Scrambling for Survival

Our Dow/Gold ratio tells us that stocks have a long way to climb down. The ratio is usually around 10. Now, it’s 16.5. Stocks will have to lose about 40% of their value to get down to the average.

Wednesday, May 1st, 2024

Bill Bonner, reckoning today from Dublin, Ireland

During the episodes of financial chaos that occasionally erupt in our economy, we will be equipped both financially and emotionally to play offense while others scramble for survival.

— Warren Buffett

Here at Bonner Private Research, we are in Maximum Safety Mode. Why?

Like Buffett, we suspect that a period of financial chaos is coming. We want to be ready for it.

The Primary Trend has turned down; it could last for many years. As prices sink, there are bound to be crises.

But we don’t have to predict anything; we just have to notice that stocks are expensive. The S&P is selling at a CAPE ratio of 34. That’s twice the average price for stocks — in the 97th percentile historically.

This suggests that stock prices could be cut in half, just to get back into a ‘normal’ range.

Our Dow/Gold ratio, too, tells us that stocks have a long way to climb down. The ratio is usually around 10. Now, it’s 16.5. Stocks will have to lose about 40% of their value to get down to the average.

But markets do not simply go to ‘normal’ and stay there. They swing from over-priced to under-priced... and back. Right now, stocks are on a downswing (or so we believe) of unknown magnitude. But since the feds pushed the last Primary Trend to an extreme...

... and since they now seem to be pushing this one to an opposite extreme...

... the coming period of chaos should be a doozy.

Our model tells us to stay put in safety mode until the Dow/Gold ratio falls to 5 or lower (when you can buy the entire list of 30 Dow stocks for the equivalent of 5 ounces of gold). At that point, it will be time to channel our inner Warren Buffett and “play offense while others are scrambling for survival.” Like Buffett, we are hoarding cash... (in our case, precious metals and dollars).

In the meantime, we continue to marvel at the astonishing ways in which the feds make a bad situation worse. This just in from the DailyHODL:

US National Debt Surges $273,859,000,000 in Two Months As Billionaire Leon Cooperman Warns Nation Heading Toward Financial Crisis

Cooperman:

‘You have no idea when the stuff hits the fan... If deficits don’t matter as some people insist, then I’m being too conservative. But deficits matter... I think we’re heading into a financial crisis in this country.’

Colleague Dan Denning adds:

The Treasury announced it would be borrowing $243 billion in the April-June quarter and $847 billion in the following quarter. That means the government's annual deficit will probably be much larger than the current projections of $1.5 trillion. The second quarter figure is $41 billion larger than they figured in January. But these days, what's $41 billion in the context of $35 trillion?

Demand for longer-term bonds has been weak. So everyone is expecting the Treasury to announce a mix of Bills and Notes. Shorter-term debt. But it means that everything sold at a shorter maturity has to be refinanced sooner as well.

Wouldn't want to be Janet Yellen this week. Or ever, really.

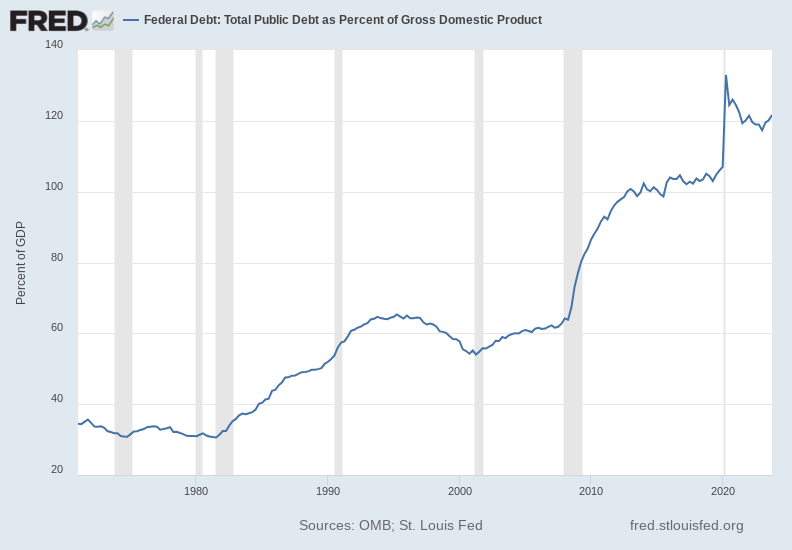

It is obvious to everyone that adding debt at this stage will lead to trouble. Big trouble. Soon, we will hit the doomsday trigger — with debt at 130% of GDP. Fifty one times out of fifty two, when the trigger level was hit... the system blew up. But maybe this time it won’t.

We’re special, aren’t we? We’re the indispensable nation, no? The normal rules don’t apply to us, do they?

Tomorrow... we’ll try to figure out why policymakers seem to be aiming for chaos. We’ll also look at another ‘trigger’ point just revealed in a Goldman Sachs study. It could be hit any day now. And when that happens, stocks go down.

What? You say stocks are already going down? The Dow went down more than 570 points yesterday? But you ain’t seen nuthin’ yet. Nobody is ‘scrambling for survival.’ Not yet. And when they are, we don’t want to be among them.

Stay tuned.

Regards,

Bill Bonner

Research Note, by Dan Denning

What ‘proves’ that the gross debt-to-GDP ratio is a trigger of a currency or bond market crisis? In the last two and half years, BPR has pored over the historical research covering debt crisis and the government responses. The highlights of that research are available in our library of Research Reports for paying subscribers. Below is an excerpt from The Dollar Report.

Please note that The Dollar Report, The Gold Report, The Trade of the Decade, and The Strategy Report are long-from research reports into key investment issues prepared for new readers. Those themes are updated in twice-weekly updates from Tom Dyson and Dan Denning.

Paying subscribers also receive a Monthly Strategy Report which provides updates analysis of the Dow/Gold ratio, the Doom Index, and BPR’s Asset Allocation Strategy. The Official List, with all the prices and performance of all investments covered by BPR, is updated and published on Wednesdays.

Excerpt From Chapter 3 of The Dollar Report

Three Ways the Dollar Dies

Richard Nixon completely severed the link between US paper money and gold and silver when he shut the gold window in 1971. Peter Bernholz, the German–Swiss author of Monetary Regimes and Inflation describes this as part of the cycle of inflation in a fiat money regime.

The paper money is introduced and, for a time, is exchangeable at a fixed rate for real money (gold or silver). But as a country continues to live further beyond its means and the trade deficits pile up, more foreigners choose to exchange the paper notes for real metal. This is what happened in the mid and late 1960s in the US. That leads to the next stage in the inflationary cycle.

At that stage convertibility is suspended or dropped altogether.

The main point that we want to explore in this chapter is that: rising government deficits as a percentage of GDP can only be financed through the printing of more money (or in our case the ‘monetization’ of new government debt by the Federal Reserve, who ‘prints’ money to buy it).

At that point, when the deficits are larger than 20% of GDP, ordinary people begin to sense that something is not right with the money. The three charts below are a quick visual summary of the status quo for US government finances. As they go, so goes the dollar.

Debt-to-GDP ratio and the critical 130% level

Federal Deficits as a Percentage of GDP Growing Larger

Money Supply growth making up the difference

Source: US Federal Reserve

We believe that the growth of the total debt (relative to GDP), the size of the annual deficits (again relative to GDP), and the growth of the money supply in recent years (M2) all indicate we’re at a critical point.

If the government begins financing annual spending with printing press money, something has to give. It will either be the bond market or the value of the dollar. We’re betting on the dollar. And we’re betting it will cause this old dollar to be replaced by something new. But what?

The currency trajectory of the country’s debt hastens the point at which only three things can happen: currency reform, currency replacement, or currency substitution. Let’s look at each to see which is most likely for the Federal Reserve Notes in your wallet….

(The rest of The Dollar Report is available to paying subscribers of Bonner Private Research.)

At some point, the government simply creates "money" without bothering to record, anchor, secure it with "debt". In other words, it forsakes the travesty of the balance sheet. Then, it's over quickly, if not mercifully. Then we can learn the really important thing: what form does our inevitable political restart take? To "survive" the coming mess, you will need two things: hard assets in whatever form AND the ability to retain possession of those assets throughout and ongoing. If you don't have both of those things, then it doesn't matter what you do, now or ever. Best always. PM

Perhaps the best piece of investment wisdom I ever received was this: “If everyone at the dance is ugly, there’s still dancing going on”.

But what if everyone at the dance has a broken leg, or two?