

The Q ratio measures whether a given security, or an entire stock market, is overvalued or undervalued. The ratio is market value divided by the replacement cost of assets on the balance sheet. When it trades on the stock market, the value of a business is rarely exactly equal to the replacement cost of its assets.

If investors expect great profits from a business or consistently high returns on capital, the Q ratio will be above one (and technically, will indicate the business is overvalued). If investors are bearish on a company or the market, the Q ratio will be below one (and suggest a business is undervalued). The ratio for US stocks is currently around 1.56. Stocks have never been more overvalued.

As a market timing tool, the Q ratio has mixed results. Historic lows in the 1950s and early 1980s showed that the market value of assets was below replacement cost—a good time to buy. In 2009, the Q ratio briefly dipped below its historic mean, which also turned out to be a great time to buy.

A Q ratio more than two standard deviations above the historic mean has always preceded a mean reverting correction in stocks. In plain terms, when people are far too optimistic about the future earnings of today’s market superstars, they pay too much for those earnings, dooming themselves to either big capital losses or years of ‘dead capital’ and no real, inflation-adjusted returns in stocks. Is it different this time?

The AI and chip darlings generating the biggest gains in market value are said to be less capital intensive in generating earnings and profits. Or, because the market is optimistic about the future of these technologies and industries, it lowers the real cost of raising equity or debt capital, giving these companies a big advantage over competitors (and justifying the premium price of the shares).

Is it really different this time? Let us know by leaving your comment below.