The cycle of life and wealth [Free Preview]

Both stocks and real estate face more losses as the Fed wrecking ball of higher rates swings its way through the economy to contain inflation.

Friday, September 9, 2022,

Laramie, Wyoming

By Dan Denning

It’s National Grandparents Day on Sunday! I didn’t remember that myself (all but one of my grandparents were deceased by the time I was born). But DoorDash reminded me of that with a notification on my phone. I’ll come back to that later. It’s both useful and creepy.

But first, it’s an ambitious update this week. And trigger warning: Today’s update is unusually long.

I’m always conscious of not wanting to waste your time. But with so many new readers in the last few months, and so many momentous events recently, I thought it would be a good time to step back and review the really big picture, using long-term cycles.

From the data this week, we’ve got changes in household net worth to look at. Those might give us a clue as to what’s about to happen with real estate in the US (not good). We’ll look at a few charts to get a better picture.

Cycles and Forecasts

If you’re an active trader and investor, I want to focus on the difference between short-term technical analysis of stock prices and long-term cycle forecasting in the economy (this is only useful if cycles are both explanatory and predictive, and not all of them are). From sunspots to capital investment, there are some interesting ways to figure out what ‘the big picture’ really is.

Since I learned most of what I know about cycles from past mentors, and one of those mentors was in London, I’ll share a bit with you about what I learned the first time I lived in London. It’s not just a stroll down memory lane, though.

The last time a Queen of the United Kingdom died, it was also the end of an era. And the beginning of a revolutionary period, politically, socially, economically, and monetarily. More on that later. Let’s start with the chart below.

Source: US Federal Reserve

US household net worth fell by $6.1 trillion in the second quarter of this year, according to data published by the Federal Reserve earlier today. It’s the largest quarterly fall on record. And it would have been even larger if the $7.7 trillion fall in stocks wasn’t offset by a $1.42 trillion rise in the value of real estate during the same time. That’s important. Why?

The chart above is one I’ve customized directly from data from the Fed’s quarterly Financial Accounts of the United States. It’s an ugly chart, I admit. But it’s useful. It shows the total change in household net worth on a quarterly basis, with the composition of those changes based on asset class. You can see at the bottom what makes up household net worth: stocks (corporate equity), real estate (your home), debt securities (corporate and government bonds) and other (cash).

Before the first two quarters of this year, soaring stocks–boosted by government stimulus and Fed Quantitative Easing (QE)--increased household net worth by $22.7 trillion. The first two quarters of 2022 wiped off over $10 trillion from equities. Some of that’s been recovered since the June bottom. But easy come, easy go is the lesson in a bubble.

Second, since the fourth quarter of 2020, the value of real estate has gone up by more than $1 trillion every single quarter (seven quarters in a row). In three of the last four quarters, real estate gains have been bigger than stock market gains for households. For perspective on how strong house price gains have been, there was not a single quarter in the housing boom of 2004-2007 in which the real estate portion of household net worth grew by more than $1 trillion.

We know that US new home sales hit a six-year low in July. We know that the national average for a 30-year mortgage is 5.95% (according to bankrate.com) and that it was 2.65% this time last year (the largest one-year increase since 1980-1981). We know that at the end of the second quarter, the median price for sold homes in the US was $440,000 and that according Black Knight, median home values fell 0.77% from June–the largest such fall in 11 years.

We also know that with the spike in median home prices and the increase in mortgage rates, the monthly mortgage payment on a median home is up over 40% in the last year. Not coincidentally, we learned that mortgage demand fell to a 22-year low in late July, according to the Mortgage Bankers Association.

‘Super Bubble’ in everything is bursting

What does all this add up to? The housing bubble is bursting as interest rates go up. It’s killing mortgage demand. Only much lower house prices will lead to greater affordability and, eventually, greater mortgage demand. If the Fed pumped up real estate values on the household balance sheet by $11.35 trillion in nine quarters, then how fast will it disappear in a crash?

This is why we remain in ‘Maximum Safety Mode.’ Both stocks and real estate face more losses as the Fed wrecking ball of higher rates swings its way through the economy to contain inflation. It’s not good news, but at some point, the destruction of household net worth will also destroy demand. And then inflation might be back below 4%. Take a look at the next chart.

Source: US Federal Reserve

How do you really know we’re in the middle of one of the greatest (and most dangerous) financial experiments of all time? Couldn’t it just be a normal business cycle? Or a normal boom, followed by a normal bust? The chart above says, ‘No!’

It’s the ratio between household net worth and disposable income. You can see that from the post-war period on, the ratio was more or less in a range between 5.6 at the top and 4.6 at the bottom. Both disposable income and household net worth grew in tandem. But then something weird happened.

Disposable income growth, in real terms, slowed down in the 1970s. Then, after the 1987 crash, household net worth–driven by rising stock and real estate prices–went ballistic. It’s all there in the chart: the dot.com boom, the dot.com crash, lower rates in the early 2000s that kicked off the housing boom, then the 2008 crash, and more recently the incredible spike to record levels.

Easy credit drives asset price growth. Tight credit destroys that growth. The boom was extraordinary. The crash is going to be spectacular. One final chart.

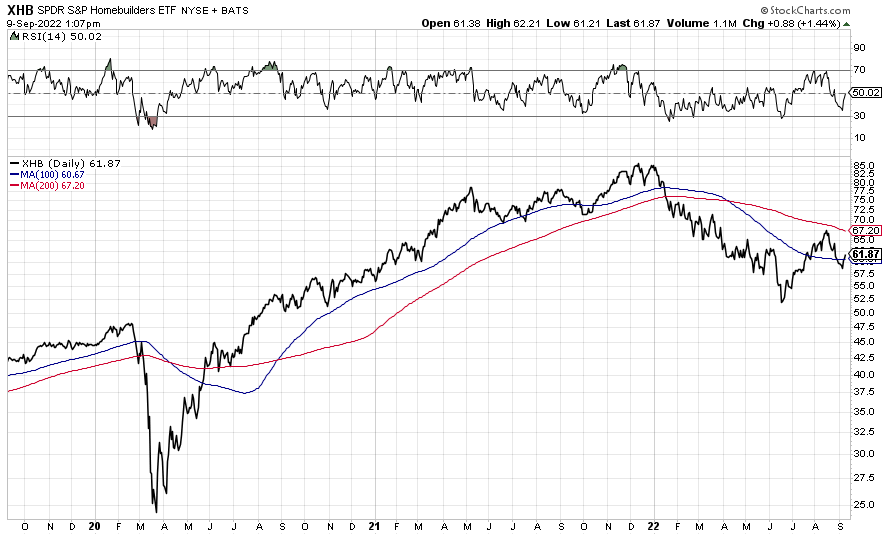

Source: www.stockcharts.com

The stock market proxy I’m using to track whether real estate follows equities into a major, market-clearing, final bear phase is the one above. I’ve shown it to you before. XHB is an exchange traded fund (ETF) that includes home builders, home furnishing retailers, household appliance manufacturers, and household building materials.

XHB started making lower lows and lower highs in late December of last year. The shorter-term moving 100-day moving average (the blue line) crossed below the longer-term moving average (the red line) this spring. The ETF failed to rally above longer-term MA this summer. And now?

The short-term momentum is up (the relative strength spiked recently). But the longer-term trend is down. The bear rally is over. Now, driven by higher mortgage rates, lower mortgage applications, and falling median home prices, I’d expect lower lows.

This is not something we’d try to trade. As Tom mentions often, our primary mission is avoiding the big loss and not capitalizing on every tactical trade we see. But we’ll keep our eyes open if something is too good to pass up. In the meantime, this is a good opportunity to make clear just what kind of charting analysis we find useful.

Kondratiev, Jevons, Juglar, Dow/Gold

When I first started working with Bill Bonner in the late 1990s, my office was in an old building on St. Paul Street. This was the early days of the Internet, so almost everything we published was still printed and mailed to subscribers. But not everything we published sold very well.

Case in point: a basement full of books about Austrian Economics and the Kondratiev Cycle. I’d barely heard of the first and had never heard of the latter. But as an exercise in clearing out the basement (which would eventually make way for an employee gym) we decided to see if we could sell the books. There was a catch: we had to read them first!

I’m not going to tell you I read them all. I didn’t. I DID read The Road to Serfdom and The Fatal Conceit, by the great Freiderich Hayek. And I did read some of the work of Joseph Schumpeter, Carl Menger, and Ludwig von Mises (especially Human Action.) All of these are well-worth reading (along with Economics in One Lesson by Henry Hazlitt).

But for the work on Kondratiev cycles I had to rely on James Dale Davidson and Lord William Rees-Mogg. I worked with both at the time. And both had already collaborated on several books, including The Great Reckoning and the Sovereign Individual.

Those books are great reads, even today. I’ve read that Peter Thiel credits the Sovereign Individual with accurately forecasting much of the future we now live in. But it wasn’t until I met Lord Rees-Mogg in person in 2003 (he treated me to lunch in the House of Lords at Westminster) that I started to learn a lot more about long-term economic cycles and forecasting.

Rees-Mogg was a partner with Bill at Pickering and Chatto, the company that published all these volumes. But he was a former Editor at The Times of London and a collaborator with us on The Fleet Street Letter (the UK’s oldest investment intelligence newsletter). The first time I lived in London from 2003 to 2004, I worked on the Fleet Street Letter with him and learned how long-term cycles can help investors.

Technology, population, capital investment, sunspots

What cycles? The big one was the 64-year Kondratiev Cycle, named after the Russian economist Nickolai Kondratiev. This cycle suggests that growth (and contraction) come in distinct ‘waves,’ driven by technology and demography. It can’t help you pick stocks. But it can help tell you whether we’re in the start of a cycle or in a Kondratiev ‘winter’ of consolidation.

The Juglar Cycle says the economy (and thus stock prices) are driven by capital investment. That was certainly true in the Industrial Revolution and most of the 20th century. Investment in fixed capital generated jobs and incomes and increased the capital stock of a country.

In the late half of the 20th century and early part of the 21st, intangible capital (ideas more than machines) has generated a higher return on investment. Will this change with ‘de-globalzization’ and the breaking of global supply chains? Will ‘re-shoring’ of America’s industrial base lead to capital spending driving the business cycle again? Maybe.

Another cycle that might be worth looking at again today is the Jevons Cycle. Sunspots. The idea is that solar activity determines crop yields (at least since the 16th century). The abundance (or dearth) of food leads to changes in the rate of population growth, inflation, and all the political and geopolitical instability that come from periods of great change.

For example, keep a close eye on what’s happening with the displacement of millions of Pakistanis due to flooding all over Pakistan right now. Maybe some study of the Jevons Cycle could tell us whether today’s ‘climate emergency’ is really an emergency, or just part of a larger, observable, predictable cycle in the activity of our sun.

As you can see, none of this has anything to do with the timing of our tactical trades. We don’t do that kind of technical analysis. It certainly can help boost your P/L if you’re good at it, or know someone who is. But it’s not our main mission. It’s not the best way we can help you.

The closest we get is Bill and Tom’s use of the Dow/Gold ratio. New readers should consult Tom’s Gold Report to see what I mean. But the idea is simple. There’s an observable relationship between the Dow Jones Industrials and the dollar price of an ounce of gold. We intend to use this to keep out of stocks until they’re cheap, preserving our capital until it can again be put to use investing in productive enterprises.

Door Dash and ‘Fog Reveal’

This is a longer than normal update. But I mentioned something about DoorDash at the beginning as it relates to something important I read earlier this week. I’ll keep it short. It’s about mass surveillance and the emergence of a permanent Police State in America.

First, is it creepy that DoorDash sends notifications to my phone about Grandparents Day? Not really. What’s interesting is that DoorDash is expanding into delivering flowers on special occasions. Post-pandemic, delivering food might not be enough. Here in Laramie, DoorDash also delivers groceries from Wal-Mart (for those winter months when I lose the will to step out the front door into the bitter, windy cold.)

What IS creepy is that police across America have been using an app called ‘Fog Reveal’ to map out your personal movements, based on data from your cell phone. Law enforcement officials call it creating location analysis based on ‘patterns of life.’ Those patterns emerge if they can collate the digital exhaust your phone emits from all the apps on it, especially location data.

If you have a mobile phone in your pocket, it’s a surveillance device. You can’t truly be free if you’re being watched all the time. The knowledge of Big Brother watching alters your behavior whether you consciously know it or not.

With my previous publisher, I wrote a report about ‘Going Dark’ and restoring your online privacy. It’s about how to escape mass surveillance in the digital world and, increasingly, personal surveillance in the real world. If you think we should revisit this subject and write a new report, write to us at bonnerprivateresearch@gmail.com . And in the meantime don’t forget that Sunday is Grandparents Day!

Until next week,

Dan

PS The second time I lived in London was between 2015 and 2017. It was another project with Bill, and happened to coincide with Brexit (an exciting time to be in the UK for lots of reasons). I lived in an area called Shad Thames, on the south side of Tower Bridge. My commute to work took me east up the Thames toward Blackfriars Bridge.

Embedded in the pavement along the way were commemorative markers for the Silver Jubilee of Queen Elizabeth II. The Silver Jubilee marked the 25th anniversary of the Queen’s ascension to the British throne in 1952. It was built in 1977.

The Queen went on to reign for over 70 years, celebrating a Golden Jubilee in 2002 and a Platinum Jubilee in earlier this year. Aside from being the longest-serving monarch in British History, she saw a tremendous amount of change in her life. I don’t think we’ll see another public figure of such significance in our lifetime. By that, I mean a single person whose life has spanned such a transformative period in history.

The whole thing reminded me of a quotation I included in The Dollar Report. It was from David-Hackett Fischer’s book The Great Wave. It was about the celebration of the Diamond Jubilee (60 years) of Queen Victoria. I’ll reproduce it here for the benefit of new readers who haven’t reviewed the report yet:

On Diamond Jubilee Day [22 June] in 1897, eminent Victorians contemplated the future with the same confidence that marked their memories of the past. Peace, progress, and stability were thought to be natural and normal in the world. They were firmly expected to continue.

But it was not to be. The Victorian certainties that London celebrated on Diamond Jubilee Day had already begun to be left behind by events. When we look back on the economic indicators for the year 1897, they reveal to us in retrospect a pattern that was still mercifully invisible to those whose lives it would transform. Beneath the surface of events, the equilibrium of the Victorian era had come quietly to an end.

On the day that the Queen and her subjects commemorated sixty years of stability and peace, a deep change was silently occurring in the structure of change itself. That sunny June morning in 1897, the Western world was entering a new era, which would be filled with horror that the Victorians could scarcely have imagined, much less foretold. This new epoch has continued to our own time. One of its many material manifestations was a long movement that might be called the price-revolution of the 20th century.

It’s another great book about long-term cycles and the nature of change itself. I highly recommend it. But I’m quoting it to you here because this time, the end of the second Elizabethan Era in the UK coincides with another period of great global change. Only this time, it’s likely that Americans will see the greatest (and possibly most negative) changes in their quality of life (if they do nothing to prepare).

Look around the world. The United States has ‘weaponized’ the dollar and the global payments system through which the dollar runs. China has ‘weaponized’ the global supply chain to influence inflation and political and social instability in America. Russia has ‘weaponized’ energy. And the European Union has ‘weaponized’ regulation.

In the next price revolution, we’ll see where power really resides. Will it be imaginary wealth created by central banks? Will it be real wealth by the owners and producers of real assets? And Great Powers aside, what can ordinary people like us do to not get run over by events. That’s our challenge now. At least we’re in it together (you, Tom, Bill, Joel, myself, and all of thousands of other readers).