Punked

Officially, consumer price inflation meant that stocks lost about half their value. The price of gold, meanwhile, jumped from $35 in the beginning of the 70s, to $540 at the end.

Wednesday, September 10th, 2025

Bill Bonner, from Poitou, France

‘The current situation rivals the most hypervalued extremes in history.’

--John Hussman

As predicted...nearly a million jobs just disappeared. The Washington Post:

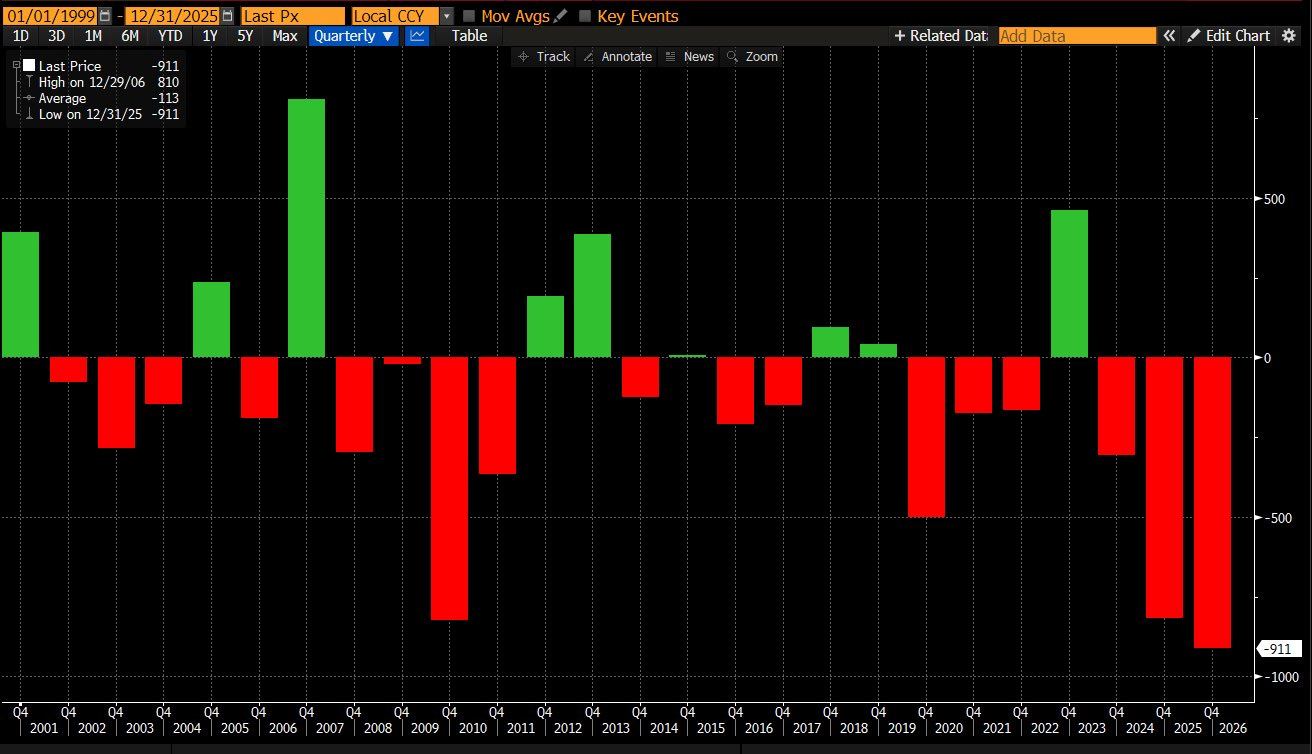

BLS revises jobs numbers down by 911,000 in annual revision

U.S. employers created 911,000 fewer jobs from April 2024 through March 2025 than initial reports showed, according to the Bureau of Labor Statistics, in the biggest initial revision to federal jobs data on record going back to 2000. The figures are preliminary and will be finalized early next year.

Meanwhile, gold has hit a new high. Reuters:

Gold marches on to fresh record high, propelled by Fed rate cut bets

Both Biden and Trump claimed they had a great economy. But it wasn’t nearly as great as they thought.

Fewer jobs. Higher prices. Sounds like st...st...stagflation. A punky economy along with price inflation. It’s the worst combination for average citizens. They are squeezed between higher prices and lower (generally) earnings.

The Fed is trapped too. It very much wants to relive its glory days...flying to rescue the economy with lower interest rates and QE. MarketWatch:

After nine months on the sidelines, the Federal Reserve is almost certain to cut interest rates by a quarter of a percentage point at its upcoming meeting. But the pending move has sparked much angst and conflict. What’s behind the fracas?

In this environment, economists are split into opposite camps over which is more important for the Fed to battle — slower growth or higher inflation.

Lower rates don’t really help the ‘stag’ situation. In real terms, the Fed’s key rate has been below zero for much of this century. The Fed’s balance sheet (a measure of how much money it has pumped into the economy) has gone up eight times. And an index of government transfer payments has tripled since 1999.

But for all this ‘stimulation,’ GDP growth rates have been cut in half.

What lower rates wrought was higher asset prices...along with a mountain of debt...not a stronger economy.

The problem now is the other part of the word...the ‘flation’ part. A rate cut now — as higher prices from the ‘trade war’ are widely anticipated — could put the Fed ‘behind the curve,’ just as it was in the 1970s.

The Fed began that decade with huge interest rate cuts. From a 9% Fed Funds rate in 1969, the rate was dropped to 3.3% in 1972. What followed was a sprint of inflation, with mortgage interest rates up to 20%. The Fed spent the rest of the decade huffing and puffing, trying to catch up.

And what happened to stock prices? The Dow began the 1970s around 815. Then, it went up a little. And down a little. And by the time the ‘70s were over it was...around 815.

So, you might say that at least investors were no worse off? But the investor who was no worse off was not in the stock market at all. Because, while stocks’ nominal prices held steady, their real, inflation-adjusted prices collapsed.

Officially, consumer price inflation meant that stocks lost about half their value. The price of gold, meanwhile, jumped from $35 in the beginning of the 70s, to $540 at the end. That is, the gold buyer was up 14 times, while the stock holder lost money. (Over the longer run, from 1969 to today, the Dow has gone from 815 to 45,500 – up 55 times. Gold has risen from $35 to $3,600 – up nearly twice as much.)

Could we have a repeat of the 1970s?

Or something liken unto it?

Maybe.

Stay tuned.

Regards,

Bill Bonner

Haven't we reached the point where the Fed's ability to influence the economy by controlling the price of credit has been swamped by the tidal wave of fiscal government debt? The fractional reserve system in which most dollars are borrowed into existence by private sector borrowing has been so dwarfed by government borrowing that it is no longer the primary driver. Even if all private sector borrowing stopped tomorrow the borrowing needed to fund the US government would still lead to massive dollar creation and debasement - with those dollars continuing to flow to favoured entities within the economy - the reality is that nothing can stop the inflation train this time around - historical examples from the 70's and 80's don't reflect the current debt/deficit situation - which is so large that it really defies human comprehension. The reality is that the Fed is becoming a fly on the back of a charging elephant...

That job number Bull**** doesn't matter anyway. If it has anything to do with government, it is rigged and fake, just like everything else that comes out of Washington. I am in manufacturing. It has sucked out there for over 10 years. We had blips in there with Covid. Our automotive industry is a joke compared to the 80's and 90's. Start selling high quality, competitively priced, made in America cars, and everything gets better. It is all smoke and mirrors. The level of waste and corruption is well beyond what the average American realizes.