The Day the Earth Stood Still

The only big effect was to get people out of the cars they owned and into cars they didn’t own, requiring monthly payments! People who had had no auto debt now saw themselves indentured for four years

Friday, November 28th, 2025

Bill Bonner, from Baltimore, Maryland

Yesterday, we raised a provocative issue. If a foreign power — or space aliens — wanted to wreck our economy, why waste time and money on firepower? All they would have to do is cut off our access to funny-money credit.

Auto sales would stop. House building sites would go quiet. Restaurants and hotels would be safe spaces for mice and cockroaches. Millions of people would be out of work. Millions of houses would be foreclosed. There would be long lines at the food banks.

It’s credit that makes the world go ‘round today. ABC news:

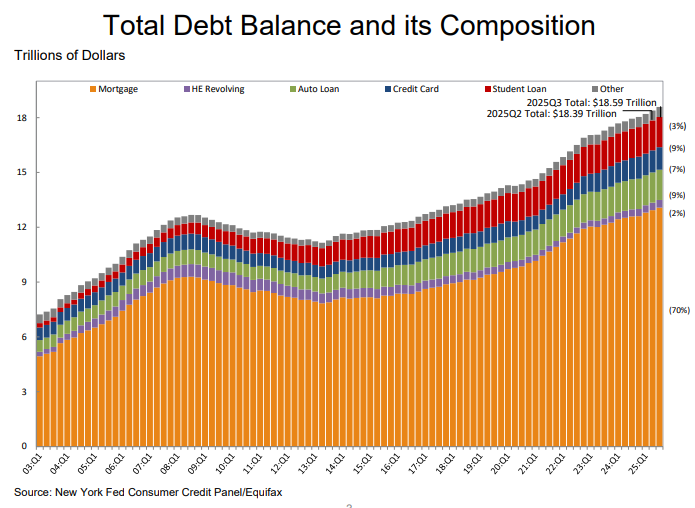

Americans’ household debt levels – including mortgages, car loans, credit cards and student loans – are now at a new record high, according to data released Wednesday by the Federal Reserve Bank of New York. Total household debt reached $18.59 trillion from July through September of this year, up by $197 billion from the previous quarter. Overall debt levels are up by $4.4 trillion since the end of 2019, just before the pandemic recession.

When one of our forebears arrived in the New World, early in the 18th century, he came subject to an indenture. He was a Scot and had been captured by the English in one of their battles. They then sent him to Kent Island, Maryland, where he was purchased by a local planter. He was lodged and fed with the African slaves. Unlike the Africans, he was released after seven years, when his indenture was up. But during those seven years, his time was not his own. He was obliged to work for his master.

A 30-year mortgage is a kind of indenture, an obligation to work for someone else’s benefit. A 50-year mortgage extends the indenture...requiring a half century of servitude.

So, the shift from owning one’s own house, car, tools, etc...to just making monthly payments on them...was an important difference. The master became the slave. The economy changed from accumulating wealth to accumulating debt. And the political system no longer encouraged wealth building; instead, the voters were urged to go deeper into debt in order to stimulate the economy!

One of the most remarkably blockheaded programs in US government history was the 2009 CARS act. It paid people to trade in their old autos and buy new ones. Then, it required that the old cars be murdered, by lethal injection. The engine oil was replaced with sodium silicate, which caused moving parts to seize up permanently.

What possible utility was served by getting rid of cars before they arrived at the end of their useful lives? A later study by the Quarterly Journal of Economics found the ‘Cash for Clunkers’ program to be completely useless. Researchers found “no evidence of an effect on employment, house prices, or household default rates.”

The only substantial effect was to get people out of the cars they owned...and into cars they didn’t own, requiring monthly payments! People who had had no auto debt now saw themselves indentured for four years.

Looking at the economy at large, the shift from real money to credit money changed the economic system, the political system, and the social structure. Households used to have to work and save. That is, they had to produce wealth before they could enjoy it. Wealth earned...and wealth enjoyed...were equal. Both rose in tandem.

But today, you can get the cart and the horse at the same time — without having to fully pay for either. The average person uses the credit system to enjoy houses, cars, vacations, meals, and big screen TVs. They are all readily at hand...but only by accepting a lifetime indenture...in which he pays monthly, and cannot tolerate unemployment or higher interest rates.

As we saw, the price of the average house is now $420,000. With interest over 30 years of mortgage, it comes to more than $800,000. Pay interest on a 50-year mortgage, however, and you will pay $1.2 million.

The man with capital...with savings...with real money, meanwhile, will pay only $420,000. He will enjoy the same house for the same 50 years as the man with the half-century mortgage. But he will pay only a third as much. What’s more, he will enjoy the independence and the confidence of actually owning his own home. Bad times...good times...low rates...high rates — he will still have a roof over his head.

Today, no act of Congress is necessary to bring US households to their knees. No attack by a foreign power...or extraterrestrials. Not even an Executive Order. The Fed simply has to increase the interest rate. Credit would dry up, overnight.

In 1980, Paul Volcker was able to push the Fed’s key rate to 20%. He did it to squeeze inflation out of the system.

Today, with US households much deeper in debt...and much more dependent on credit… even 10% would be…the day the earth stood still.

Regards,

Bill Bonner

Two comments The first is that the last time I purchased a car (earlier this fall) the dealer offered to do the DMV paperwork for me BUT ONLY IF I FINANCED THE CAR through the dealer. (Since I am 83 and dread the DMV I financed the car, which makes sense- given point 2.The second point I would make is that if the real inflation rate is around 8%-10% and I am a solvent person, I would still buy with financing; after all I expect to be repaying with depreciated dollars and the 'real interest rate' is negative.

I totally agree with you about negative consequences of our debt based system but debt and the resultant economic instability is just a natural result of rampant money printing

Volcker (ironically a transmogrified form of "Voelker", German for "a man of/for the people"), "squeezed" inflation from the system only momentarily. To have ended inflation permanently, Volcker's partner in crime, the government, would have had to cease the insidious process of deficit spending and the resultant debt monetization, which, the government not only did not do, but increased the activity! The FED should prove its "independence" by refusing to "buy" any more debt and see how long it remains in existence. Best always. PM