The 2026 Battle Royale

The numbers speak for themselves. Higher government debt levels increase inflation, which is another way of saying they accelerate the rate of dollar debasement. This is one of our big challenges.

Friday, November 27th, 2025

Laramie, Wyoming

By Dan Denning

Not cool. The Chicago Mercantile Exchange (CME) reported a ‘chiller plant failure’ at one of its data centers interrupted futures trading on stocks, commodities, and foreign exchange trading overnight. Markets were back up and running this morning. But it’s Black Friday. Wall Street will closed at 1pm ET.

The same thing happened in 2019. It lasted for a few hours. And then things were back to normal. But this is the end of the month, when lots of positions are being closed out and options expiring. Financialization and digitization have allowed markets to trade around the clock and around the world seamlessly.

So much depends on data centers! In today’s note, I’ll look at the output of those data centers (AI) and whether a battle royale is shaping up in 2026. In one corner, the natural tendency of technology to make things cheaper (deflation). In the other, exploding government liabilities as AI displaces millions of workers and turns them into dependents of the State (inflationary).

What’s the right investment strategy for this coming conflict? Stay tuned for more. In the meantime, please note that silver futures jumped almost 4% once the markets opened back up. That makes for a 90% gain year-to-date and a new 50-year high. Another image.

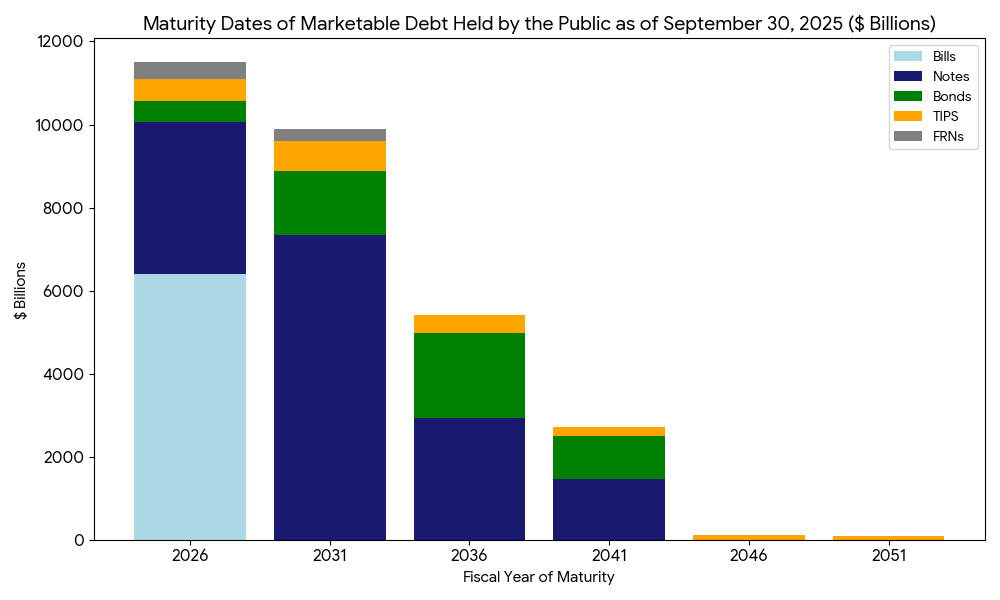

Around this time of year I would normally show you the latest version of what I’ve called ‘the most important chart in the world.’ It tells you when the $38 trillion in US government debt matures. Normally, the Government Accounting Office publishes its annual audit of the debt figures published by the Bureau of the Fiscal Service.

The audit is a snapshot of how much pressure is building up on interest rates. Think of that $38 trillion in debt as water building up behind a dam. If too much debt matures too soon, that water spills over. The result is higher interest rates–higher borrowing costs for the US government, which tips the annual interest expense on debt over $1 trillion and consumes more tax receipts out of the government’s annual budget (you can find last year’s report here, with the chart in question on page 19 of the PDF).

The problem this year is that the data GAO uses to prepare its report is provided by the Treasury and the Office of Management and Budget. Because of the government shutdown in October, I’m told by my contact at GAO the report will be delayed until December or possibly January. But the data itself is public domain. So I did a thing.

I used my AI agent to reconstruct the chart for 2025 based on the publicly available data. That’s the image you see above. It breaks down US debt into bills, notes, bonds, TIPS, and cash. What you’ll see is that nearly 50% of marketable public debt ($14.8 trillion) matures in the next two years. But fully 71% of the debt–or $21.5 trillion–matures in the next five years.

There is no hiding from this debt tsunami. The debt must be repaid or refinanced. The bigger it gets, the less likely investors are willing to buy it–at least at these interest rates. That pushes up rates higher. And that results in one of two things (probably both)--yield curve control on the lower end of the interest rate curve and/or an resumption of bond buying by the Federal Reserve (Quantitative Easing).

I will not rehash the technical argument that Quantitative Easing is not money printing and therefore not inflationary. The numbers speak for themselves. Higher government debt levels increase inflation, which is another way of saying they accelerate the rate of dollar debasement. This is one of our big investment challenges going into 2026. But there are also opportunities.

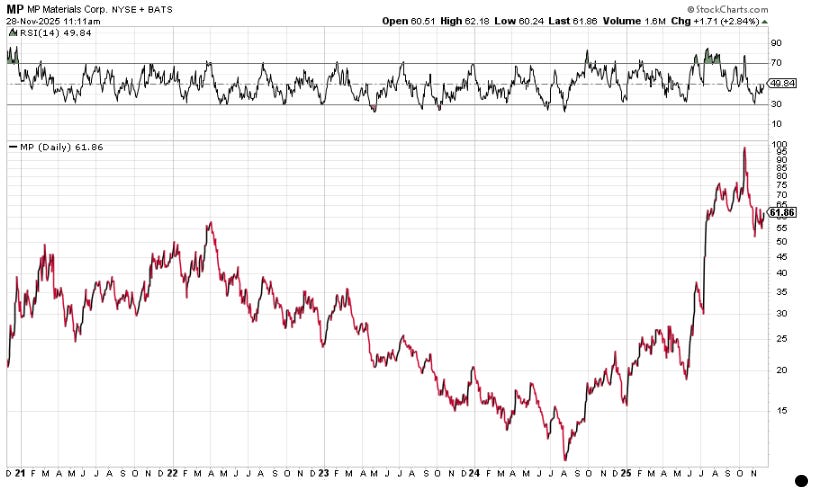

MP Materials [MP] is our poster boy stock for what can happen when an activist federal government backs certain companies and projects for national security reasons. MP is the biggest US rare earths company. It has a mine producing ore (although it sends that ore to Chinese refineries at present).

In July, the US Department of War made a $400 million equity investment in MP. It came in the form of preferred convertible stock and warrants. It made the DoW the largest single shareholder in MP. It underscored how important rare earths and critical minerals are to the US firepower industry.

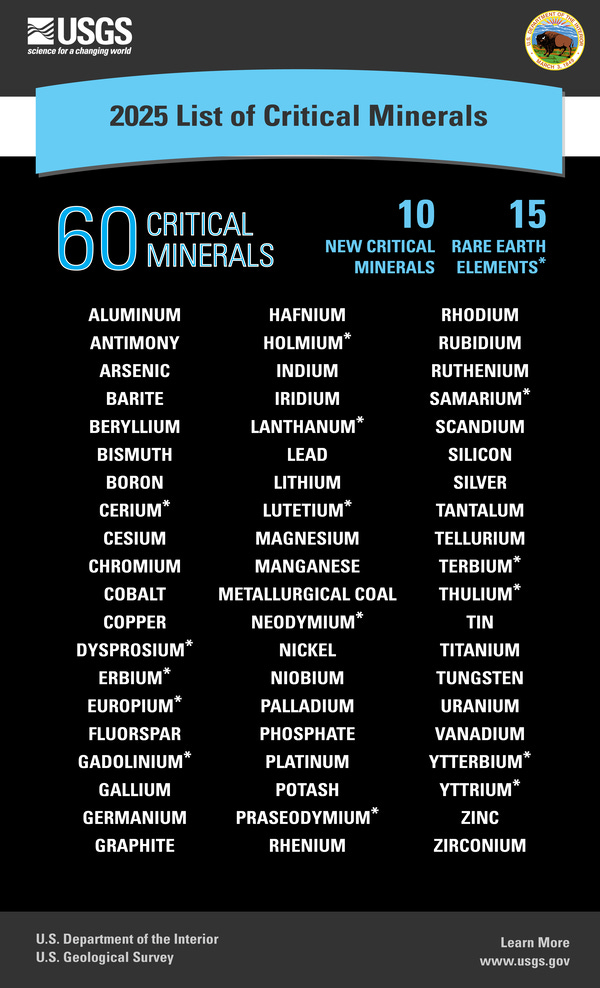

Late last week we learned the DoW is not done (Deep State pockets, baby). The Department of War announced a $30 million investment (an ‘award’ under the Defense Production Act) to Element US Minerals. Element is a private company whose aim, in this case, is to recover gallium and scandium from the industrial waste from alumina production.

Gallium is not technically a rare earth element. But it IS used in the production of integrated circuits, transistors, and semiconductors–the kind used in US hypersonic missiles, fighter jets, and other weapons systems. Scandium is a critical metal (number 21 on the periodic table) that is stronger and lighter weight than aluminum.

This deal is about refining critical minerals in the US, and doing it very quickly. You still have to mine them as well. And on that score, the US Export/Import Bank’s head, John Jovanovic told the Financial Times that he Bank will invest $100 billion abroad. The goal is to build out supply chains for critical minerals, nuclear energy, and liquified natural gas (LNG) that don’t involve Russia, China, or Iran.

Should we change our investment strategy based on this information and aim to make speculative profits?

Explicit government investment in public AND private companies–aside from being economically ‘problematic’-- CAN be an opportunity. Look at MP stock. It was up 532% year-to-date at one point. But then it fell by almost 40% as speculators liquidated. It’s still up almost 300% year-to-date. Wild ride.

I’d encourage new readers to go back and listen to what Rick Rule said about this earlier this year in Private Briefing. If you want the US government as your business partner, invest in the right projects (‘right’ meaning either those mines closest to production but requiring capital, or projects in friendly jurisdictions that help build out the supply chain–including refining–in the key elements that USG has identified as critical), go for it. And review the 60 elements the Department of the Interior identified as ‘critical’ in its final report earlier this month (please note the presence of silver on the list.)

But in Maximum Safety Mode, I’d encourage you to re-read Tom’s December Monthly Strategy Report published on Wednesday. The Interior Department’s critical mineral list explicitly excludes energy and fuels. Tom reckons oil and gas stocks may be the safest bet to earn income from hard assets in 2026. He’s replacing the tanker stocks we just removed from the Official List with hated stocks that own valuable scarce assets in the oil and gas patch and pay big dividends.