Sunday, May 25th, 2025

Laramie, Wyoming

By Dan Denning

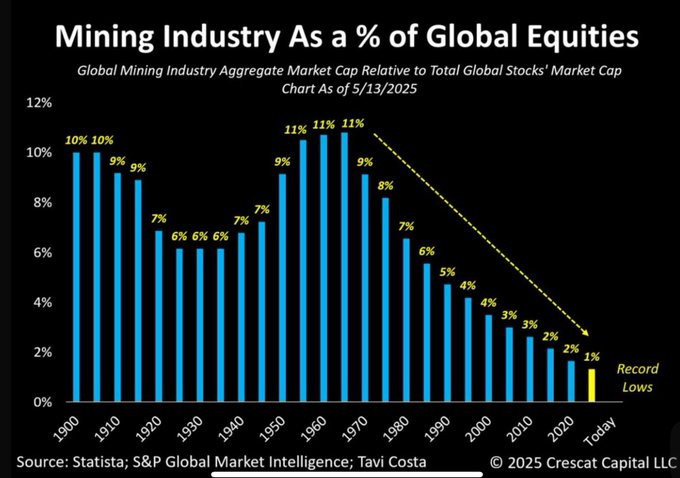

In the age of technology, is mining an ancient business, destined to be unprofitable and frustrating for investors? That’s what the chart above made me wonder. I saw it last week a few hours before I spoke to our latest guest for a Private Briefing (transcript and video below).

The chart shows that the mining industry is at historically low levels as a percentage of the total value of global equities. There are thousands of mining stocks—large ones and small ones—but their market value has never been lower relative to the rest of the market. Everyone wants growth and high tech.

Could that change?

Of course it could!

In the Private Briefing below, I talk to Edward Bonner from Sprott Global Resource Investments Limited about how individual investors should evaluate mining stocks and how to build portfolios leveraged to the best sectors for this year and the years to come.

We didn’t discuss the obvious—that when retail interest in mining stocks finally DOES increase, you’ll have an ocean of liquidity heading for a small universe of investable assets (typically a formula for the kind of bull market you’ll tell your grandchildren about).

But I also asked Edward why mining is such a bad (difficult) business. It was a useful and detailed conversation that I hope you’ll enjoy as you’re relaxing on this Memorial Day weekend. We’ll resume our normal publishing schedule tomorrow.

Until then,

Dan

THE TRANSCRIPT BELOW HAS BEEN LIGHTLY EDITED FOR BREVITY AND CLARITY