Bill Bonner, reckoning today from Youghal, Ireland...

We are on our way to France. Checking the maritime forecast, we expected the sea to be so rough. We didn’t want to be seasick for a 17-hour voyage. So, we’re taking the short route to Wales, thence across England to the southeast coast, where we will board the Eurotunnel and cross to Calais.

This leaves us little time to read or write. So, we begin with a quick market update…and tomorrow…leave you with our memoire of our first Christmas in Ireland.

Here’s the headline from the Financial Times:

Markets lose more than $30 trillion in worst year since financial crisis

“The end of cheap money,” begins an editorial.

The BBC adds more bad news:

A third of the global economy will be in recession this year, the head of the International Monetary Fund (IMF) has warned.

Kristalina Georgieva said 2023 will be "tougher" than last year as the US, EU and China see their economies slow .

"Even countries that are not in recession, it would feel like recession for hundreds of millions of people," she added.

Caveats and Qualifiers

Reading the news, we find many “predictions for 2023.” The consensus view is that inflation will relent, the Fed will either ‘pivot’ or at least swing around to less of a ‘tightening’ program...and stocks will end the year higher.

In that regard a couple of caveats and qualifiers are needed. While US stocks were down about 20% for the year, Turkish stocks rose 110%. What made the Istanbul market suddenly worth twice its value in 2021? A return to the free market by the authorities? New inventions? A booming economy?

None of the above. Instead, an inflation rate of 85% caused Turks to seek shelter in equities. “There is a lack of alternatives…” said a sage in Istanbul.

In other words, stock market gains are not always what they appear to be. Recall that during the late ‘60s and ‘70s, the US stock market held steady…even as inflation erased 75% of the values.

So, rather than guess about the level of the Dow, let’s try to figure out what is really going on.

Readers of these posts will recall, too, that just before the holidays we suggested a couple of provocative, and perhaps seditious, ideas.

First, ‘the government’ is not all of us; it is just some of us. That is always true. And everywhere true. No matter what you call your government, a small elite always takes control.

When the US was formed, those ‘deciders’ were also outsiders. They made their living by providing goods and services to one another. They understood that government was always a threat to honest commerce. So, they attempted to limit it…and to leave ultimate control of the government with ‘The People’ and their representatives.

Leading Us to Crisis

It was a good try. But after a couple hundred years, the termites have gotten into the woodwork. And the parasites can do pretty much whatever they want. The things that are most ruinous to a country – war and inflation – are entirely under their control. The president can start a war on his own say-so. And the Fed can manipulate the value of the US dollar with no discussion or vote in Congress. Even the First Amendment, guaranteeing Free Speech, has largely been ignored, as federal agents conspire with private companies to restrict what Americans can read.

And now, the deciders are not longer outsiders. Now, they’re insiders. They do not want to limit the power of government, but to extend it further and further. Each step, they realize, brings them more power, money and status…while diminishing the wealth and independence of their rivals in the private sector.

And the US Constitution is largely irrelevant. The people who wrote the Constitution and the Bill of Rights were completely different from the people who now ignore it.

We have seen, too, that the situation in today’s economy and its markets is almost the exact opposite of what it was 40 years ago. Back then, stocks had been in a bear market for the previous 16 years; prices were low. Bonds had been in a bear market too – dating back to the late ‘40s. As for debt levels, the US government owed less than $1 trillion. And the benchmark 10-year US treasury sported a yield over 15%.

Today, stocks, bonds, and debt are high, with stocks and bonds nearer to the top of their ranges rather than the bottom…and US debt is over $31 trillion. Interest rates are low (even after the Fed’s hikes, the key lending rate is still about 300 basis points…3 percentage points…below the level of consumer price inflation.)

Given these circumstances, we have a hunch about where today’s markets are headed…and what the Fed is likely to do about it. In short, we are in a correction. The primary trend is down – for both stocks and bonds. This will lead to a crisis – as it becomes more and more expensive to finance debt.

How the elite will react to this coming crisis is the story of the coming years. Will they tighten their belts and allow the correction to do its work, returning us to a more ‘normal’ financial world? Or will they panic…pivot…and print more money?

We think we know the answer. But we would be happy to be surprised.

Stay tuned.

Bill Bonner

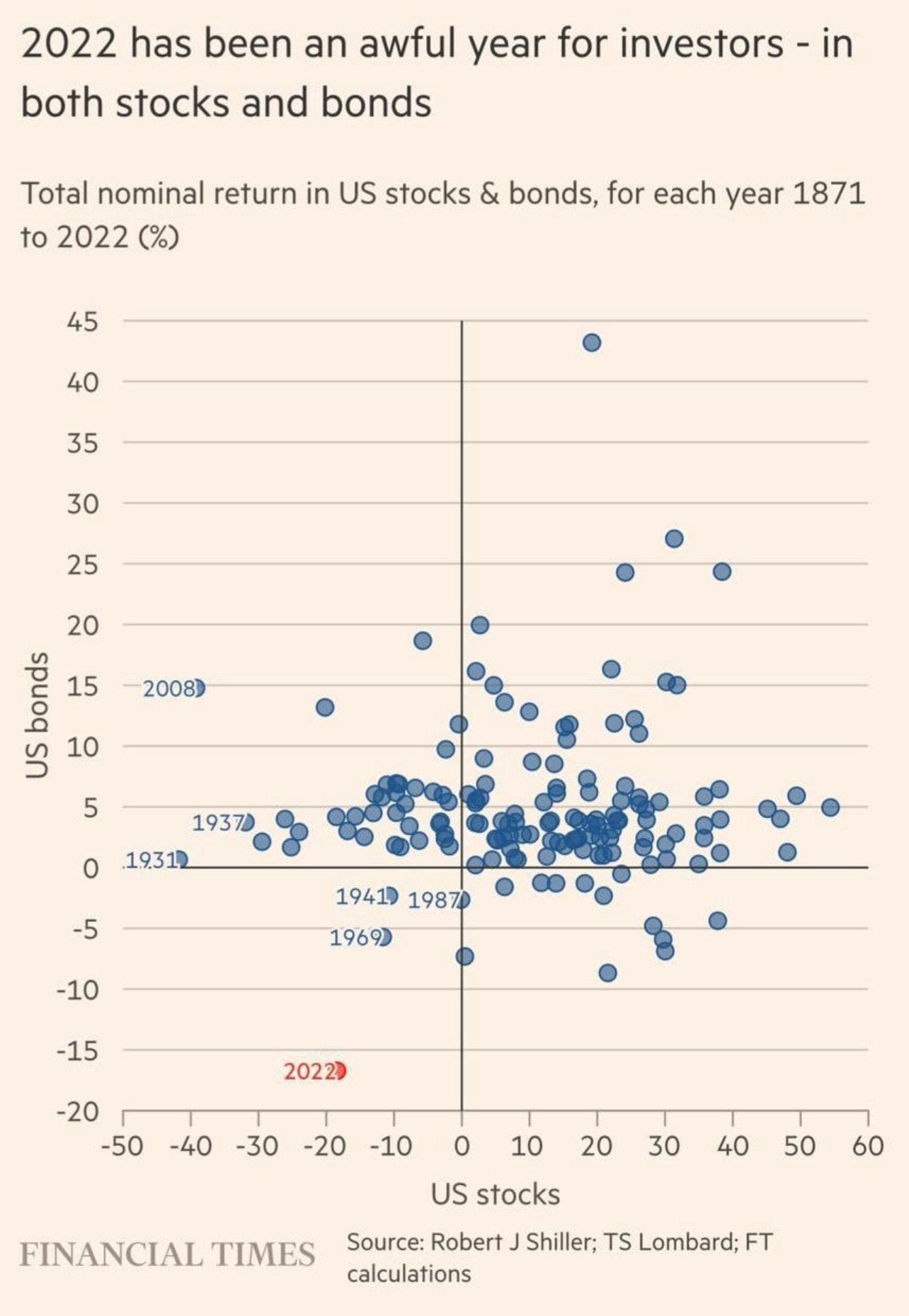

Joel’s Note: Behold, a visual representation of “The year that cost the world $30 trillion,” courtesy of the Financial Times:

There we are, way down there in the murky depths of the Descartes’ Third Quadrant, negative x and negative y. What gives?

“I have one core insight,” Bonner Private Research’s Investment Director, Tom Dyson, wrote to members in last week’s research note, “that they blew up a gigantic worldwide debt bubble and that debt bubble has now burst.”

Tom reckons that, viewed as though it were a business, the global financial system is “bankrupt, unable to continue as a going concern.” From last week’s note:

Investors have not realized this yet… they’re still operating broadly as if nothing’s changed… that we’re just going through another routine business cycle and everything will go back to normal soon. They’re going to be sorely disappointed…

For one thing, stocks are in a bear market (especially in terms of gold). And this bear market has much further to go…

For another thing, the United States Treasury is broke and we’re heading into a sovereign debt crisis… the first in 100 years.

Getting down to brass tacks, what’s an investor to do? Tom and Dan held fast to their overall allocation strategy last year, wax firmly in their ears as multiple bear market traps were singing investors to rock and ruin. It was the right course…

Unsurprisingly, therefore, they’ve set the same course for the rough seas ahead in 2023. Tom again:

KEEP the dial set to maximum safety. KEEP away from bonds and the major stock market averages. Continue holding lots of cash and physical gold. Stay very discerning about what you invest in.

Right now there are seven open positions in the BPR watchlist, all rated a “BUY.” Plus our Trade of the Decade, also rated a “BUY,” which is nevertheless up just on 100% since they recommended it to members back in January 2021.

You can follow along with all our paid research by joining us for 2023. Find a membership that works for you, below…

Termites? I have been called worse. God called us crickets in the Book of Isaiah. The government also looks at us like insects. My own accountant called that one. The EV idea to me is one thing! Destroy our independence and freedom. Just punch a button and the unwashed are sitting on the side of the road, helpless. You can take your ev or whatever we wind up calling it and stick it!! Freedom is the one thing that I cherish more than anything. As to the oil price, the government will screw that up, too. Like I have said, all this is on purpose, cause you will never get this much incompetence and ignorance by accident. Although, I will say, the border deal still puzzles me. We are importing poverty and ignorance by the boatload. Still have not figured this one out. My son says the plan is to turn us into a poverty-stricken narco state. Does have some merit. But, Rush Limbaugh used to say, we need to have more guns. Let all the people have guns and we will cut the gun murders by 90 per cent. Think of the old west. Gotta go practice my fast draw. Just sayin'

Don Harrell

The XOP trade is a long term trade that will have to fight the ESG and WEF head winds for many years until debt sinks governments. It is a 30% gamble of our investments. But, it is a well thought out trade, since war and all economies run on fossil fuels. Nothing runs in a significant way on fake Green Energy. Think of Green Energy as the Cryptocurrency of the energy world.