Sometimes right. Sometimes wrong. Always in doubt.

A short history of how Bonner Private Research came to be, and why independent financial research is more valuable than ever.

By Bill Bonner

Founder, Bonner Private Research

(The following is a revised version of an essay originally published on January 24th, 2022, Why We Decided to Private After 40 Years of Public Spectacle. It’s pinned here as an introduction to new readers and subscribers)

We set out on a new venture in 2021. If you’re new to our daily reports, or to Bonner Private Research in general, what follows is a fuller explanation of what we set out to do on your behalf, how it all began, and where it may be headed.

We began writing in 1998. Sometimes, these daily missives were hard to write. They must have been even harder to read!

Because, we’re like travelers who never know exactly where they’re going. Instead, we look, we wonder… What’s happening? Why? Where does it lead?

Sometimes the questions take us down blind alleys and waste our time. Often, they simply lead to more questions. Only occasionally do they guide us to useful insights. Rarer still, to actual wisdom.

The Benefit of Experience

We started our first newsletter, International Living, in 1978. In it, we hoped to show Americans how to retire overseas. It was a dream then. For many thousands since, it’s become a reality (and for some today, an urgent priority).

More than 40 years later, in the home stretch of our career, we are beginning a new project again. Fortunately, writing about money is one of the few métiers where age is actually a benefit. After all, you have to be over 70 to have lived through, as an adult, the inflation of the 1970s. You have to be at least in your 60s to recall how Paul Volcker stopped it.

Besides, as you get older, you may become more vulnerable to the Covid, but you become more resistant to claptrap. You remember the WIN buttons… the lime-green leisure suits…and the Vietnam War. You’ve embarrassed yourself more often than you can remember…and you’ve heard too many something-for-nothing claims, seen too many new tech promises that didn’t work out, and voted for too many disappointing politicians; a grain of salt is no longer enough… you need tons of the stuff.

We bring this up because we think we are approaching a period of Peak Disillusion – when the silly pretensions of the governing class create a disaster for everybody. A good dose of geezer cynicism may be the only way to survive it.

Many of the trends we’ve been following for decades seem to be both accelerating and converging at the same time. The ‘new’ dollar – without gold backing – was introduced more than 50 years ago. When it came out, the old-timers preached doom.

Now, we’re going to see that they were right. No pure paper money has ever survived a full credit cycle. Our guess is that this dollar will be gone when interest rates reach their next top. Will it be replaced by something else? Perhaps a Central Bank Digital Currency. Is it coming soon?

The Four Stages of Work

Looking back over our half-century of work, we see different stages. First, we thought we could change the world. Young people often think they have the answers; we did. And we were worried, in the early 70s, as now, about the growth of government.

The central competition in public life is not really between Democrats and Republicans or liberals and conservatives. It is between those who go about their business… helping each other… providing goods and services to each other… building wealth and families… and those who want to stop them.

It is the difference we described in much more detail in our book, ‘Win-Win…or Lose,’ between those who make… and those who take, between those who get what they want by honest, consensual exchange and those who use armies, sanctions, laws and regulations. It is the difference between violence and persuasion.

Still in our twenties, we were naïve and foolish. We believed the growth of Washington and the proliferation of laws and regulations was some kind of ‘mistake.’ People just failed to realize that ‘win-win’ was a better way to go.

But after seven years in Washington, heading up a group called the National Taxpayers Union, we finally had to face facts: a lot of people prefer power to prosperity… and that includes almost everyone within the DC beltway.

Information is not Wisdom

So, in the second chapter of our career, we left “public interest” and decided to focus on private interest. We couldn’t change the world, we reasoned, but at least we could help people get through it… and make some money for ourselves doing it.

We were supremely lucky. It was just the beginning of the financialization phase of the US economy. In 1971 the feds had switched to a paper money system, unconnected and unrestrained by gold. It was off to the races. Everyone wanted to know what horse to bet on.

We were, however, woefully unprepared for our new role. We didn’t understand much about economics or investing. So, we teamed up with people who did. Gary North, Mark Hulbert, Adrian Day, Doug Casey, Jim Davidson, John Dessauer, Porter Stansberry, Steve Sjuggerud, Alex Green and many others.

Sometimes they were right. Sometimes they were wrong. But we were always learning. And we are grateful to them all.

Then, in the late ‘90s, came the third stage of our career. The internet arrived. People said it would make ‘information’ available – free – to everyone. That would put us old-fashioned newsletter publishers out of business, they said.

But ‘information’ is worthless… less than worthless… without context… trust… training… preparation… circumstance and all the other things that give it value. “Imagine Napoleon on the retreat from Moscow,” we invited readers.

“His soldiers are freezing to death. Starving. Getting slaughtered by partisans. And then… as if by some miracle… someone hands him the plans for building a nuclear bomb! What value would that have had? Zero.”

Our point was that the precise ‘information’ you need, precisely when you need it, is extremely valuable. Otherwise, it’s just excess baggage. We went on to speculate that with the build-out of the internet, “the world may soon be stuffed with information… and starved for wisdom.”

In the following years, instead of fading away… our business boomed – thanks to the internet. Investors gorged on ideas, recommendations, revelations… about new tech breakthroughs… trading techniques… cryptos… pot stocks… and much, much more. Many of these turned out to be astonishingly profitable.

A Wet Blanket

But your editor, who began writing a daily ‘blog’ in 1998, was a wet blanket. He doubted that these innovations would produce lasting wealth – after all, what did they produce at all? Many provided neither products nor services… and many lost money, year after year. As to the new tech, he urged caution.

In retrospect, his counsel turned out to be both good and bad. He eschewed investments in dot.coms… even in the most successful of them of all – Amazon.

He wondered aloud if the whole “information revolution” was anything more than a time waster. And he ridiculed many of the most sacred tenets of tech believers… including the doctrine that new technology always means progress and that progress will free humans from work, thrift and sin.

Trade of the Decade

On the other hand, his one, very simple ‘Trade of the Decade’ – sell stocks, buy gold – turned out to be the best trade of two decades. Gold, at the end of the 1990s, was trading at $282 an ounce. The Dow was just over 11,000. Since then, gold has gone up about six times. The Dow is only up three times.

Investors who made our trade have coasted calmly through the three major crises of the 21st century… and are still way ahead. Our current Trade of the Decade, unveiled around this time last year, is doing well too.

The ‘short’ side isn’t complicated: the US dollar. The whole worldwide bubble is full of dollars. Stocks, bonds, real estate – everything is quoted in dollars. And while the Fed will be desperate to keep asset prices from crashing… it can only hope to do so by ‘printing’ more dollars to boost them up.

It’s the “Inflate or Die” trap. Either asset prices decline… or the dollar does. The dollar will be sacrificed, we believe, to try to save a corrupt and doomed financial system.

The long side of our latest trade is simple. The ‘Energy Transition’ is asking for trouble. Demand for oil and gas is growing. Thanks to naïve or misguided public policy (and capital allocation) supply is not. Prices will rise.

Too Much Noise, Not Enough Signal

But now, we see a bigger challenge ahead… and the fourth and final lap for our career. After a quarter of a century of burgeoning internet-based investment advice… and all manner of opportunities – NFTs, cryptos, tech breakthroughs galore – investors are swamped by ‘information’ and opportunities. But wisdom? It seems to have disappeared.

Where it still appears in residual clumps, like survivors after a world-wide plague, it is furtive… fearful… and almost ashamed of itself. And it is completely upstaged by the gaudy claims of the tech futurists. One says a new “disruptive” tech will bring 10,000% gains. Another says a pharma breakthrough will allow children born today to live to 200 years old. Still another claims you can double your money overnight.

And maybe they’ll be right!

But we have our doubts. Nature is not so promiscuous as to give out her favors to every Tom, Dick and Harry who buys a newsletter subscription. She knows that real progress… and real wealth... require real work, real investment, real reflection and real self-discipline over what is generally a really long time.

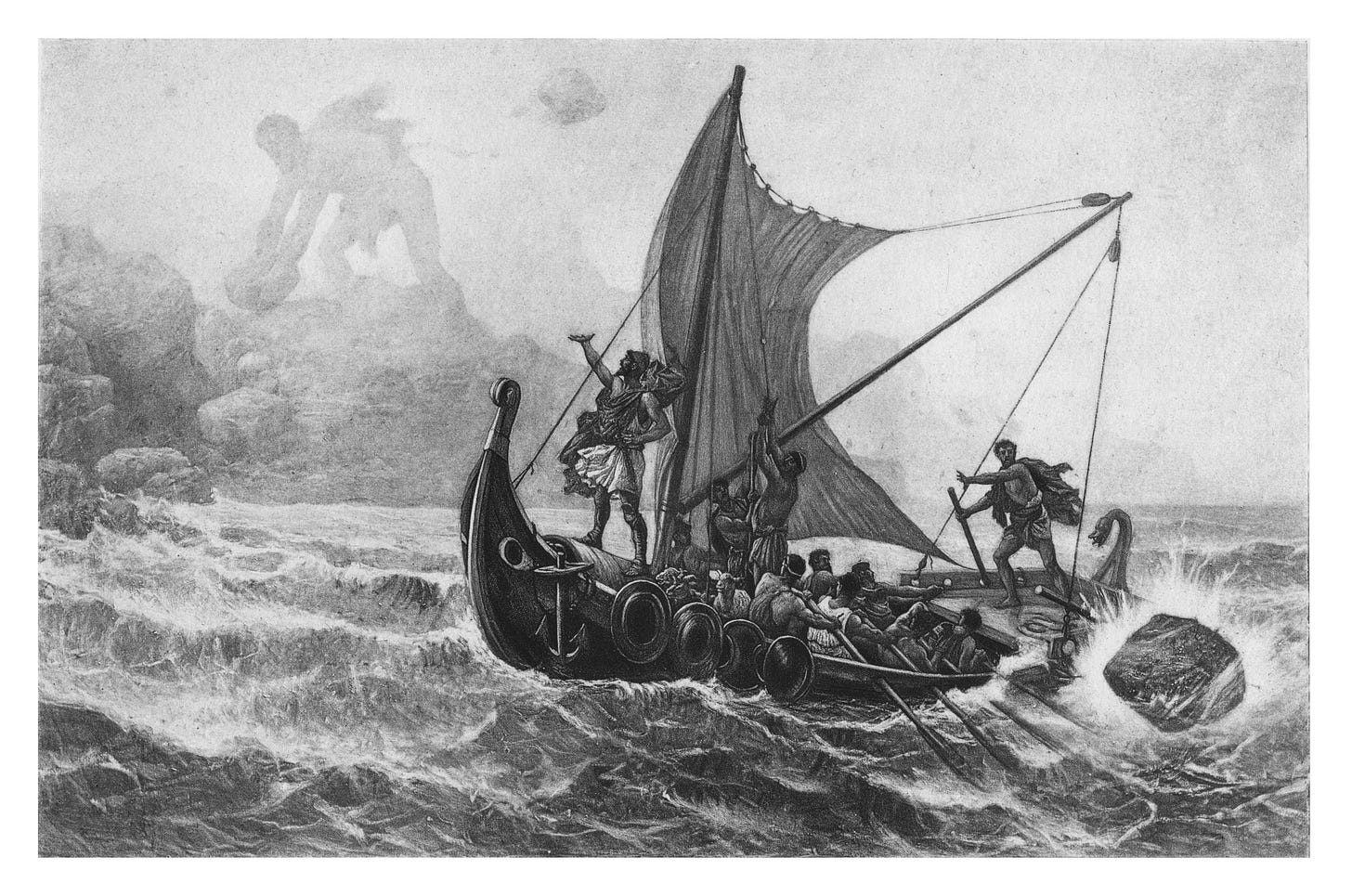

Source: Getty Images

So that is our goal. We’ve joined up with colleagues Dan Denning, Tom Dyson and Joel Bowman to plug our ears with wax, to tie ourselves to the mast… and resist the sirens of easy money and fast profits… luring us onto the rocks.

Subscribers will get weekly investment updates from Tom, including news and updates on the companies he’s researching (as he adds them). Dan will provide weekly updates from the macro perspective, connecting the dots, looking at the big picture, and reviewing and revising our strategy.

Tom writes a fuller, more traditional monthly newsletter every month too. In this report, he’ll deliver his best investment research each month. We usually publish it on the third Wednesday of each month.

Joel heads up our weekend editions and, for those of you so inclined, our podcast. It’s called Fatal Conceits (after the great work of economist Friederich Hayek). This is free to everyone, even if you choose not to subscribe to our investment research.

Our Research Reports are for paid-up readers only. We’re building this library as we take a deeper dive into key topics that affect your money, your retirement, and our strategy for helping with both. The first three reports are: The Gold Report, The Strategy Report, and The Trade of the Decade. A fourth one, The Dollar Report, is coming soon.

We’re using a new platform because it lets us focus almost entirely on writing and researching. That’s why you don’t find any offers for other services in these letters. There is no advertising.

All we have to offer you is ourselves… our research… our guesses and hunches. Sometimes right. Sometimes wrong. And always in doubt.

But like any new project, there are a few bumps in the road. We’re working on them. Thanks for your patience.

In the meantime, we’ll keep our eyes on the big prize. Yes, we search for the rarest and most precious thing in the financial world – wisdom. And while we may not find it, it won’t be for lack of trying.

Until next time,

Bill Bonner

P.S. We’ll continue to write in this space… to wonder, to doubt and to reckon daily. Our missives are free, and free for you to share with friend and foe alike. (Please do.) Our investment research, however, comes with a small fee… less than $2/week.

We think that’s pretty reasonable, given what you get: access to our private investment network, one we spent the better part of four decades building, plus weekly and monthly updates and reports, our very best financial analysis, as well as podcasts, private Zoom calls, transcripts and much more.

What you won't get are a lot of hype... and mixed messages. That's worth something too. As you see, it’s a whole new path we’re on. We hope you’ll join us…

© 2022 Bonner Private Research, Carrick Road, Portlaw, County Waterford, Ireland.

All Rights Reserved.

Any reproduction, copying, or distribution, in whole or in part, is prohibited without permission from the publisher. Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal circumstances–we are not financial advisors and do not give personalized financial advice. The opinions expressed here are those of the publisher and are subject to change without notice. It may become outdated and there is no obligation to update any such information.

Investments should be made only after consulting with your financial advisor and only after reviewing the prospectus or financial statements of the company or companies in question. You shouldn’t make any decision based solely on what you read here. Neither Bonner Private Research nor its employees and writers receive any compensation for securities or investments covered herein.

Invaluable financial research and insightful political and topical commentary. Look forward to the missives every day wish I would found you guys sooner.

A fantastic service for a very reasonable price. Long may it continue.